Bonds funds are in high demand at the moment given fears of a recession and falling interest rates. But with so many to choose from, how do you know which one is the best fit?

In this uncertain climate when everyone is asking “will there” or “won’t there” be a global recession, bond funds offer a win-win solution.

However, there are many types of bond funds in the market. Most tend to differ in terms of their duration and credit quality. These factors can greatly influence a fund’s potential to outperform in various market scenarios. They also impact the level of riskiness of a fund.

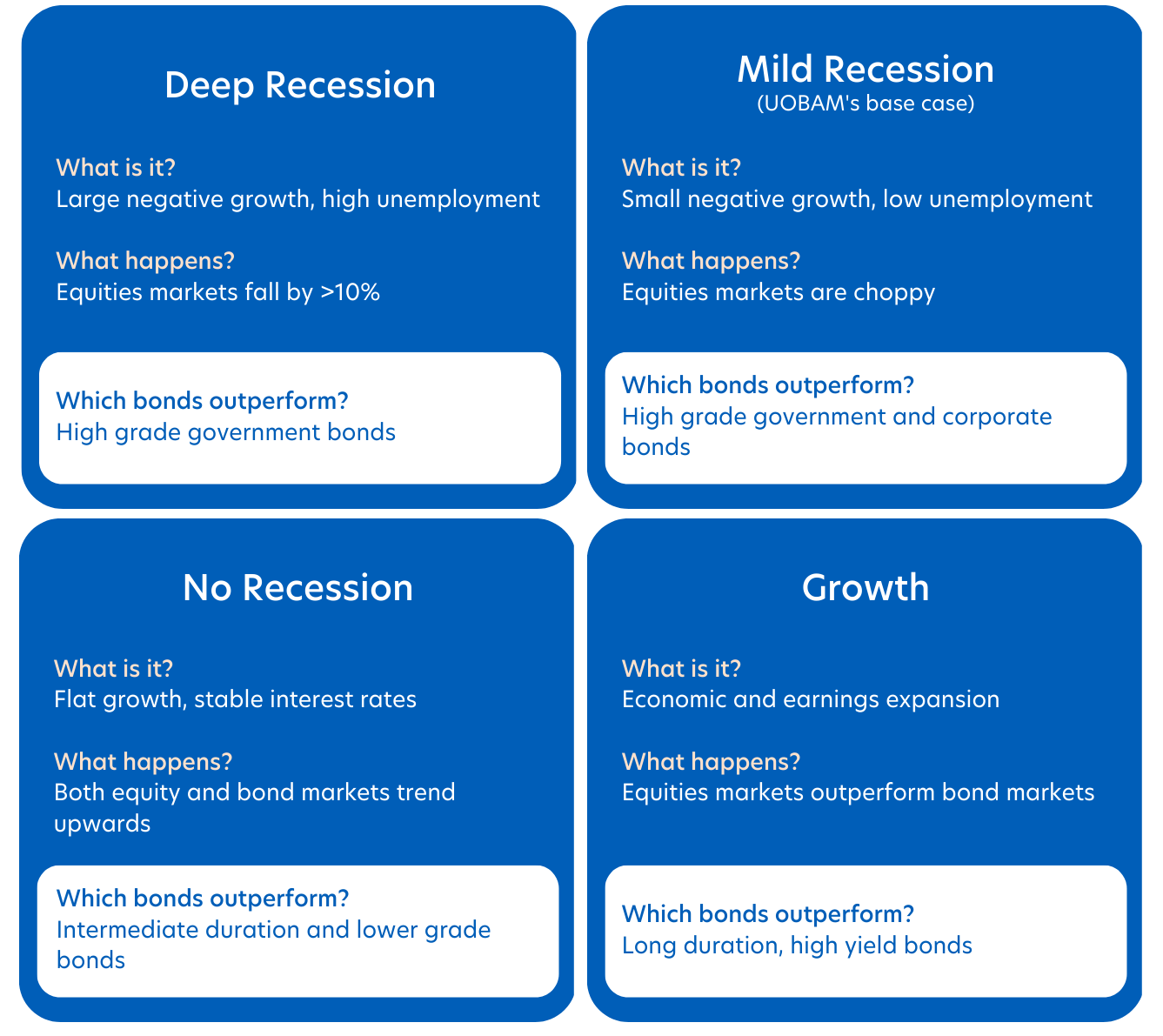

Economic outlook

Here is an example how different bonds perform under different market circumstances.

Duration and credit quality

As can be seen from the above diagram, duration and credit quality are significant features when investing in bonds and bond funds.

Duration: Bonds with shorter duration are less sensitive to changes in interest rates, which means they tend to offer more stable returns compared to longer duration bonds.

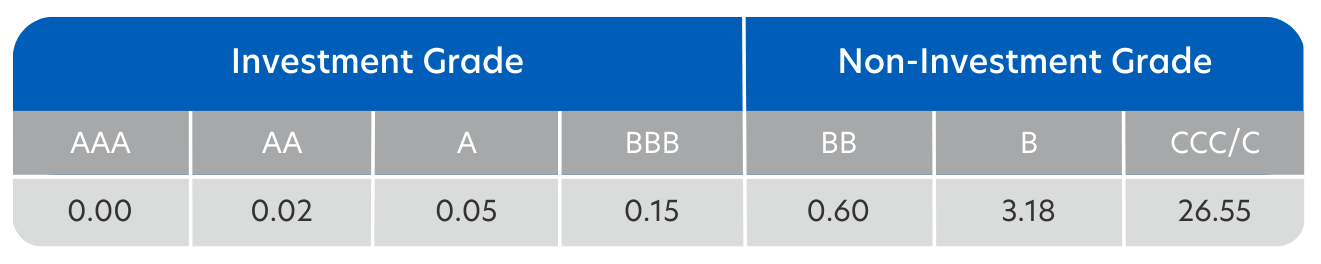

Credit quality: This is the likelihood of the bond defaulting. Bonds rated ‘BBB’ or higher by Standard & Poor’s are considered high quality. Here’s the weighted long term average default rate for various bond ratings:

Source: S&P Global Ratings Research and S&P Global Market Intelligence data from 1981 to 2021, 31 March 2023

Bond solutions from UOBAM

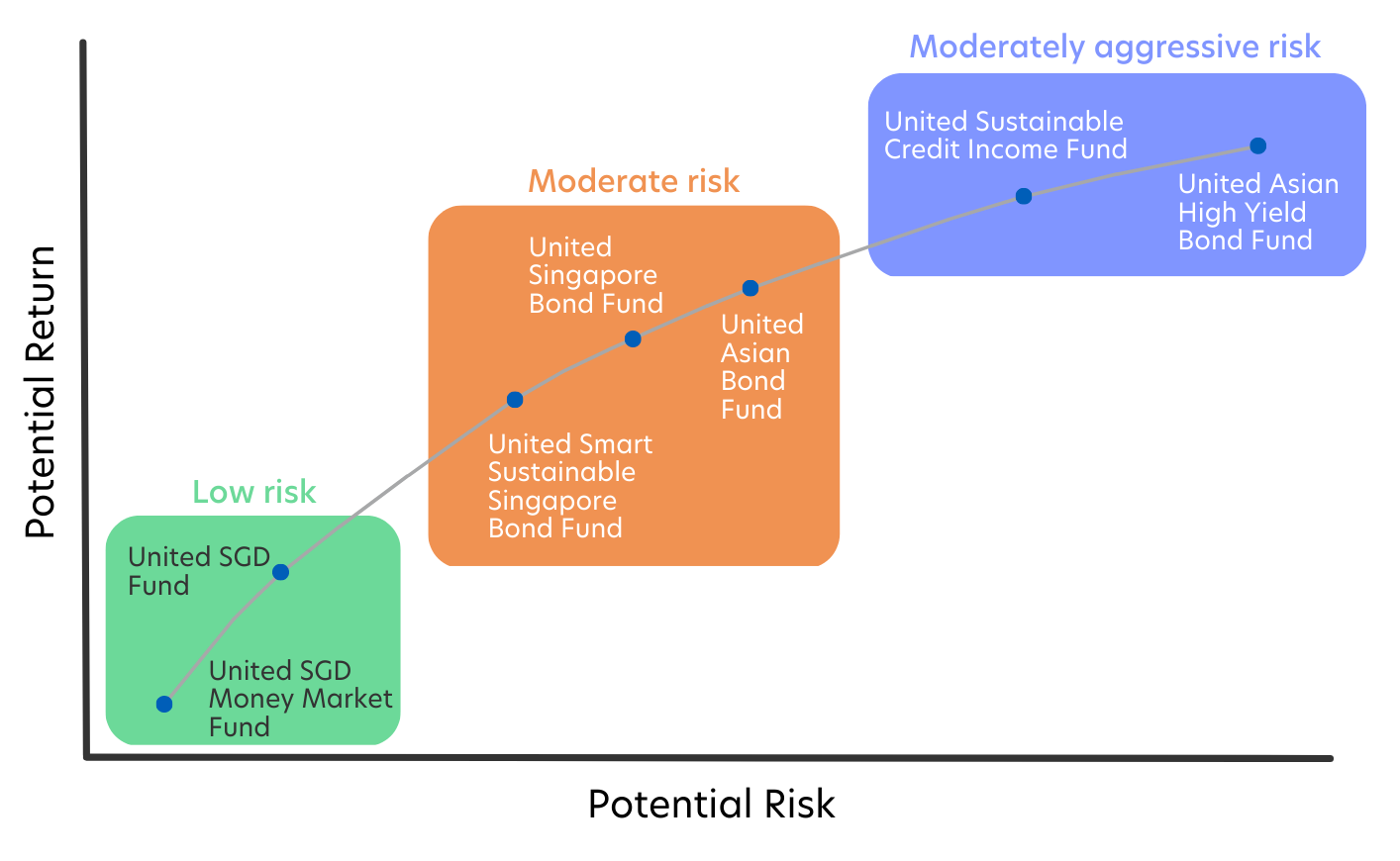

UOBAM offers seven money market and bond fund options. These funds select different types of bonds to hold and therefore they sit across a wide spectrum in terms of their average duration and credit ratings. They also align to different economic conditions.

The funds also offer different weighted average yield-to-maturities (YTM). This is the weighted average YTM of all the bonds in a fund’s portfolio. YTM is the annualised return that a bond would generate if held to maturity, assuming interest payments are re-invested. Note that a fund’s holdings can change regularly and therefore, so can the YTM.

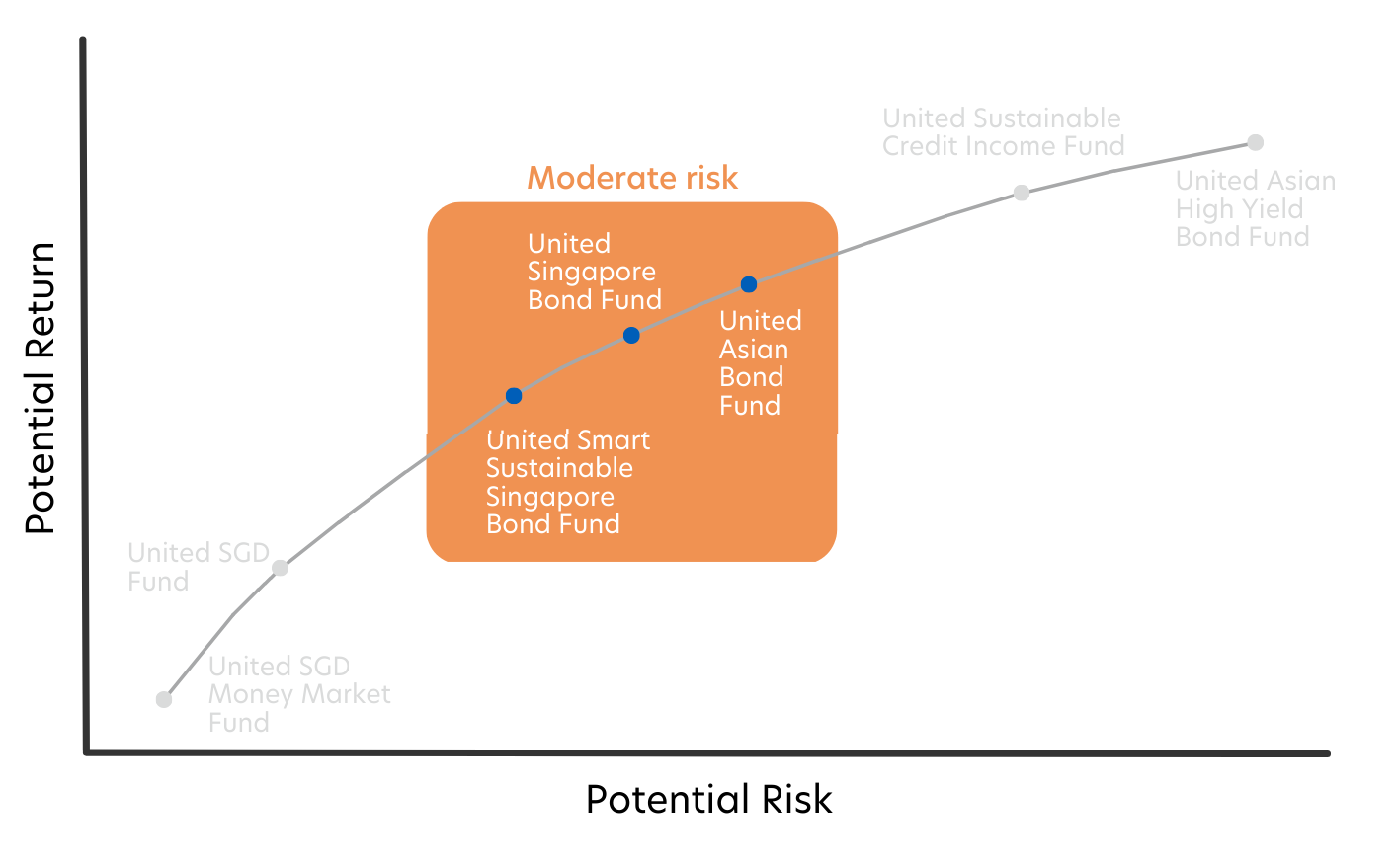

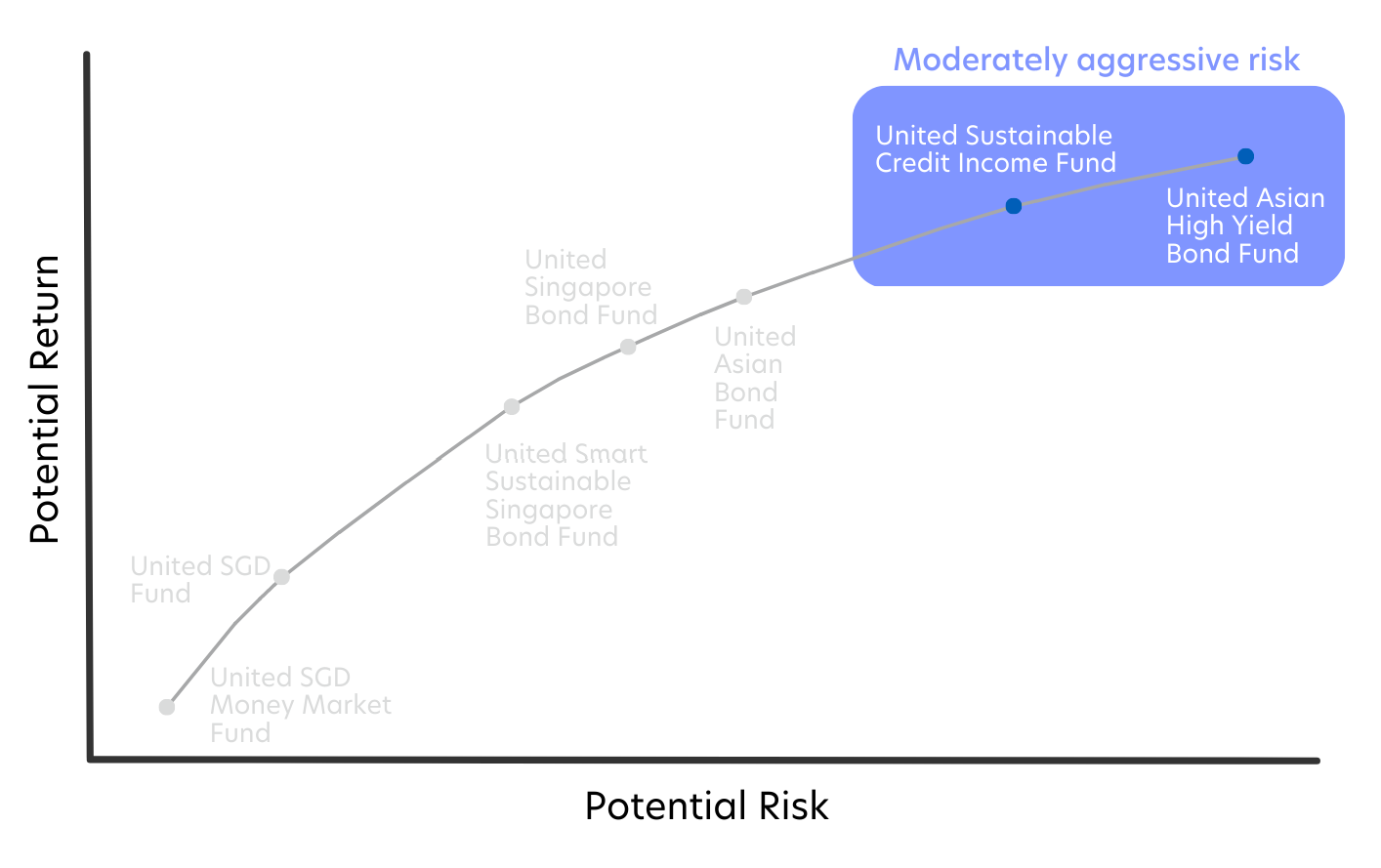

Figure 1: UOBAM bond funds on the risk-return spectrum

Source: UOBAM

Depending on their duration, credit quality and risk/return features, these seven funds suit different investor needs and profiles.

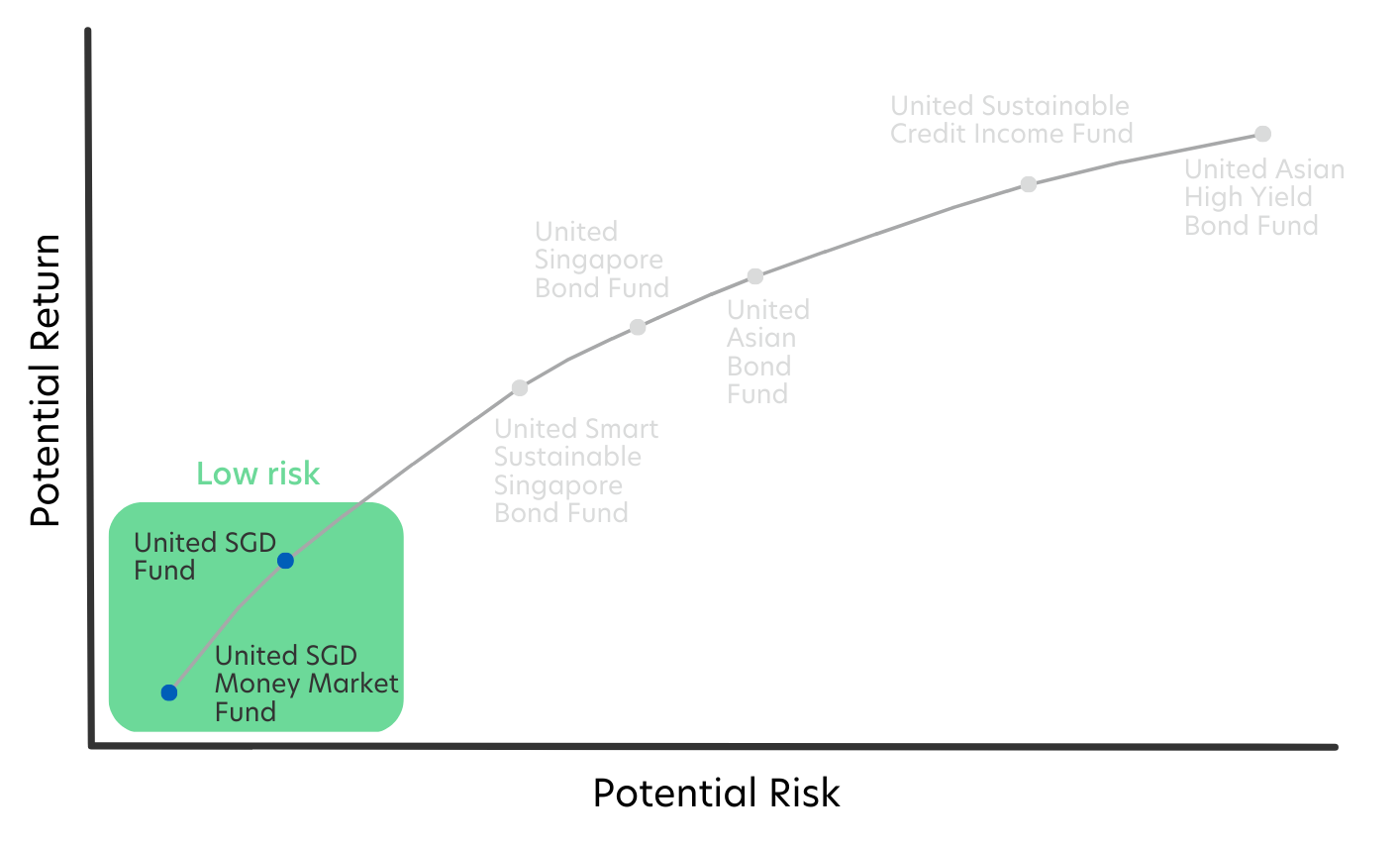

Conservative bond funds

The United SGD Money Market Fund and the United SGD Fund sit on the low end of the risk-return spectrum. They invest primarily in high-quality, short-term securities issued by governments and companies with robust credit ratings. As such, they are considered to be low risk in nature.

Here is what to consider when evaluating the two bond funds:

1. I want the flexibility to access my money anytime

United SGD Money Market Fund1

- Effective duration: 0.11 years

- Credit rating: AAA

- Weighted average YTM : 3.45 percent

The Fund invests mainly in Singapore Treasury bills (T-bills) and MAS bills – very high-quality, short-term instruments that offer investors stable returns and capital preservation.

The liquid and short duration nature of the Fund is ideal for investors who do not wish to lock up their cash but still want to earn decent returns.

Since your investment proceeds can be withdrawn and received within one business day, the Fund is also attractive for people who wish to park their cash while waiting for investment opportunities.

Please see the United SGD Money Market Fund page for more details, important notes and disclaimers.

2. I want capital preservation with the potential to earn attractive regular income

United SGD Fund1

- Effective duration: 1.14 years

- Credit rating: BBB+

- Weighted average YTM: 4.46 percent

This award-winning2 Fund invests in high-quality, short-term investment grade (IG) bonds with different maturities spread across a three-year timeframe. By using such a laddered bond strategy, the Fund is able to smoothen out the impact of fluctuating interest rates and enhance overall return.

Also, given that the Fund invests across one-year, two-year and three-year horizons, the expected slowdown in global interest rates will boost the Fund's capital gains and enable a shorter pay-back time for investors.

Unlike the United SGD Money Market Fund which does not pay out dividends, the United SGD Fund provides an annualised dividend yield of 5.0 percent*, paid out monthly (United SGD Fund Class S SGD Dist). This makes it ideal for investors seeking regular income.

Please see the United SGD Fund page for more details, important notes and disclaimers.

*Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus

Moderate-risk bond funds

The United Smart Sustainable Singapore Bond Fund, United Singapore Bond Fund, and United Asian Bond Fund fall in the middle of the risk-return spectrum, given that they primarily invest in investment-grade government and corporate bonds with medium durations.

Here is what to consider:

3. I want a high-quality Singapore bond fund that is sustainability-focused

United Smart Sustainable Singapore Bond Fund1

- Effective duration: 2.47 years

- Credit quality: BBB+

- Weighted average YTM: 4.62 percent

The Fund invests in Singapore-focused bonds that incorporate Sustainable and Environmental, Social and Governance (ESG) factors. Its investment themes directly support Singapore’s green development plans in three key areas:

- Contributing to a sustainable Singapore

- Supporting solutions that address the impact of climate change

- Supporting the development of resilient and sustainable supply chains

By investing in bonds of companies that are aligned to Singapore’s sustainability objectives, the Fund seeks to achieve attractive yet resilient growth over a multi-year investment horizon, making it ideal for investors who wish to invest for profit and purpose.

Please see the United Smart Sustainable Singapore Bond Fund, page for more details, important notes and disclaimers.

4. I want to invest in Singapore bonds that are longer duration to pick up higher yield

United Singapore Bond Fund1

- Effective duration: 7.56 years

- Credit quality: A-

- Weighted average YTM: 4.00 percent

The Fund aims to maximise returns over the longer term by investing primarily in Singapore Dollar (SGD) denominated bonds issued by Singapore or global entities, and Foreign currency-denominated bonds issued by Singapore entities.

As a result, the Fund benefits from the strength of the SGD and the stability of Singapore’s capital markets.

Although there is no target industry or sector, the Fund currently has a 41 percent allocation to government bonds (as of 31 March 2023) which contributes to its strong credit rating of ‘A-’.

Furthermore, given its longer duration, this Fund is ideal for investors seeking to lock in attractive yields for longer.

Please see the United Singapore Bond Fund page for more details, important notes and disclaimers.

5. I want exposure to investment-grade Asian bonds with intermediate duration to lock in current yields and hedge against recession

United Asian Bond Fund1

- Effective duration: 3.44 years

- Credit quality: A

- Weighted average YTM: 5.38 percent

The Fund seeks to provide stable current income and capital appreciation by investing in investment-grade bonds issued by Asian corporations, financial institutions and governments.

Within these bonds, the top geographical allocations include China, Hong Kong, Indonesia, Singapore and South Korea.

Over the past year, the Asian credit market has been pressured by the debt woes of private Chinese property developers. In light of this, the Fund is currently underweight in the China Property sector.

Moreover, the Fund continues to maintain a defensive positioning with a preference for quality companies, as reflected by its strong credit rating of ‘A’.

At 4.50 percent* , the Fund’s annualised dividend yield, paid out monthly, may also be attractive for investors seeking regular income.

Please see the United Asian Bond Fund page for more details, important notes and disclaimers.

*Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus

Moderately aggressive bond funds

The United Sustainable Credit Income Fund and United Asian High Yield Fund sit on the higher end of the risk-return spectrum. Both funds have exposure to riskier high yield bonds – bonds rated below ‘BBB’ but offering relatively higher yields compared to investment-grade.

Here is what to consider:

6. I want diversified global bond exposure with attractive income potential and a sustainability focus

United Sustainable Credit Income Fund1

- Effective duration: 5.02 years

- Credit quality: BBB

- Weighted average YTM: 7.03 percent

The Fund invests in the RobecoSAM SDG Credit Income, which provides diversified exposure to global bonds and aims to maximise income throughout different market conditions. Robeco is an investment specialist in sustainable investing, with the fixed income team being one of the largest in Europe.

Furthermore, the Fund adopts a prudent approach in bottom-up credit selection for flexible portfolio exposures across ratings, sectors, or regions. This means the Fund is able to invest in the most attractive yield opportunities globally.

As of 31 March 2023, the Fund has about 50 percent exposure to developed market investment-grade bonds, 30 percent exposure to developed high yield bonds, and 20 percent exposure to emerging market bonds.

The top ten holdings include mostly bank and insurance companies.

The Fund also works to make a positive impact on the United Nations Sustainable Development Goals (UN SDGs), and will not invest in bonds of corporates that detract from these goals or have a negative SDG rating.

The Fund’s annualised dividend yield of 5.0 percent*, paid out monthly, may also be ideal for investors seeking regular income.

Please see the United Sustainable Credit Income Fund page for more details, important notes and disclaimers.

*Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus

7. I want higher yields and access to Asia’s diverse investment opportunities, and am willing to keep a long-term perspective to capture growth

United Asian High Yield Bond Fund 1

- Effective duration: 2.22 years

- Credit quality: BB-

- Weighted average YTM: 8.89 percent

The Fund invests primarily in high yield bonds issued by Asian corporations, financial institutions and governments. Within these bonds, India, China, Hong Kong, Macau, and Singapore are the top five geographical allocations.

In particular, the Fund’s strategy is to continue underweighting Chinese property while riding on the China reopening theme.

Given the high interest rate environment, high-yield corporates could face a tougher environment for refinancing. To that end, the Fund maintains a relatively short effective duration of 2.22 years and favours shorter-dated high-yielding bonds with more certainty of refinancing and companies with good access to capital markets. The Fund’s annualised dividend yield of 7.0 percent*, paid out monthly, could be attractive for investors seeking regular income as well.

Please see the United Asian High Yield Bond Fund page for more details, important notes and disclaimers.

1 Source: UOBAM, as of 31 Mar 2023

2 Refer to www.uobam.com.sg/awards for a full list of UOBAM awards.

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the month. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. The Managers reserve the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a return of part of your original investment and may result in reduced future returns. Please refer to the Fund’s prospectus for more information.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM.The value of Units and the income from them, if any, may fall as well as rise. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z