Why invest in Greater China?

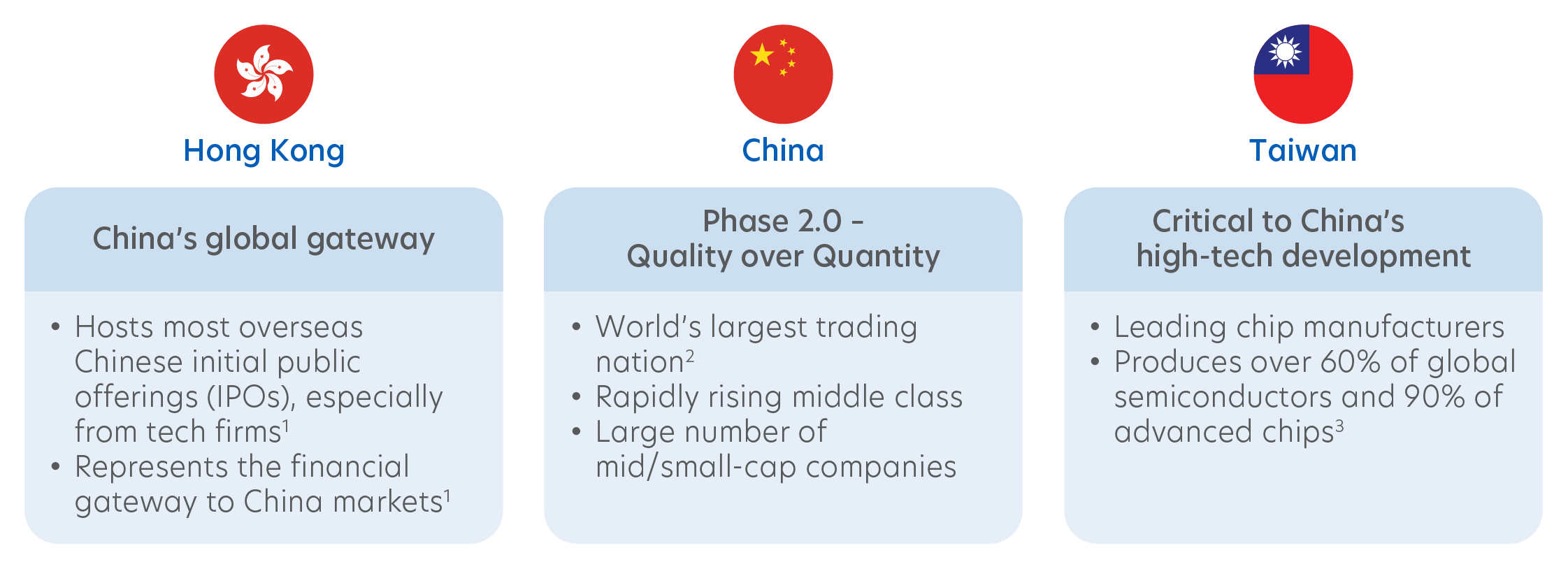

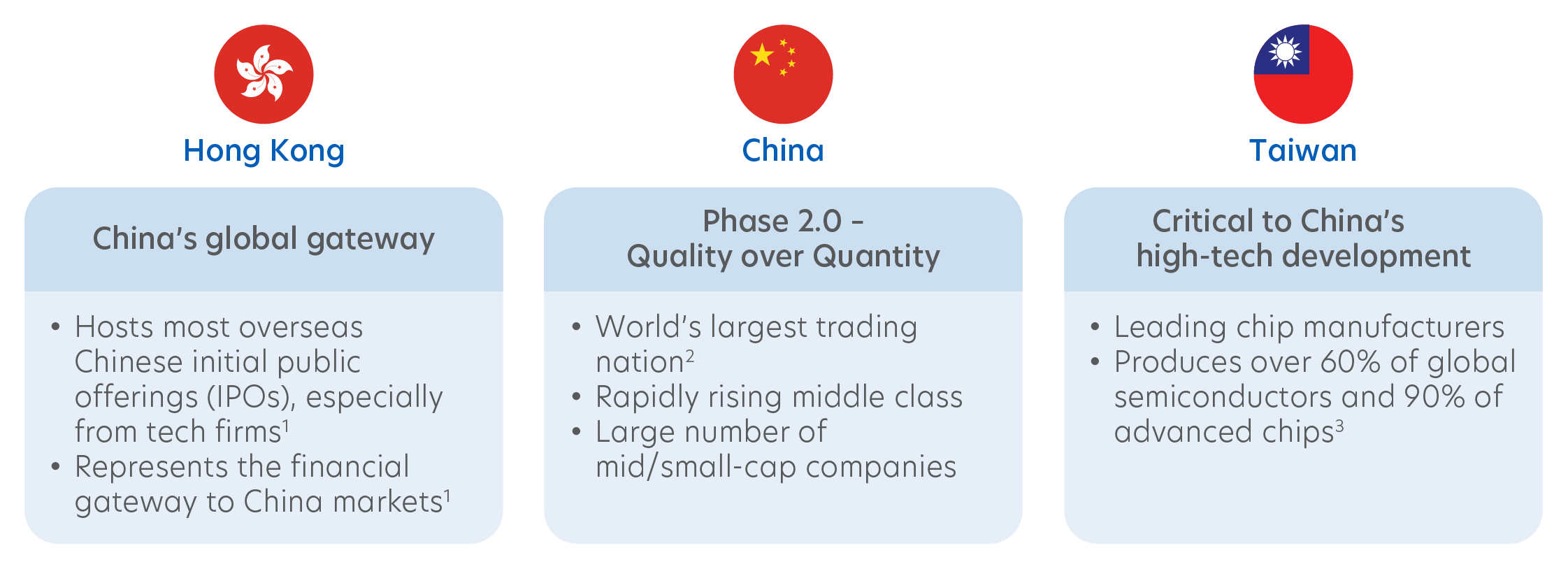

1) Leverage Greater China’s regional interdependency

By investing in Greater China, investors can also harness the growth of China’s most mutually dependent markets, Hong Kong and Taiwan.

While China remains the main growth engine, the interdependency in the region provides a wider range of mutually beneficial opportunities.

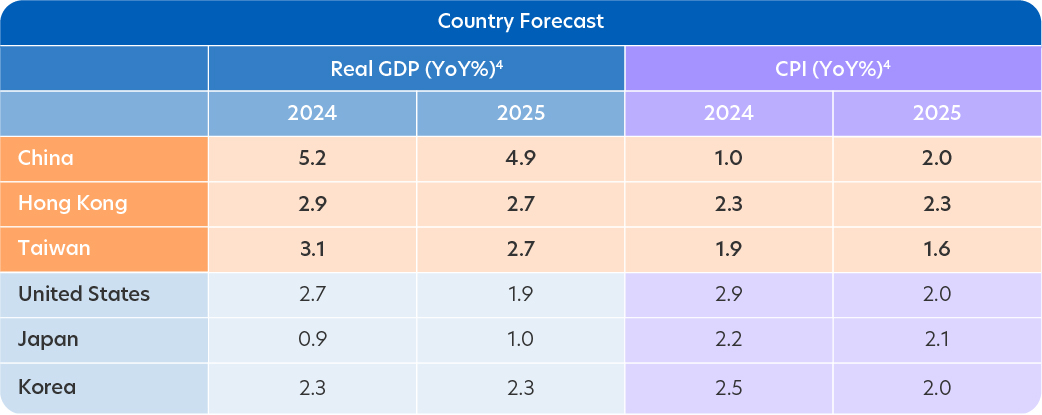

2) Ride the next wave of Greater China’s growth

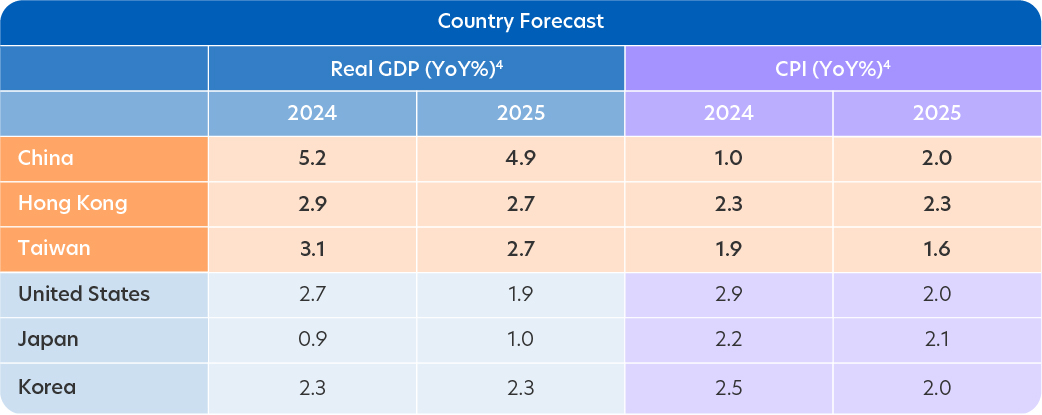

Greater China’s real gross domestic product (GDP) is among the highest globally, and it is poised for a growth recovery. Meanwhile, the region’s low consumer price index (CPI) indicates low inflation, which provides room for monetary support.

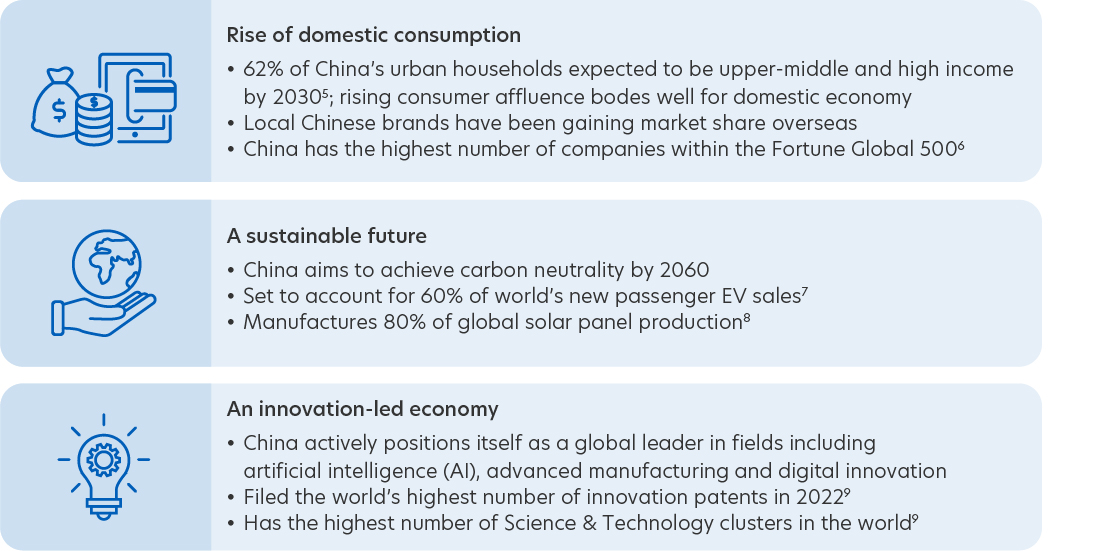

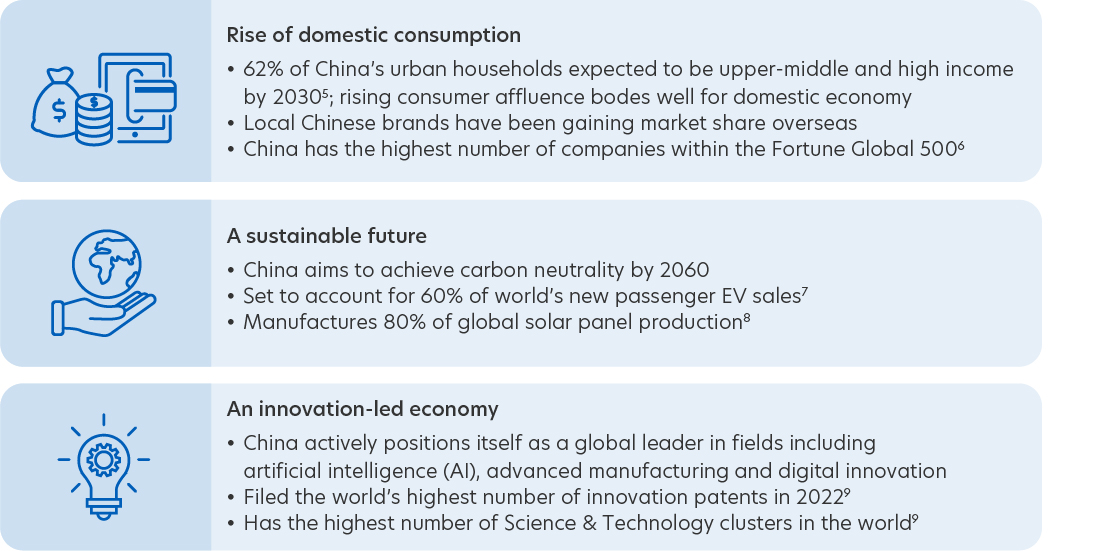

Key engines propelling the next phase of Greater China’s growth are:

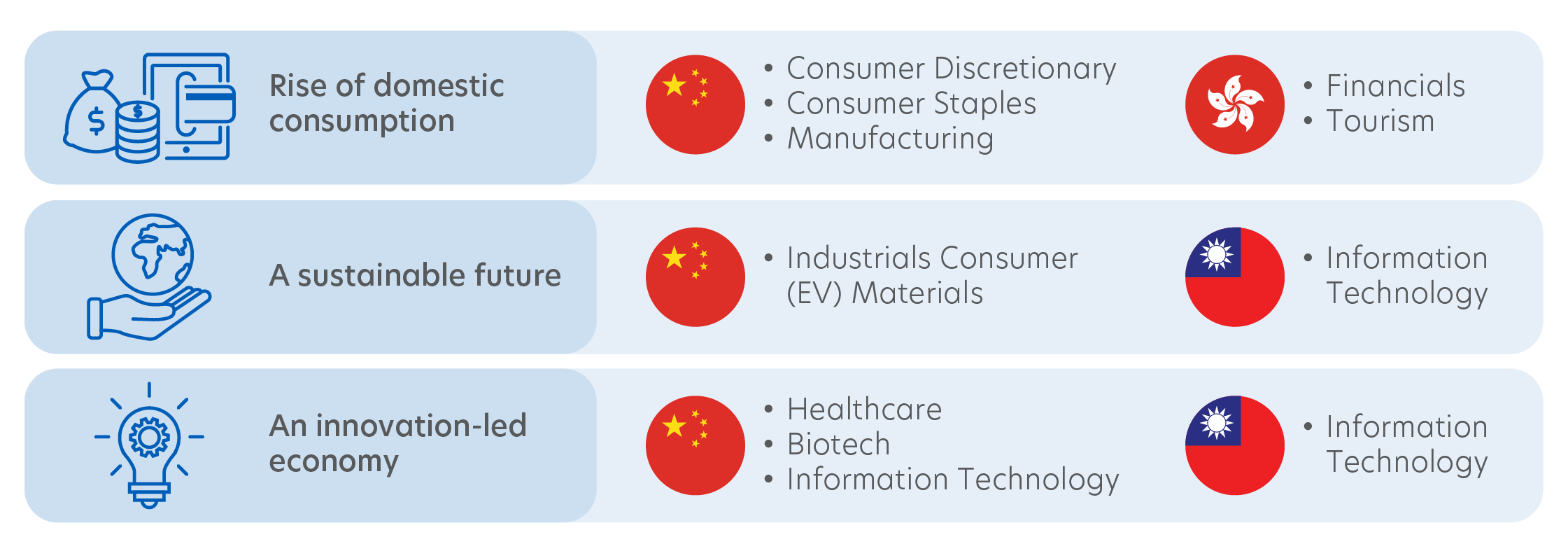

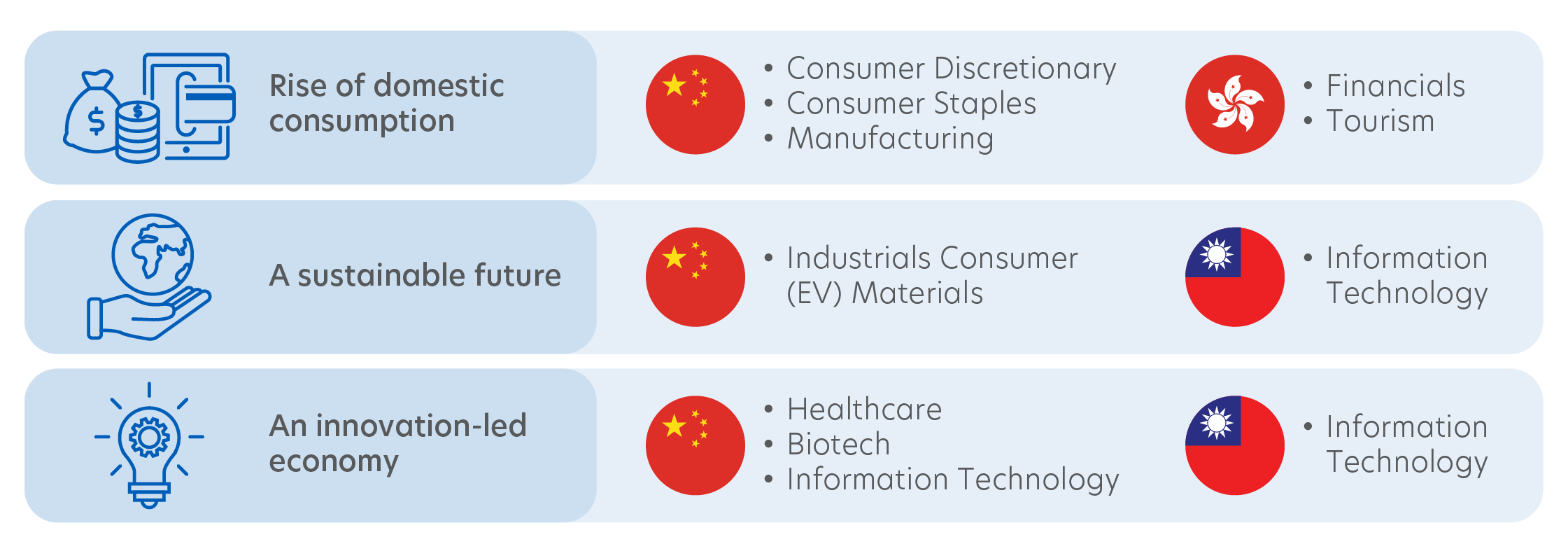

Here are the potential sectors benefitting from the economic dynamism within Greater China:

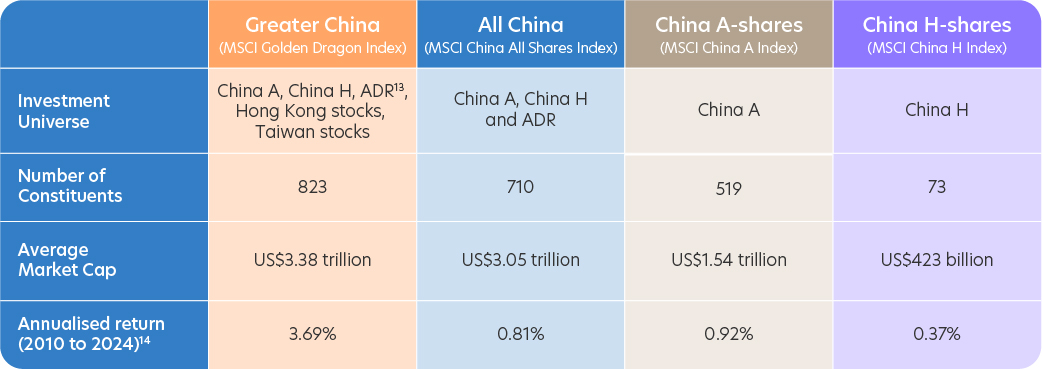

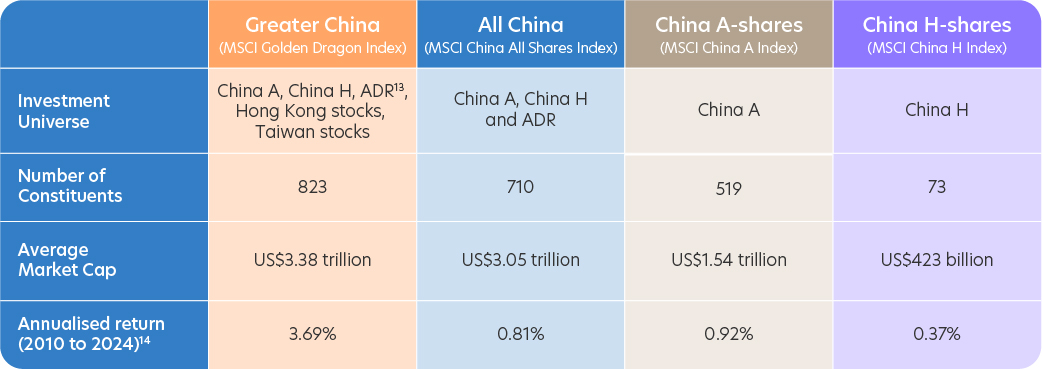

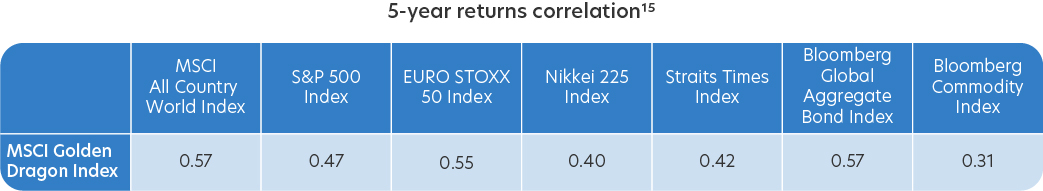

3) Greater China offers diversification and high returns at lower risk11

The Greater China market reduces concentration risk, provides investors with a diversified portfolio, and offers the potential of higher returns at a lower risk.12

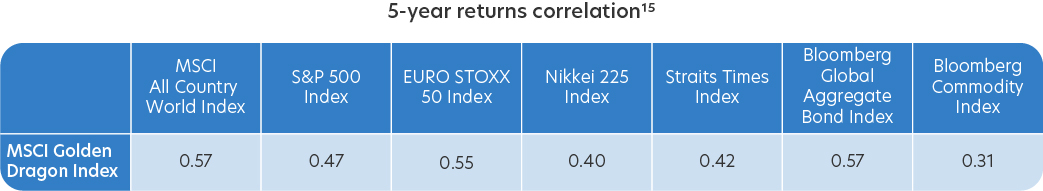

Investors can also enjoy diversification benefits due to the region’s relatively low correlation with major broad market indexes and alternative asset classes. It can be used as a satellite component in a core-satellite portfolio.

Why invest in the United Greater China Fund?

1) Award-winning16

Winner of the Refinitiv Lipper Fund Awards in the category of Best Fund over 3 Years Equity Greater China (consecutive) and Best Fund over 5 Years Equity Greater China

LSEG Lipper Fund Awards, ©2024 LSEG. All rights reserved. Used under license.

Received the Outstanding Achiever award for the Greater China Equity category at the Benchmark Fund of the Year 2023 awards.

Given a five-star rating by Morningstar in the category of EAA Fund Greater China Equity as of 31 March 2024.

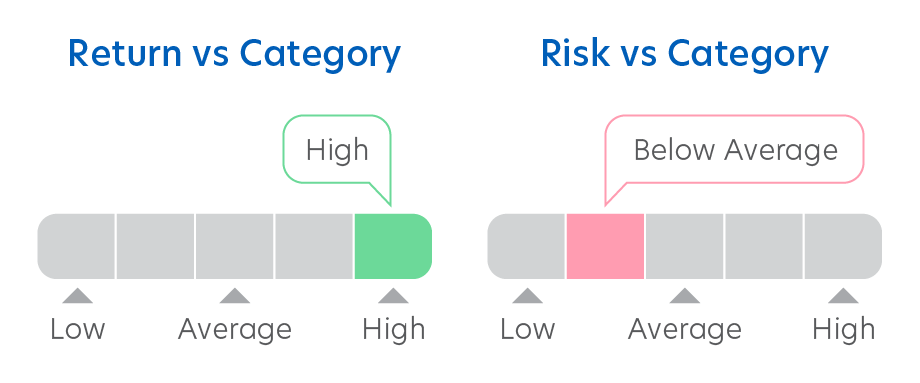

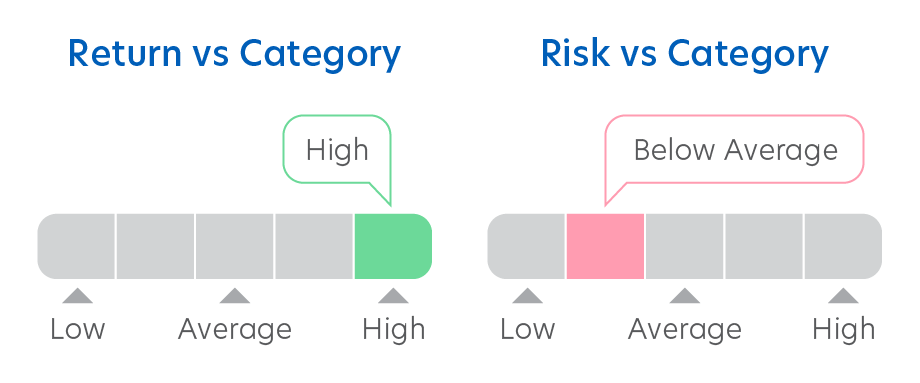

Compared to its peers, the Fund gives high returns at a lower than average risk17.

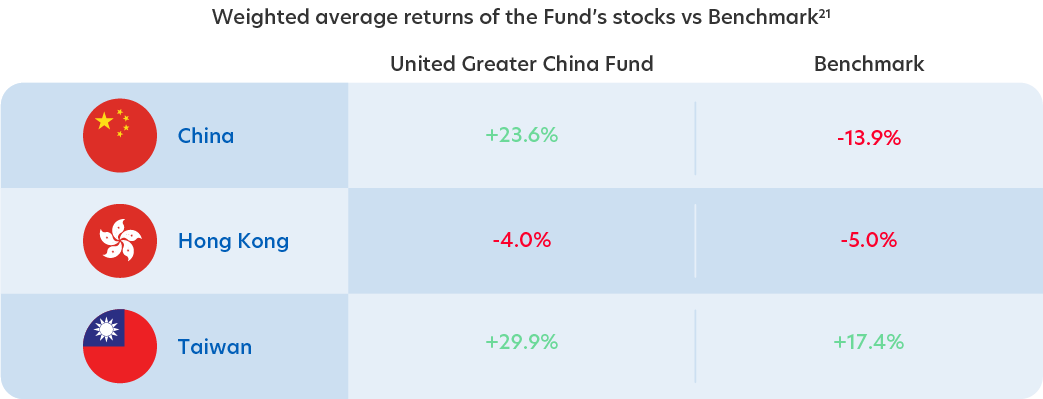

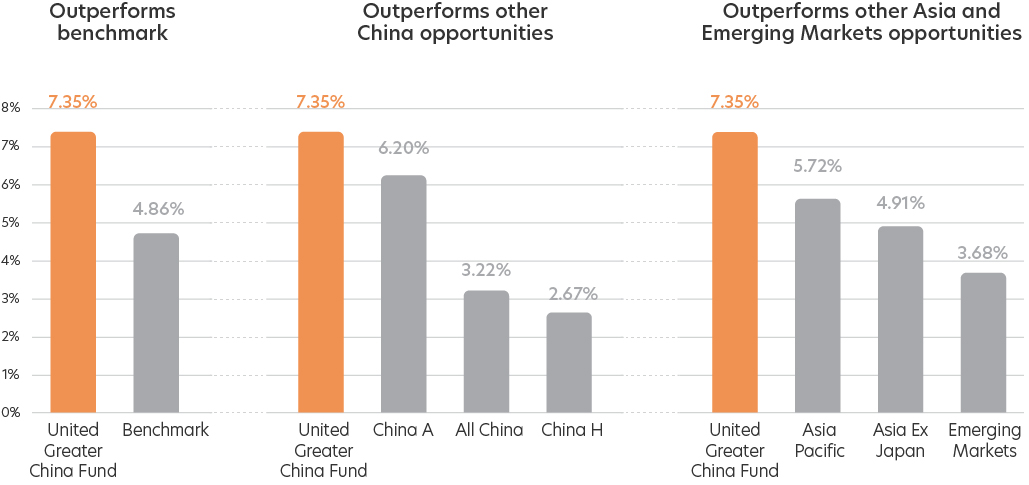

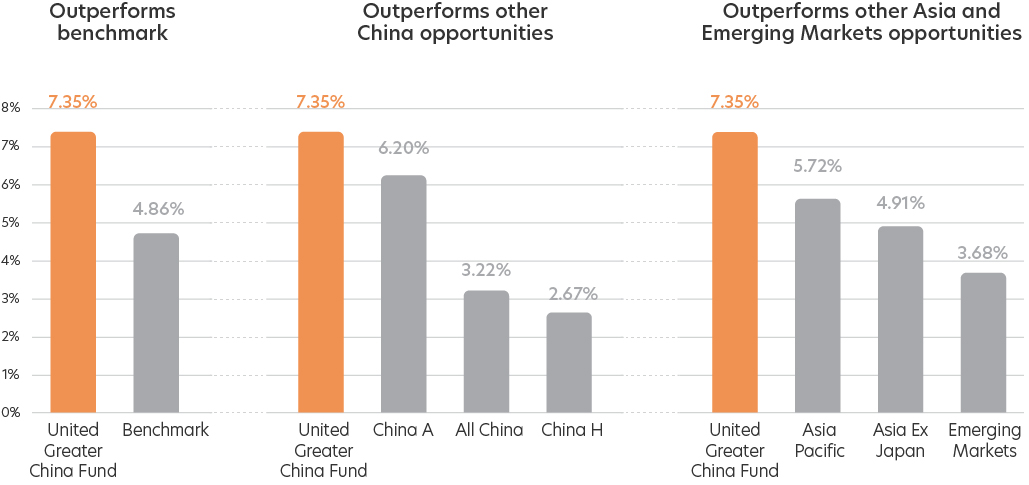

2) Strong outperformance

Over the past 10 years, the Fund has outperformed its benchmark, peers and other related markets18.

Note: United Greater China Fund refers to United Greater China Fund Class A SGD Acc, Benchmark refers to MSCI Golden Dragon Index NR USD, China A refers to MSCI China A Index (USD), All China refers to MSCI China All Shares Index (USD), China H refers to MSCI China H Index (USD), Asia Pacific: MSCI AC Asia Pacific Index (USD), Asia Ex Japan: MSCI AC Asia Ex-Japan Index (USD), Emerging Markets: MSCI Emerging Markets Index (USD)

3) Powered by AI-Augmentation@UOBAM

The United Greater China Fund applies UOBAM’s proprietary artificial intelligence (AI)-Augmentation capabilities. The Fund was launched in 1997 but revised its approach in 2021 to incorporate insights generated by a unique AI model.

How our investment process creates value:

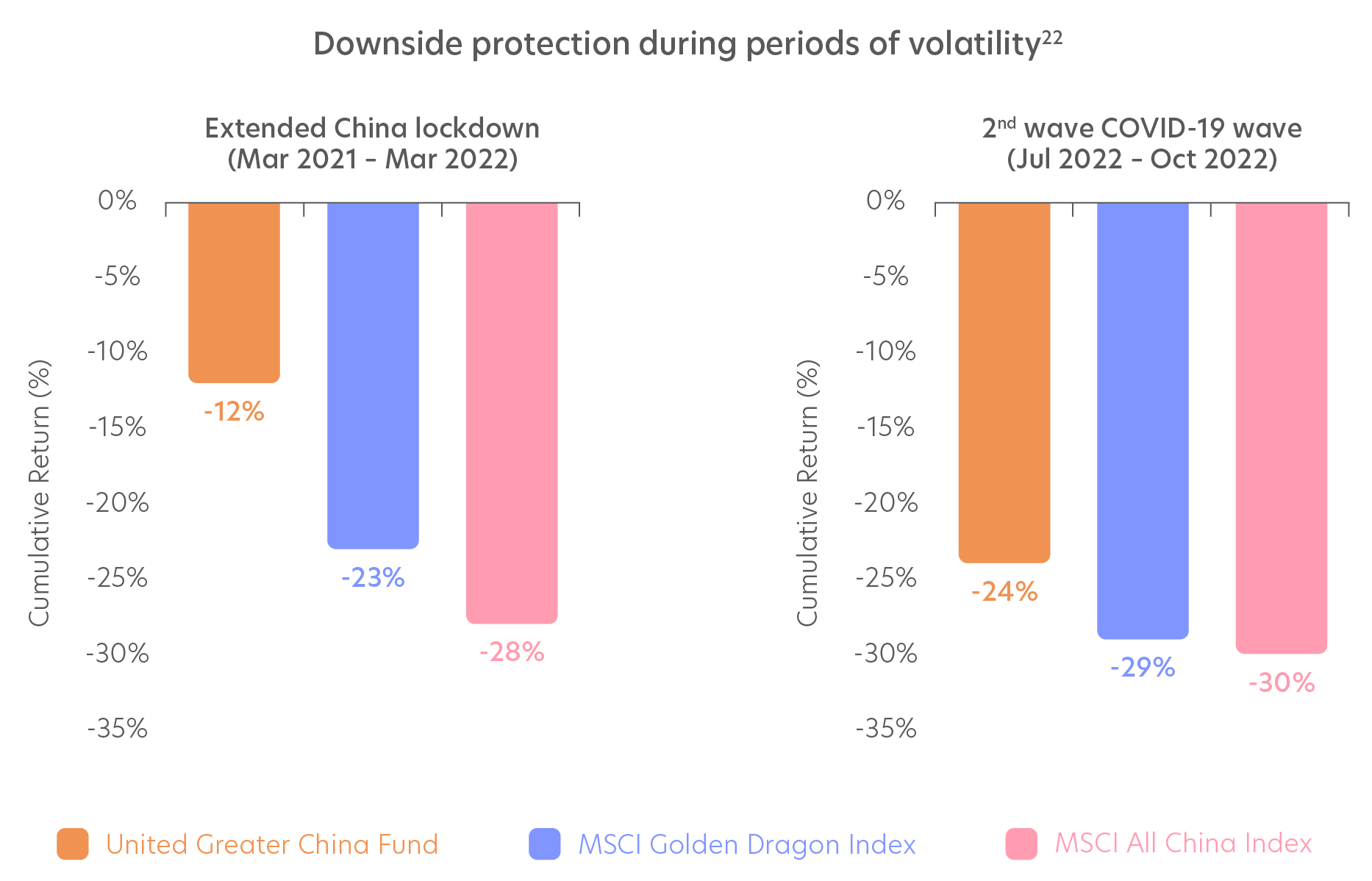

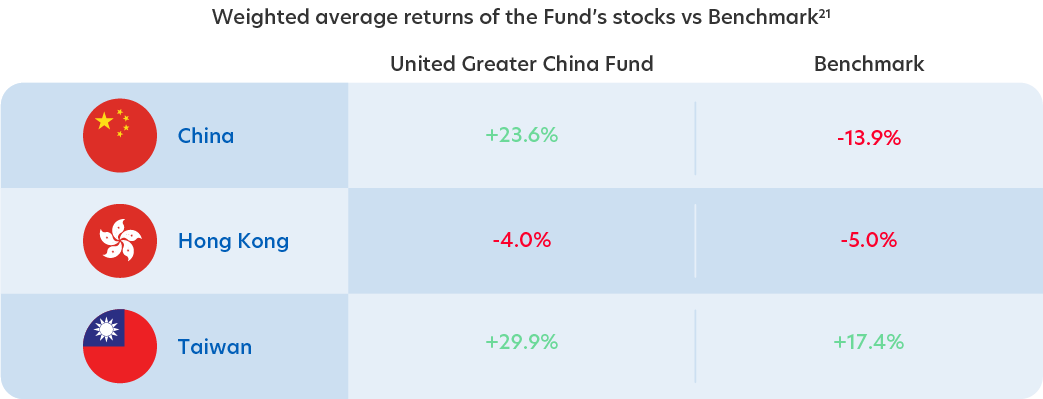

Data-driven and objective

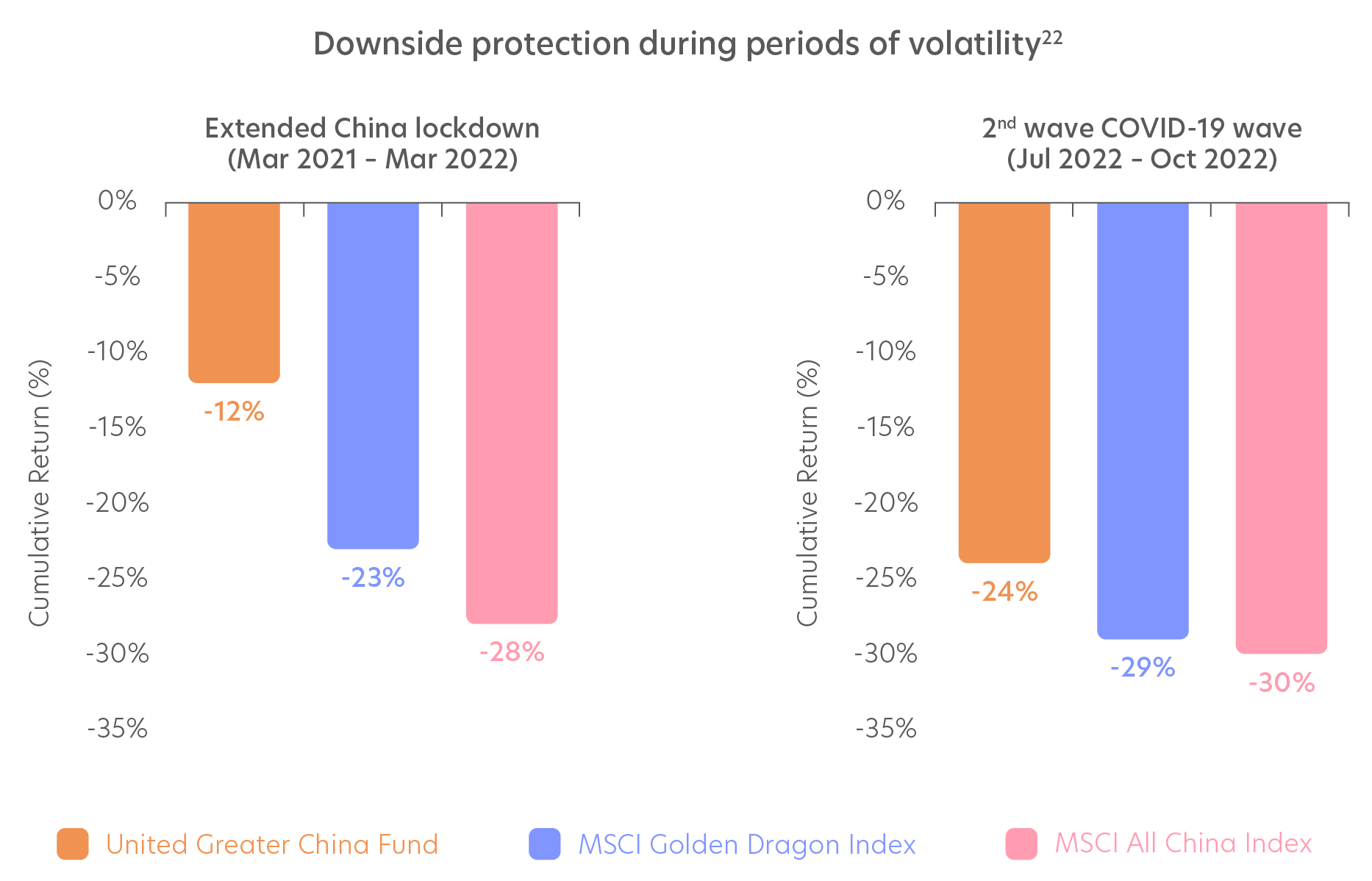

The process has allowed the Fund to deliver significant outperformance from stock selection. Besides higher long-term returns, it has lower downside risk19, providing strong downside protection in periods of volatility20.