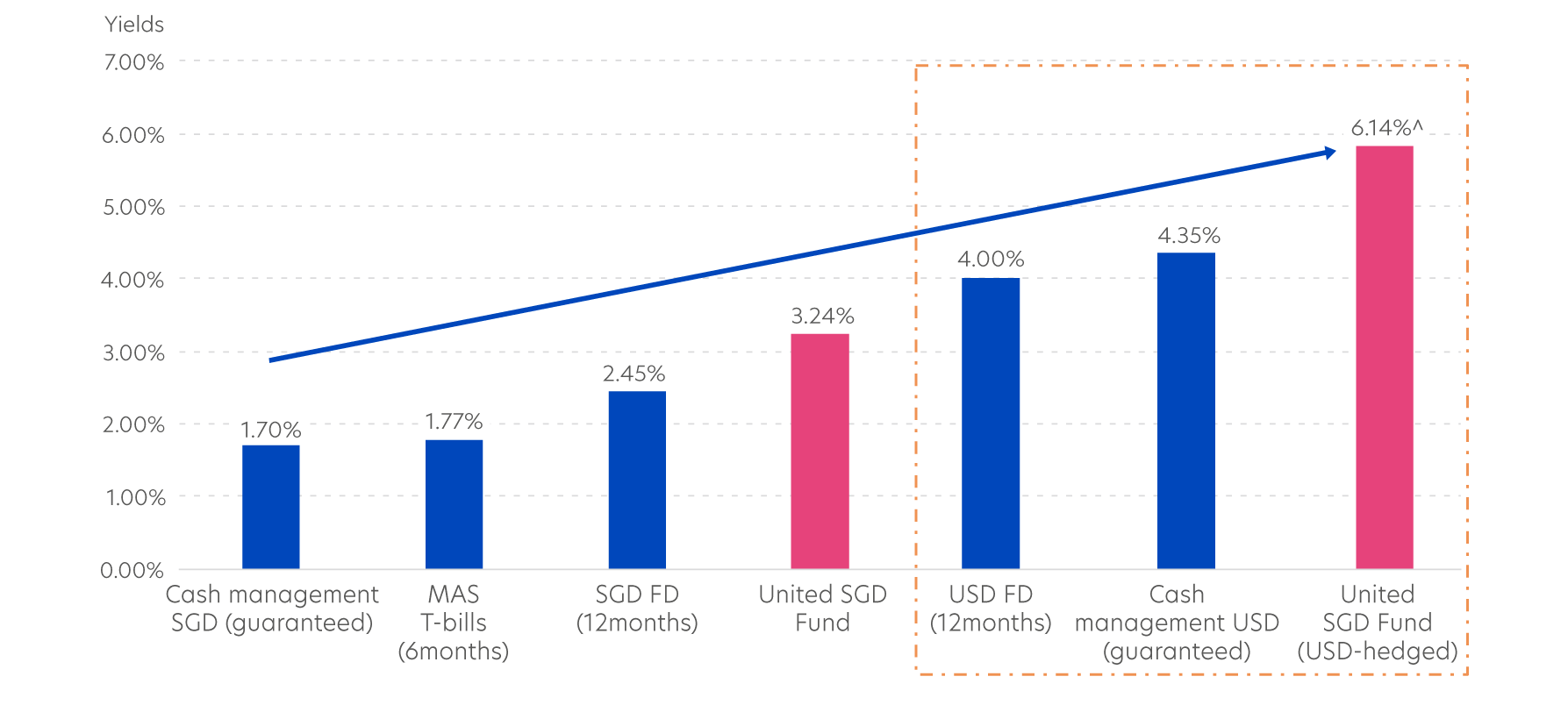

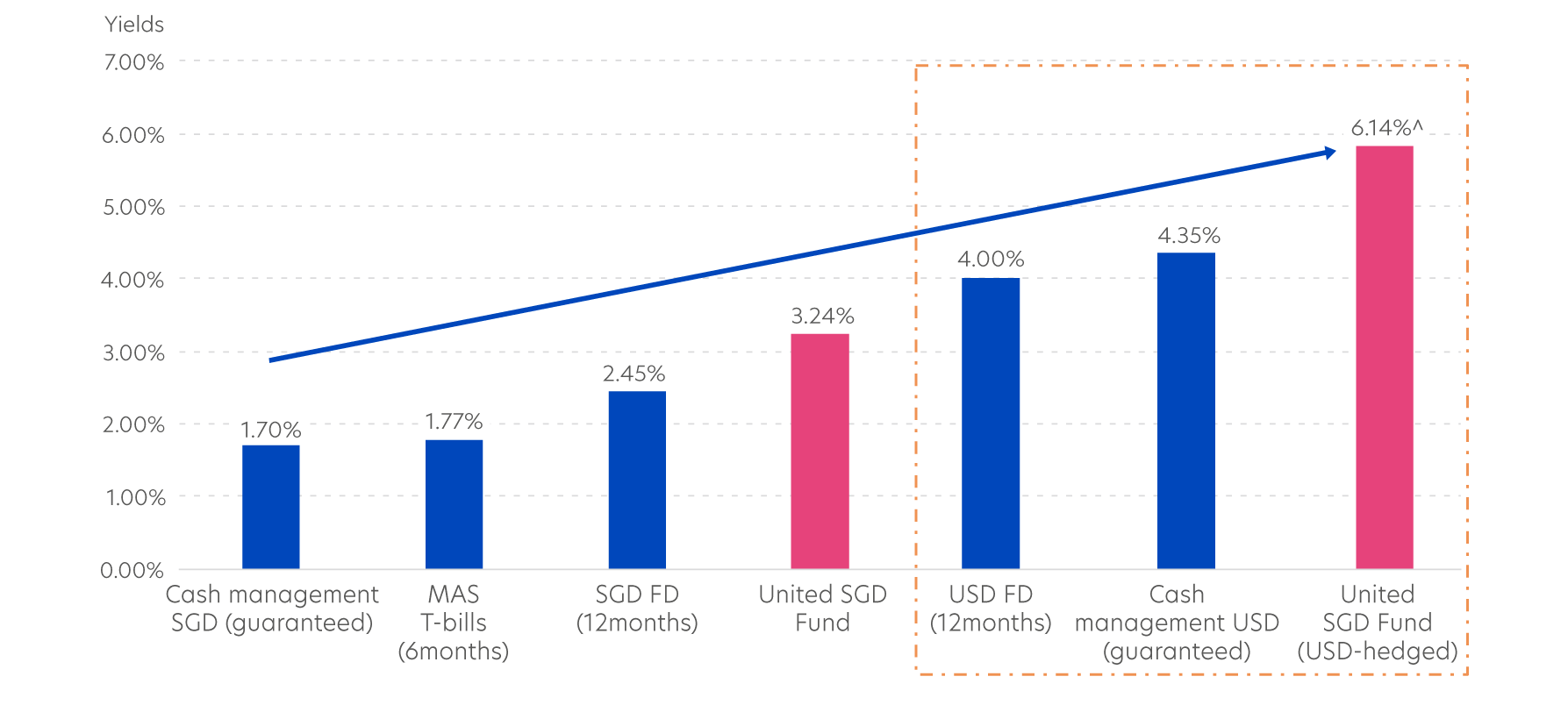

1. Step-up in yields

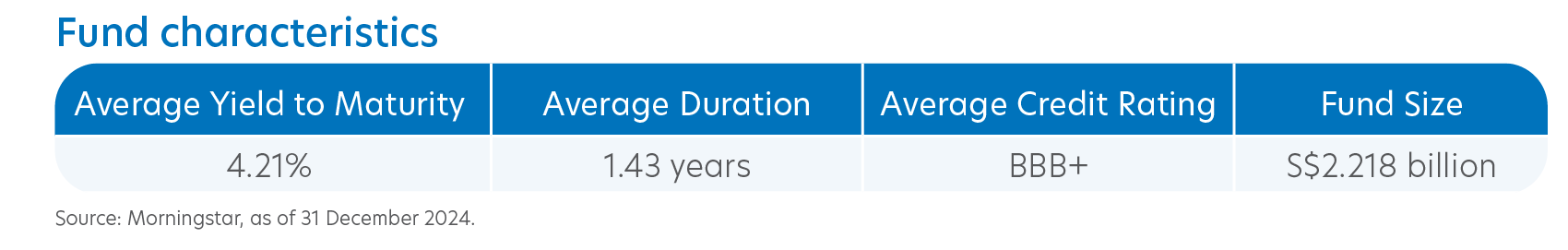

The Fund has a weighted average annualised yield-to-maturity of 3.24%*. It also maintains an effective duration of 1.78 years* to minimise interest rate risk.

Source: Beansprout, UOBAM, 31 July 2025. Yield is computed based on the weighted average yield-to-maturity of the Fund’s holdings and are not guaranteed.

*Source: UOBAM, as of 31 July 2025. ^The yield provided is for indicative purposes only

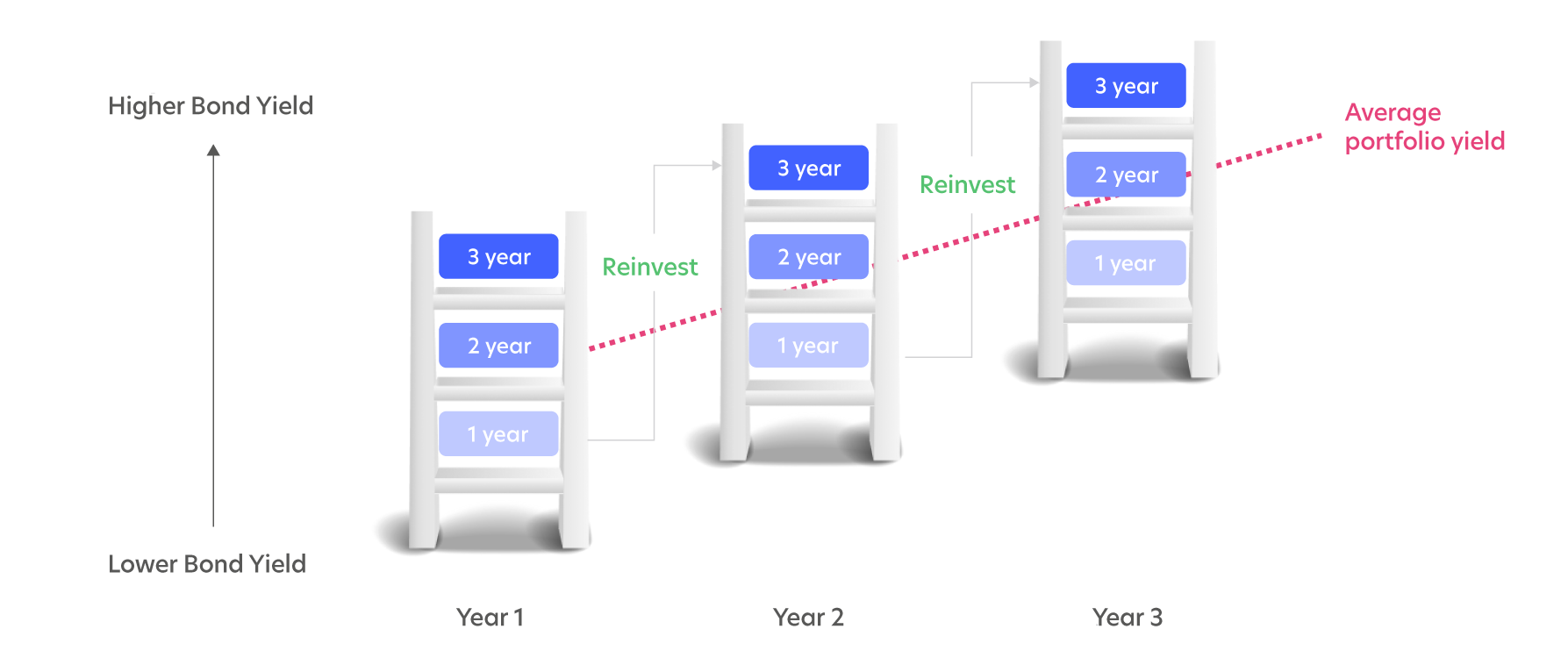

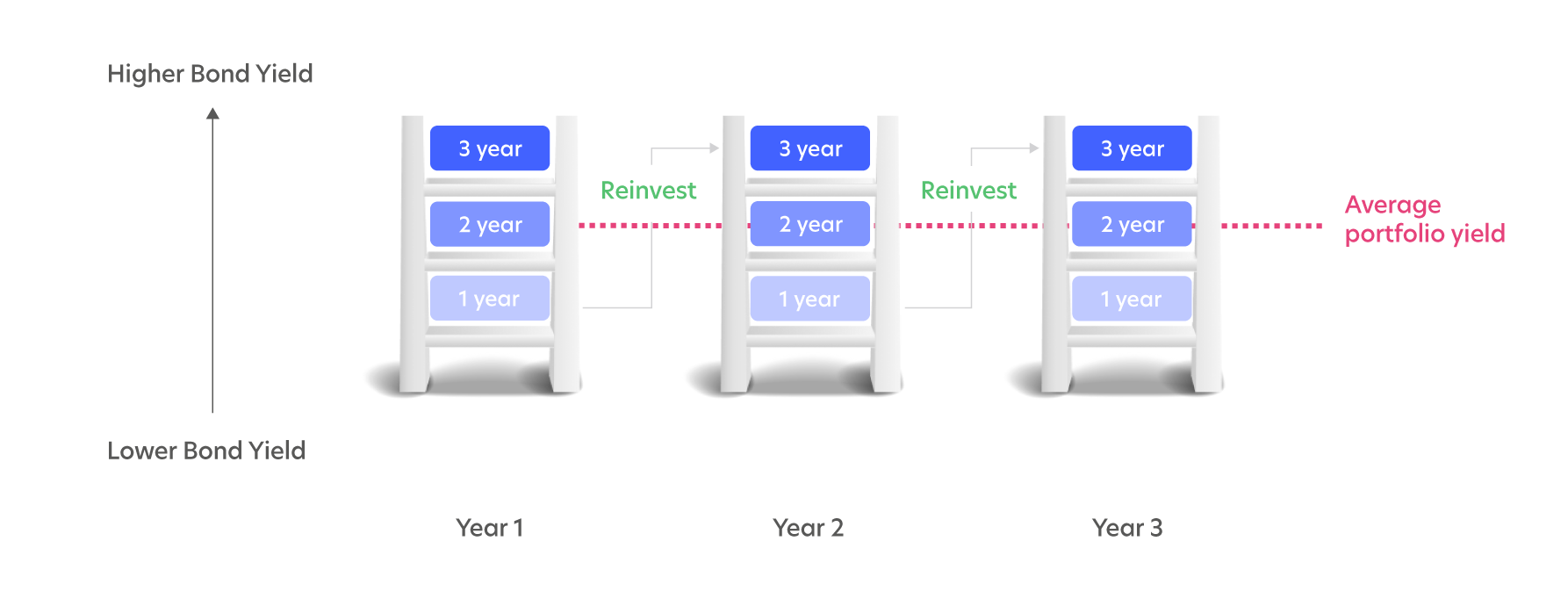

2. Positioned to cope in different market environments

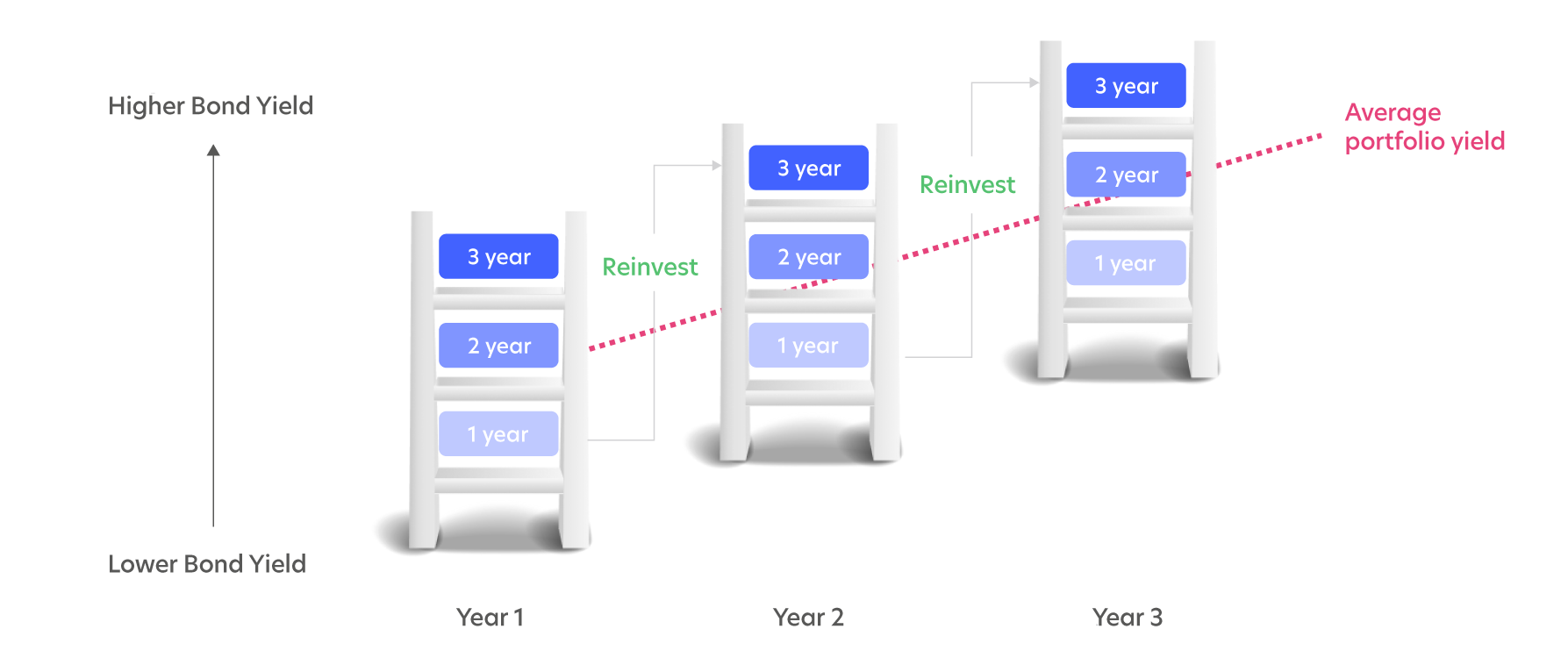

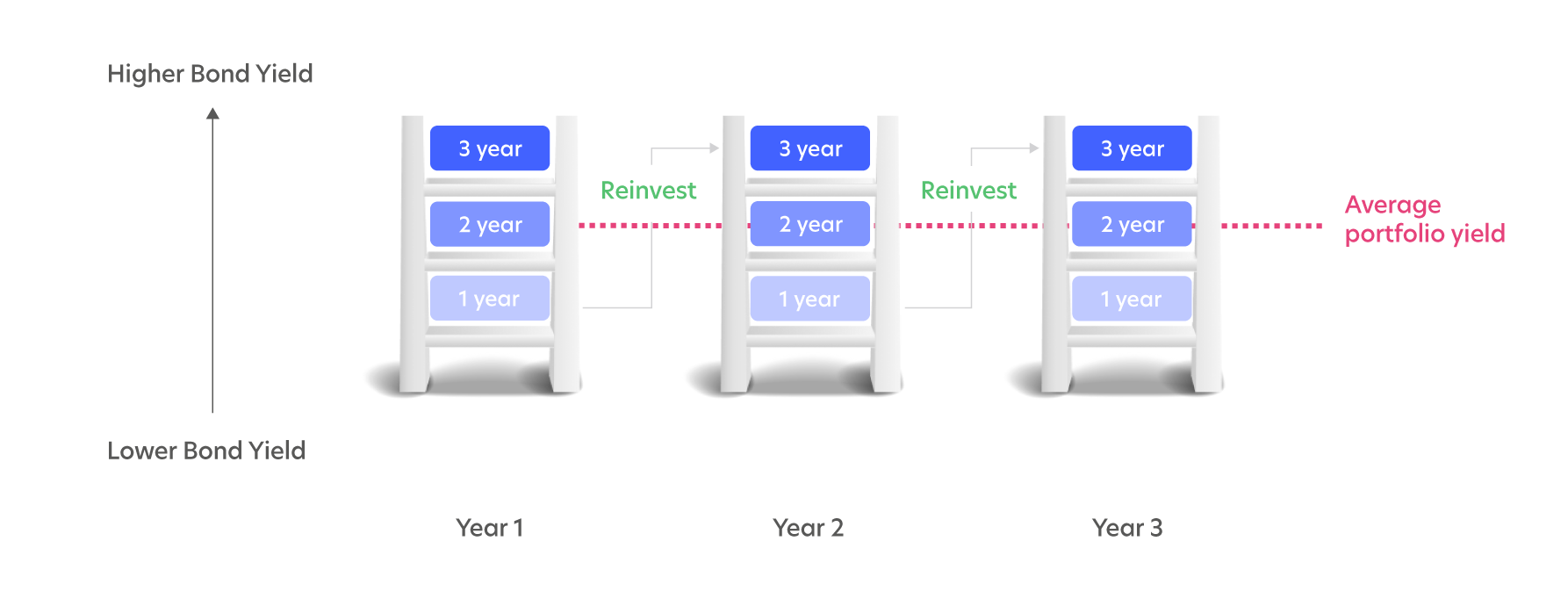

Interest rates fluctuate over time, making it difficult for traditional fixed income funds to deliver consistent returns. To address this, the United SGD Fund employs a laddered investment strategy to smoothen out the impact of fluctuating interest rates.

The Fund invests in investment grade bonds with different maturity dates across a three-year timeframe. This way, investment maturities of bonds are spread across one-year, two-year and three-year horizons to enhance the overall return. This strategy tends to and has shown to work in both environments of rising or falling interest rates.

In a rising interest rate environment, the capital from matured bonds in the Fund will be reinvested in higher-yielding, shorter-dated bonds. This approach enables the Fund to capture higher yields and enhance total return for investors.

In a lower interest rate environment, the Fund remains invested in longer maturity bonds and continues to earn higher yields.

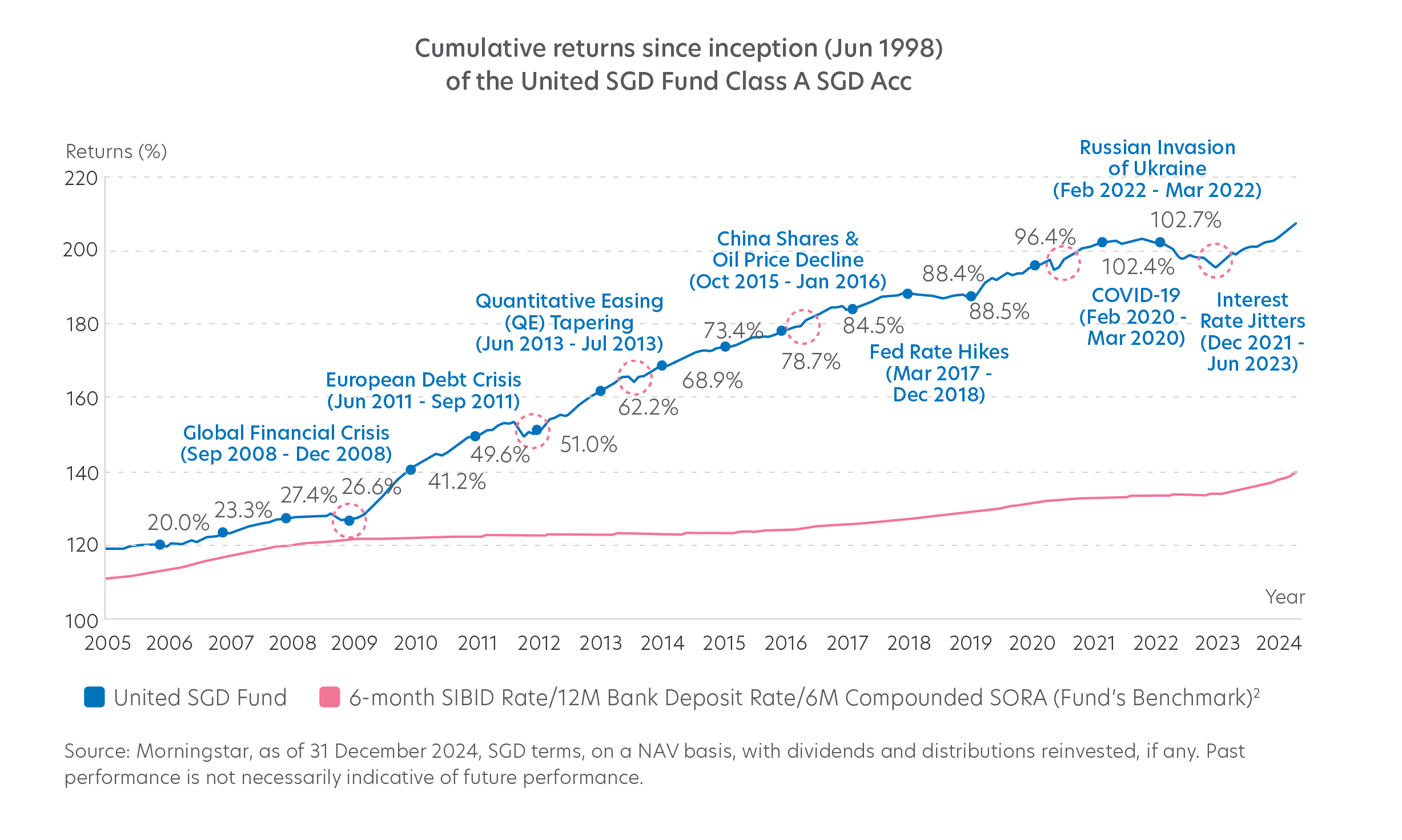

Quality and stability

Protect the downside in midst of market instability

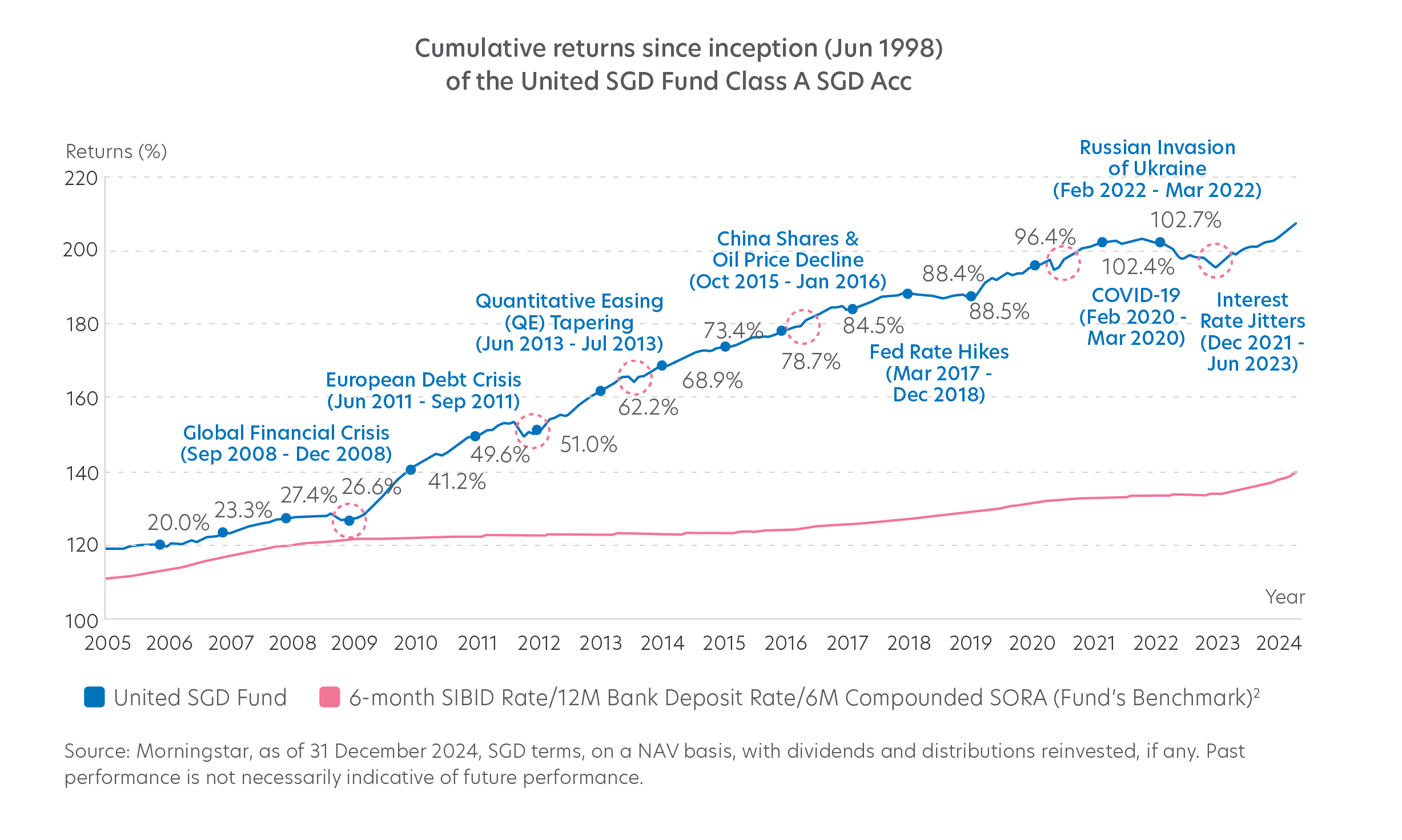

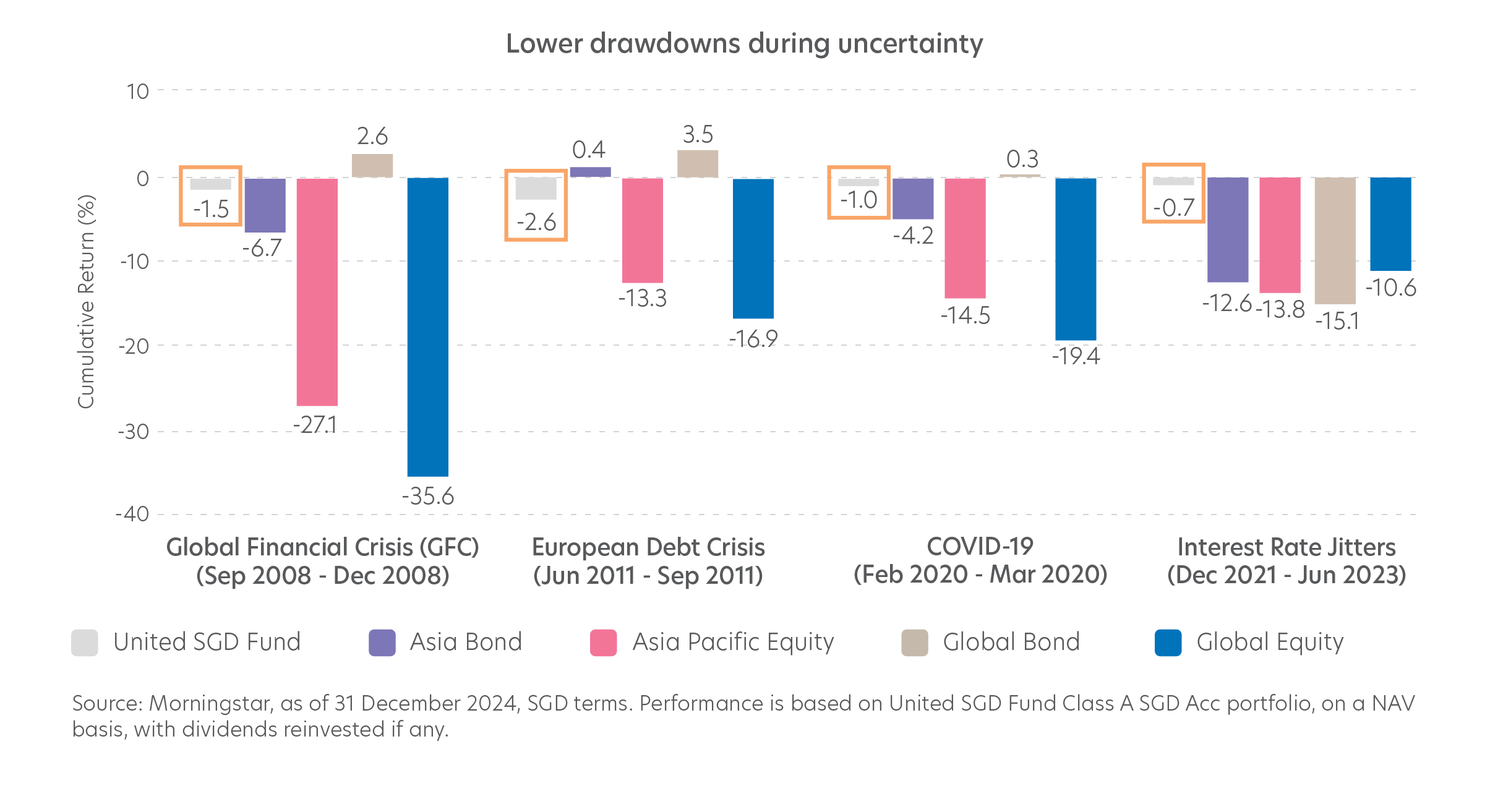

The Fund has thrived over market cycles with its strategy of investing into short-term, high-quality investment-grade bonds and focus on mitigating credit risk.

Source: Morningstar, as of 31 July 2025. Past performance is not necessarily indicative of future performance. Performance is net of fees and is based on United SGD Fund Class A SGD Acc, in SGD terms, on a NAV basis, with dividends and distributions reinvested, if any.

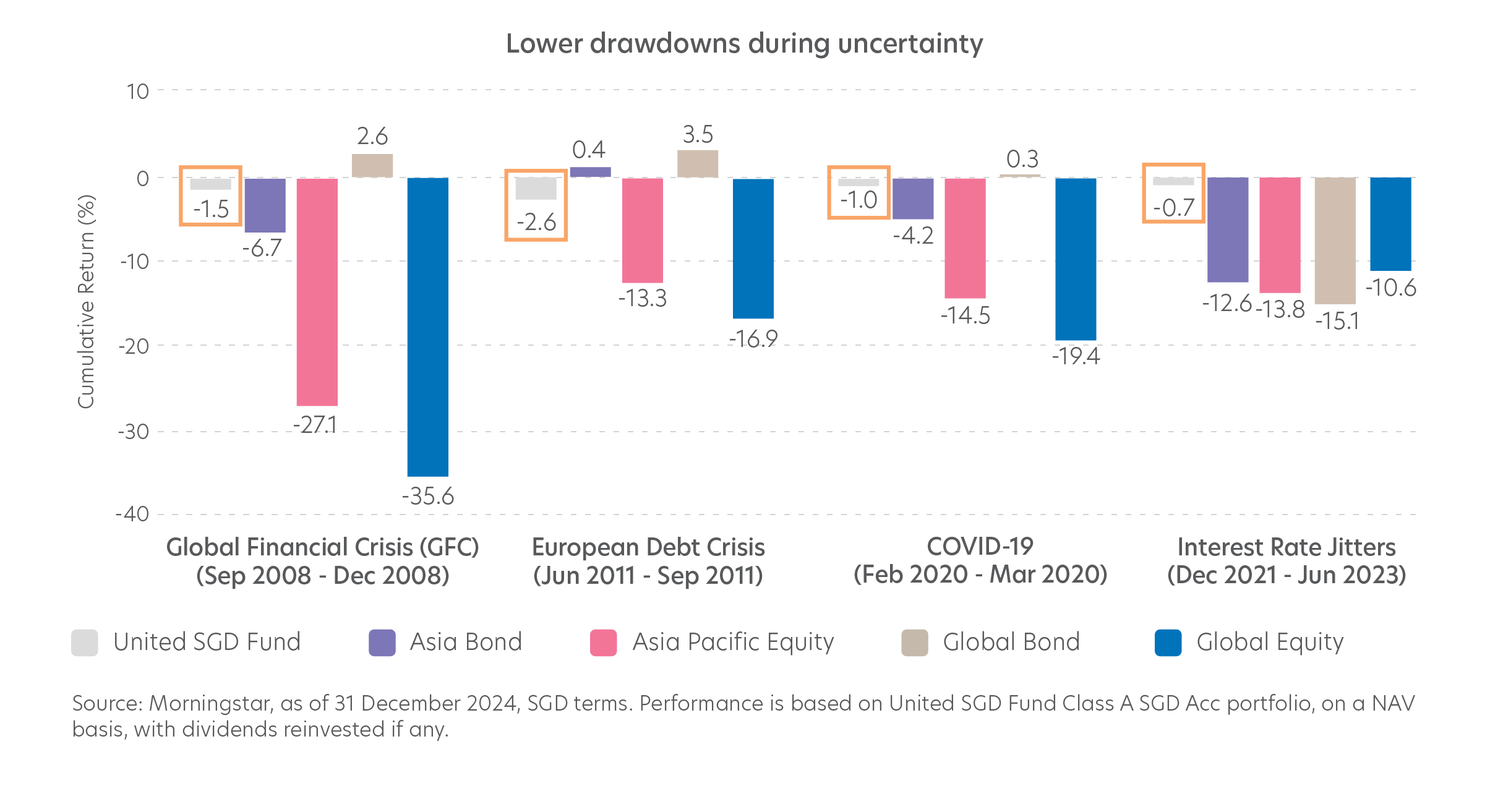

The Fund seeks to provide capital preservation, and buffers against market instability with lower drawdowns compared to peer asset classes during market instability.

Source: Morningstar, as of 31 July 2025, SGD terms. Performance is based on United SGD Fund Class A SGD Acc portfolio, on a NAV basis, with dividends reinvested if any.

Award-winning expertise

The Fund has clinched 15 awards4. The portfolio manager, Joyce Tan, CFA, Head of Fixed Income Asia & Singapore at UOBAM has over 25 years of investment experience, over 15 years of expertise in managing the Fund, and has received multiple industry awards. Notably in 2022, she received the Highly Commended Award for the Most Astute Investor in Asian local currency bonds by The Asset Benchmark Awards. This marks her 7th Most Astute Investor recognition since 2011 for this category.

In 2023, the Fund won the Outstanding Achiever and Best-in-Class awards for Singapore Fixed Income at the Benchmark Fund of the Year Awards 2022 and 2023, respectively.

ESG enhanced

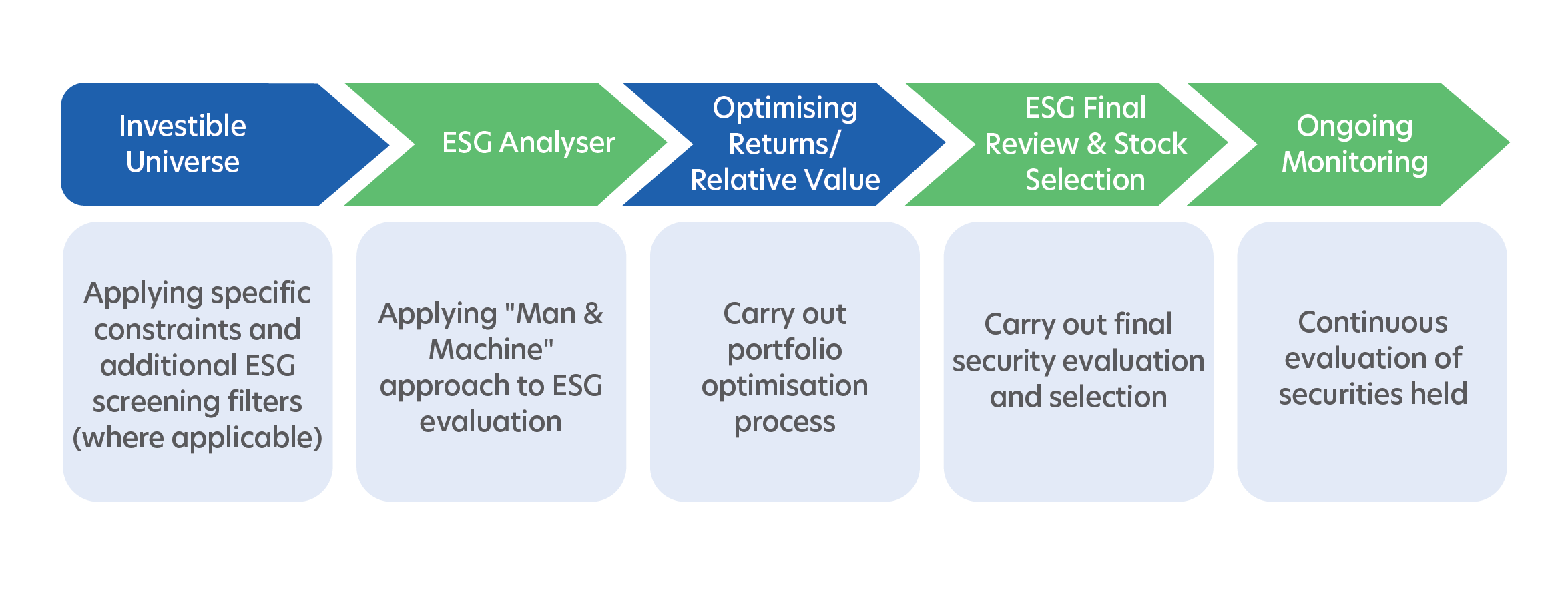

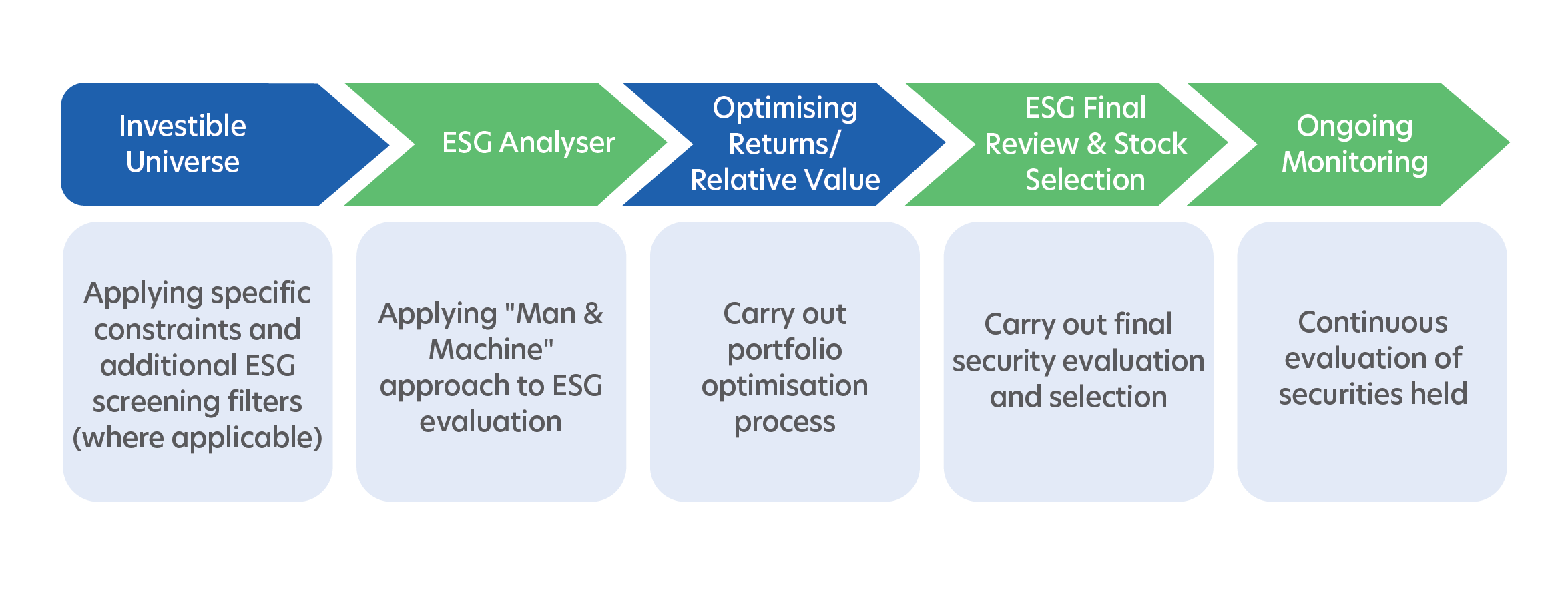

Investors are looking to see how they can do their part for the environment, while generating investment returns. The Fund adopts UOBAM's sustainable investment framework.

UOBAM has defined a list of metrics for monitoring the Environmental, Social and Governance (ESG) performance of portfolio companies and this is incorporated into our ESG evaluation process. Below is an overview of how ESG is incorporated into the investment process.

Source: UOBAM