Good stock-picking even more important as Asia and China decouples

As the world’s second-largest economy, China is often regarded as the engine of Asia’s growth. So not surprisingly, China’s faltering post-pandemic rebound is causing some concern about the region’s prospects. However, there are signs that Asia is outgrowing China, but also China is outgrowing Asia.

Asia and China becoming less co-dependent

While China remains the top trading partner for most Asian economies, its share of Asian exports is falling. In just two years - from April 2022 to June 2023 – this share has shrunk from 22 percent to 17.9 percent1.

In recent years, rising labour costs in China have driven companies to seek cheaper Asian alternatives. Threats to the global supply chain and US-China tensions have accelerated this shift by prompting companies to adopt “China plus one” and “friend-shoring” strategies.

However, the shift is not one-sided. China too has sought to reduce its reliance on Asia-imported industrial components and low-value product assembly. Instead, the country is now more focused on domestic supply chains and higher value manufacturing, such as of new energy and green tech products.

Asia’s strong prospects – with or without China

As a result, China’s role as an Asian safety net is diminishing. So far, Asian economies have managed to weather the global slowdown in exports and tighter monetary policies. And going forward, despite the forecast of still-sluggish China growth over the next two years, all other major Asian economies are expected to either maintain or exceed their current growth rates.

Fig 1: Asian economies GDP growth: 2023 – 2025 (forecast)

| 2023 (actual) | 2024 (forecast) | 2025 (forecast) | |

| India | 7.2 | 6.8 | 6.3 |

| Vietnam | 5.1 | 6.0 | 6.3 |

| Indonesia | 5.1 | 5.0 | 5.1 |

| China | 5.2 | 4.6 | 4.4 |

| Thailand | 1.8 | 3.4 | 3.4 |

| Taiwan | 1.4 | 3.1 | 2.6 |

| Hong Kong | 3.2 | 2.7 | 3.0 |

| Singapore | 1.2 | 2.3 | 2.6 |

| South Korea | 1.4 | 2.1 | 2.2 |

Source: Bloomberg, as of 8 Feb 2024

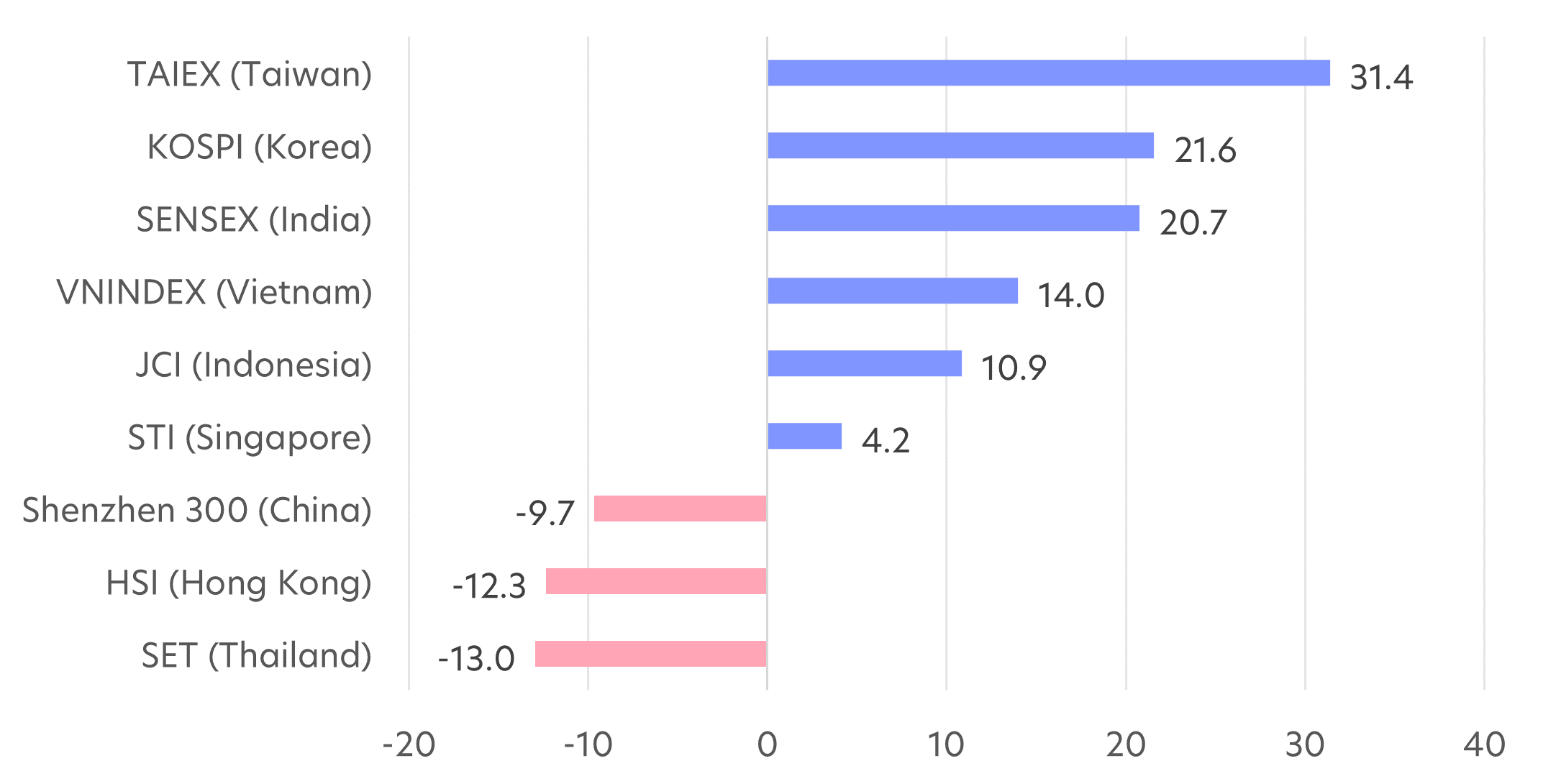

Asia’s stock markets are showing similar resilience. While investor sentiment has been dragged down by three years of declines in Chinese equities, with losses of about 10 percent in 2023, most Asian markets have managed to stay in positive territory. Meanwhile, Taiwan, Korea and India stormed out in front in 2023 with returns of 31, 22 and 21 percent respectively.

Fig 2: Asian market performance (%) in 2023

Source: Bloomberg, as of 14 Feb 2024

Going forward, investors will likely become more confident about Asian markets’ ability to escape China’s shadow, and focus more on the region’s attractive valuations and good growth trajectory. However, they will also likely become more discerning, and choose stocks based on their fundamentals rather than their location. The lesson of 2023 is that there are good stock picks across Asia if you know where to find them.

The United Asia Fund

Outstanding performance since AI implementation

The United Asia Fund (“the Fund”) aims to achieve long-term capital growth by investing mainly in companies based in Asia, excluding Japan.

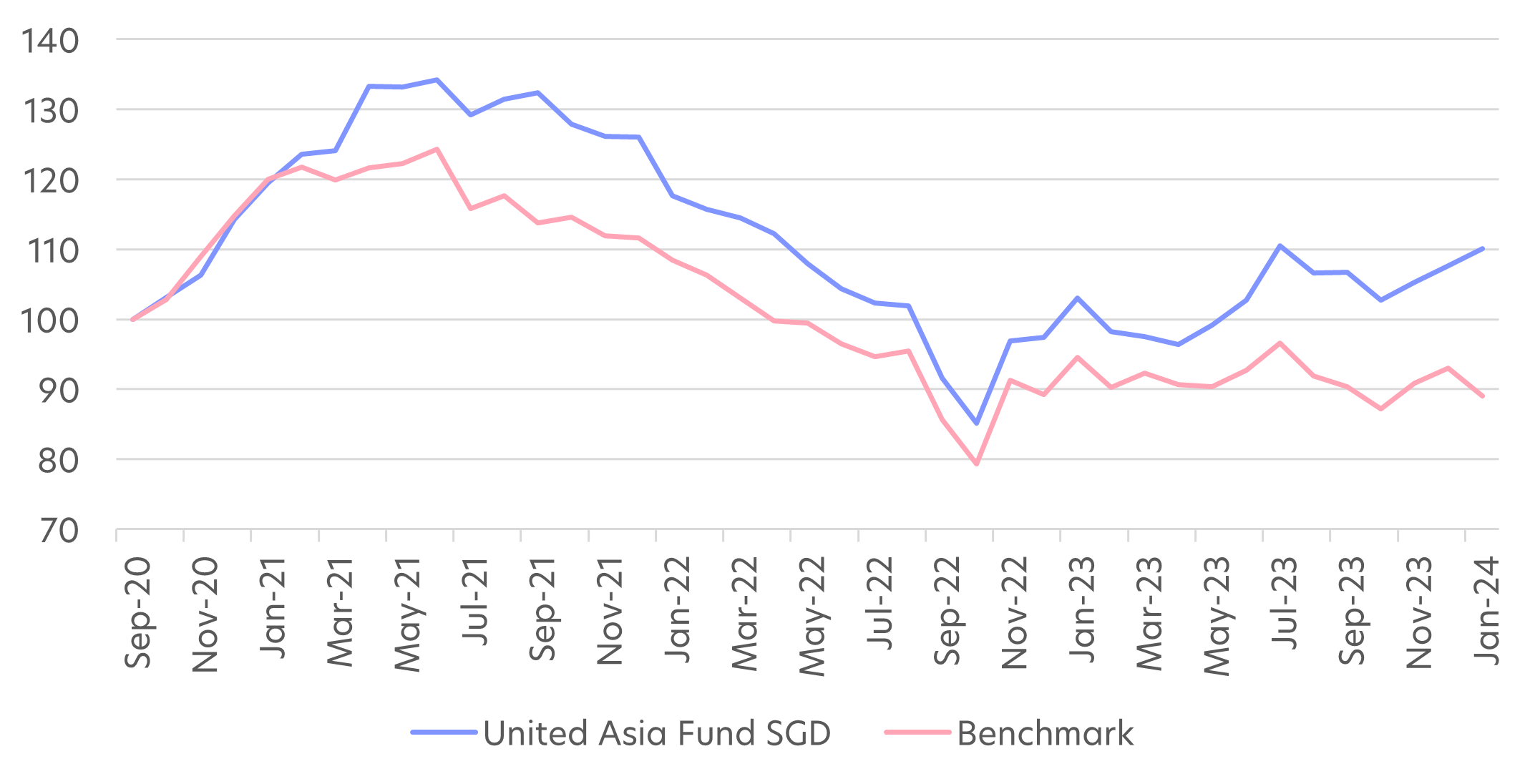

To do so, the Fund taps on UOBAM’s artificial intelligence and machine learning (AIML) capabilities and deep investment expertise for stock-picking opportunities. The results have been remarkable since this AI-Augmentation framework was introduced in Q4 2020.

For 2023, the Fund posted full-year returns of 10.53 percent, compared to 4.24 percent for its benchmark, putting it in the Top Three across all Asia ex-Japan funds2.

For the month of January 2024, the Fund delivered returns of 2.29 percent, outperforming the market by 6.51 percent and making the United Asia Fund number one among its peers3. Given its solid performance, the Fund is also rated 5-stars by Morningstar.

Fig 3: United Asia Fund Performance (Sept 2020 – Jan 2023)

Source: Morningstar. Fund performance is calculated on a NAV to NAV basis. Benchmark: MSCI AC Asia ex Japan. Performance as of 31 Jan 2024, SGD basis, with dividends and distributions reinvested, if any.

Indian and Taiwanese stocks feature strongly in portfolio

This outperformance over the benchmark can be attributed to the United Asia Fund’s AI-driven stock selection. The Fund’s AI-Augmentation model is currently finding good potential among Indian energy and Taiwanese manufacturing companies. There is also increasing exposure to Korean financial stocks.

Figure 4: Fund Top 10 holdings as of 31 Jan 2024

| Company name | Country | Weighting (%) | Description |

| Rec Ltd | India | 3.57 | Infrastructure finance company |

| Bharat Petroleum | India | 3.39 | One of the leading oil and gas companies in India |

| Gail India | India | 3.39 | India's largest natural gas company |

| Indian Oil Corp | India | 3.28 | Integrated oil company |

| Tongcheng Travel | China | 3.25 | One-stop online travel platform |

| Tung Ho Steel Enterprise | Taiwan | 2.88 | Producer of steel products |

| Arcadyan Technology | Taiwan | 2.88 | Manufacturer of wireless local area network (WLAN) products |

| Sun TV Network | India | 2.86 | One of the largest media conglomerates in India |

| Power Grid Corp of India | India | 2.84 | Power transmission company |

| Jasa Marga Persero TBK PT | Indonesia | 2.84 | Toll road operator |

The Fund’s relative underweight in China and Hong Kong stocks also helped to limit losses after both regions ended January as the worst-performing Asian markets.

Fund Details

| United Asia Fund, as of 31 Jan 2024 | |

| Fund objective | The investment objective of the Fund is to achieve long term capital growth mainly through investing in the securities of corporations in, or corporations listed or traded on stock exchanges in, or corporations which derive a significant proportion of their revenue or profits from or have a significant proportion of their assets in, Asia (excluding Japan) |

| Top 5 geographical allocation (%) | India: 31.08 Taiwan: 22.70 China: 18.20 Singapore: 7.46 South Korea: 7.22 |

| Top 5 sector allocation (%) | Financials: 16.39 Consumer Discretionary: 15.79 Information Technology: 11.41 Communication Services: 10.11 Energy: 9.59 |

| Fund class available | Class SGD |

| Management fee | Class SGD: Currently 1.25% p.a. |

| Subscription fee | Up to 5% |

| Minimum subscription / trading size | Class SGD: S$1000(initial); S$500 (subsequent) |

1Source: Nomura, Is Asia slowly decoupling from China, Sept 2023

2Source: Morningstar, for the category Asia ex Japan Equity, as of 31 Dec 2023

3Source: Morningstar, as of 31 Jan 2024

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z