In the final instalment of our Singapore series to accompany the launch of the United SG Dynamic Income Fund, we ask: when can Singapore’s equity market break out of its trading range?

Lacklustre backdrop

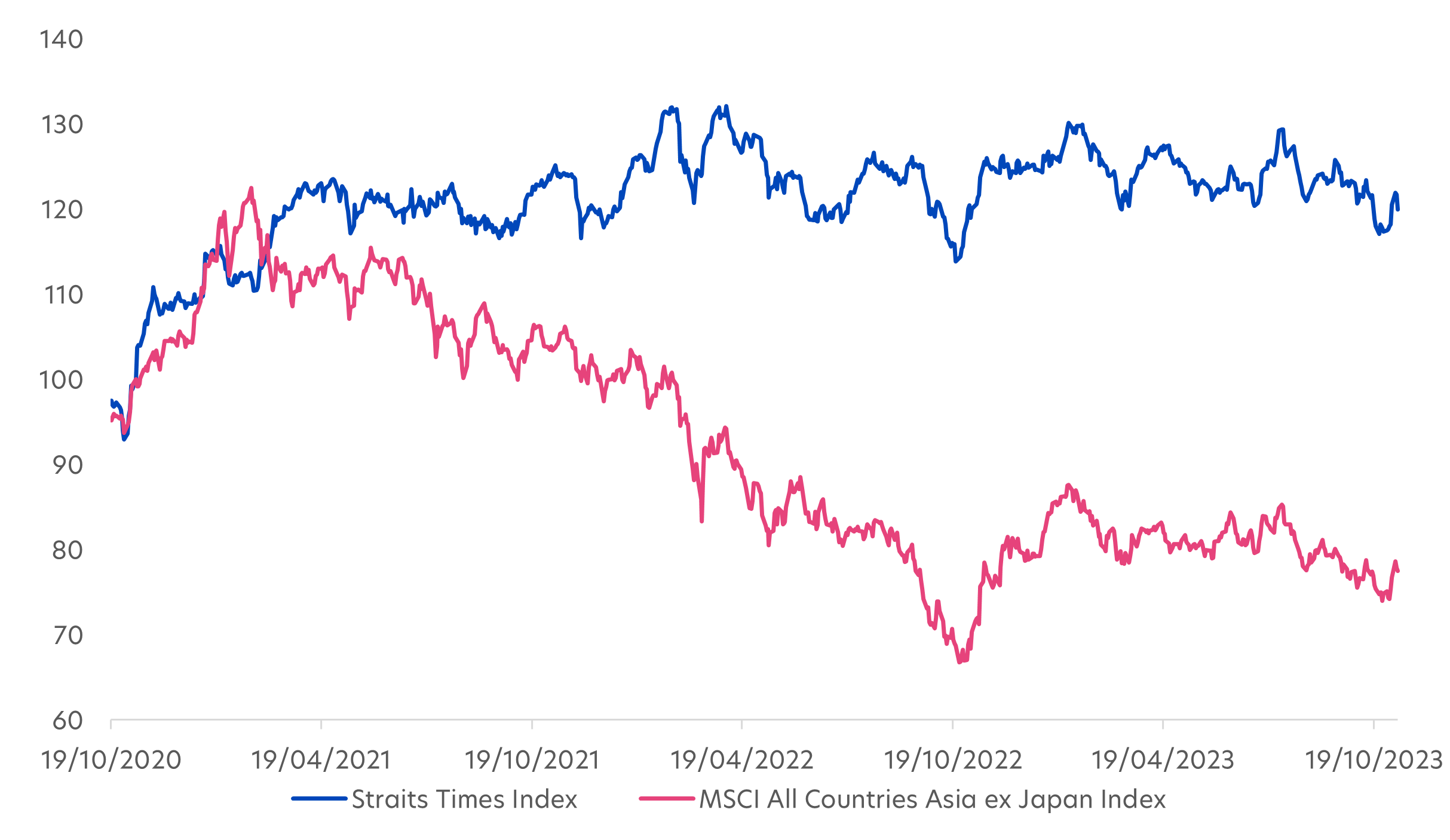

Singapore is known as a defensive market, and indeed over the past year, the Straits Times Index (STI) has managed to resist some of the pressures forcing down, for example, the broad MSCI Asia ex Japan index.

Figure 1: Singapore equities vs Asia ex Japan equities, Oct 2020 – Oct 2023

Source: UOBAM/ Bloomberg

But this offers only limited comfort for investors looking to enter the Singapore equities market. Over the past 12 months, the market has range-traded between 3.40K and a year-to-date low in October of 3.10K. This recent weakness is likely the result of lower-than-expected retail sales growth in September of just 0.6 percent year-on-year, well below August’s 4.2 percent.

As such, going into 2024, a catalyst for change in the equity market will most likely come from improvements in Singapore’s economic backdrop.

Inflation on the way down

While retail sales is faltering, a promising trend so far is the easing of Singapore’s inflationary pressures. In September, core inflation slowed to 3.0 percent, a significant fall from the 14-year high of 5.5 percent seen at the start of the year.

There are strong hopes that this easing trend will continue to gather pace over the next few months. Assuming no oil price spikes resulting from an escalation of hostilities in the Middle East, the Monetary Authority of Singapore (MAS) is forecasting year-on-year core inflation to be 4.0 percent for 2023, and between 2.5 to 3.5 percent for 2024.

This shift towards lower inflation is also taking place in the US. The Fed is expected to hold off on any more rate hikes this year, and for the first rate cuts to start towards the middle of next year, with one or two more in subsequent months.

2024 economic revival

Singapore's GDP for this year is forecast to land somewhere between 0.5 to 1.5 percent. With this timetable in mind, we would expect Singapore’s GDP growth to remain subdued for the first half of 2024.

However, US rate cuts could provide a leg-up for global demand. This would be a boost for trade-dependent economies like Singapore’s. As such, we expect Singapore’s GDP growth to improve gradually in the second half of the year.

At the same time the MAS, in its April 2024 monetary policy statement, is expected to announce a 50-basis-point reduction in the slope of the S$NEER policy band. This again has the potential to provide some counter cyclical effects that is supportive of the economy.

Scope to become less defensive in 2H24

Given the economic uncertainties, we believe that a more defensive positioning is appropriate for Singapore investors as we head into the new year. A multi-asset Singapore portfolio during this time is therefore likely to be weighted towards bonds and lower-risk assets.

However, are we approach mid-year, the equity market is set to gain strength. Travel-related industries is still a favourite on back of continued robust visitor arrivals. Meanwhile select financial services could pick up as interest rates start to soften.

To enjoy higher growth potential, investors may want to stay on the front-foot for these equity opportunities. But it is not easy to time the market, even in the past decade’s low-rate, low-volatility environment. In a new higher-for-longer inflation and interest rate regime that we believe will prevail over the next few years, investors may want to ensure that their assets are even more diversified, and they take more active asset allocation decisions.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z