Investing early and regularly is key to a comfortable retirement and SRS is a good way to do this. UOBAM offers four SRS-approved funds to suit different investment needs.

The growing popularity of retirement planning

Singapore’s Supplementary Retirement Scheme (SRS) helps people save for their golden years. One of the scheme’s key features is its offer of attractive tax savings, and it has become a core pillar of Singaporeans’ retirement planning. The number of SRS account holders rose by 75 percent from 2020 to 2022 and over the same period, contributions increased from S$12.2 billion to S$16.31.

While this is encouraging, there are still many people who are falling behind on their retirement plans. A recent study found that 65 percent of Singaporeans aspire to a comfortable retirement lifestyle, but only one in five are on track to achieve the amounts needed2.

Compounding is key

Singapore’s high inflation rate of 4 percent this year and drop in real income growth will likely have contributed to this gap. The job market is also becoming challenging with the number of retrenchments rising this year.

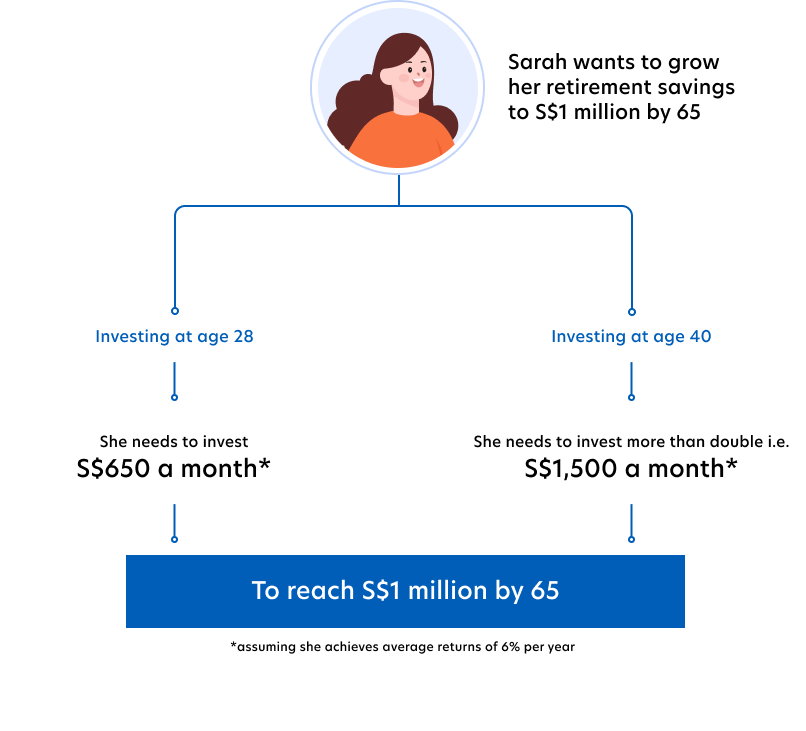

However, neglecting or postponing retirement planning can have enormous consequences down the line because it means setting aside larger amounts and sacrificing the benefits of compounding.

Take for example a 28-year old who aims to achieve a nest egg of S$1 million by 65.

Fig 1: The power of compounding

This is the compounding effect at work, which allows small amounts of money to accelerate its growth over the long term.

How SRS works

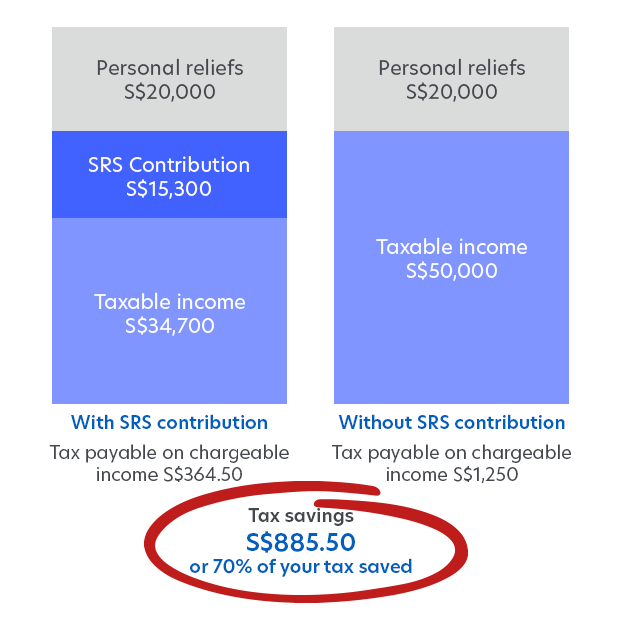

- Currently, you can contribute up to a maximum of S$15,300 per year for Singapore citizens/PR (S$35,700 per year for foreigners) into your SRS account

- You will get a dollar-for-dollar tax relief on SRS contributions, which will be applied in the following Year of Assessment^ (see Fig 2).

- When you reach the statutory retirement age (currently 63) and stop working, only 50 percent of your yearly SRS withdrawal amount will be taxed.

^As SRS contributions cannot be refunded, SRS members should take note that a personal income tax relief cap of S$80,000 applies to all tax reliefs claimed in each Year of Assessment, including relief on SRS contributions.

Fig 2: Potential tax savings with SRS, assuming total annual income of S$70,000

Not just about tax benefits

Tax benefits aside, SRS instills a disciplined, long-term retirement planning mindset in a number of ways:

- To encourage people to only withdraw on or after the statutory retirement age and therefore to enjoy compounding benefits, early SRS withdrawals will be subject to tax and a 5 percent penalty^.

- Currently, monies in SRS accounts earns only 0.05 percent interest each year. Investing your SRS savings is one way to outpace inflation and earn potentially higher returns on your savings.

- There are a wide range of SRS-approved investments available, including funds, stocks, bonds, endowment plans, and fixed deposits.

- Returns generated from these investments are credited directly to your SRS account where it can compound and grow.

^ Note: Tax and penalty on early SRS withdrawal will not be imposed if the SRS contribution and withdrawal are made in the same year.

Strategies to supercharge your SRS

To summarise, making your SRS account work most effectively depends on three key steps:

- Start making contributions to SRS early to enjoy the full benefits of compounding and tax benefits

- Invest your SRS monies to outpace inflation and achieve potentially higher returns

- Choose investments to suit your risk tolerance and investment needs

Potential solutions

UOBAM offers four SRS-approved funds that align to different investor needs and profiles:

- United SGD Fund

- United SG Dynamic Income Fund

- United Greater China Fund

- United Global Quality Growth Fund

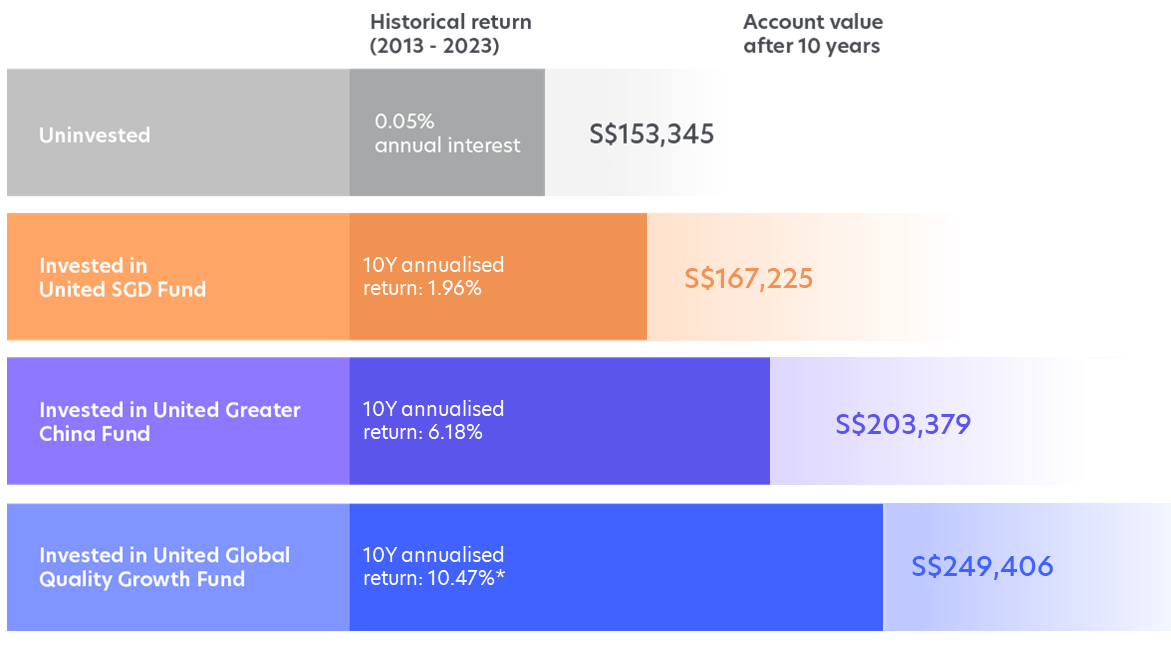

Assuming you contribute the maximum S$15,300 to your SRS account every year into these funds, based on their historical annualised 10-year returns, here is what you can expect after 10 years.

Fig 3: Growth of SRS contribution of S$15,300 per year

Source: UOBAM. Performance from respective Fund factsheets, based on Class A SGD Acc share class, in SGD terms, as of 31 Oct 2023. Past performance is not necessarily indicative of future performance.

*The underlying manager, Lazard Asset Management, has delivered a 10-year annualised return of 10.47% as of 31 Oct 2023, SGD terms. Source: Lazard

Funds listed in the illustration have performance history dating back at least 10 years. The United SG Dynamic Income Fund was incepted in 2023 and no annualised performance is available yet.

Which fund to choose?

1. I am looking for stability and capital preservation

United SGD Fund3

- Holdings: High-quality, short-term investment grade bonds

- Weighted average yield to maturity: 4.82%

- Investment strategy: The Fund uses a laddered strategy so that capital from matured bonds is continuously reinvested at higher interest rates, thus enhancing total return for investors

- Why invest: During periods of market volatility, the Fund serves as a defensive asset by offering downside protection

2. I prefer to to invest close to home

United SG Dynamic Income Fund4

- Holdings: Multiple Singapore asset classes, including money market funds, bonds, equities, and real estate investment trusts (REITs)

- Distribution: Monthly distribution of up to 6% p.a.*

- Investment strategy: The Fund applies UOBAM’s proprietary artificial intelligence (AI)-Augmentation capabilities to dynamically allocate asset class weights. Security selection is then conducted by managers who are expert Singapore stock and bond-pickers

- Why invest: With inflation expected to stay higher-for-longer, the Fund aims to help investors achieve income, growth and stability in any economic condition

*Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus.

3. I am looking to invest in Greater China’s long-term potential

United Greater China Fund5

- Holdings: Equities from China, Taiwan, Hong Kong

- Performance: 10-year annualised returns of 6.18% (versus 5.64% for its benchmark)

- Investment strategy: The Fund applies UOBAM’s AI-Augmentation strategy to find attractive stock opportunities in the Greater China region

- Why invest: The Fund’s AI process has enabled it to deliver higher long-term returns while providing stronger downside protection in periods of volatility, making it an attractive choice for investors seeking to partake in China’s next phase of growth

4. I prefer to invest in the world’s leading companies

United Global Quality Growth Fund

- Holdings: Global quality stocks

- Performance: 10-year annualised returns of 10.47% (versus 7.88% for its benchmark)6

- Investment strategy: The Fund holds high exposure to “compounders”: high quality, financially productive companies that reinvest a significant portion of their cash flows into their business to drive higher efficiency and higher profits

- Why invest: Quality stocks have historically offered better returns and lower volatility compared to growth and value stocks. By offering diversified exposure to global quality stocks from different sectors, the Fund seeks to balance returns and risk amid global economic headwinds

1Source: Ministry of Finance, Nov 2023

2Source: OCBC Financial Wellness Index 2023, Nov 2023

3,4,5Source: UOBAM. All data as of 31 Oct 2023, unless otherwise specified

6The underlying manager, Lazard Asset Management, has delivered a 10-year annualised return of 10.47% as of 31 Oct 2023 for the Lazard Global Quality Growth strategy. Source: Lazard, 31 Oct 2023

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the calendar month or quarter. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. UOBAM reserves the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of income, capital gains, capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a reduction of part of your original investment and may result in reduced future returns. Please refer to the Fund's prospectus for more information.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z