“AI is a must-have. This prospect has become increasingly evident in investment circles.” CFA Institute, T-shaped Teams: Organising to adopt AI and big data at investment firms, 2021

UOB Asset Management (UOBAM) began developing its artificial intelligence and machine learning (AIML) capabilities in 2019. This was driven by our philosophy of leveraging investment-related technologies in a prudent way to help deliver the best-possible outcomes for our customers.

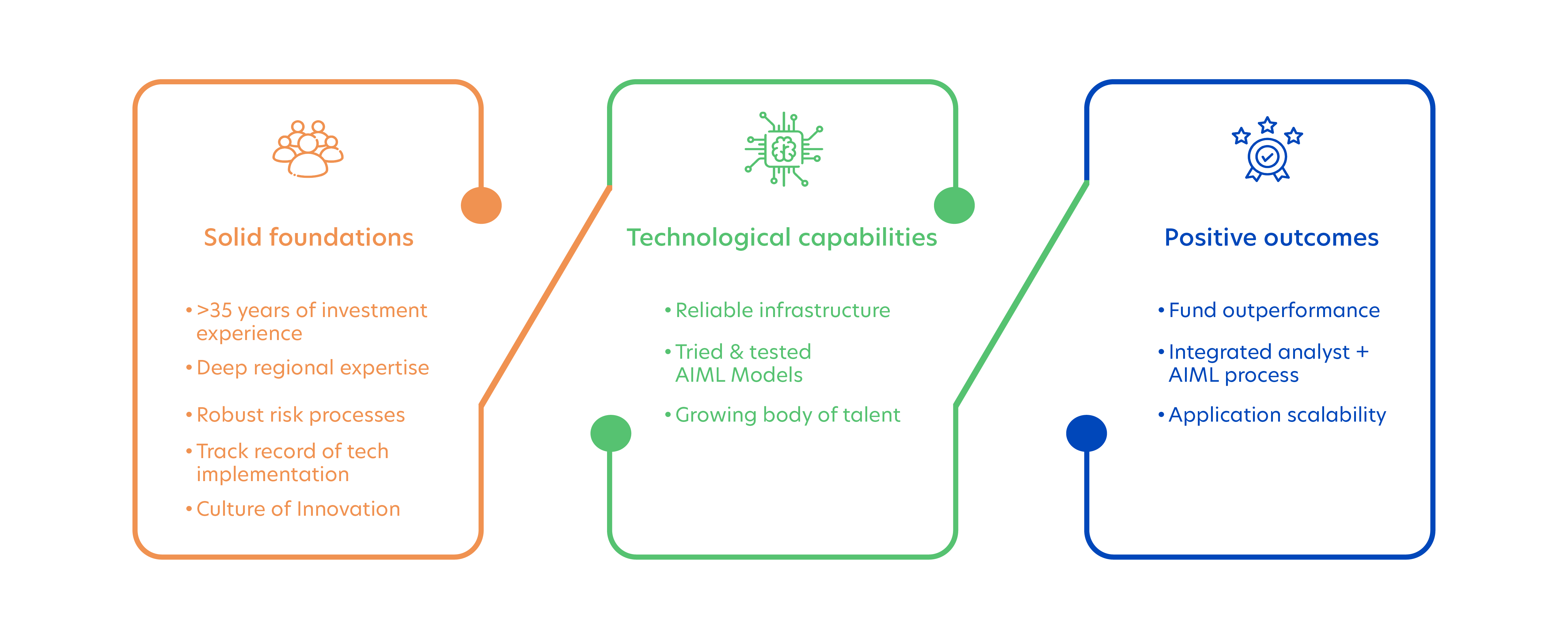

Here are UOBAM’s building blocks for technology-powered investment management.

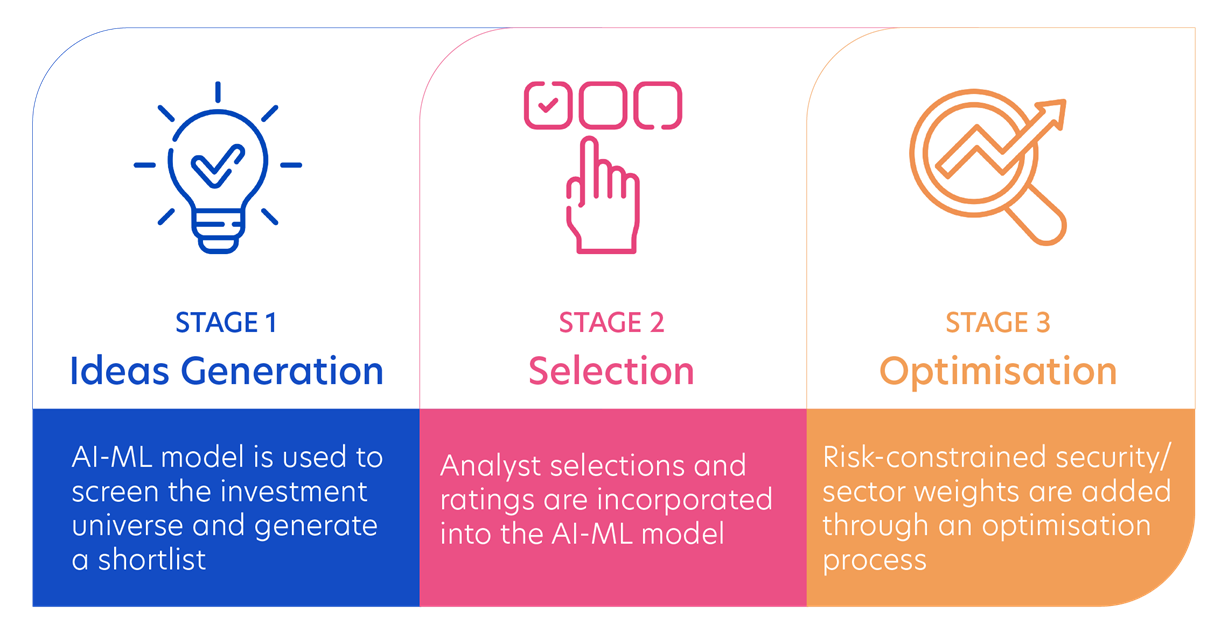

These building blocks have been used to develop a highly structured investment management process that we call AI-Augmentation@UOBAM.

This AI-Augmentation@UOBAM process has been proven to achieve superior investment returns by supplementing our deep investment expertise and robust management processes with AIML-driven analyses and insights.

Why AI + Analyst = higher returns?

UOBAM’s AIML models can analyse the complete investment universe, usually not possible without engaging an army of human analysts.

On the other hand, UOBAM’s analysts have many years of experience and on-the-ground knowledge that AIML models cannot replace.

What is unique about AI-Augmentation@UOBAM?

- AIML techniques are integrated with analyst research capabilities into a seamless investment management process

- 5 years track record – one of the longest in Asia

- Investment outperformance against benchmark and peers

- Models have been adapted to enhance equity, fixed income and multi-asset research

By combining our AIML models with the expertise of our analysts, we have produced investments returns that outperform benchmarks or peers, earning us several industry recognitions.

Most Innovative Application of Artificial Intelligence

Asia Pacific Ex-Japan Equity Outstanding Achiever

Greater China Equity Outstanding Achiever

United Greater China Fund

Best Fund over 3 Years (Equity Greater China) – consecutive win

Best Fund over 5 Years (Equity Greater China)

LSEG Lipper Fund Awards, ©2024 LSEG. All rights reserved. Used under license.

For details on the latest list of awards, click here.