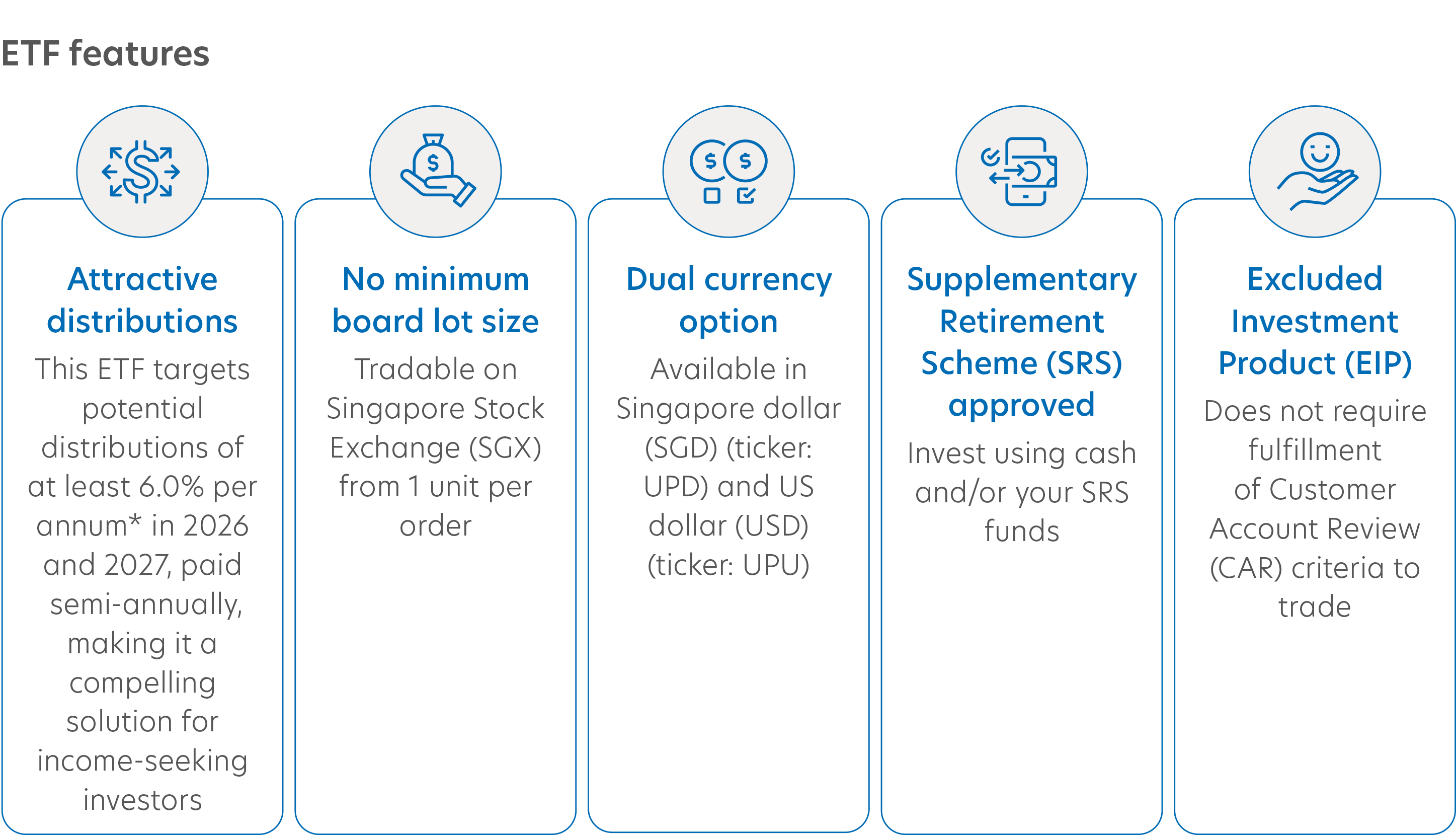

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the calendar month or quarter. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. UOBAM reserves the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of income, capital gains, capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a reduction of part of your original investment and may result in reduced future returns. Please refer to the Fund's prospectus for more information.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it.

The information contained in this document, including any data, projections and underlying assumptions, are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and UOB Asset Management Ltd’s (“UOBAM”) views as of the date of the document, all of which are subject to change at any time without notice. In preparing this document, UOBAM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was otherwise reviewed by UOBAM. While the information provided herein is believed to be reliable, UOBAM makes no representation or warranty whether express or implied, and accepts no responsibility or liability for its completeness or accuracy. Nothing in this document shall, under any circumstances constitute a continuing representation or give rise to any implication that there has not been or there will not be any change affecting the Fund. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOBAM and any past performance or prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund.

Investors should note that the Fund is not like a conventional unit trust in that an investor cannot redeem his Units directly with UOBAM and can only do so through the participating dealers if his redemption amount satisfies a prescribed minimum that will be comparatively larger than that required for redemptions of units in a conventional unit trust. An investor may therefore only be able to realise the value of his Units by selling the Units on the Singapore Exchange Limited (“SGX”). Investors should also note that any listing and quotation of Units on the SGX does not guarantee a liquid market for the Units.

An investment in unit trusts is subject to investment risks and foreign exchange risks, including the possible loss of all or part of the principal amount invested. Investors should read the Fund's prospectus and product highlights sheet, which are available and may be obtained from UOBAM or any of its appointed agents or distributors, before deciding whether to subscribe for or purchase any Units. You are responsible for your own investment decisions. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you.

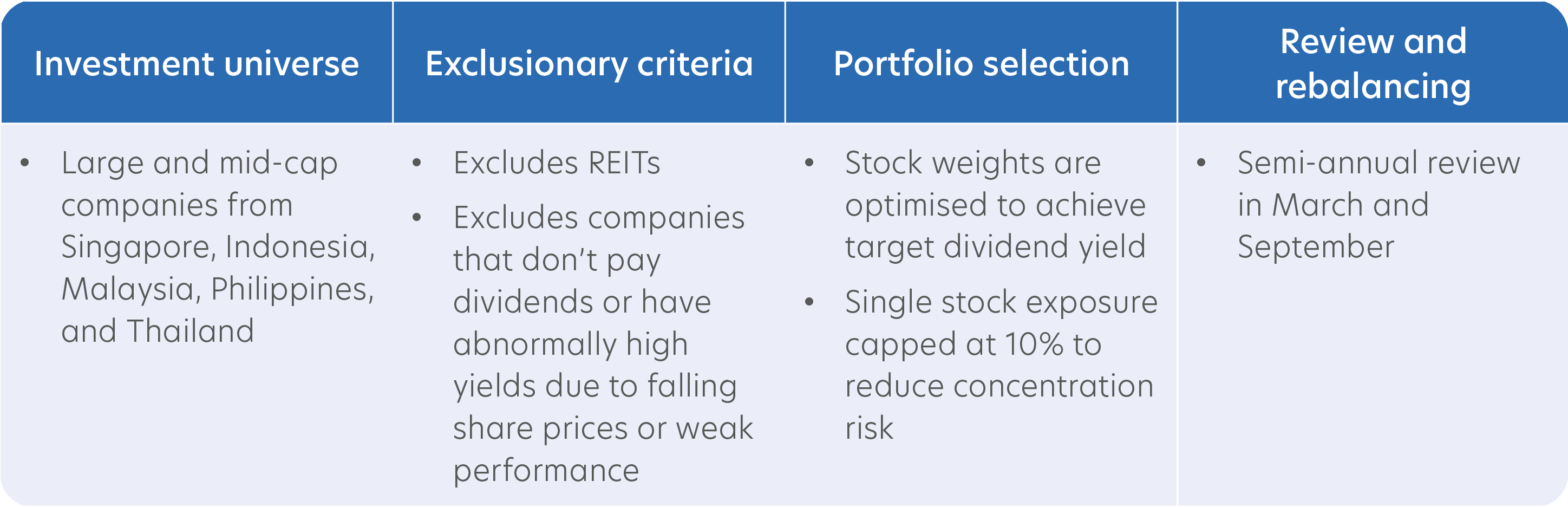

The UOBAM Ping An FTSE ASEAN Dividend Index ETF has been developed solely by UOBAM. The UOBAM Ping An FTSE ASEAN Dividend Index ETF is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE ASEAN ex REITs Target Dividend Index vest in the relevant LSE Group company which owns the FTSE ASEAN ex REITs Target Dividend Index. “FTSE®” is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license.

The FTSE ASEAN ex REITs Target Dividend Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the FTSE ASEAN ex REITs Target Dividend Index or (b) investment in or operation of the UOBAM Ping An FTSE ASEAN Dividend Index ETF. The LSE Group makes no claim, prediction, warranty, or representation either as to the results to be obtained from the UOBAM Ping An FTSE ASEAN Dividend Index ETF or the suitability of the FTSE ASEAN ex REITs Target Dividend Index for the purpose to which it is being put by UOBAM.

The inclusion of “Ping An” in the name of the UOBAM Ping An FTSE ASEAN Dividend Index ETF reflects the collaboration between us and Ping An Fund Management Company Limited in relation to the Sub-Fund (which a Ping An feeder ETF in China is expected to feed into in the future). For clarity, Ping An is not a sub-manager or advisor in relation to the Sub-Fund, and the Sub-Fund is solely managed by us.

This advertisement has not been reviewed by the Monetary Authority of Singapore.