After a decade of near-zero interest rates, the next decade could see interest rates averaging above 4 percent in most developed markets. In the second of our 5-part Higher-for-Longer series, we look at what this means for financial markets.

Seesaw inflation

As we head into 2024, we will be continuing a journey marked by economic distortions due to Covid after-effects, climate change and geopolitical conflicts.

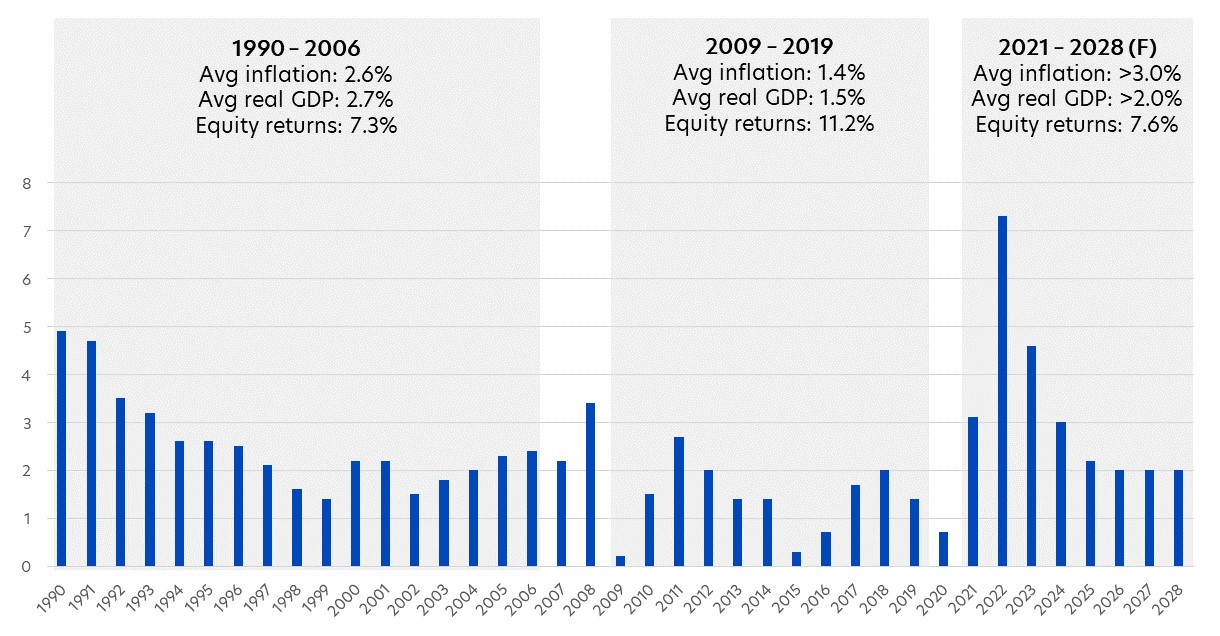

However, it is easy to lose sight of the fact that recent past decades were also not “normal”. Between 1990 – 2006, many advanced economies were highly leveraged, producing strong real GDP growth, but also leading ultimately to a serious housing bubble and the Great Financial Crisis.

The shock caused financial institutions to tilt in the opposite direction. Credit was withdrawn and the world entered a prolonged period of deleveraging. As a result, the world struggled with low growth and unusually low interest rates.

Fig 1: Inflation annual percent change, advanced economies, 1990 – 2028 (F)

Source: Bloomberg, IMF, UOBAM. Equity returns are annualised; forecasted returns based on UOBAM’s capital market assumptions for next 10 years

What does high inflation mean for growth?

So what can we learn from history to help us navigate the 2020s? It is arguable that since a global pandemic has never occurred in modern times, the post-Covid era is unprecedented, making it difficult to apply historical trends. Nevertheless, our studies of previous inflationary periods provide a few useful indications of what investors can look out for:

- Haphazard inflation can lead to lower growth

Steady inflation, even when high, is not necessarily damaging for economic growth because expectations are well-anchored. However, inflation that is unexpected and haphazard can lead to lower growth and high interest rate volatility, which is rarely conducive for markets. - Higher inflation can lead to higher growth

It may seem counter-intuitive but periods of sustained inflation can produce economic resilience and strength. This is because higher interest rates mean capital is allocated more efficiently, leading to higher economic efficiency and better-functioning economies. - Higher inflation can lead to higher growth fluctuations

That said, we also observe that high inflation regimes can lead to more accelerated economic and market cycles. As mentioned, this does not necessarily mean lower growth, but rather a more volatile growth environment.

What does high inflation mean for investments?

Having lived through the pre-Covid decade, most of us will be familiar with how to invest in a low inflation/ low interest rate environment. But the strategies relevant then do not all apply in this new regime. As a reference, here are how asset classes performed in recent high versus low inflation years.

| Asset Class | 1990-2006 High Inflation (%) | 2010-2019 Disinflation (%) |

| US Cash | 4.2 | 0.5 |

| Global REITs | 13.2 | 11.6 |

| Commodities | 7.9 | -4.7 |

| US Treasuries | 6.3 | 2.5 |

| US Investment Grade Bonds | 7.2 | 3.7 |

| US Equities (S&P 500) | 10.9 | 13.6 |

| Gold | 2.8 | 3.3 |

Source: Bloomberg, UOBAM

- Real estate

Real estate prices go up with inflation. This is because physical assets become more valuable when inflation is high, reflecting the high cost of raw materials and labour. Rent also increases because they typically mirror the direction of inflation and mortgage rates. - Commodities

Like real estate, commodities are physical assets that retain their value even when cash is devalued by inflation. This asset class also provides investors with diversification benefits as their prices tend not to move in tandem with conventional investments like bonds and equities. - Bonds

As discussed previously, higher inflationary pressures could show through, not as higher prices, but as higher interest rates. If so, bond instruments offer attractive yields, and given the likely end of rate hikes, can also provide capital gains. We favour shorter-dated over longer-dated bonds due to their better risk-adjusted returns. - Equities

High quality stocks, that is, those with strong pricing power, have the potential to perform well in high inflation environments. This is because they either have evergreen consumer demand, such as those in healthcare, energy and consumer staples, or they are able to keep costs down, such as companies offering technology and communication services. - Gold

Gold does not perform uniformly well in all inflation environments. Gold demand can sometimes soften when interest rates are high as investors may prefer to hold income-paying investments. That said, like other commodities, gold is a good diversifier, and offers protection against the risk of a recession.

The need to stay nimble

It is worth bearing in mind that returns in a high inflation environment can be positive over a longer time frame but more volatile over the short term. This is because market drivers such as interest rates, economic growth and earnings can shift more frequently and cause uncertainty among investors. There is therefore a greater need for investors to stay on their toes.

If you are interested in investment opportunities related to the theme covered in this article, here are three UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you..

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z