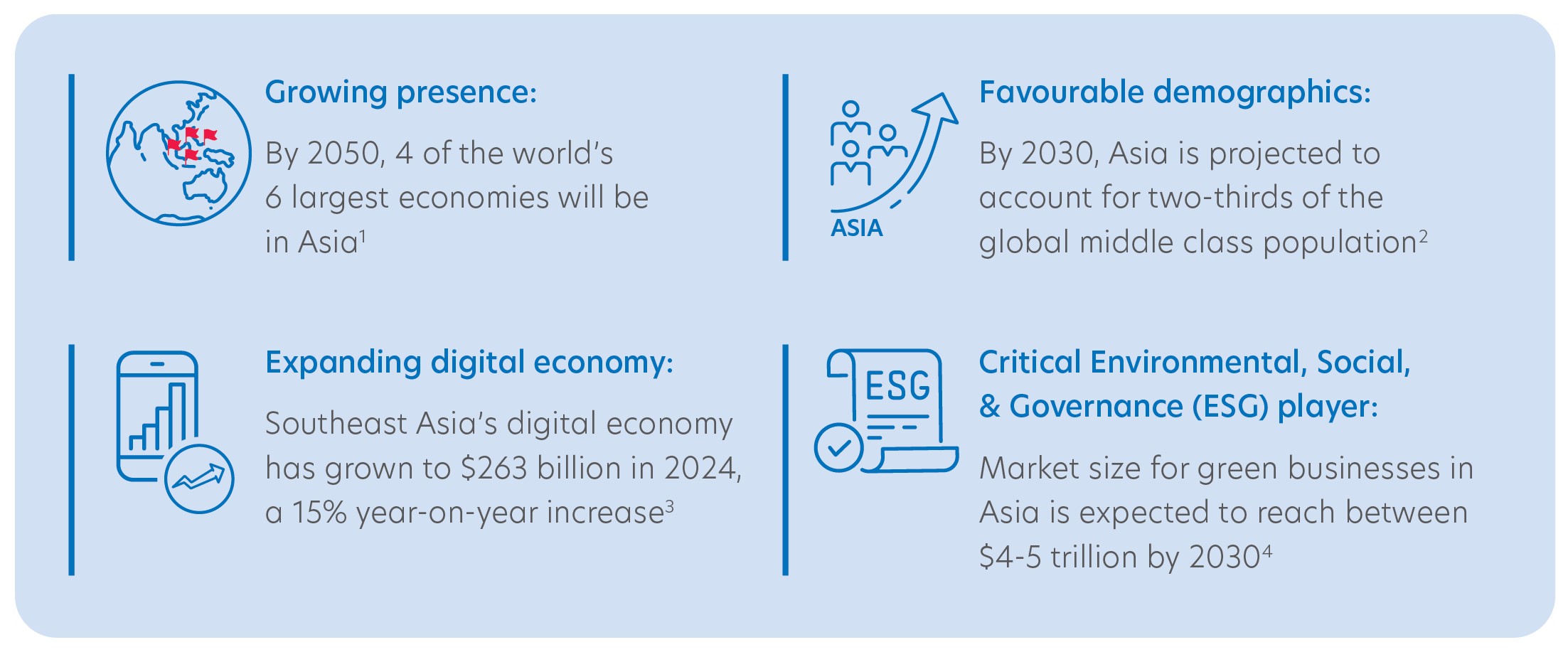

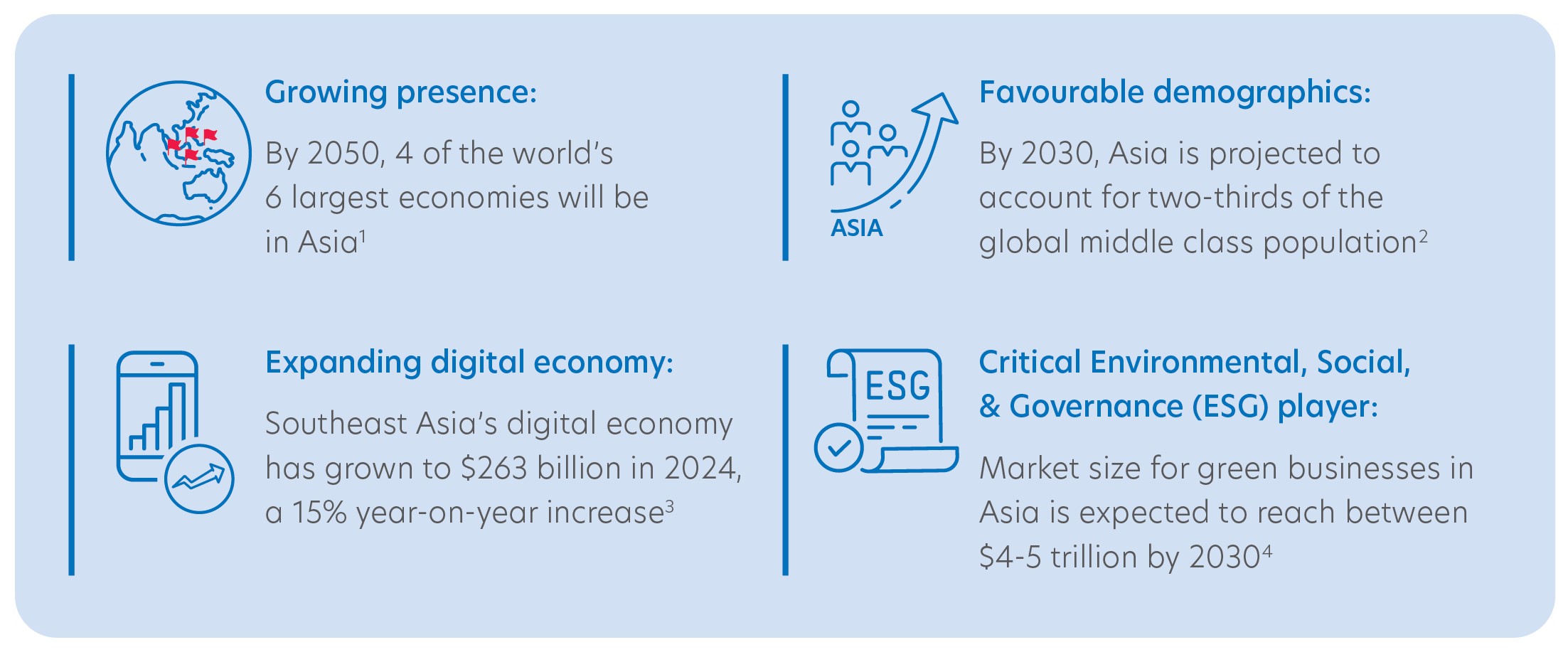

Why invest in Asia?

1) Investors can no longer ignore Asia

1 Visual Capitalist, Ranked: The Top Economies in the World (1980 2075), July 2023.

2 Futures Platform, How Asia’s growing middle class is reshaping global consumption, September 2023. Middle class is defined ashouseholds with per capita incomes between US$11 and US$110 per person per day in 2011 Purchasing Power Parity (PPP) terms.

3 Google, e-Conomy SEA 2024 report, November 2024.

4 McKinsey & Company, Green Growth: Capturing Asia’s $5 trillion green business opportunity, September 2022.

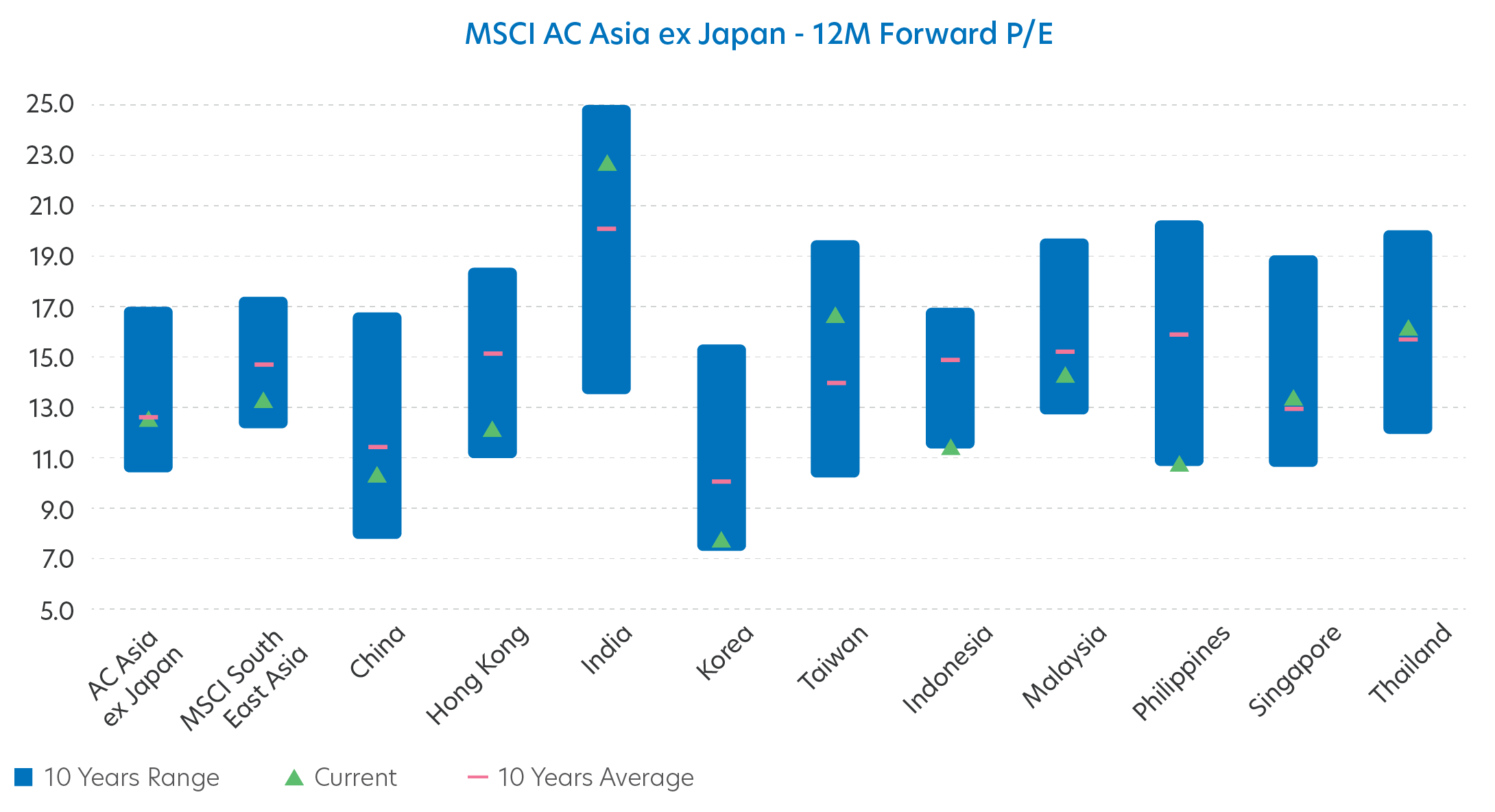

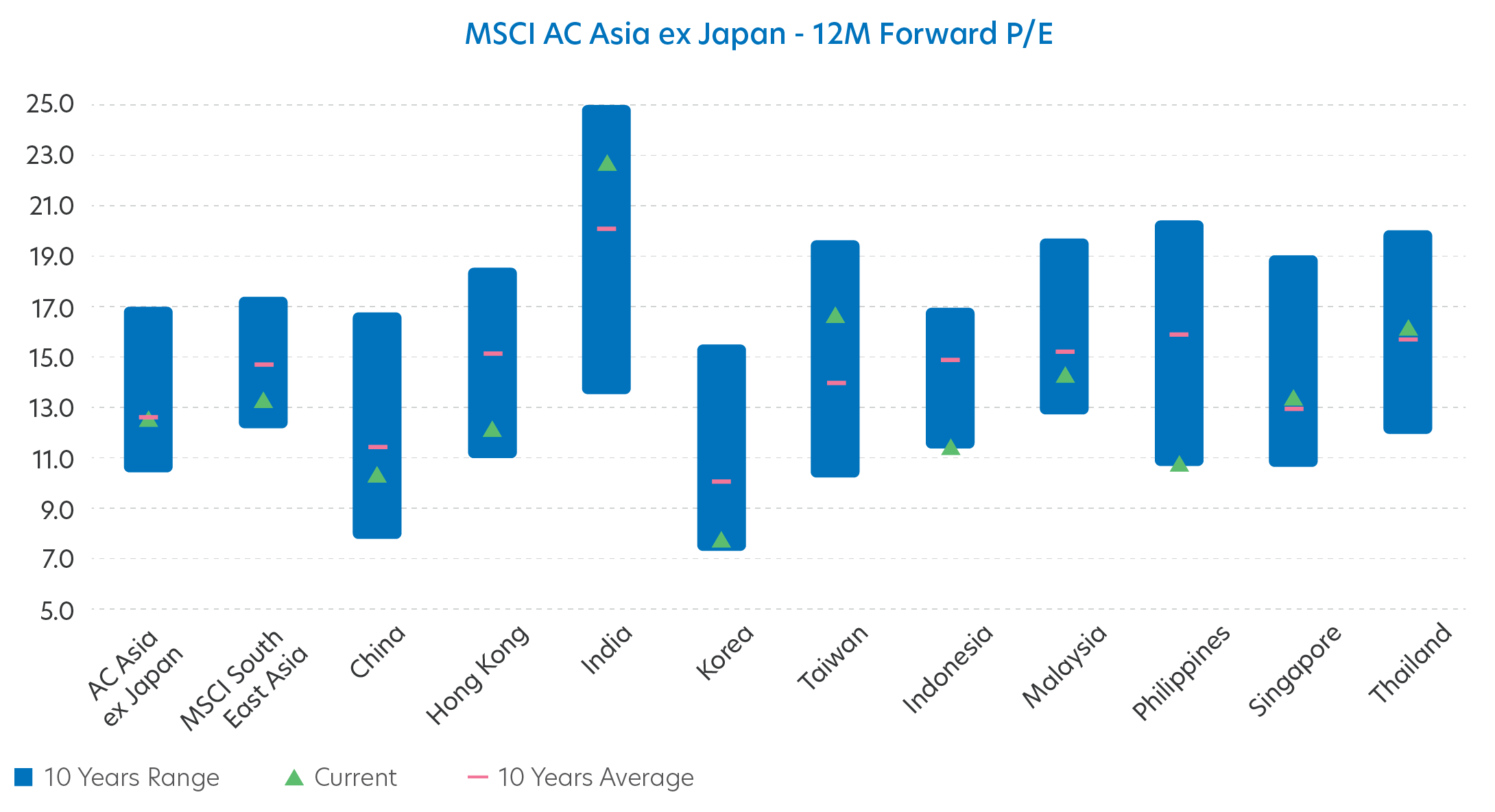

2) Good time to enter Asian markets

Attractive valuations

Major Asian markets, including China, Hong Kong and ASEAN are attractively priced. Current Price-to-Earnings (P/E) valuations of most Asian markets are still lower than their 10-year average.5

Source: UOBAM, Factset, as of December 2024.

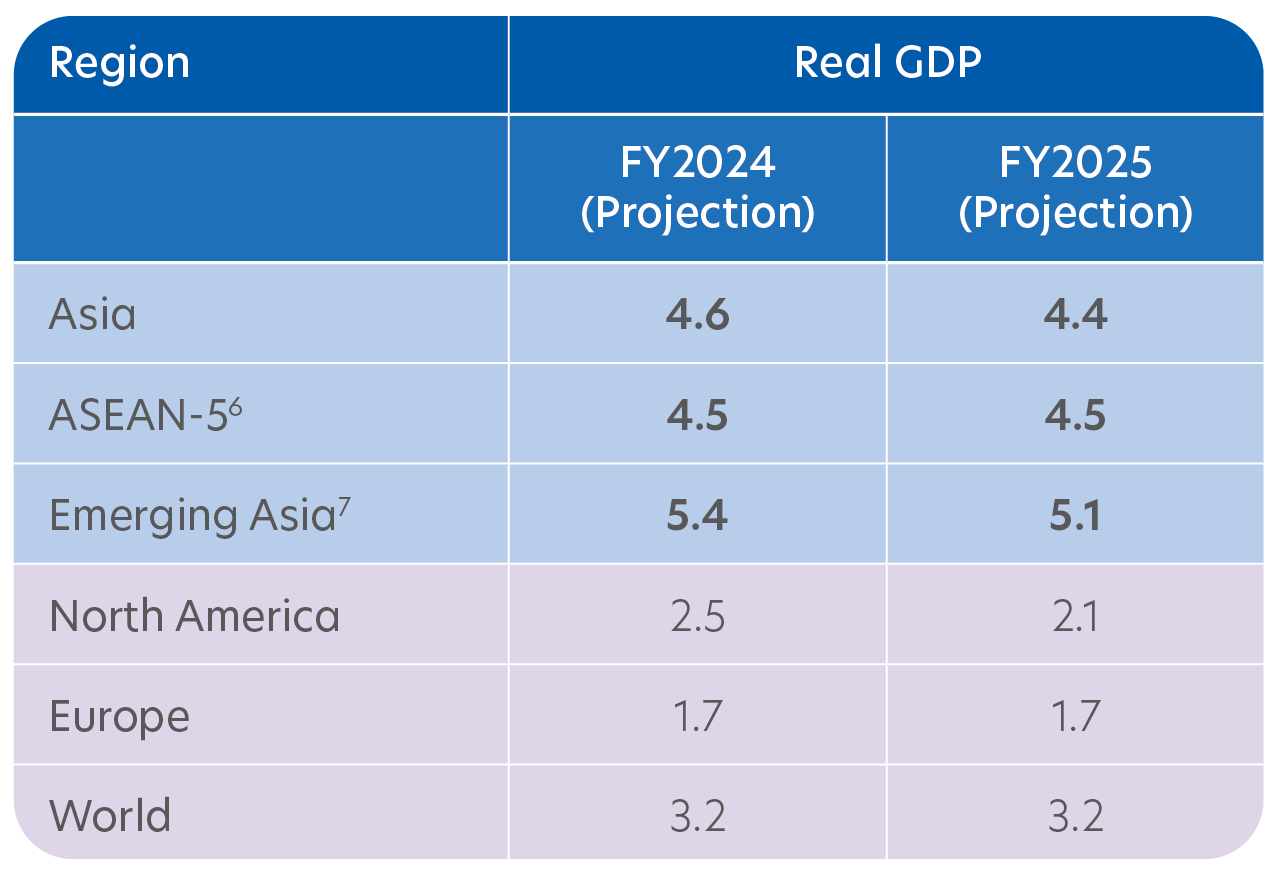

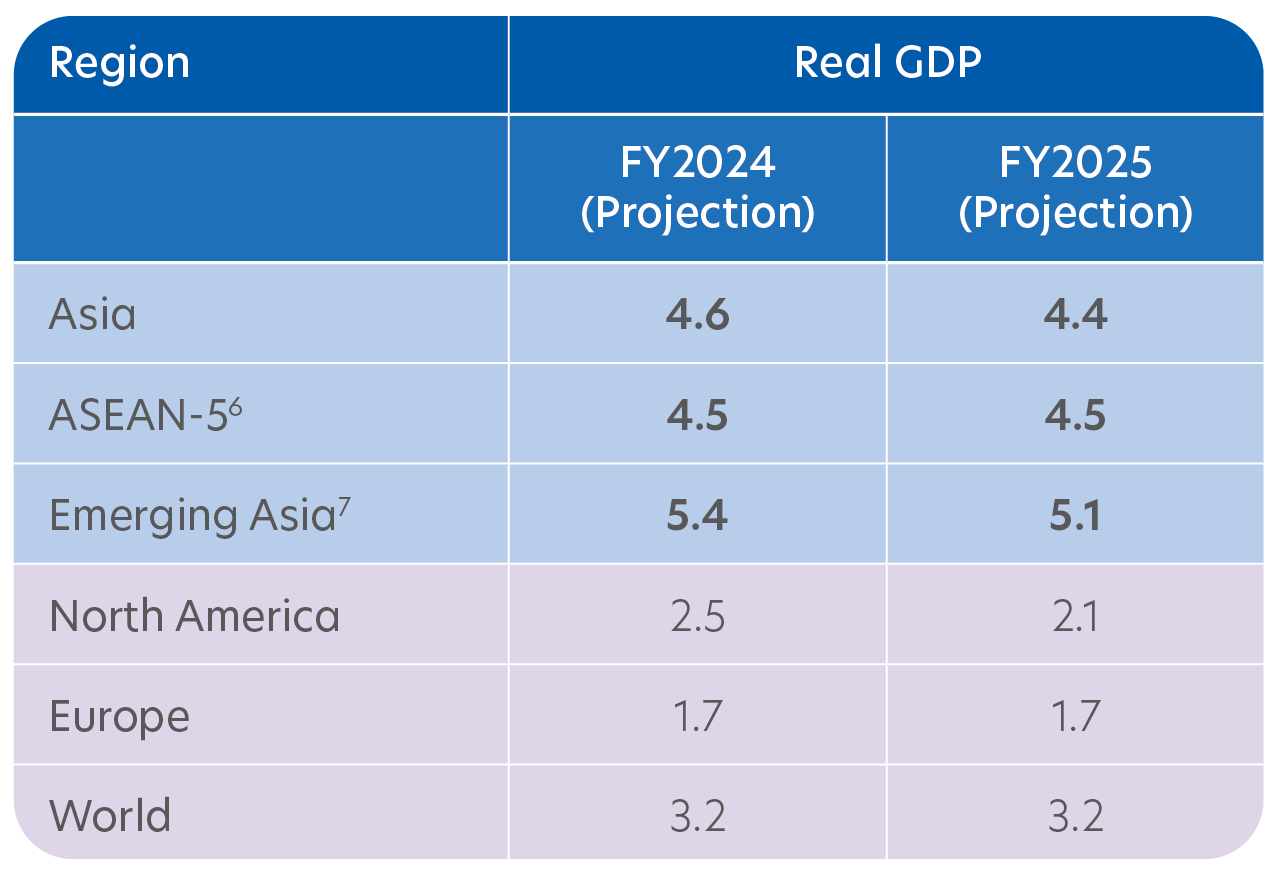

Resilience despite global challenges

Asia continues to show economic resilience with healthy real gross domestic product (GDP) levels net of inflation, compared to the rest of the world.

Source: International Monetary Fund, World Economic Outlook, October 2024

Market under-representation

Even though over half of the world’s stocks are listed in Asia, Asian markets comprise less than 15% of global indices.8 Institutional investors will likely have to increase their Asia holdings in the coming year.

8 Source: MSCI, as of 31 December 2024. Asia countries represent 6.21% of the MSCI World Index, and 13.58% of the MSCI All Country World Index.

Why invest in the United Asia Fund?

1) Strong long-term outperformance

The Fund has delivered returns above its industry peers over the long term.

Source: Morningstar, as of 31 December 2024 | Peers category: Asia ex Japan Equity, Index: Morningstar Asia x Japan SGD | Benchmark: MSCI AC (All Country) Asia ex Japan Index. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns. Past performance is not necessarily indicative of future performance.

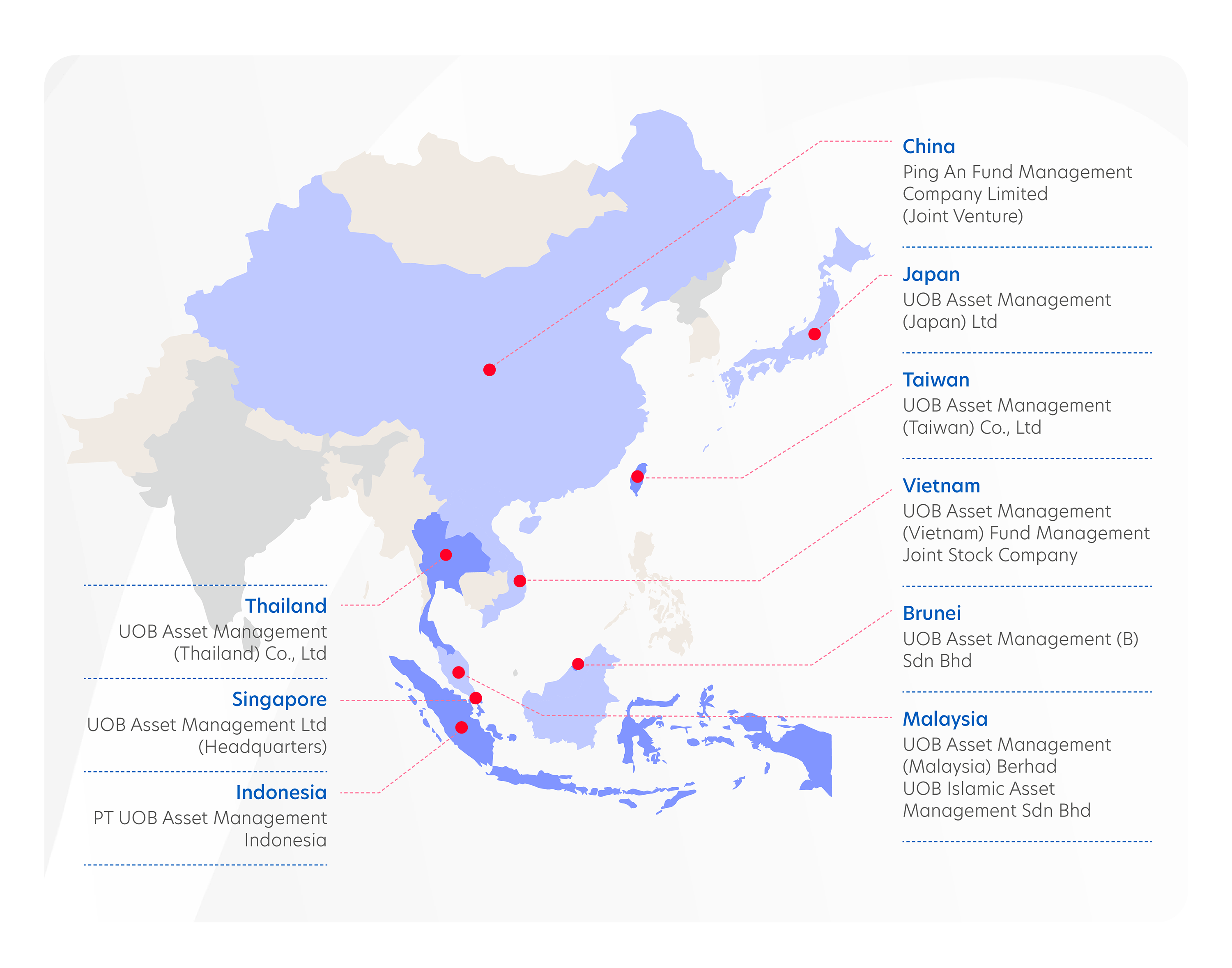

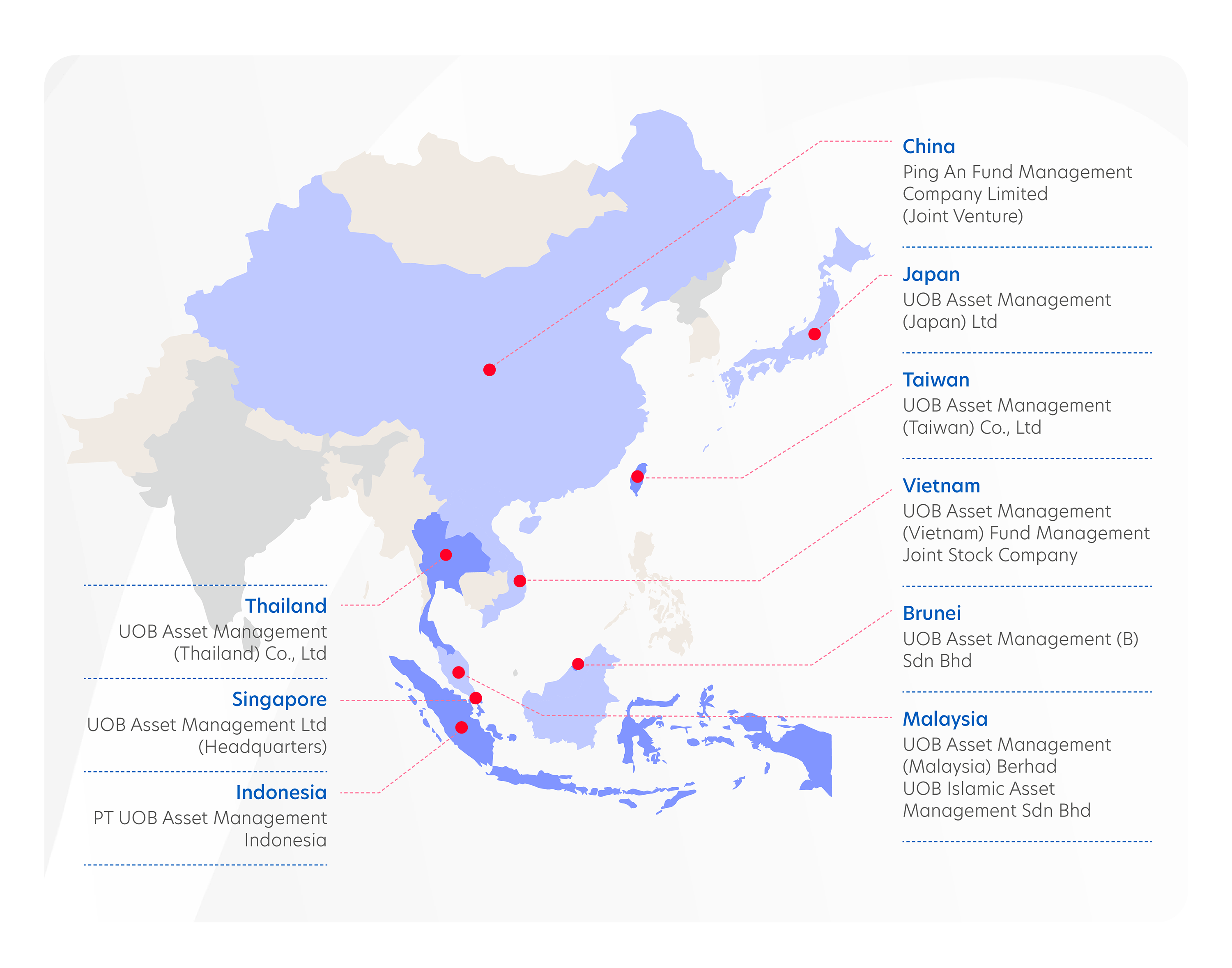

2) Extensive presence in Asia

Headquartered in Singapore, UOBAM has an extensive local presence across Asia. By investing in the Fund, investors can leverage UOBAM’s on-the-ground insights for opportunities in the region.

3) Powered by AI Augmentation@UOBAM

The Fund applies UOBAM’s proprietary artificial intelligence (AI)-Augmentation capabilities. AI can enhance investment returns, but even more so in highly diverse and data-rich Asian markets. In 2020, the United Asia Fund became one of the first funds in UOBAM to apply the firm’s AI-Augmentation investment framework.

The framework seamlessly merges AI techniques with analyst processes, enabling the integration of AI-driven insights and human expertise.

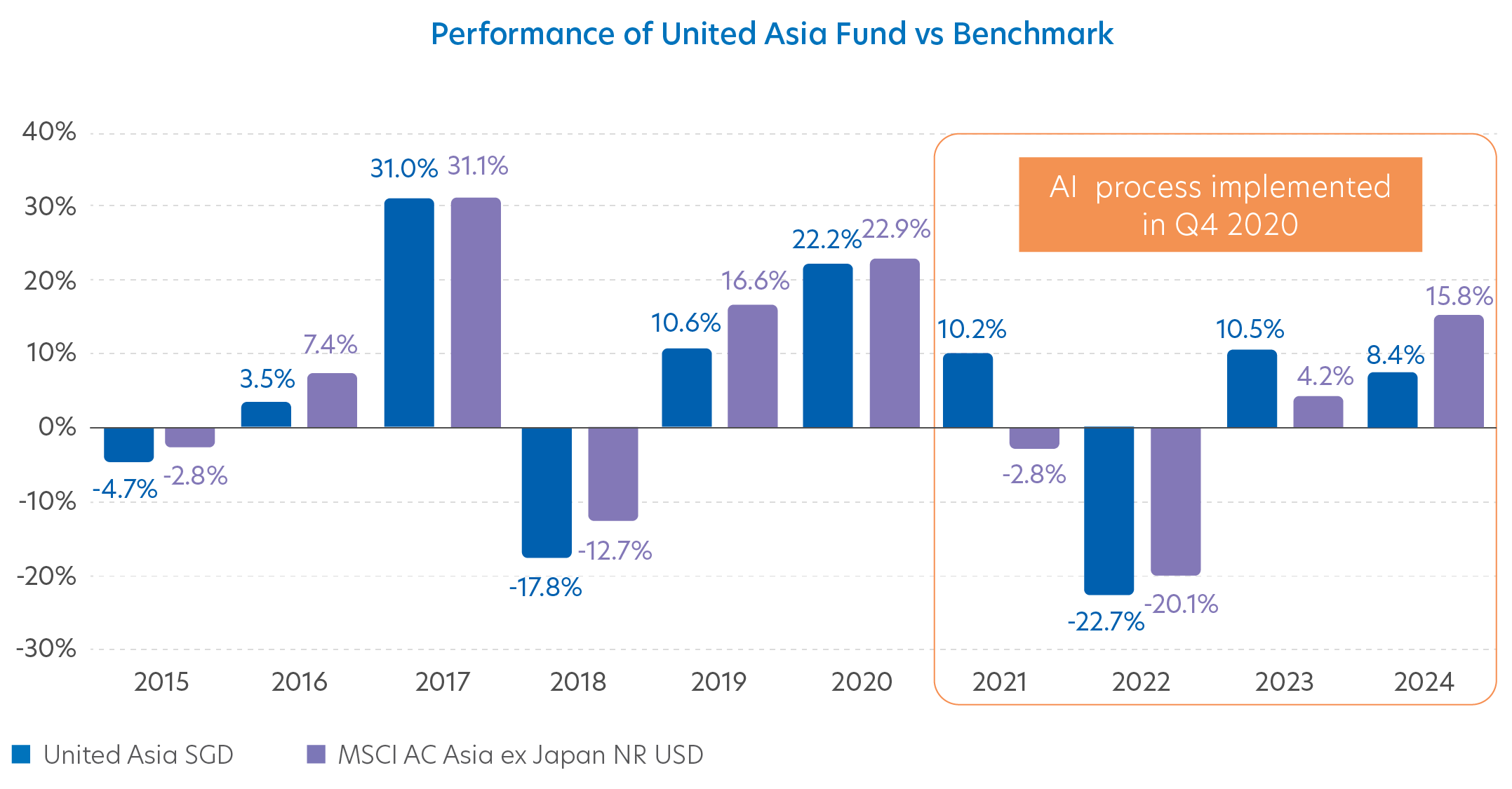

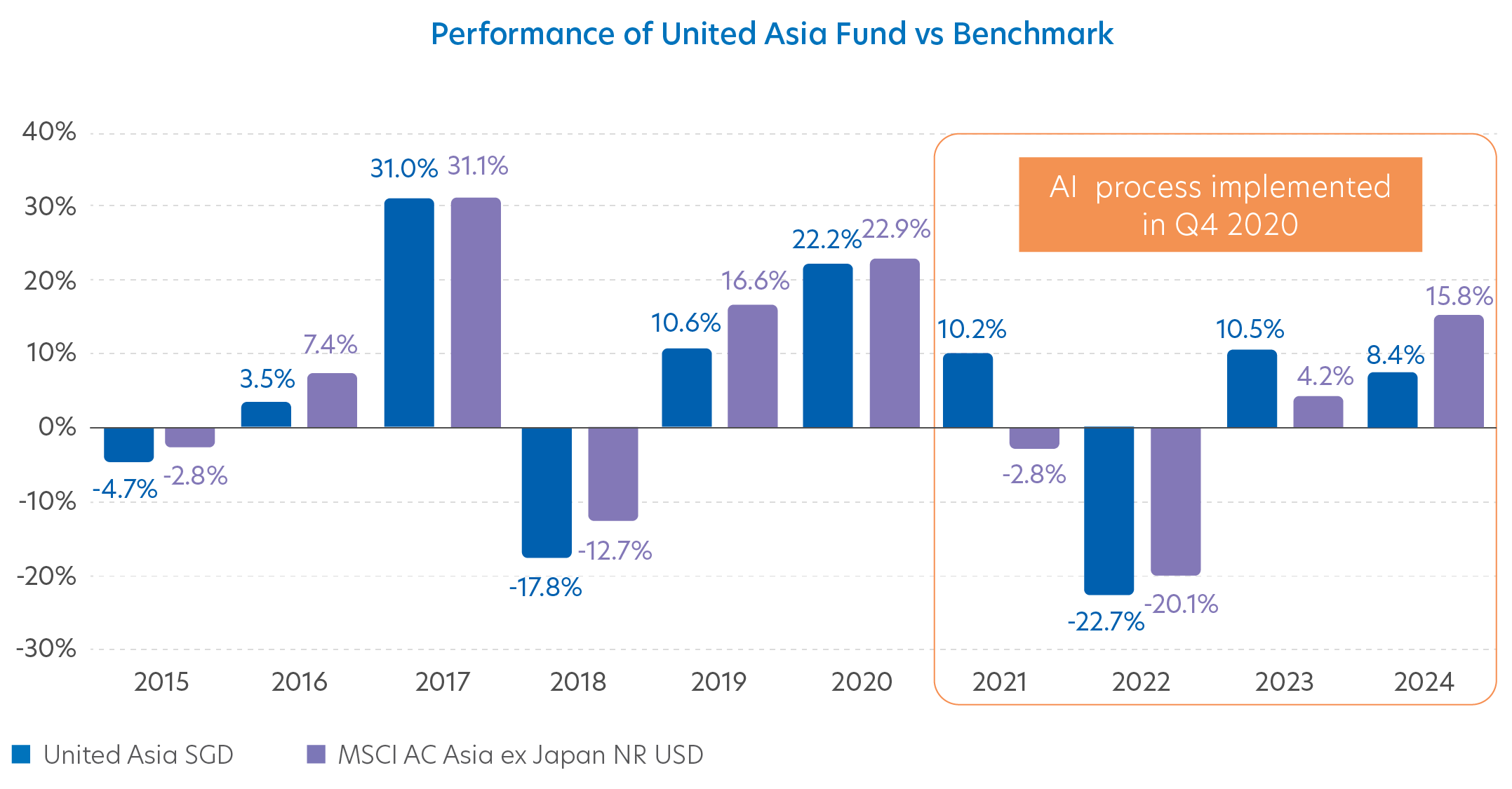

Since the implementation of the AI-Augmentation investment framework, the Fund has frequently outperformed its benchmark, achieving a significant excess return. This performance underscores the effectiveness of our strategic approach in the investment landscape.

Source: UOBAM, Morningstar, as of 31 December 2024.

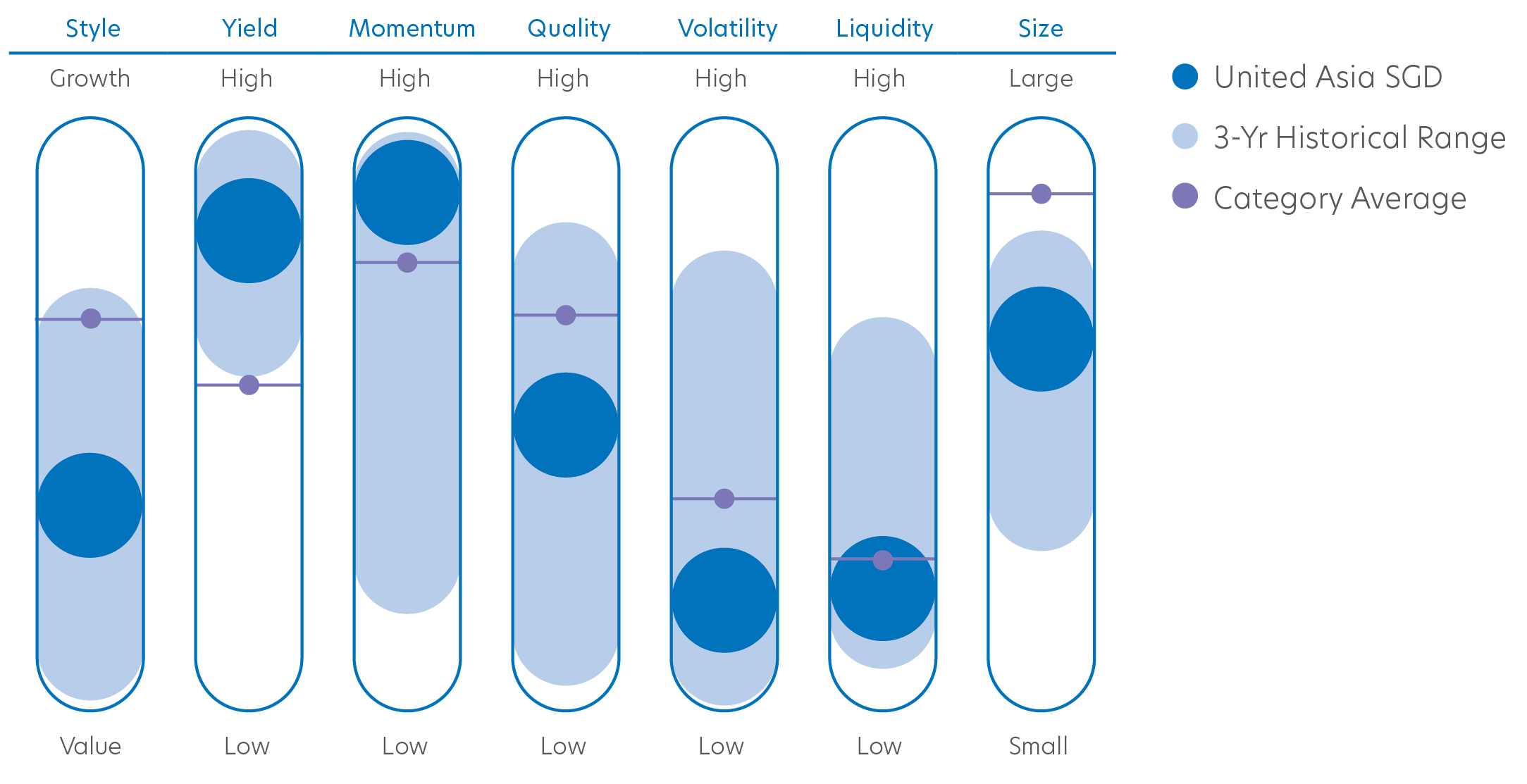

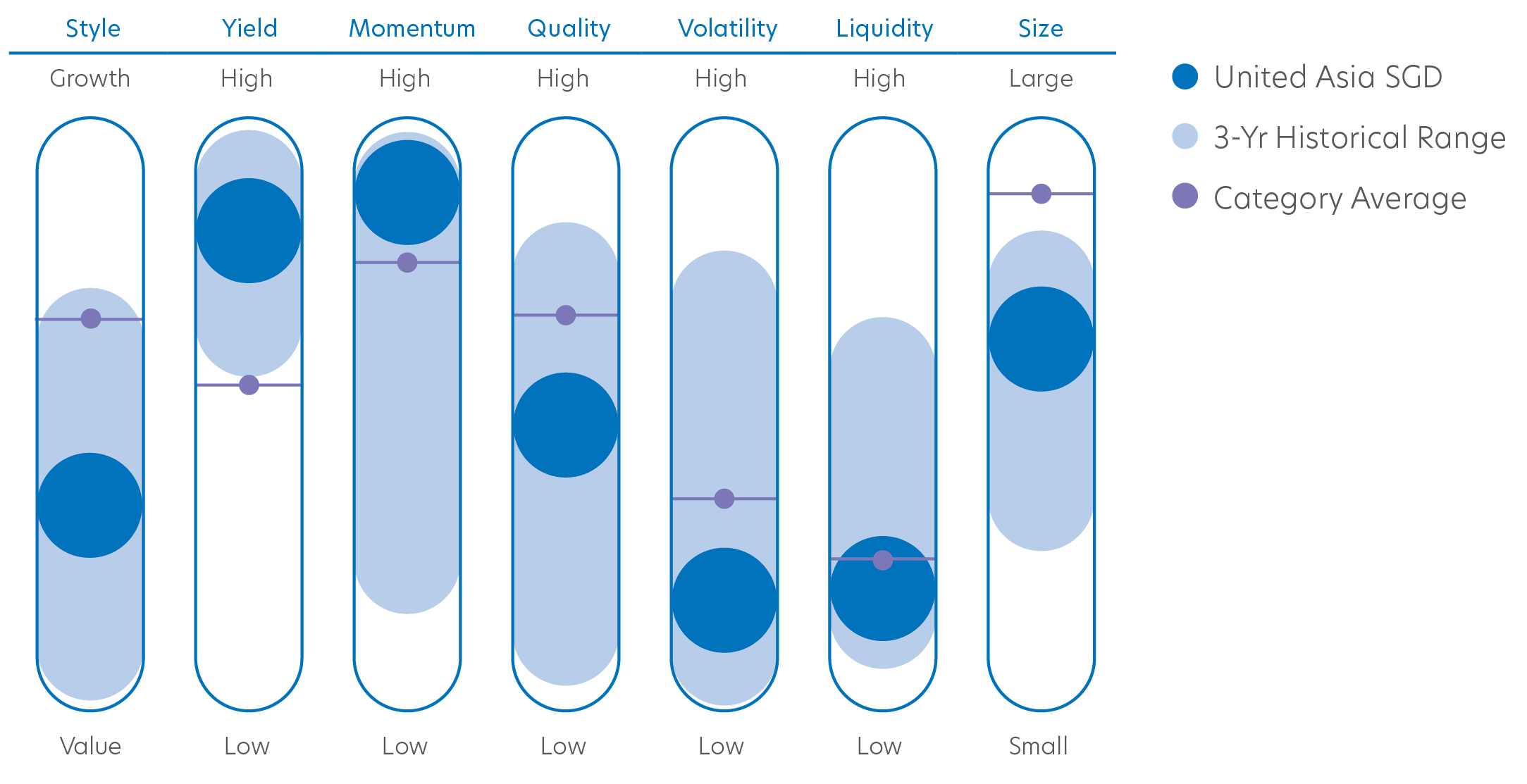

4) Flexibility to adjust according to market conditions

UOBAM’s proprietary AI-Augmentation capabilities allow the Fund to dynamically allocate across investment factors based on market conditions, to mitigate risks while maximising returns.

In the past 3 years, the Fund had dynamically allocated across the factor profiles as depicted by the light blue shaded areas.

Considering the Size factor as an example, the Fund’s flexibility allowed for a smaller allocation to large cap companies like Alibaba and Tencent that did not perform well after Covid-19, unlike its peers who continued to invest in them.

Source: Morningstar, as of 31 December 2024. United Asia Fund data as of 31 October 2024.

Category: Asia ex Japan Equity, as of 31 October 2024.

5) Award-winning and highly rated9

Received the Outstanding Achiever award for the Asia Pacific ex-Japan Equity category at the Benchmark Fund of the Year 2023 awards.

Given a four-star rating by Morningstar in the category of EAA Fund Asia ex-Japan Equity as of 31 December 2024.

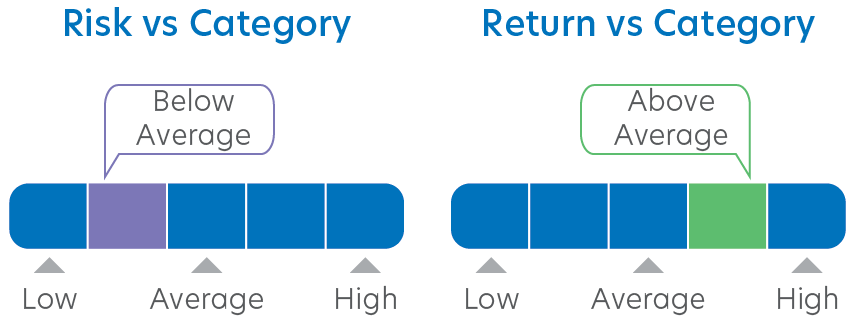

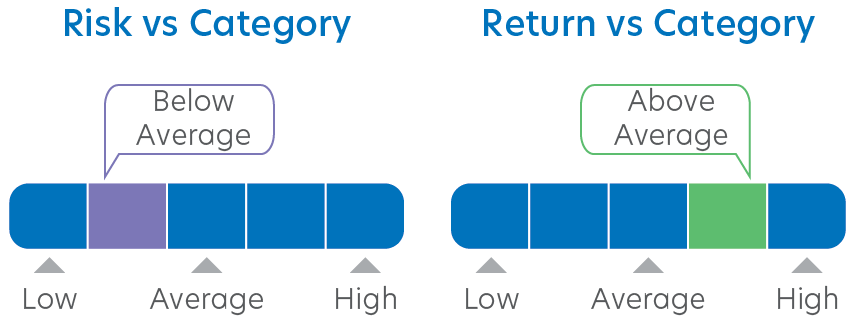

Compared to its peers, the Fund gives above average returns at below average risk10 in the past 3 years.

9 Please refer to uobam.com.sg/awards for the latest list of UOBAM awards.

10 Source: Morningstar, as of 31 December 2024. Category: Asia ex-Japan Equity. Rankings are out of 1313 investments.