UOBAM believes companies that incorporate Sustainability/ESG factors/frameworks are more resilient, more focused on their long-term business viability and hence are more likely to remain competitive in the long-term. Accordingly, SSS will invest in bonds issued by companies that are successful in incorporating Sustainability/ESG factors/frameworks, are competitive, well managed and offer attractive growth prospects over a multi-year investment horizon.

The SSS is the First Singapore Focused ESG Fixed Income Fund to provide profit, purpose and payout. Creating an opportunity to invest and benefit in Singapore.

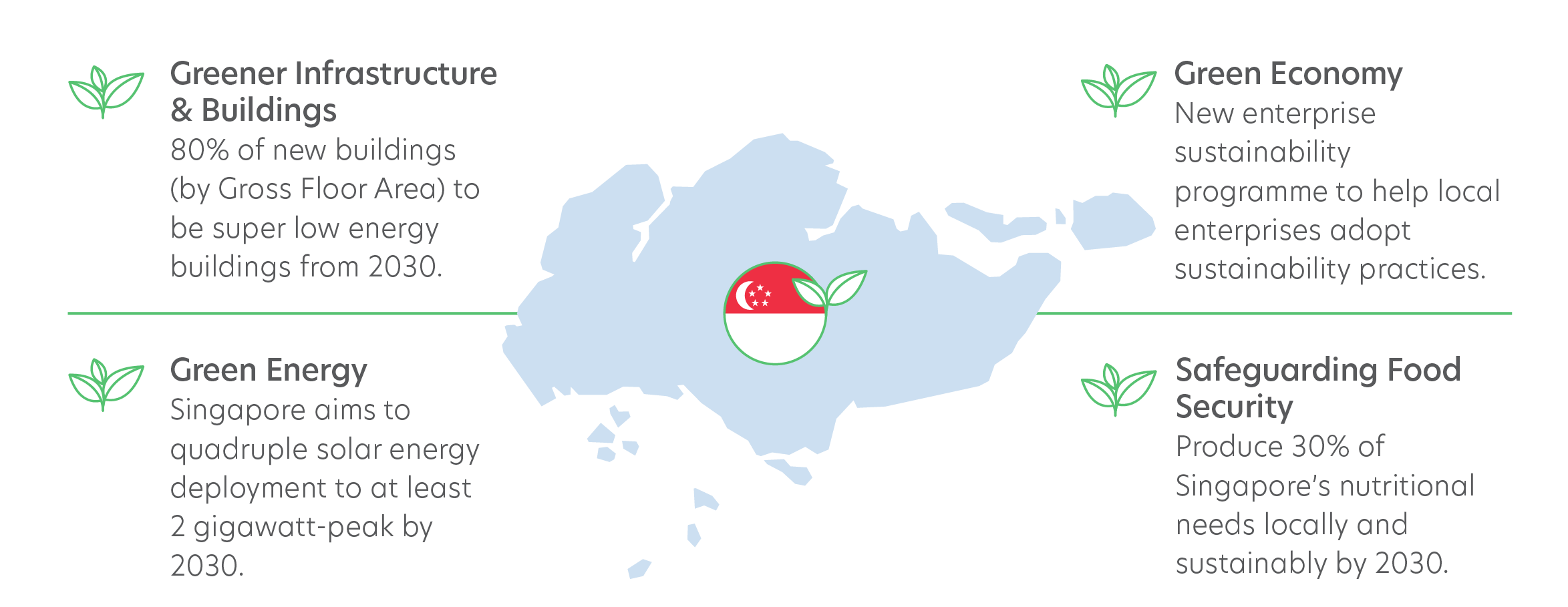

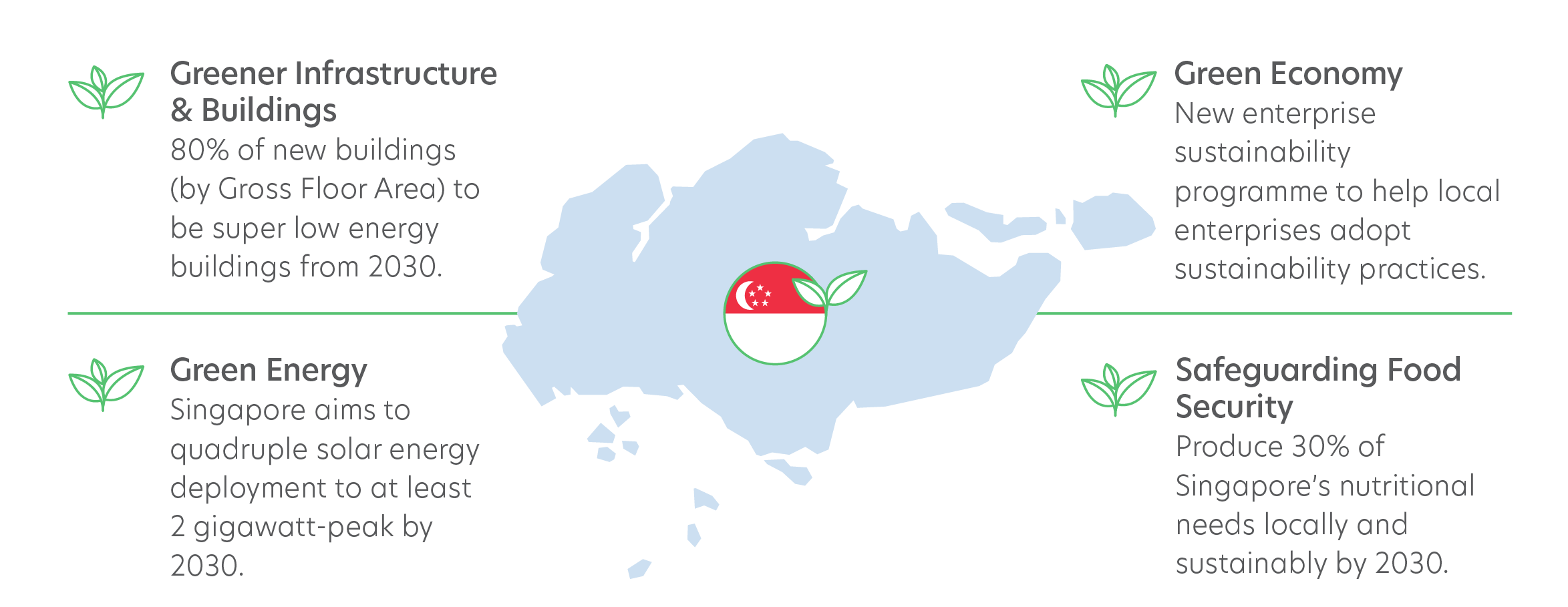

Current State of Sustainability in Singapore

The growing importance of Sustainability in Singapore has led to Singapore raising its national climate target to achieve net zero emissions by 20501. Furthermore, the issues surrounding Sustainability is multi faceted and require substantial funding to support immediate action and strategic long term solutions which will enable Singapore to achieve its goal of a Climate Resilient & Sustainable Future.

Source: greenplan.gov.sg, December 2023

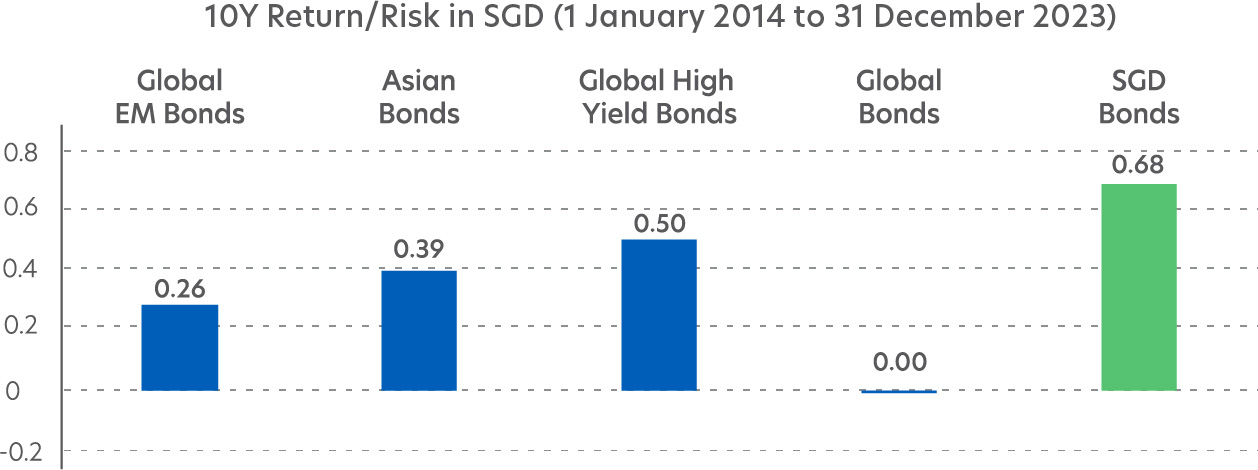

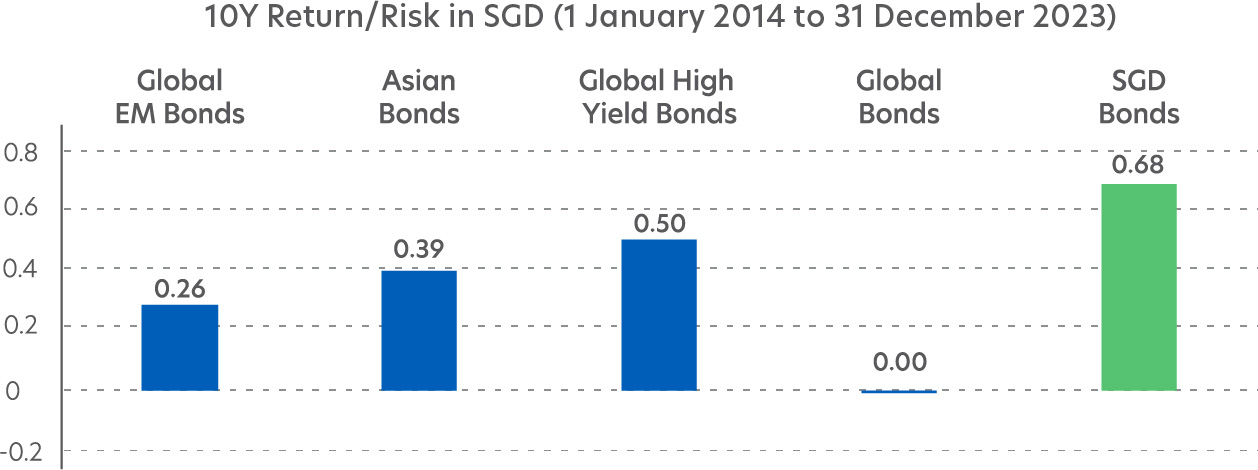

Positive Risk Adjusted Returns^

Singapore Bond Funds provide positive risk adjusted returns. In the past ten years, Singapore Bond Funds delivered a return of 2.02% p.a. with an annualised volatility of 2.96% p.a. and from a Return/Risk perspective provides the best Return/Risk profile versus funds from major asset classes.

Source: Morningstar, as at 31 December 2023. Return/Risk is calculated by Return ( Annualised ) ÷ Standard Deviation ( Annualised ). Global EM Bonds - Morningstar EAA Fund Global Emerging Markets Bond, Asian Bonds - Morningstar EAA Fund Asia Bond, Global Bonds - Morningstar EAA Fund Global Bond, Global High Yield Bonds - Morningstar EAA Fund Global High Yield Bond. Past performance is not necessarily indicative of future performance. EM: Emerging Markets; EAA: Europe/Africa/Asia

^As shown in the above chart on Return/Risk of SGD Bonds from period 1 January 2014 to 31 December 2023

ESG measurement

Every company in the Fund's holdings is assessed using UOBAM's methodology which combines ESG data, artificial intelligence-machine learning (AI-ML) models and UOBAM's independent analysis. This methodology helps our clients to track, measure and understand the sustainability profile and performance of the Fund to achieve desired high sustainability quality.

The sustainability profile largely involves mapping every underlying security invested into at least one of the three core sustainability investment themes.