This award-winning Fund has been implementing AI-driven insights since 2020. In August this year, the Fund began tilting towards consumer spending sectors

Back in 2020, the management approach of the United Greater China Fund (the "Fund") was changed to include a mix of human expertise and artificial intelligence (AI). This has paid off handsomely as the Fund is now one of the top performers among its Morningstar peer group. It also recently won the Refinitive Lipper Fund award for the Best Performing Fund in the Greater China 3-Year Category1.

Here is an interview with Benchmark, the organisation behind the asset management industry’s prestigious Fund Of The Year awards, on UOBAM’s AI-Augmentation process. This strategy is not the same as investing in AI stocks. Rather, it leverages UOBAM’s AI and machine learning (AIML) capabilities and deep investment expertise to help deliver superior investment returns.

Learn more

What makes UOBAM’s AI-and-analyst strategy so successful? Paul Ho, Senior Director of Asian Equities at UOB Asset Management and Elsa Pau, Benchmark Awards' Curator discuss how AI is helping fund managers uncover interesting opportunities for outperformance.

Are you comfortable investing in funds managed using AI?

Tell us how you feel about AI-driven investing by completing this short survey.

China’s stock-picking opportunities

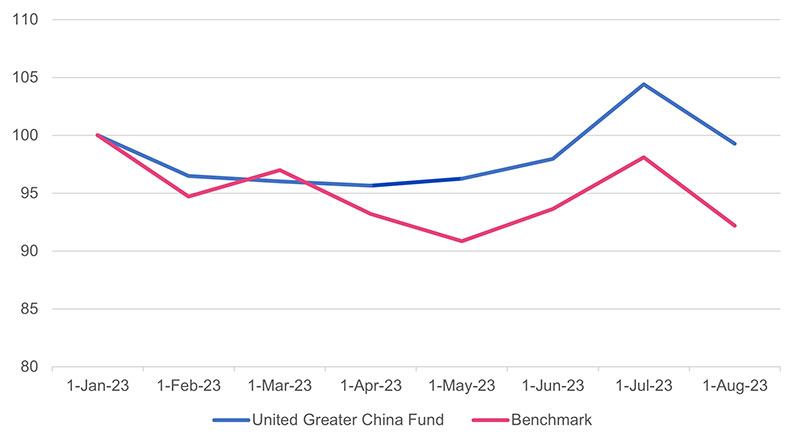

Year to date, the Fund's AI-Augmentation strategy continues to strongly outperform, with positive returns of 5.80 percent compared to its benchmark, which returned just 0.26 percent2.

Figure 1: Fund performance vs benchmark, 1 Jan – 31 Aug, 2023

Source: UOBAM, as of 31 August 2023. Benchmark: MSCI Golden Dragon Index

These positive returns have been achieved despite China’s difficult macro environment. This year the country has faced many local and global headwinds, including the property sector crisis, rising geopolitical tensions, US trade restrictions and negative foreign investor sentiment.

That said, there is no denying that there are still many gems to be found in China’s stock market, provided you know where to look. In the current environment, the Fund’s AI-Augmentation approach is finding good potential among China’s tourism and semiconductor companies, driven by the following factors:

- Rapid recovery in domestic tourism: This year’s “golden week” holiday period is expected to record domestic tourist spending of 783 billion yuan (S$150 billion). This is a 20 percent jump from the same period in 2019, a boost for domestic travel companies and tourist destinations.

- Breakthroughs in high-end semiconductor manufacturing: With China’s semiconductor self-sufficiency rate now exceeding 50 percent, this sector is becoming a driver of fresh interest in Chinese equities3.

Given these developments, here are a few examples of stocks that have recently been added to the Fund's portfolio.

- Chow Tai Fook, a Hong Kong based conglomerate with interests in jewellery, hotels and department stores, has the potential to benefit from Chinese tourists' luxury and gold consumption in Hong Kong

- Galaxy Entertainment Group, owners and operators of hotels and casinos in Macao, looks set to benefit from the return of Chinese tourists to Macau, with gaming one of the few sectors in China still seeing a cyclical upturn in earnings

- Getac Holdings, a specialised computer maker, and Naura Technology Group, a manufacturer of integrated circuit equipment, appear well-positioned for growth in China’s semiconductor sector

Here are some of the other stocks in the Fund’s portfolio:

Figure 2: Fund Top 10 holdings as of 31 Aug 2023

| Company | Weighting (%) | Sector | Description |

| Hisense Home Appliances Group | 3.59 | Consumer Discretionary | Chinese multinational appliance and electronics manufacturer |

| Swire Pacific | 3.54 | Real Estate | Hong Kong conglomerate with core businesses in property, beverages, aviation, and marine services |

| Montnets Cloud Technology Group | 3.43 | Information Technology | Chinese enterprise cloud communication service provider |

| Getac Holdings Corp | 3.22 | Information Technology | Taiwanese specialised computer maker |

| Cheng Shin Rubber Industry | 3.15 | Consumer Discretionary | Taiwan's largest tire maker and a top 10 global tire supplier |

| GF Securities | 3.12 | Financials | Chinese securities broking and trading company |

| Budweiser Brewing Co APAC | 3.10 | Consumer Staples | Largest beer company in Asia Pacific in terms of sales value; headquartered in Hong Kong |

| Chow Tai Fook Jewellery Group | 3.07 | Consumer Discretionary | Hong Kong conglomerate with holdings in jewellery, property development, hotel, and other businesses |

| Taishin Financial Holding | 3.05 | Financials | Taiwanese financial services company |

| NetEase Inc | 2.98 | Communication Services | Chinese Internet and game services provider |

Source: UOBAM

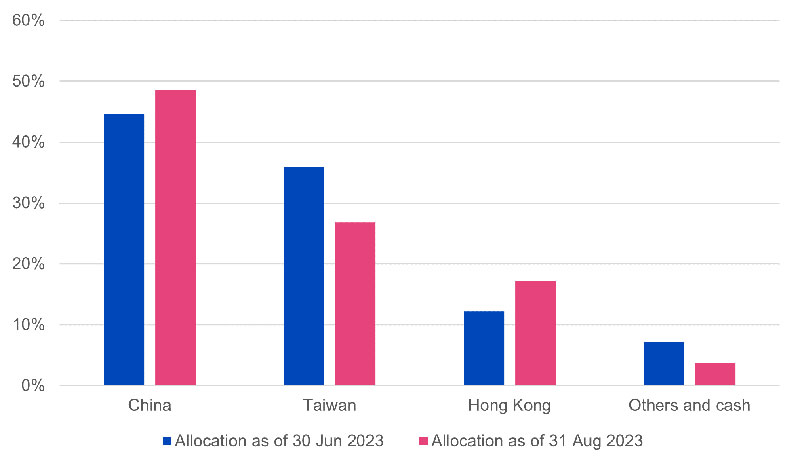

Higher exposure to Hong Kong and China

In August, the Fund also made dynamic adjustments to its geographical allocation. As high-tech and AI stock momentum appears to be waning for now, the Fund has taken profit in some of the best performing Taiwanese AI names and pared back its overweight allocation to Taiwan. Instead, the Fund’s AI-Augmentation process is pointing to opportunities in Hong Kong, a likely beneficiary of the rise in Chinese tourism, and China, given attractive valuations.

Figure 3: Fund geographical allocation as of 31 Aug 2023

Source: UOBAM

In fact, this shift in geographical allocation has played a role in the Fund’s outperformance against its benchmark. For the month of August, the Fund recorded a lower drawdown of -4.93 percent, compared to the benchmark's decline of -6.05 percent4.

Fund Details

| United Greater China Fund, as of 31 August 2023 | |

| Fund objective | Achieve long-term capital growth primarily through investment in companies with assets or revenues being in or derived from the People’s Republic of China, Hong Kong SAR and Taiwan. |

| Geographical allocation (%) | China: 48.61 Taiwan: 26.80 Hong Kong:17.18 Singapore: 0.98 Cash & Other: 6.42 |

| Sector allocation (%) | Financials: 19.97 Consumer Discretionary: 19.70 Information Technology: 16.53 Communication Services: 11.91 Consumer Staples: 8.81 Real Estate: 5.76 Industrials: 4.71 Health care: 4.47 Cash & Others: 8.14 |

| Top 5 holdings (%) | Hisense Home Appliances Group: 3.59 Swire Pacific: 3.54 Montnets Cloud Technology Group: 3.43 Getac Holdings Corp: 3.22 Cheng Shin Rubber Industry: 3.15 |

| Fund class available | Class A SGD Acc |

| Management fee | 1.50% |

| Subscription fee | Up to 5% |

| Minimum subscription / trading size | Class A SGD Acc: S$1000 (initial); S$500 (subsequent) |

1Refinitiv Lipper Fund Awards 2023 Winner Singapore, United Greater China Fund A SGD Acc | Refer to uobam.com.sg/awards for latest list of awards by UOBAM

2Source: UOBAM, as of 31 August 2023. Fund performance is calculated on a NAV to NAV basis, SGD basis, with dividends and distributions reinvested, if any.

3Sources: UOBAM, Brilliance, Golden Pine, 3W, Keystone, IvyRock, Sep 2023

4Source: UOBAM, as of 31 August 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z