In a falling interest rate environment, short-maturity bond funds help to lock in today’s higher yields

Fixed deposit rates have already started to ease. When the interest rate-cutting cycle gets going in earnest this year, this easing will become steeper.

So how can depositors maintain the good returns they enjoyed last year, but without taking on too much extra risk?

One way to achieve higher yields is to buy bonds and bond funds that are of longer maturity. Under normal circumstances, long-term bonds will have a higher yield to compensate for their higher risk. But at the present time, that is not the case. The 2-year US Treasury is yielding 4.6 percent but the 10-year US Treasury is yielding only 3.8 percent1.

This is what is called an inverted yield curve, and under such circumstances, taking duration risk (i.e. investing in longer maturity bonds) may not be rewarded by equivalent duration rewards.

Furthermore, short-maturity bonds (typically three years or less) can continue to benefit from potential capital appreciation when interest rates eventually fall. Overall, such bonds are offering attractive total returns with less risk.

This can be seen from the historically higher Sharpe ratio produced by short-maturity bonds. The Sharpe ratio is a widely used measure of risk-adjusted returns where higher values indicate better returns per unit of risk taken.

Fig 1: Short-maturity bonds have higher risk-adjusted returns than longer maturity bonds

| Sharpe ratio | |

| ICE BofA 1-3Y Corporate Bond Index | 0.24 |

| Bloomberg US Aggregate Bond Index | 0.15 |

Source: Bloomberg, data for the period 30 Sep 2013 to 30 Sep 2023

Shorter is better

UOBAM offers two solutions for investors who wish to invest in short-maturity bonds to lock in current high short-term yields.

United SGD Fund2

- Weighted average maturity: 1.11 years

- Dividend yield: 5% per annum (United SGD Fund Class S SGD Dist)*

*Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus

This Fund holds high-quality, short-term investment grade (IG) bonds to offer investors low risk, stability, and good income potential. To achieve this, the Fund mainly invests in bonds with a 3-year maturity using a laddered strategy. 3-year bonds are generally preferred because bonds with 1- or 2-year maturities tend to be more limited in supply. If the Fund’s portfolio managers cannot find sufficient bonds to invest in, it would result in excessive cash left uninvested.

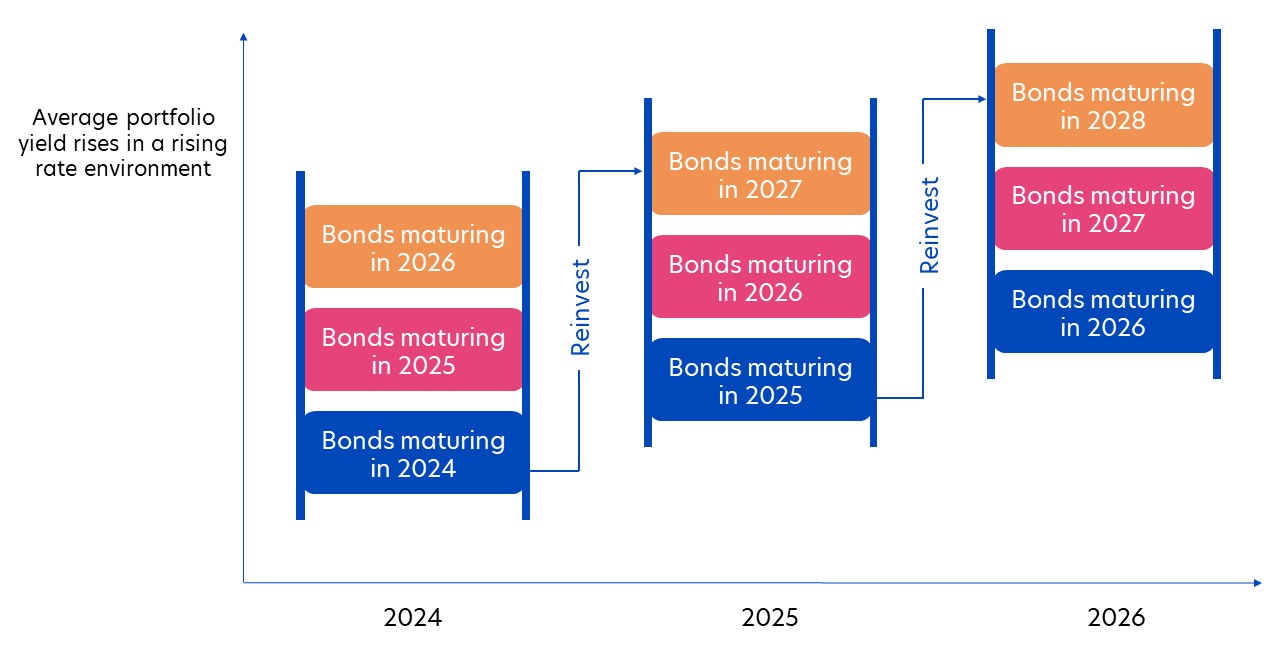

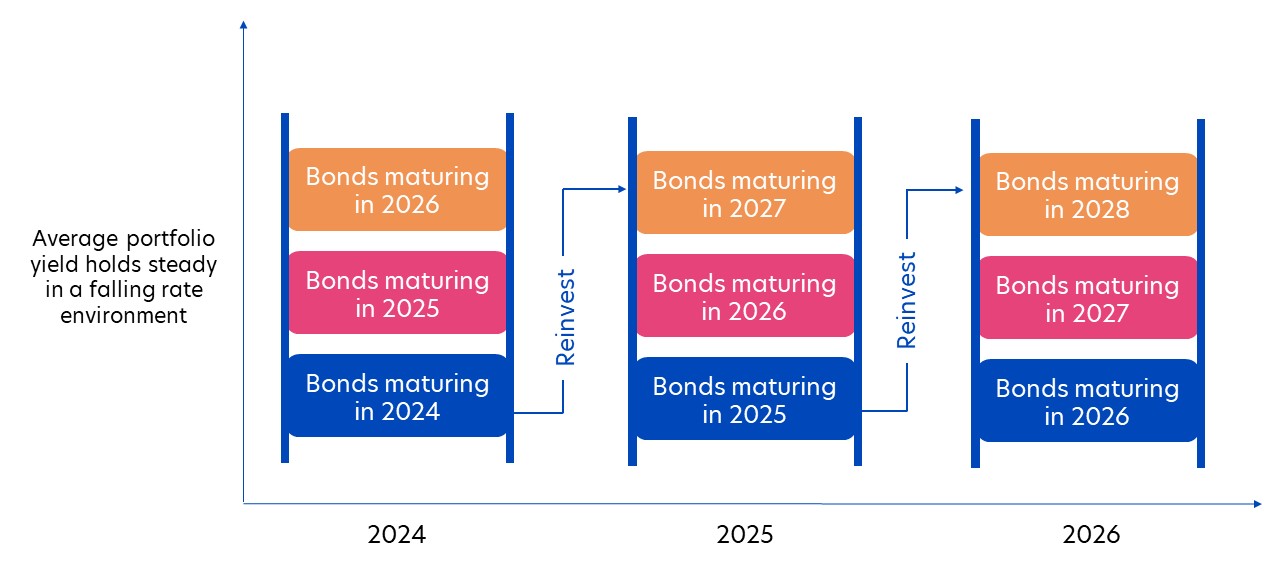

To implement the Fund’s laddered strategy, portfolio managers seek to reinvest bonds that mature in a given year into new 3-year bonds. Using the 2024 to 2026 time period as an example, if interest rates are rising (Fig 1), this means proceeds from matured bonds can be reinvested into higher-yielding bonds. If rates are falling (Fig 2), this means higher yields can be locked in for a longer period of time.

Fig 2: Rising interest rate scenario

Fig 3: Falling interest rate scenario

Currently, the bonds within the Fund have an average maturity of 1.11 years as 50 percent of them are maturing this year. As the bonds get reinvested upon maturity, the Fund’s weighted average maturity is expected to lengthen to about 1.5 years.

Overall, the short-maturity focus of the Fund helps maintain price stability amid the current uncertainty around the extent of interest rate cuts, which may not come as soon or as aggressively as markets hope.

The Fund’s portfolio managers are of the view that the Fed is likely to take a more conservative approach to rate cuts given the continued strength of the US economy. They anticipate only two to four cuts in 2024, compared to the consensus view of five cuts. Against this backdrop, bonds with shorter maturities face less interest rate risk while still offering attractive yields relative to those with longer maturities.

A compelling option for all investors

With an annualised dividend yield of 5.0 percent3, paid out monthly (United SGD Fund Class S SGD Dist), the Fund is useful for investors seeking to beat inflation in the coming year. At the same time, it offers the potential for capital appreciation amid falling interest rate expectations.

This combination makes the Fund an attractive proposition for all investors, regardless whether they are seeking income in the short-term, or looking to build wealth over the longer term.

Award-winning performance

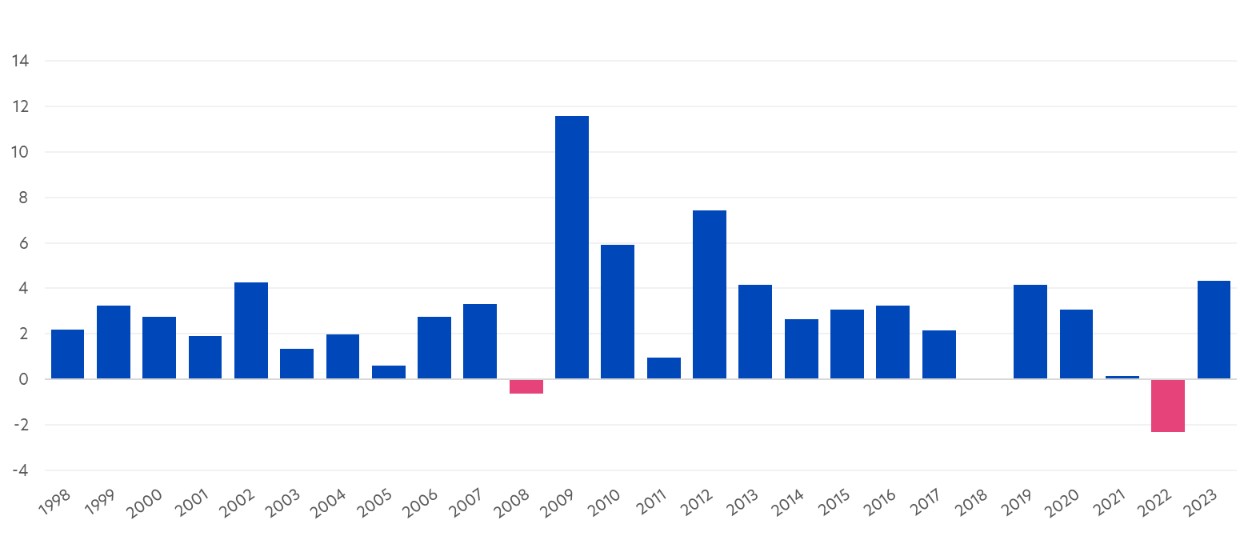

In 2023, the Fund won the Outstanding Achiever and Best-in-Class awards for Singapore Fixed Income at the Benchmark Fund of the Year Awards4. This was reflected in its superior returns of 4.27 percent in 2023, compared to 3.44 percent for its benchmark. The outperformance was driven by a combination of bond price gains arising from rate cut expectations and good income returns.

Looking back at its strong track record of over 24 years, the Fund has delivered positive returns more than 90 percent of the time. As a result, it sees strong demand from investors and is one of the most popular fixed income funds in Singapore

Fig 4: United SGD Fund calendar year returns (%) since inception

Source: UOBAM, as of 31 Dec 2023. Performance is net of fees and is based on United SGD Fund Class A (Acc) SGD, in SGD terms, on a NAV to NAV basis, with dividends and distributions reinvested, if any. Past performance is not necessarily indicative of future performance.

United SGD Money Market Fund5

- Weighted average maturity: 0.21 years (2.5 months)

- Weighted average yield to maturity: 3.89%

This Fund invests in high-quality money market instruments such as Treasury bills and Monetary Authority of Singapore (MAS) bills to provide stable returns and capital preservation. Generally, money market instruments have very short maturities of one year or less, making them very liquid.

With a very short average maturity of about two months, the Fund has a higher liquidity than most fixed deposits in Singapore while still offering a high weighted average yield to maturity (YTM) of 3.89 percent. YTM is the annualised return that a bond would generate if held to maturity, assuming interest payments are re-invested.

This makes the Fund ideal for investors who want to earn decent returns but do not wish to lock up their cash. Investment proceeds from the Fund can be withdrawn and received within one business day.

Consistent performance

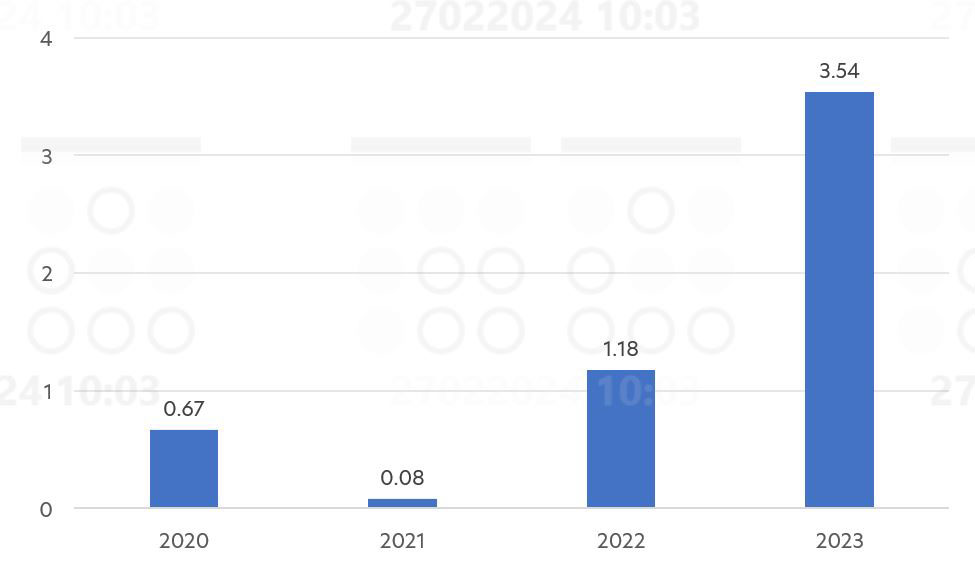

Since inception, the Fund has delivered positive annualised returns of 1.39 percent. Testament to its strong performance, it also ranks as a top quartile fund among its peers6, meaning its returns fall within the top 25 percent of funds in the same category.

Fig 5: United SGD Money Market Fund calendar year returns (%) since inception

Source: Morningstar, as of 31 Dec 2023. Performance is net of fees and is based on United SGD Money Market Fund Class A1 SGD share class, in SGD basis, on a Net Asset Value (NAV) basis, with dividends reinvested, if any.

While money market funds will likely remain popular in the near-term as short-term interest rates remain elevated, we would caution against using them for long-term wealth building. Unlike bond funds or equities, money market funds do not appreciate in price and cannot offer any capital growth. They are best suited for short-term investment goals or as a place to park cash while waiting for investment opportunities.

Fund details

The United SGD Money Market Fund and United SGD Fund are complementary and may be used together to meet both short-term and long-term income needs.

Here’s a summary of both funds.

| United SGD Fund, as of 31 Jan 2024 | United SGD Money Market Fund, as of 31 Jan 2024 | |

| Investment objective | Achieve a yield enhancement over Singapore dollar deposits | Provide a return which is comparable to that of Singapore dollar short-term deposits |

| Underlying holdings | Mainly investment grade corporate bonds | Money market instruments |

| Distribution policy | Class A SGD (Dist): Dividend rate of 4.0% per annum, paid out monthly* Class S SGD (Dist): Dividend rate of 5.0% per annum, paid out monthly* *Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus |

Not applicable |

| Benefits | Steady monthly income and potential for good capital gains | Inflation-beating returns without the need to lock up funds |

| Top 5 country allocation (%) | Singapore: 22.08 China: 16.66 South Korea: 14.23 Hong Kong: 9.42 Australia: 5.73 |

Singapore: 85.16 Hong Kong: 1.06 China: 0.35 Indonesia: 0.13 Cash: 13.30 |

| Top 5 sector allocation (%) | Financials: 39.59 Government: 10.01 Utilities: 7.7 Industrials: 7.35 Real Estate: 7.07 |

Government: 85.16 Financials: 1.06 Information Technology: 0.35 Industrials: 0.13 Cash: 13.30 |

| Fund classes available3 | Class A SGD Acc; Class A SGD Dist Class A USD Acc (Hedged); Class A USD Dist (Hedged) Class B SGD Acc Class D SGD Acc Class S SGD Dist Class S USD Dist (Hedged) |

Class B SGD Class Z SGD Class A1 SGD Class D SGD Acc |

| Management fee | Class B SGD Acc and Class D SGD Acc: 0.33% p.a. All other Classes: 0.63% p.a. |

Class B SGD: 0.15% p.a. All other Classes: 0.25% p.a. |

| Subscription fee | Up to 2% p.a. | Not applicable |

| Minimum subscription / trading size | Class A/S: S$1000/US$1000 (initial); S$500/US$500 (subsequent) Class B: S$500,000 (initial); S$100,000 (subsequent) Class D: S$1,000 (initial); S$500 (subsequent) |

Class B/Z: S$1,000,000 (initial); S$500,000 (subsequent) Class A1/D: S$1,000 (initial); S$500 (subsequent) |

1 Source: MarketWatch, as of 20 Feb 2024

2 Source: UOBAM, as of 31 Dec 2023

3 Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus

4 Please refer to uobam.com.sg/awards for the latest list of UOBAM awards

5 Source: UOBAM, as of 31 Jan 2024

6 Source: Morningstar, as at 31 October 2023. Quartile rankings show the fund’s position ascompared to its peers. Peers are determined by the manager through the use of objective filtersfrom Morningstar. A peer group percentile is obtained for each fund and funds are ranked asfollows: Quartile 1: <=25%, Quartile 2: <=50% and >25%, Quartile 3: <=75 and >50%, Quartile 3:>75%

If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider:

|

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the month. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. The Managers reserve the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a return of part of your original investment and may result in reduced future returns. Please refer to the Fund’s prospectus for more information.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z