- This week’s presidential election in Taiwan is one of the most closely watched in its history

- The closeness of the competition and recent market rally could lead to some market volatility regardless of the winner

- However, as seen in previous years, financial markets are more impacted by long term economic factors than election results

A close race

Taiwan’s presidential election campaign, due to culminate this week, has captured the world’s attention for several reasons.

It is widely thought that this year’s results, more than any time in the past, will define future relations between the world’s two biggest superpowers – US and China – and therefore impact the global political landscape.

This year’s three-party contest is also unusual. Traditionally a race between the Democratic Progressive Party (DPP) and the Kuomintang (KMT), the first time entry of the Taiwan People’s Party (TPP) has made it even more difficult to predict the final outcome. In fact, polling suggests that the competition has only tightened over time.

Thirdly, Taiwan’s economic issues such as the high cost of living and low wages matter as much as the security threat posed by China, especially to younger voters. However, external rather than domestic factors, including China’s weak economic growth and the US’s own impending presidential race, make it even more difficult to choose across candidates.

Limited market impact

Given this year’s tightly-fought election campaign, the final result will be a surprise to markets, regardless of who wins. Taiwan was one of Asia’s best performers in 2023, with the TAIEX gaining close to 25 percent. In November and December alone, the stock market rallied by 12 percent. Despite this, profit taking in the first week of 2024 has been relatively muted. These elevated levels increase the odds of a short term post-election correction and higher market volatility in coming weeks.

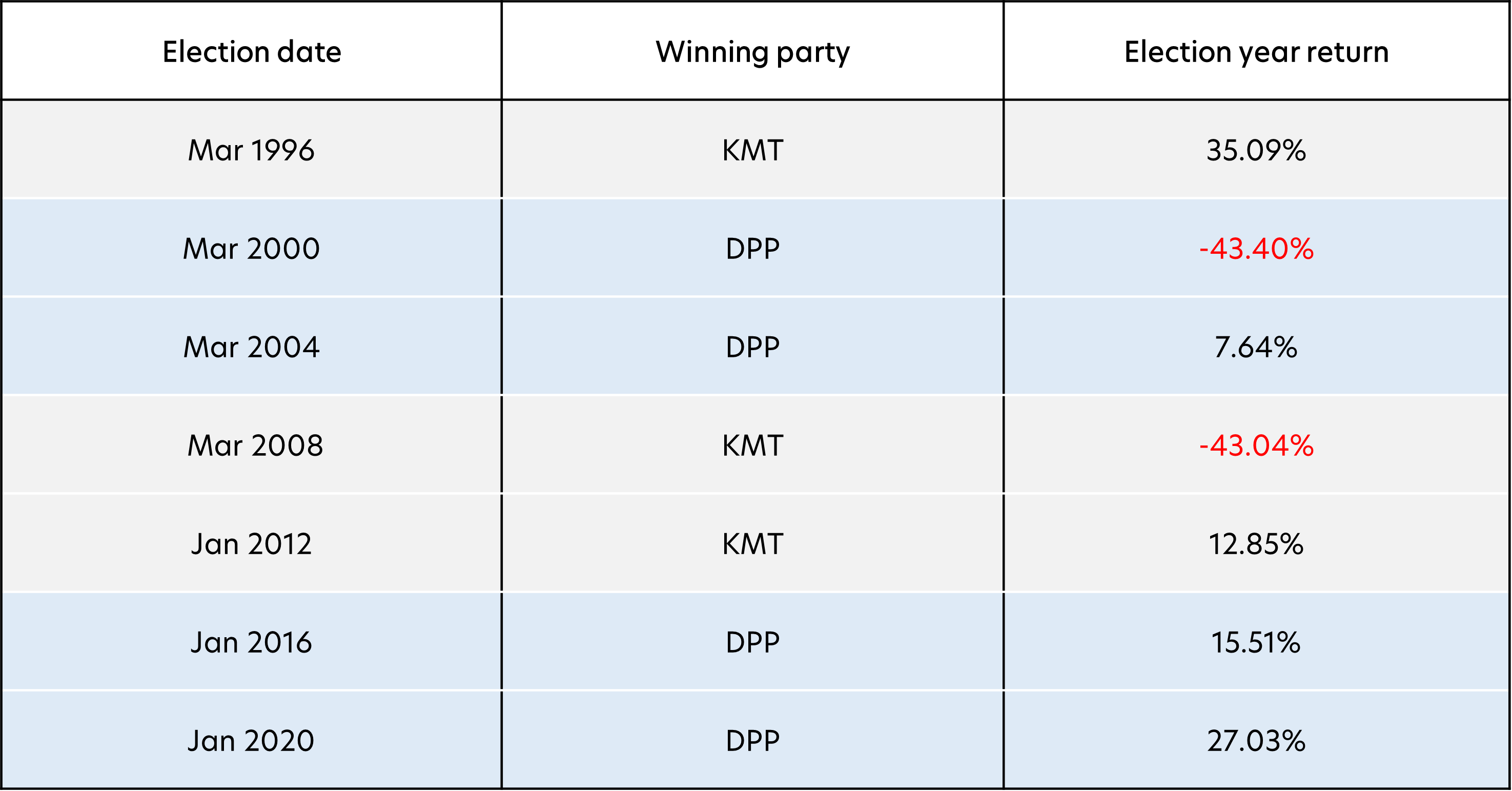

That said, elections tend to have only a limited impact on stock markets and Taiwan is no different. UOBAM analysis shows that, out of the seven Taiwan presidential elections so far, six have delivered positive returns averaging 8.1 percent within the first 15 trading days following the election date.

Even in the longer term, the Taiwan stock market closed the year in positive territory for five out of the seven previous elections, averaging about 20 percent per year. The exceptions were 2000 and 2008. In both cases, severe negative returns were caused by external factors, that is, the dot com bubble and the global financial crisis.

Fig 1: Annual equity (TAIEX) market returns in election years

Source: Bloomberg/ UOBAM

Uncertain long term trade impact

Whatever the results of the election, there are long term opportunities for both China and Taiwan if collaboration can be deepened on green energy, healthcare, technology, biotech and tourism. There are also mutual benefits if the scope of the Economic Cooperation Framework Agreement (ECFA) between China and Taiwan can be expanded further.

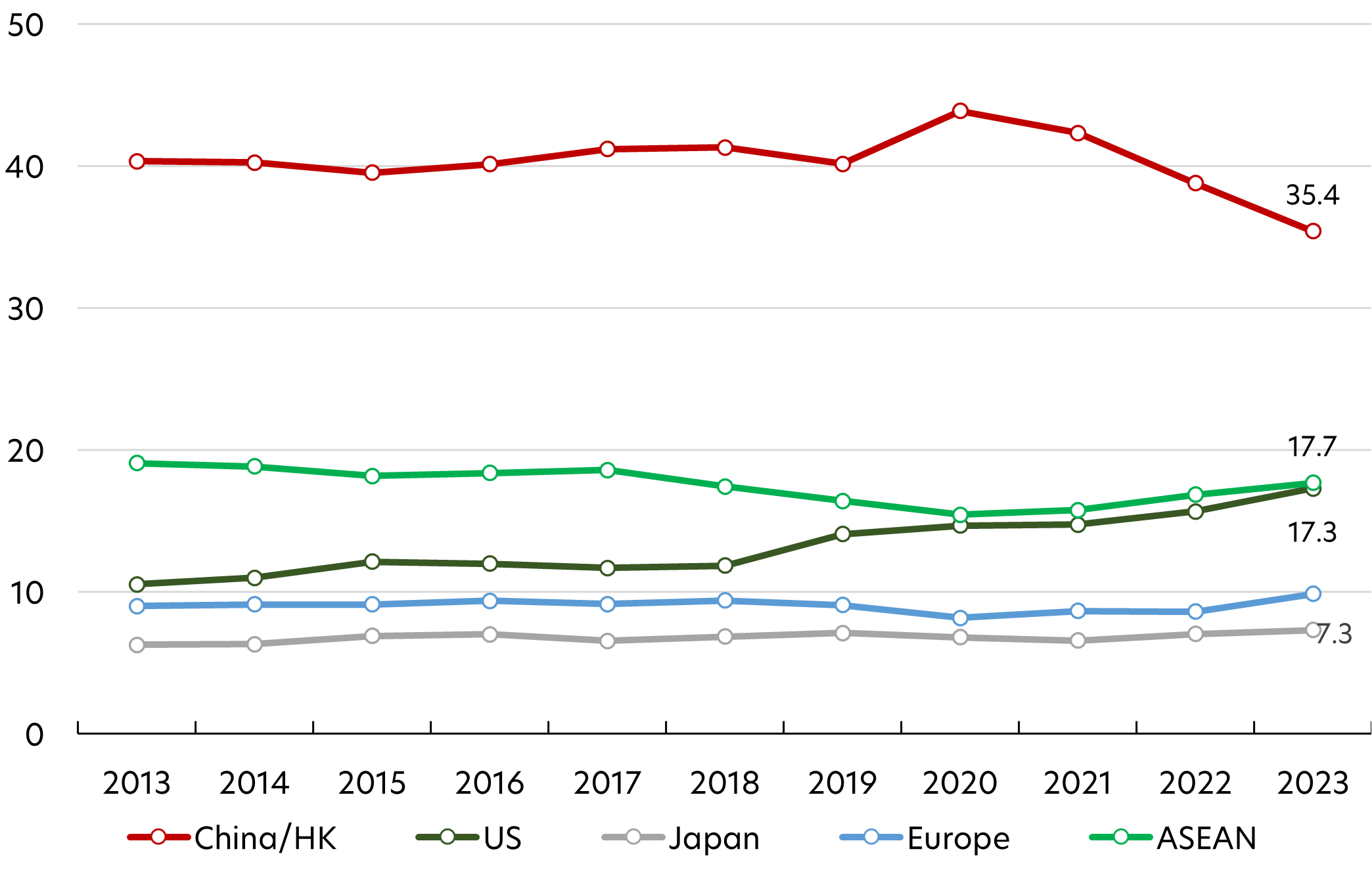

The ECFA was a turning point when it was signed back in 2010 and contributed to the steep increase in cross-straits trade from US$106 billion in 2009 to US$228 billion in 2019. Today, mainland China and Hong Kong remain Taiwan’s top trading partners, although their collective share of Taiwan’s exports has decreased to 35.2 percent. This is the lowest level in 21 years and stems from an increased demand for Taiwan-produced high performance servers, chips and AI-related communication products from the rest of the world.

Fig 2: Taiwan exports by country/region (%)

Source: Finance Ministry of Taiwan/ UOBAM

On the other hand, there are risks that cross-straits relations could deteriorate in coming years. Rather that expanding the ECFA, China recently suspended the arrangement for some products in retaliation for trade barriers that China says were placed unfairly by Taiwan. For now, this suspension affects just 1.3 percent of Taiwan’s total exports to China, but it remains to be seen whether this figure will grow and whether Taiwan can find other export partners to plug the gap.

TSMC both source of market resilience and market risk

TSMC (Taiwan Semiconductor Manufacturing Company) is the largest and one of the most advanced contract chipmakers in the world. It is a key benefactor of the current boom in AI demand and its client list includes Apple and Nvidia. Having seen the back of a global chip inventory glut, TSMC’s 4Q 2023 sales were among the highest in its history.

As such, TSMC’s prospects are likely to be agnostic to the current trade spat between China and Taiwan, and also to Taiwan’s election results. Furthermore, the company comprises about a quarter of Taiwan’s stock market capitalisation, and can therefore help shield the market from any negative sentiment arising from Taiwan’s election results.

On the other hand, TSMC’s dominance of the Taiwan stock market and importance to the global/US economy suggest that TSMC’s future is perhaps a bigger driver of global market volatility than fears about election-induced geopolitical tensions. There is intense debate about TSMC’s decision to overcome US chip import restrictions by building a massive US$40 billion factory in Arizona rather than expanding its operations at home. Going forward, economists agree that Taiwan’s future growth depends on reducing its reliance on TSMC and building out its other core industries.

Positive on Taiwan equities

Given the analyses above, UOBAM remains optimistic that the Taiwan equities market can continue to perform well in 2024, helped by attractive dividend yields averaging 3.3 percent. While the first quarter could see an increase in stock market volatility, we would expect the trading range to widen by only around 6 to 7 percent from current levels.

We favour AI and cyclical sectors including companies in the advanced tech supply chain, networking and memory chips industry. We are also looking out for reasonably-valued opportunities in green energy, defense, financial and shipping sectors given their potential to benefit from policy support. For now, we are avoiding sectors that rely heavily on China collaborations, such as plastics, chemicals and tourism.

If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.