- US economic data continues to signal that a significant recession is unlikely

- In line with UOBAM’s base case, markets seem to be getting less fearful

- This shift in thinking bodes well for riskier assets amid higher-for-longer inflation

Positive economic data

High inflation and interest rates tend to adversely impact economies. So when US interest rates started to climb back in 2022, and continued throughout 2023, it was feared that the US could be headed for a deep recession.

Yet US economic data and importantly, employment data, is still holding up. Results released just last week by the US Bureau of Labour Statistics confirmed that the non-farm unemployment rate - at 3.5 percent - has not changed compared to a year ago. Similarly, wages have moderated but remain relatively stable. July’s data showed that hourly earnings had risen by 0.4 percent compared to June, bringing the average wage increase over the past 12 months to 4.4 percent.

Recession or no recession?

Economists warn that it can take up to 12 months for rising interest rates to filter through into the wider economy. So despite the surprisingly robust data, many investment analysts had stuck to their recessionary predictions for 2023 or early 2024. Nevertheless, a smaller number, ourselves at UOBAM included, suggested that a major US recession i.e. a “hard landing” seemed remote.

Instead, in our 3Q23 Quarterly Investment Strategy, we highlighted our support for the concept of a “rolling recession”. In our view, certain goods sectors were already showing recession-like conditions, but broad service sectors were not. This two-speed economy was unlikely to result in a deep, broad-based recession, and more optimism was warranted.

10-year bond yields have risen

It appears that market players are coming round to this point of view. Equity markets had already started to rally in March, with the S&P 500 and more broad-based Russell 3000 indices up by around 17 percent year-to-date. The more tech-oriented Nasdaq Composite index is up by around 33 percent over the same period.

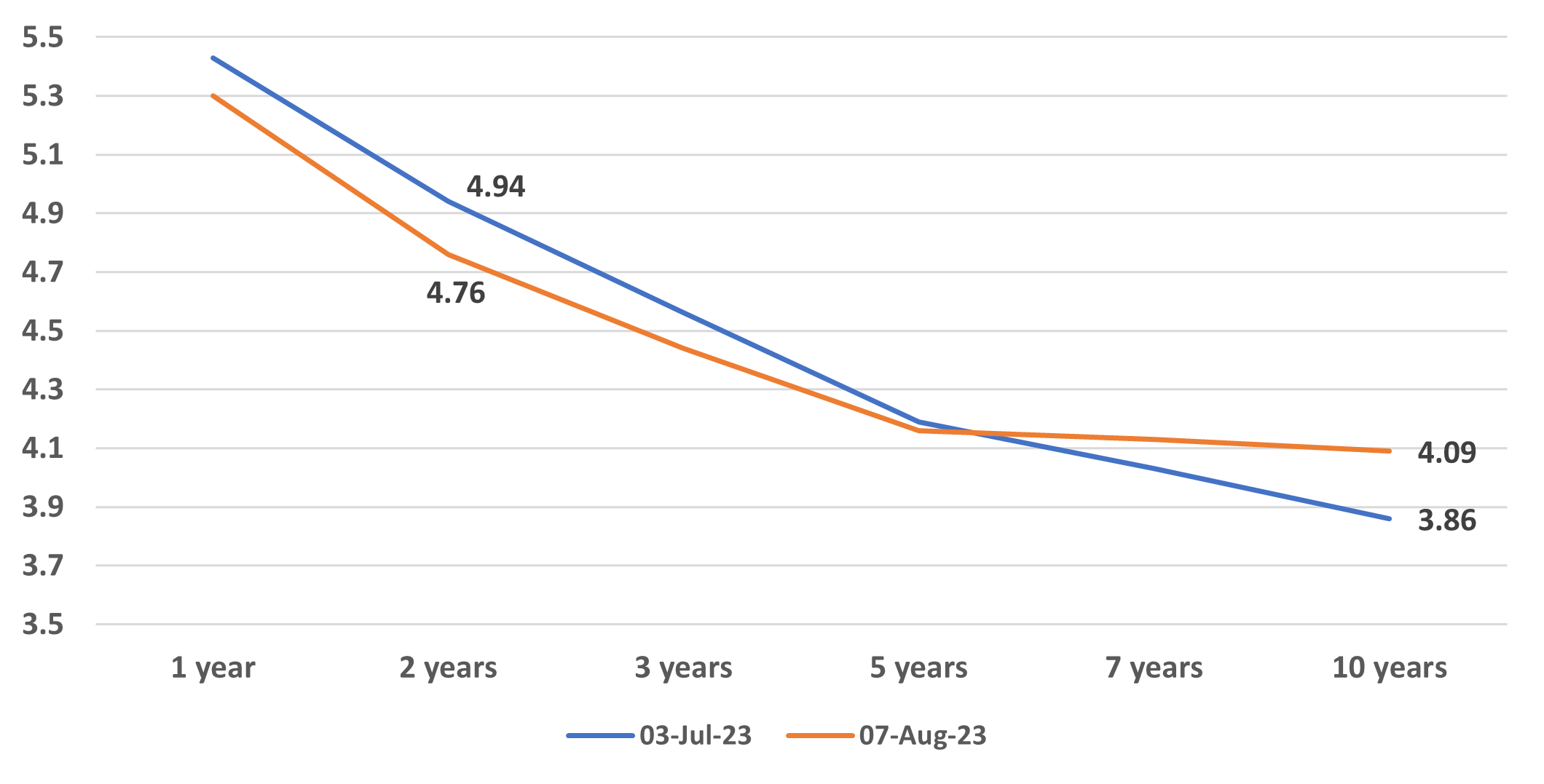

Bond markets however have been more reticent. In the current cycle, the US Treasury yield curve officially inverted for the first time in March 2022 and this remains the case today. An inverted yield curve is when the yields provided by short-dated bonds are higher than long-dated bonds of the same credit quality. A normal-sloping yield curve typically becomes inverted when a recession is expected in the near future. For example, the last time the yield curve tipped from normal to inverted was in 2019 prior to the COVID-19 crisis. On 3 July this year, the difference between 10-year and 2-year Treasuries was at -1.08 percent.

Signs of optimism

However, in recent weeks, the US yield curve inversion has been flattening at the longer end, with 10-year Treasury yields moving up sharply in what is generally termed a “bear steepening”. As a result the 10 - 2 year Treasury yield spread has reduced to -0.67 percent.

Figure 1: US Treasury yield curve: 4 August vs 3 July, 2023

Source: US Treasury Department/UOBAM

While bear steepening events are generally associated with inflation concerns and expectations of Fed rate rises, we do not believe this to be the case currently. Nor do we see this as a direct result of alarm over the the unexpected Fitch Ratings downgrade of US Treasuries from AAA to AA+.

Rather, the rise in long-end bond yields seems to be due to the confluence of several events. For one, the Bank of Japan’s (BOJ) recent announcement that it is relaxing the controls on its 10-year JGBs (Japanese government bonds) has increased concerns of a repatriation of funds towards Japan. The US Treasury also recently announced higher debt issuances, thereby increasing the supply of bonds in the market.

Potential appetite for riskier assets

Most intriguingly, we believe that bond markets are starting to toy with the idea of US economic resilience despite the decades-high 5.5 percent Fed Funds rate. In line with our view of a US soft landing, it appears that bond markets do not see a reason for the Treasury yield curve to be so steeply inverted.

Should this view take hold, and market positioning does indeed “catch up” with our more sanguine view of the US economy, we believe that the appetite for risk assets will grow. As such, investors may want to increase their portfolio weights towards risker bond assets such as high yields, emerging market debt, moderate-duration bonds and laddering strategies (that is, holding bonds of varying durations). We see longer-dated yields looking more attractive and could reach around 4.25 percent.

Higher-for-longer

This shift in thinking also supports our long-held “higher-for-longer” thesis. Acceptance by central banks that economies can function effectively at higher inflation and interest rate thresholds may dissuade them from pursuing aggressive policies to counter inflation and cut interest rates. If so, investors must contend with a high-inflation and less-liquid world, and should avoid investments that require long lock-in periods or cannot be easily traded.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z