Singapore inflation has moderated slightly but is unlikely to return to previous lows. Bonds are a way to stay one step ahead of high prices.

When cash rates started to rise in 2022 and 2023, and eventually hit a peak at around 3 to 4 percent, many consumers assumed that the interest from their fixed deposit accounts would help them overcome the elevated cost of everyday goods and services.

However, Singapore's core inflation (that is, excluding transport and accommodation costs) is still above 4 percent (that is, 4.2 percent in June and 4.7 percent in May year-on-year). This means that the returns offered by fixed deposits are not managing to outpace inflation. Therefore consumers who keep all their excess cash in fixed deposits are at risk of inflation chipping away at their purchasing power and eroding their income growth.

Keeping up with inflation

The Monetary Authority of Singapore (MAS) projects core inflation for the full-year 2023 to average 3.5 percent to 4.5 percent and headline inflation to range from 4.5 percent to 5.5 percent. These figures represent an improvement from a year ago and the MAS expects inflation to continue moderating in the months ahead.

However, unless there is a deep recession, we are unlikely to see a quick return to Singapore's historical inflation average of 2.6 percent per year1. Even less likely are the below-one percent levels seen in the pre-Covid years (2015 – 2020). This is because, in this post-Covid era, wage growth and price expectations are set to persist, as in the case globally.

Singapore bonds are a good starting point

For those looking to stay ahead of inflation, and yet keep investment risk under control, Singapore bonds are an attractive asset class to consider. Singapore government and corporate bond yields are near multi-year highs, offering compelling income for bond investors.

2-year and 10-year Singapore government bonds are yielding 3.47 percent and 3.05 percent respectively2 as of 31 July. Meanwhile, Singapore corporate bonds are yielding 4.41 percent on average3.

Looking ahead, these yields are likely to remain supported by Singapore’s resilient macro backdrop and healthy corporate credit fundamentals.

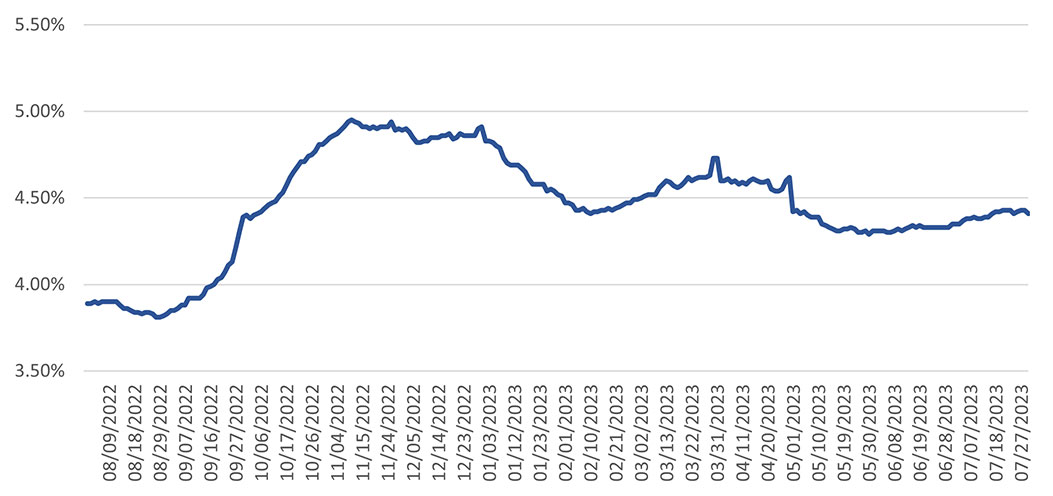

Fig 1: Singapore corporate bonds yield to maturity

Source: S&P Singapore Corporate Bond Index, data from 1 Aug 2022 to 31 July 2023

Attractive yields aside, should interest rates fall, as many economists expect in 2024, Singapore bonds are also poised to enjoy capital gains – something that fixed deposits cannot provide.

As it stands, Singapore government bond prices have been outperforming their US peers as Singapore has paused its monetary policy tightening rate hikes while the US remains on its rate hiking trajectory.

SGD bond demand is growing

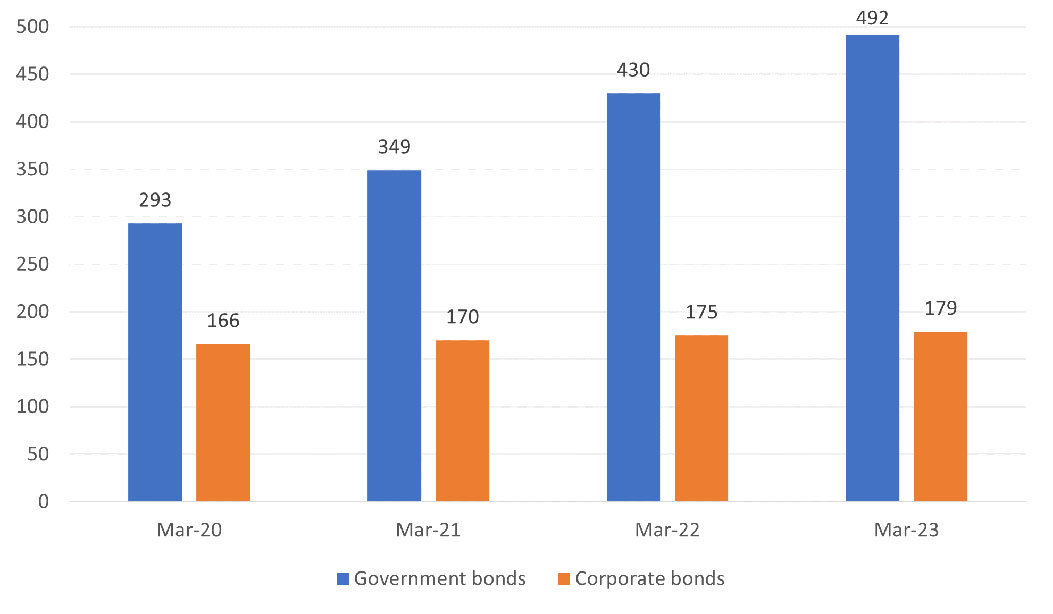

Given these characteristics, it is not surprising that demand for Singapore bonds has been soaring. The amount of Singapore dollar (SGD) bond issuances has risen from S$459 billion in 2020 to S$670 billion as at March 2023, representing a 46 percent increase.

Although the bulk of these issuances are comprised of government bonds, the local corporate bond market has been slowly expanding, with issuers across a range of different sectors providing investors with diversification opportunities.

Figure 2: Growth of the Singapore bond market (SGD billions)

That said, Singapore corporate bond issuances have been subdued in recent months. The market only saw S$400 million of new issues in June, a drop from the S$853 million issued in May. In the coming months, corporate issues will likely remain sparse as many issuers appear to prefer bank loans versus the cost of raising debt from the bond market.

From a technical perspective however, the lower supply of new SGD corporate bonds should support prices in the near term and be favourable for investors.

Investment grade bonds offer good value

Within the SGD corporate space, we favour investment grade issuers especially those with healthy credit profiles given slowing global growth. Examples of such issuers are companies that have good access to capital markets and defensive business models that can hold up even during a recession. We believe telecom and utility companies currently fit this profile.

Shorter-duration bonds also remain attractive in the current interest rate environment. We think the sweet spot lies in bonds with maturities of 3-years or less. As the yield curve is currently inverted, this is where the highest yields are currently available, while avoiding the significant duration risks associated with longer-term bonds.

Sustainability finance offers new opportunities

Singapore aims to be a leading centre for sustainable finance in Asia and across the world. Working towards that goal, the Singapore government announced at Budget 2022 plans to issue up to S$35 billion of sovereign and public sector green bonds by 2030.

Beyond green bonds, Singapore is expanding its focus to include transition finance, a financing approach that aims to support high carbon-emitting companies in reducing emissions. To do so, the MAS in April expanded the scope of its grant schemes for sustainable bonds to include transition bonds. S$15 million will also be set aside to enhance and extend the sustainable bond grant scheme for a further five years till 2028.

Transition bonds currently form a small segment of the sustainable bond market. But with these incentives, there is room for the transition bond market in Singapore to grow.

Overall, given the strong top-down government support, Singapore’s sustainability finance market is set to evolve and deepen further. This in turn provides bond investors with new return opportunities while furthering the sustainability objectives.

1Source: World Data, from 1961 to 2022

2Source: MAS

3Based on yield to maturity. Singapore corporate bonds represented by S&P Singapore Corporate Bond Index

If you are interested in investment opportunities related to the theme covered in this article, here are two UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z