Investing in multiple asset classes is a good way to stabilise returns. But overweighting the right asset classes at the right time is even better.

Uncertainties abound in these unusual times

Investors interested in Singapore markets have many questions in the current environment:

- Is it better to hold only cash and bonds?

- Or is it time to start adding some stocks?

- How about real estate assets?

And if indeed it is time to diversify:

- how much should I allocate into each asset class?

- And when should I rebalance?

These are difficult questions for investors to answer, even in familiar economic cycles. However, the current economic cycle is far from familiar. Singapore’s borrowing rates are close to all-time highs and inflation has not reached this level for 15 years.

While these are expected to ease next year, they are unlikely to return to the easy money conditions of the pre-Covid decade. This situation is expected to persist for several years, leading many asset managers, ourselves included, to the view that we are entering a “higher-for-longer” era.

Asset class volatilities can vary greatly

Against this new and unfamiliar backdrop, questions about how, where and when to invest can seem even more daunting. It is likely that there will both new opportunities and new risks.

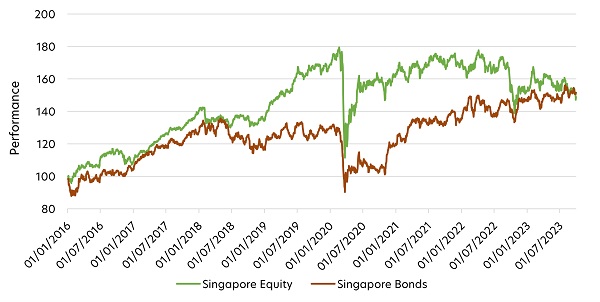

In such uncertain markets, diversification is all the more important and Singapore, as a sophisticated financial hub with a wide range of investment opportunities, is ideally suited for diversification strategies. Figure 1 shows how Singapore equity returns and volatility differs from that of Singapore bonds.

Figure 1: SG Equity vs SG bond performance (Jan 2016 – Sept 2023)

Source: Bloomberg/UOBAM. Singapore equities: STI Index, Singapore Bonds: TRSGG Index

Not just a random mix of asset classes

Diversification is important not only because it is unwise to put all your eggs in one basket. It is also possible to stabilise portfolio returns by diversifying your portfolio across different asset classes and sectors, especially those that have a low or negative correlation to each other.

Importantly, a portfolio of highly-correlated asset classes, say US and Europe equities, has limited diversification benefits because the two sectors tend to react to events by moving in the same direction and to a similar extent.

On the other hand, portfolios that contain low correlation assets stand to enjoy higher diversification benefits. This is because there is a weak relationship between the price movements of the assets in the portfolio, which can help to ensure a steady stream of returns regardless of the environment.

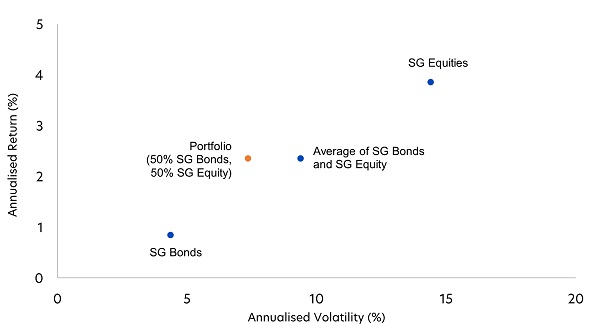

For example, Figure 2 demonstrates how it is possible to achieve a lower level of volatility for the same level of returns, by combining just two asset classes: Singapore equities and Singapore bonds.

Over a five year period, a portfolio of 50 percent Singapore equities and 50 percent Singapore bonds delivers the same returns as an average (i.e. midpoint) of the two asset classes. However, its volatility is about a fifth lower than the average. This is due to the fact that when Singapore equity prices fall, Singapore bond prices tend to rise and vice versa, thereby ensuring that the portfolio is less vulnerable to extreme price movements.

Figure 2: Annualised returns and volatility for Singapore equities + bonds portfolio

(Oct 2018 – Sept 2023)

Source: Bloomberg/UOBAM. Singapore equities: STI Index, Singapore Bonds: TRSGG Index

This means that to diversify effectively, investors have to ensure not just a mix of several asset classes, but an optimal mix of asset classes. Beside just bonds and equities, well-diversified portfolios tend to include other asset classes such as commodities and real estate. These are all driven by different factors and therefore tend to be less correlated.

Does dynamic asset allocation work?

Having achieved diversification via a portfolio of less-correlated assets, can the portfolio be dynamically rebalanced? If so, this would be a powerful combination of optimal diversification to help reduce portfolio risk, and dynamic rebalancing to help enhance returns.

However it can be difficult to formulate strong convictions based on short term information. As a result, many investors choose to review their portfolio allocations only annually or semi-annually.

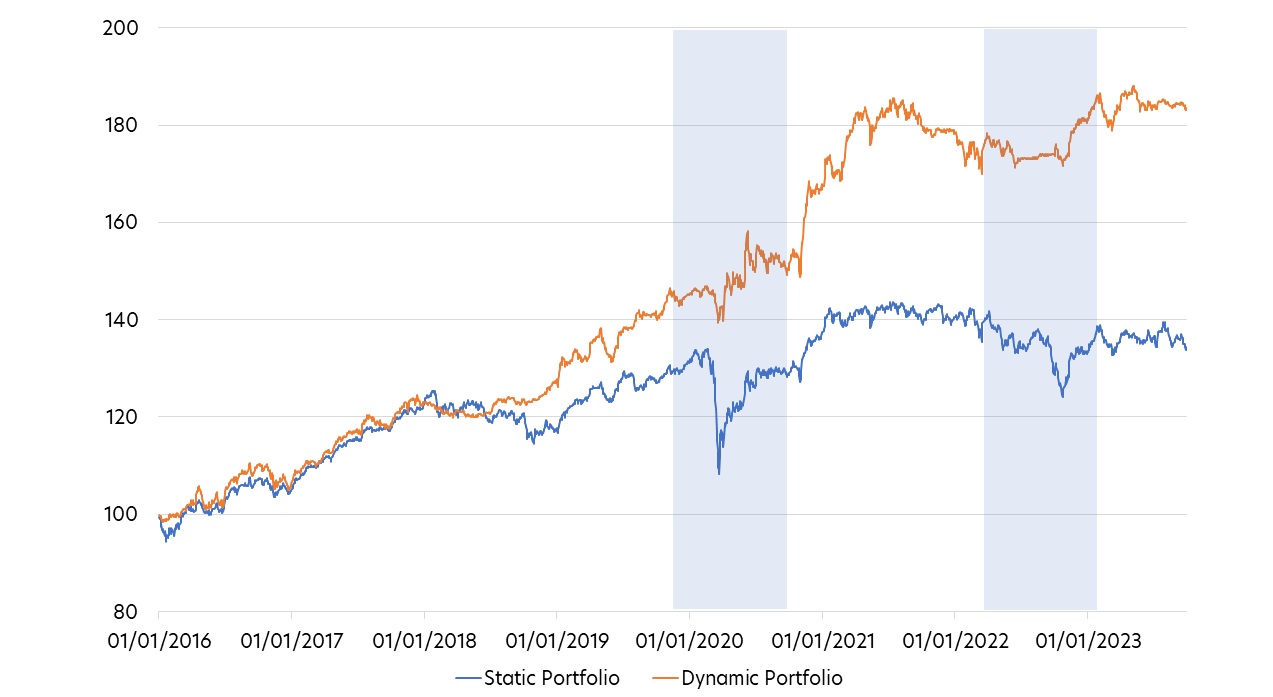

To test this potential, the UOBAM team looked at the performance of two portfolios investing in the same five asset classes: Singapore equities, Singapore REITs (real estate investment trusts), Singapore bonds, Singapore money market instruments and Asia equities:

- One portfolio was static and equally weighted across all asset classes.

- The other was rebalanced quarterly, based on insights derived from an AI (artificial intelligence) model.

The results, as shown below, demonstrated that it was possible to achieve higher returns using a dynamic asset allocation approach. The dynamic portfolio also showed less volatility, especially during major events such as the Covid pandemic, Russia invasion, and start of interest rate hikes.

Figure 3: Static versus dynamic portfolio performance (Jan 2016 – Sept 2023)

Source: UOBAM. Static Portfolio: 20% SG Money market (UNSMMZS SP index) 20% SG bonds (TRSGG Index), 20% SG REITS (FSTREI Index), 20% SG Equities (STI Index), 20% Asia Equities (NDUECAXJ Index). Dynamic Portfolio: Same as asset classes as Static Portfolio, rebalanced quarterly

Benefits but also challenges

As the world comes to terms with a higher-for-longer interest rate regime, diversification is key, even if portfolios are largely static. As the investment mantra goes, “time in the market is more important than timing the market”.

However, dynamic asset allocation strategies have the potential to deliver even greater value, assuming an accurate way of detecting short term market trends and patterns. Advances in AI-based investment analytics offer a way to make this a reality.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z