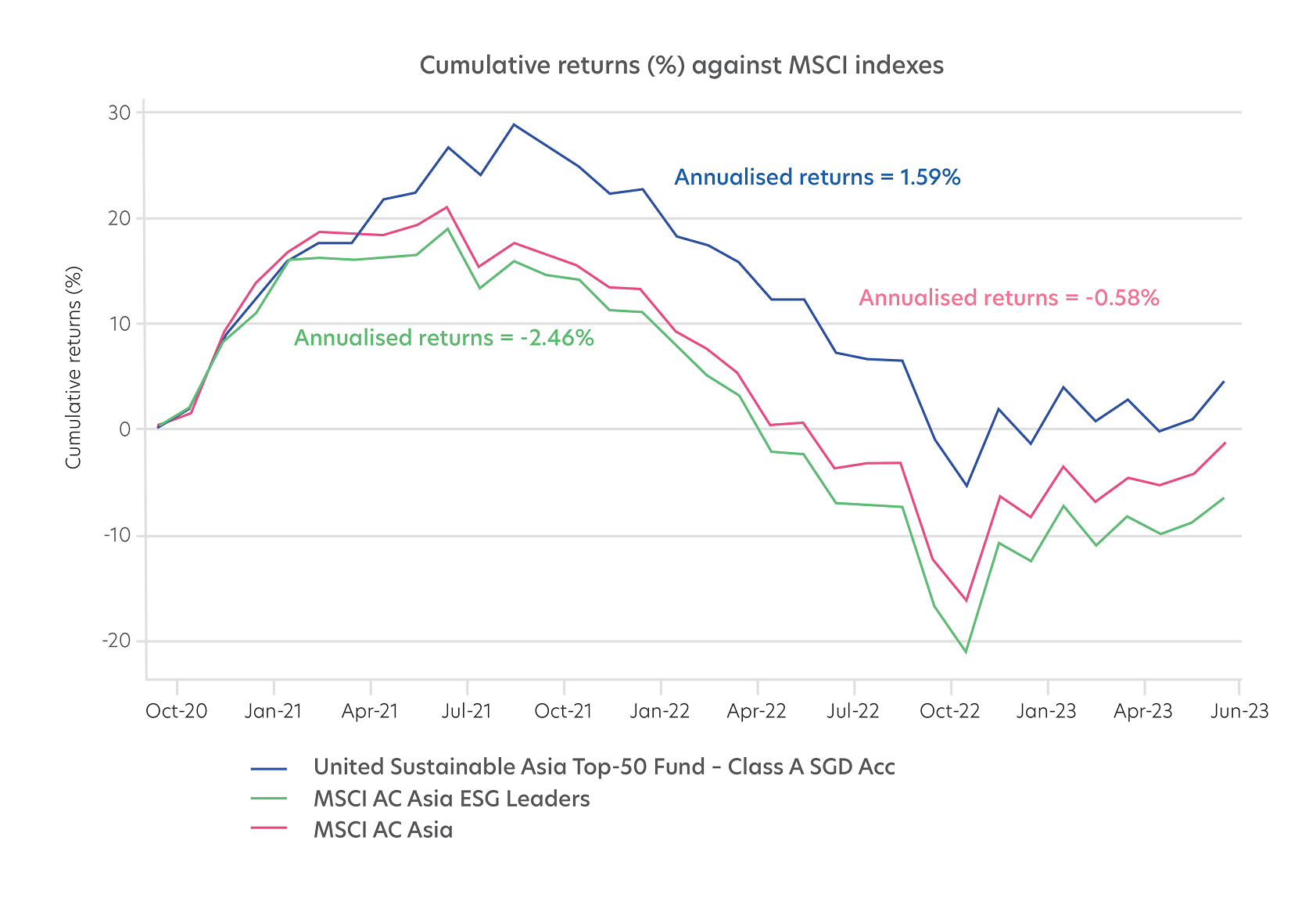

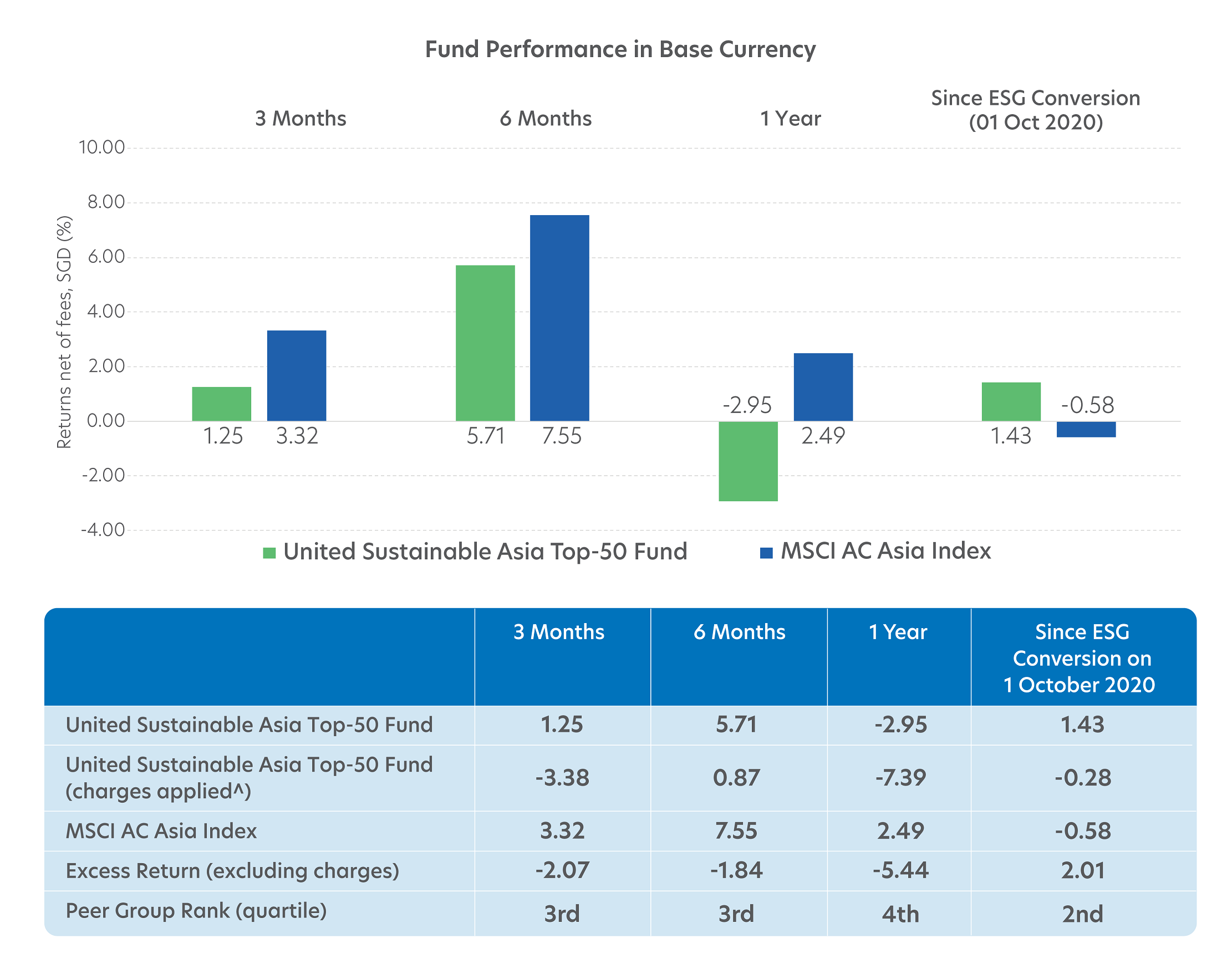

Invest for profit and purpose with Asia’s top 50 sustainable corporations who are shaping the region. The Fund aims to achieve long-term capital appreciation by investing in 50 in total, of the top corporations incorporated in, or whose principal operations are in, Asia including Japan. These companies are selected following the Fund’s investment focus on Environmental, Social, and Governance (ESG) factors using UOB Asset Management (UOBAM)’s proprietary ESG selection process.

Outlook of sustainability in Asia

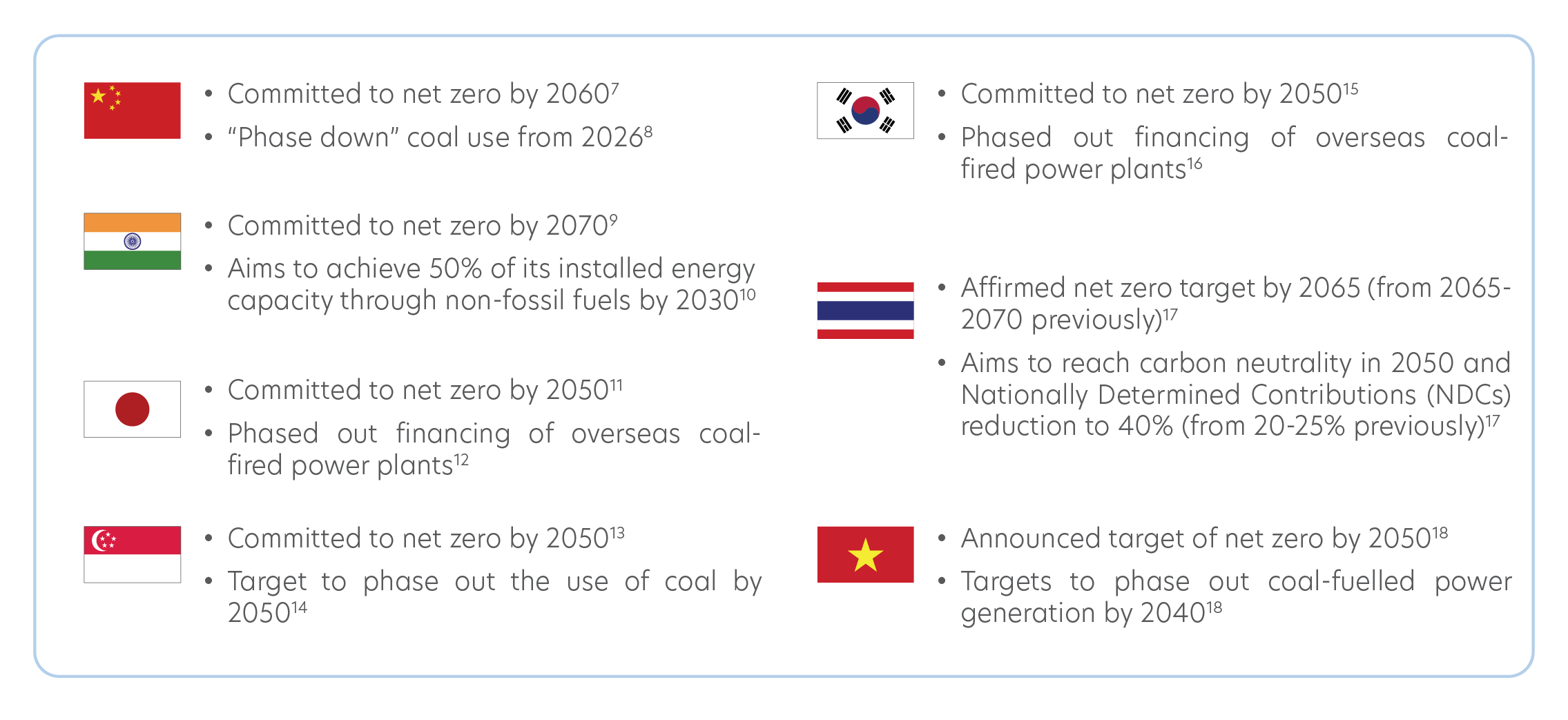

In Asia, there has been growing awareness of the importance of sustainability, with strong commitment from governments to promote sustainability.

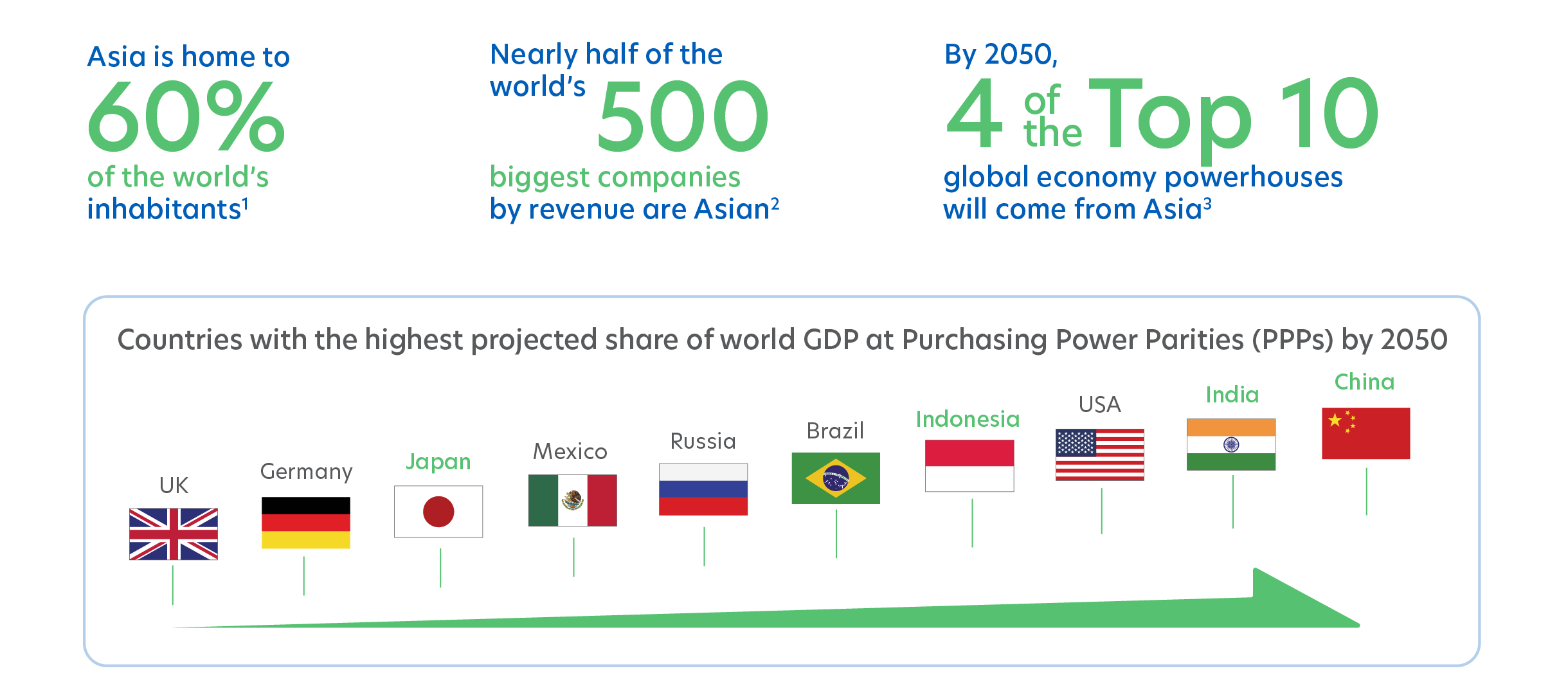

Asia growth

Asia’s large population will enable a strong and resilient economic growth.

Source: PwC, PwC analysis for projections to 2050, June 2022.

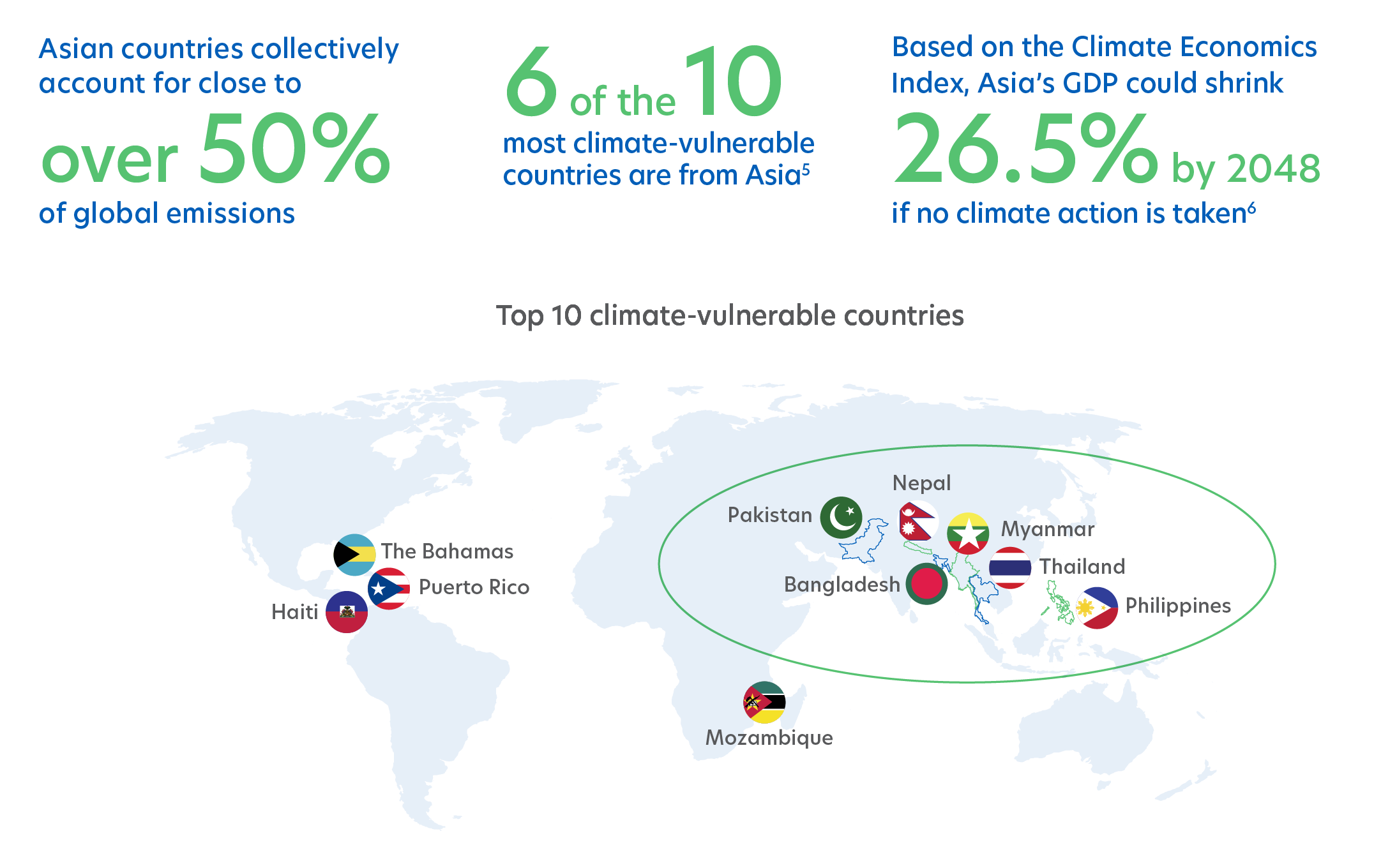

Vulnerable to climate change

Greater resource utilisation and consumption is expected from the growing population trends and consumption pattern in Asia. In addition, Asia is more vulnerable to climate change than other parts of the world4.

Greater commitments, more policy developments, more sustainable investment opportunities

As one of the fastest-growing regions and most at-risk regions to climate shocks, Asia must develop in a sustainable manner. The commitments and policy developments by the governments of Asian countries are a positive step.

Asia’s need for a sustainability transition presents a unique landscape full of sustainable investment opportunities. There is an estimated $1 trillion worth of annual economic opportunity to achieve a green economy by 2030 in Southeast Asia alone19.