US interest rate cuts loom in 2024, but due to residual inflationary pressures, levels are unlikely to fall to pre-pandemic lows. In the fourth of our 5-part Higher-for-Longer series, we look at how the United SGD Fund offers investors the potential for both steady monthly income and good capital gains

The rise of reinvestment risk

Cash was a star performer in 2022 and 2023 as interest rates climbed and other asset classes underperformed. Many investors flocked to cash to earn decent returns with little risk.

But the US Fed is likely done hiking interest rates, and is set to embark on rate cuts instead. Economic data shows inflation is moderating and the labour market is gradually cooling, signs that there is room for the Fed to start loosening its monetary policy in 2024.

This means that currently high cash rates could fall in 2024, and reinvestment risk – i.e. the risk that investors are forced to reinvest their money at a lower interest rate because they failed to lock in higher levels – could rise.

Cuts on the cards

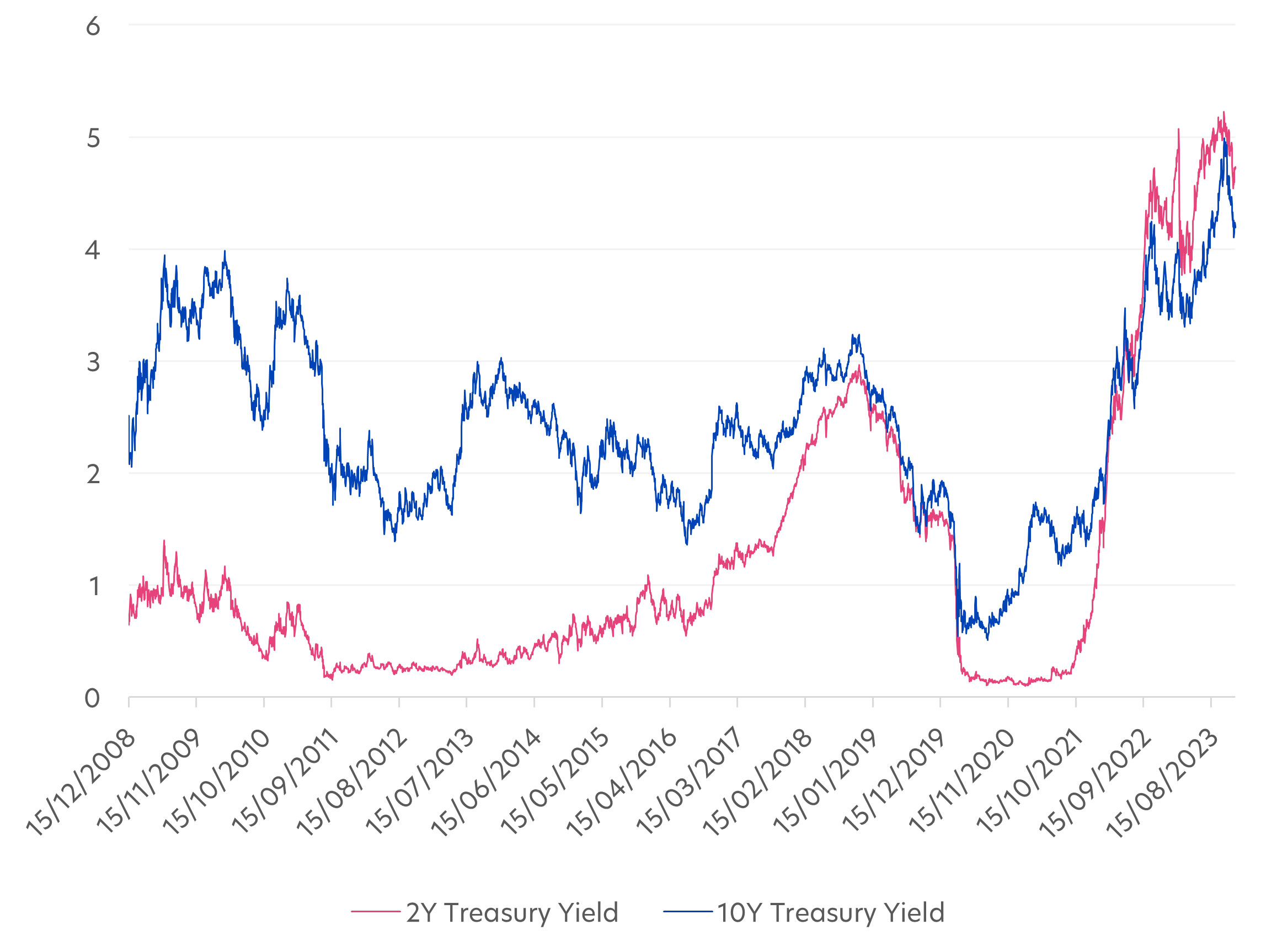

Typically, investors mitigate this risk is by locking in today’s higher yields for a longer period using bonds. After years of paltry yields amid low or even negative interest rates post global financial crisis (GFC), bonds now offer compelling income for investors with yields at levels not seen in 15 years.

Figure 1: US 2Y and 10Y Treasury yields (%), 2008 - 2023

Source: Bloomberg, UOBAM, 13 Dec 2023

On top of locking in attractive yields, investors stand to benefit from higher bond prices if interest rates start to fall. Over the past weeks, it is this expectation of US rate cuts that has caused bonds to rally. As a result, bond returns across all sectors significantly outperformed cash in November and year-to-date.

Figure 2: Bonds vs Cash returns

| Nov 2023 (%) | Jan – Nov, 2023 (%) | |

| Cash | 0.32 | 3.48 |

| Global investment grade (IG) bonds | 4.18 | 4.18 |

| Asia IG bonds | 2.57 | 3.58 |

| Global high yield bonds | 4.64 | 8.79 |

Source: Bloomberg, UOBAM, Nov 2023. Global IG bonds: Barclays Global Corporate Aggregate Index; Asia IG bonds: JACI Investment Grade Index; Global high yield bonds: Barclays Global High Yield Index

This bond price appreciation is expected to continue into 2024. Following the Fed’s recent December meeting, the projections from the Statement of Economic Projections (SEP) "dot-plot" show a 75-basis-point cut in 2024, although there is still debate on the exact timing of these cuts.

The United SGD Fund

Multi-maturity portfolio

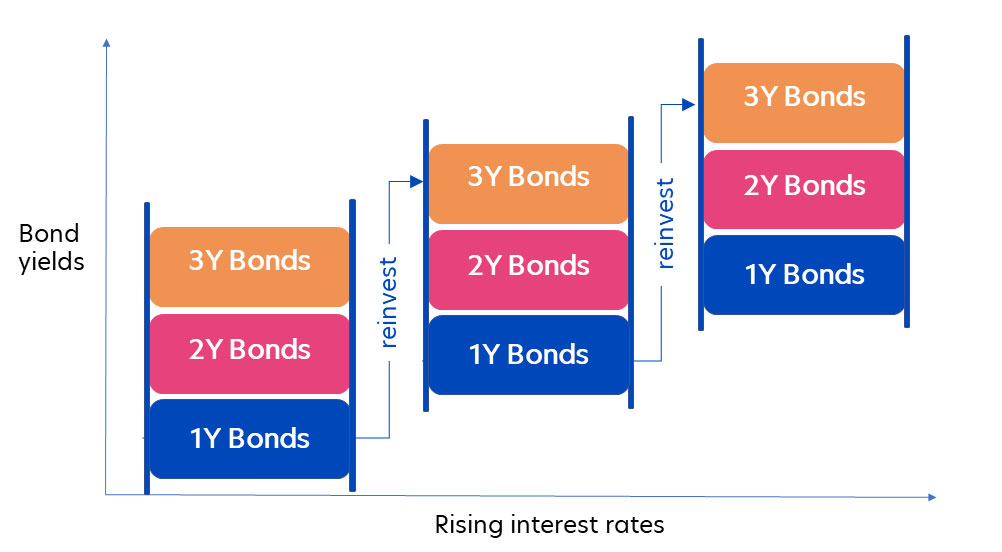

The United SGD Fund (the “Fund”) invests in high-quality, short duration investment grade bonds. It uses a laddered strategy to smoothen the impact of fluctuating interest rates and enhance overall returns.

This works by deliberately investing in bonds of different maturities. So when interest rates rise, the Fund’s laddered portfolio enables proceeds from matured bonds to be reinvested into new, longer maturity bonds at higher interest rates.

In the 2022 – 2023 period, when rates were rising, this strategy helped boost the Fund’s weighted average yield to maturity (YTM) from 2.10 percent as of 31 Jan 2022, to 4.82 percent as of 31 Oct 20231.

In the coming few years, when interest rates are expected to fall, a laddered strategy can help to lock in bond yields at previously higher rates. That’s because only a portion of the portfolio will mature in any given year, therefore reducing reinvestment risk.

While laddered strategies are known to work well in volatile interest rate environments, they are difficult to achieve without collective instruments such as mutual funds, given the capital required to invest in a multi-maturity bond portfolio.

Income and stability

The Fund currently provides an annualised dividend yield of 5.0 percent2, paid out monthly (United SGD Fund Class S SGD Dist). It does this by focusing on bond issuances from corporates that have good access to capital markets, resilient balance sheets, and defensive business models.

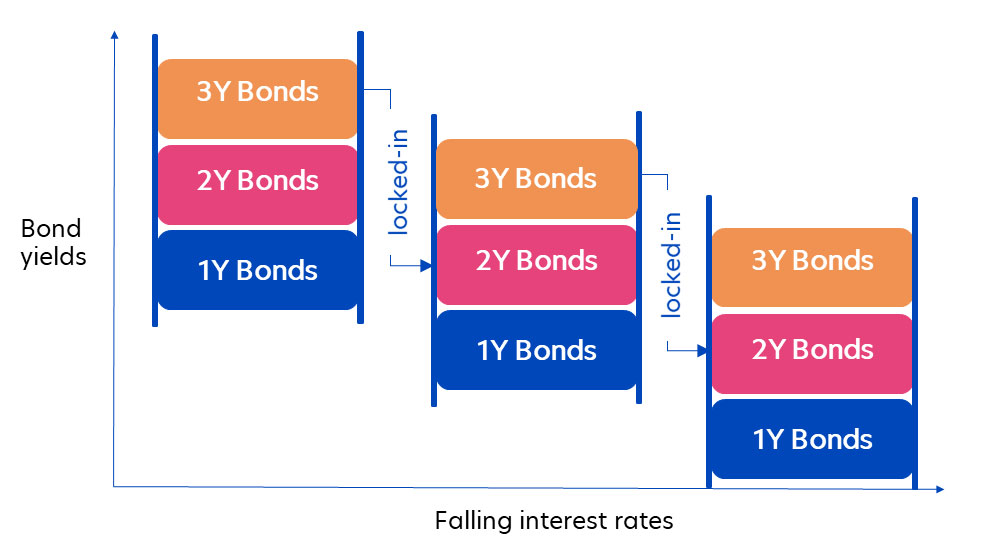

As a result, the Fund is less vulnerable to drawdowns during periods of market volatility and has delivered positive calendar year returns in 22 out of the Fund’s 24 years of existence.

Figure 3: United SGD Fund calendar year returns (%) since inception

Source: UOBAM, as of 31 Oct 2023. Performance is net of fees and is based on United SGD Fund Class A (Acc) SGD, in SGD terms, on a NAV basis, with dividends and distributions reinvested, if any. Past performance is not necessarily indicative of future performance.

Going forward, as we move into a new era of structurally higher-for-longer inflationary pressures, we would expect to interest rates to fall but still remain above pre-pandemic levels. This means the United SGD Fund offers the best of both worlds – inflation-beating monthly income plus the potential for price appreciation. The combination makes the Fund an attractive proposition for all investors, regardless whether they are seeking income in the short-term, or looking to build a nest egg over the longer term.

Fund Details

| United SGD Fund, as of 31 Oct 2023 | |

| Investment objective | Invest substantially all its assets in money market and short term interest bearing debt instruments and bank deposits with the objective of achieving a yield enhancement over Singapore dollar deposits. |

| Distribution policy | Class A SGD (Dist): Dividend rate of 4.0% per annum, paid out monthly* Class S SGD (Dist): Dividend rate of 5.0% per annum, paid out monthly* *Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus |

| Country allocation (%) | China: 20.9 Singapore: 18.6 South Korea: 12.1 Hong Kong: 10.4 India: 6.6 Japan: 5.4 UK: 4.2 Australia: 4.1 Others: 17.85 |

| Top 5 sector allocation (%) | Financials: 39.4 Utilities: 12.7 Industrials: 9.1 Consumer Discretionary: 8.8 Materials: 6.6 |

| Top 5 holdings (%) | Mizuho Fin Grp Cayman 3 Company 03/24 4.6: 2.8 Sumitomo Mitsui Financial 04/24 4.436: 2.6 China Huadian Overseas Company Var: 2.3 Misc Capital Two Labuan Company 04/25 3.625: 2.2 MAS Bill Bills 12/23 0.00000: 2.2 |

| Fund classes available3 | Class A SGD Acc; Class A SGD Dist Class A USD Acc (Hedged); Class A USD Dist (Hedged) Class B SGD Acc Class D SGD Acc Class S SGD Dist Class S USD Dist (Hedged) |

| Management fee | Class B SGD Acc and Class D SGD Acc: 0.33% p.a. All other Classes: 0.63% p.a. |

| Subscription fee | Up to 2% p.a. |

| Minimum subscription / trading size | Class A/S: S$1000/US$1000 (initial); S$500/US$500 (subsequent) Class B: S$500,000 (initial); S$100,000 (subsequent) Class D: S$1,000 (initial); S$500 (subsequent) |

1Source: UOBAM, as of 31 Oct 2023

2Source: UOBAM, Nov 2023. Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus.

3Investors should refer to the Fund’s prospectus for more details on the different classes available. Please check with our distributors on the availability of the Fund Classes.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the month. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. The Managers reserve the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a return of part of your original investment and may result in reduced future returns. Please refer to the Fund’s prospectus for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z