- Singapore’s growth is flatlining due to soft global demand

- However, some sectors are showing signs of a strong recovery

- Meanwhile Singapore remains a relatively defensive market in ASEAN

Pandemic still taking a toll

As we approach Singapore’s 58th birthday, it is worth taking stock of how the economy is performing post-Covid. For many of us, the first circuit breaker that kicked in on 7 April 2020 now seems like a distant memory.

However, three years and four months later, Singapore like the rest of the world still bears the scars of that period. While it was reported that Singapore’s GDP in 2Q 2023 grew by 0.7 percent, thereby avoiding a technical recession, it is clear that the across-the-board Covid reopening boost is coming to an end.

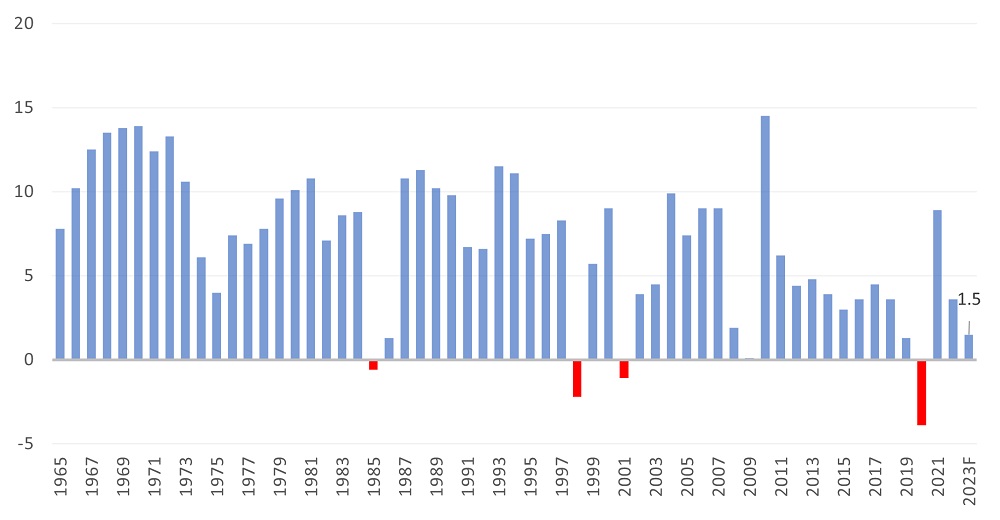

A global slowdown in demand, prompted by high inflation and high interest rates, is now taking its toll on the Singapore economy. As forecasted by Ministry of Trade and Industry (MTI), growth for Singapore will likely be between 0.5 to 2.5 percent in 2023. Growth rates equal to or below this level are unusual for Singapore. As can be seen below, since independence, they have occurred only seven times before.

Figure 1: Singapore GDP growth (annual %)

Source: The World Bank. 2023 Forecast based on mid-point of the 0.5 – 2.5% range provided by the Ministry of Trade and Industry

4 reasons why investors should not despair

But as we look forward into the second half of 2023 and start of 2024, there are good reasons to believe that investors can continue to benefit from Singapore’s capital markets. These reasons underpin UOBAM’s overweight positioning on Singapore.

1. Current economic weakness is narrowly based

It appears that the manufacturing sector is almost single-handedly dragging down Singapore’s overall economic growth. The sector contracted by 5.3 percent year-on-year in the first quarter, and again by 7.5 percent in the second quarter. This is largely due to weak electronics demand, which has contributed to a downcycle across all semiconductor manufacturers, including those in Singapore.

However, the services sector tells a different story. Collectively these industries expanded by 1.8 percent in 1Q23 and 3.0 percent in 2Q23. These sectors account for about 70 percent of Singapore nominal GDP. Once semiconductor exports stabilise (as they are expected to do in 2024 amid the artificial intelligence (AI) boom), these sectors could help lift the country’s GDP in 2024.

Figure 2: Singapore nominal GDP sector breakdown, 2022

2. Strong earnings in place for some key sectors

Regardless of the overall economic slowdown, some Singapore sectors and companies are showing a strong earnings momentum. Amid China’s reopening and global pent-up demand, tourism, hospitality and travel-related companies appear to be primary beneficiaries, notwithstanding the fact that they had suffered severe operating losses in 2020 and 2021.

SIA is a case in point. Its FY 2022/2023 net profit came in at S$2.16 billion, the highest ever in its 76-year history. As of end-April 2023, visitor arrivals into Singapore reached over 4 million and will end the year at between 12 to 14 million, according to the Singapore Tourism Board (STB). This is also helping fuel stocks like Genting Singapore. The company saw its revenue grow by 54 percent year-on-year in 1Q 2023 and the revenue recovery is expected to accelerate as Singapore visitor numbers increase.

3. Singapore property trusts expected to recover

The peaking of interest rates also bodes well for Singapore’s Real Estate Investment Trusts (S-REITS) sector. Although the sector as a whole has not turned around as yet, some select trusts are starting to deliver strong performances. Most impressive is Keppel DC REIT, which holds a portfolio of 23 data centres and is showing returns of around 20 percent year-to-date. Other recovering REITs subsectors includes industrial, hospitality and retail.

All eyes are on the distribution rates that S-REITS are able to offer. So far, the three hospitality trusts that have declared their distribution rates recently have managed to show a lift compared to the same period last year. Analysts are hoping that as rate rises end and borrowing costs stabilise, this will spread to other sub-sectors. The potential for S-REITS to provide, on average, about double the yields of Singapore 10-year bonds, will likely prop up interest in this market going into 2024.

4. Singapore bonds offer shelter from market crises

While the risks of a global recession appears to be receding, today’s post-Covid economic complexities made it hard to rule this out completely. Singapore government bonds, given their highest-possible credit rating of AAA, have long played an “insurance” role in investor portfolios, that is, protection in the event of unforeseen events.

Recent developments have made the defensive qualities of Singapore bonds even more attractive. In particular, inflationary pressures in the Singapore economy appear to be moderating. June’s headline CPI inflation of 4.5 percent year-on-year is consecutive improvement on May’s 5.1 percent. Core inflation of 4.2 percent was also lower than May’s 4.7 percent.

This is expected to ease further in coming months, and for core inflation to average 3.5 to 4.5 percent by the end of the year, a long way from the 6.1 percent average for 2022. As a result, Singapore has paused its monetary policy tightening, whereas the US continue to stay on its rate hiking trajectory. This has allowed Singapore government bond prices to outperform their US peers.

Securities selection is crucial

UOBAM remains cognisant of the risks ahead in the Singapore economy amid the global uncertainties, but we see pockets of opportunities underpinned by bottom-up drivers and laggards.

In particular, we think there is upside potential for companies that are engaged in longer-term restructuring initiatives, capital recycling and are sustainability advocates. Besides the sectors outlined above, investors may want to maintain a defensive slant by focusing on sectors that can demonstrate domestic earnings resilience, for example consumer staples companies with strong pricing power, and value food services.

There is also strong top-down government support for the Singapore Sustainability Finance market. This presents additional investment opportunities for Singapore and ASEAN companies that are leading the region’s sustainability drive.

If you are interested in investment opportunities related to the theme covered in this article, here are two UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z