This is part two of our Singapore series accompanying the launch of our United SG Dynamic Income Fund. In this article, we look at the appeal of the Singapore bond sector, but also why investors may want to reduce their holdings if the economy starts to recover next year.

A tough year so far

Singapore and the rest of the world is transitioning from an era of low interest rates to one where rates and inflation are likely to remain high, perhaps for years to come.

This has dampened global growth but contrary to expectations, most economies have so far avoided a recession. The International Monetary Fund (IMF) is expecting the world economy to average about 3.0 percent growth in 2023, slightly down from 3.5 percent in 20221, but still in positive territory.

Singapore too has managed to avoid a recession, but only just. This year, global trade, on which the Singapore economy is highly dependent, has been dampened by high borrowing costs, persistent core inflation and geopolitical concerns. As a result, Singapore’s GDP in 2023 is set to reach just 1.0 percent, according to the IMF’s October report.

Strong demand for bond-generated income

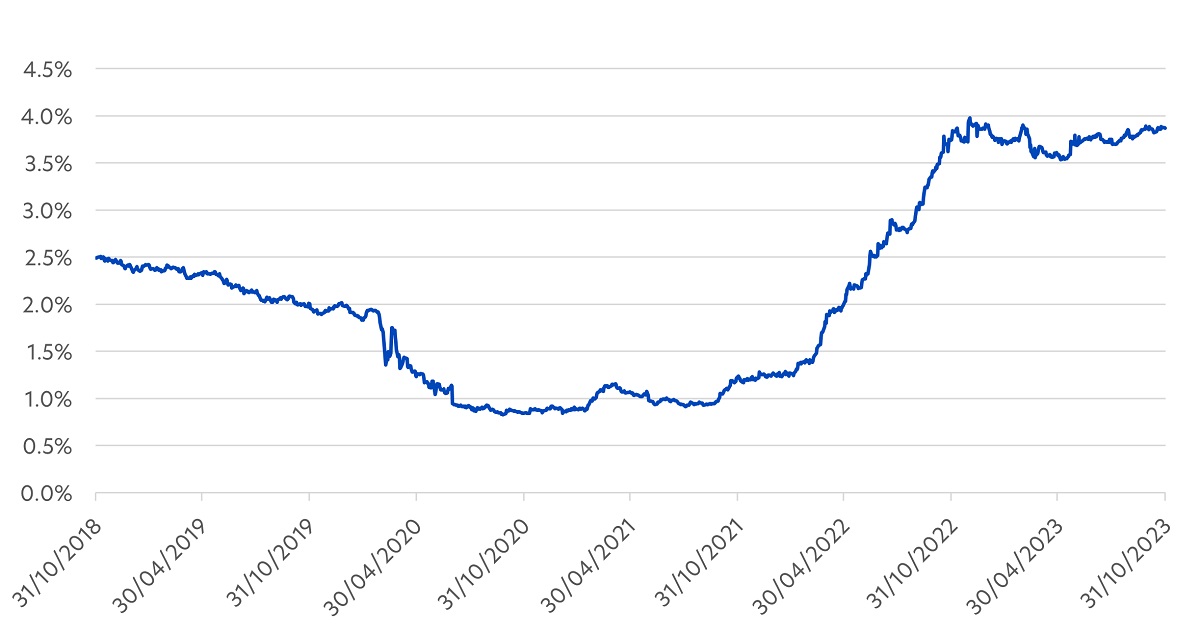

Given these economic headwinds, it is not surprising that many investors are flocking to Singapore government and corporate bonds. Singapore bond yields are at a multi-decade high, with Singapore 10-year bond yields currently at around 3.2 percent, a level not seen since September 2008.

Figure 1: Singapore bond yields, Oct 2018 – Oct 2023

Source: S&P. Based on yield to maturity of the S&P Singapore Bond Index, as of 31 Oct 2023

This means Singapore bonds are offering investors the opportunity to counter inflation, which is projected to be around 4.0 percent for 2023 as a whole. Higher inflation is eroding Singaporeans’ standard of living, with real median incomes assessed to have fallen by 4.5 percent in the first half of 2023, compared to the same time last year. So the demand for bonds as an additional source of income is set to stay strong.

Bond prices are well supported

At the same time, the technical backdrop for Singapore bonds is supportive given that current demand is expected to exceed supply. With the issuance of 30-year Singapore Government Securities (SGS) in September, the Singapore bond auction calendar has now closed.

Meanwhile, Singapore corporate bond issuances have been relatively muted since the start of the year. New issues continued to slow in October, with only S$1.2 billion new corporate bonds entering the market, compared to S$1.9 billion in September. This restricted supply, plus halt in policy rate rises, provides further upside potential for Singapore bond prices.

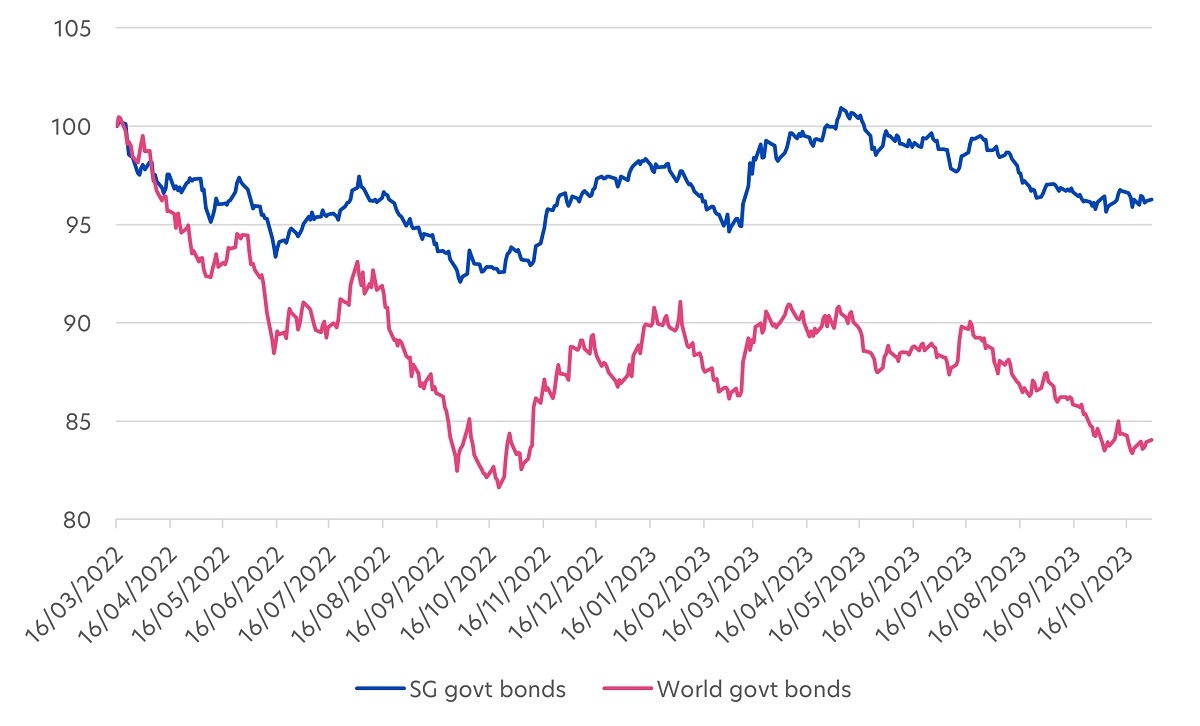

Resilience in a sea of volatility

Another reason for the strong demand for Singapore bonds is its quality. Singapore government bonds’ highest possible triple-A sovereign credit rating has allowed prices to be significantly less volatile than global government bonds. Since the US Fed started its rate hiking cycle in March 2022, Singapore government bonds have declined by 3.74 percent, compared to the 15.97 percent fall for global government bonds.2

Figure 2: Singapore vs World government bonds, March 2022 – Oct 2023

Source: Bloomberg, as of 31 Oct, Singapore government bonds (FTSE Singapore Govt Bond Index), World government bonds (FTSE World Govt Bond Index)

Similarly, Singapore’s local-currency corporate bonds are issued largely by statutory boards, financial institutions, and blue-chip companies. These entities tend to have strong credit fundamentals and lower default risk, making Singapore corporate bonds a relatively stable asset class.

Figure 3: Top 10 issuers of Singapore corporate bonds in 2022

| Issuer | Industry type |

| Housing & Development Board | Real estate |

| Singapore Airlines | Transportation |

| Land Transport Authority | Transportation |

| Temasek Financial | Finance |

| CapitaLand | Real estate |

| United Overseas Bank | Banking |

| Sembcorp Industries | Diversified |

| Frasers Property | Real estate |

| Mapletree Treasury Services | Finance |

| DBS Bank | Banking |

Source: AsianBondsOnline, as of 31 December 2022

Bonds have returns limitations

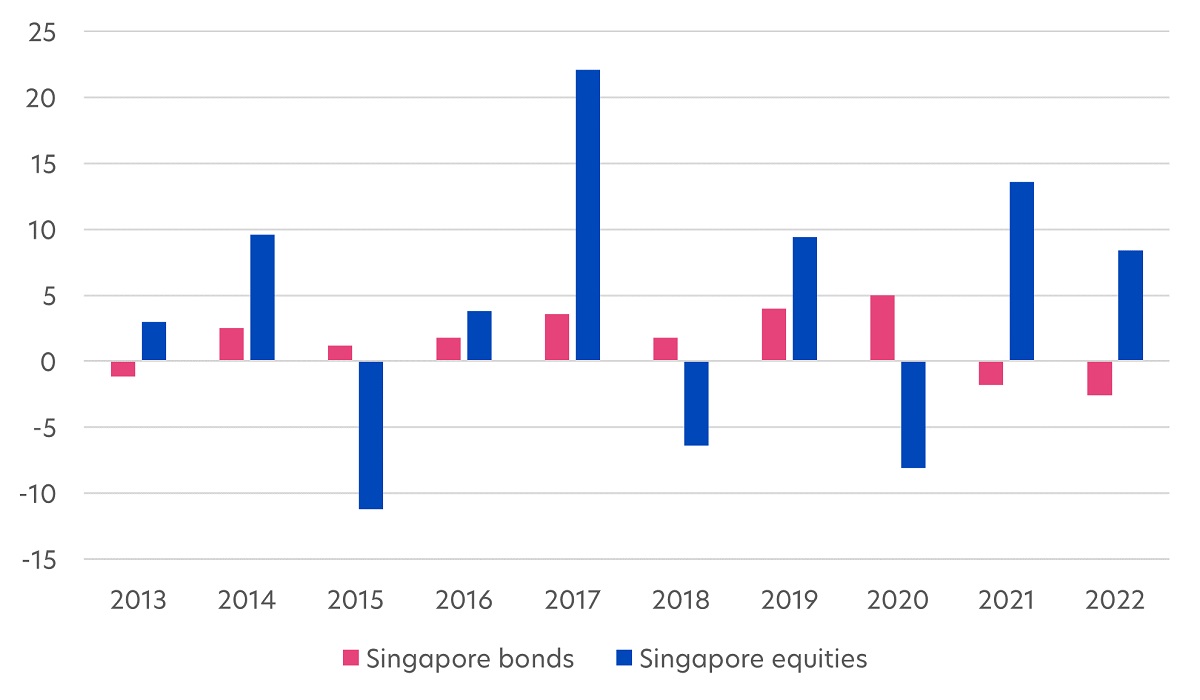

Ultimately, it is useful to think of bonds and equities as playing different roles in an investor’s portfolio. Bonds help to generate income and reduce overall portfolio risk. For example, the 5-year volatility for Singapore bonds stands at just 4 percent, compared to 14 percent for Singapore equities3.

Meanwhile, equities help to boost portfolio returns over the long term. As shown in Figure 4 below, in good years, Singapore equity returns far exceed that of bonds. As a result, looking back over the past 10 years, Singapore equities have returned 3.4 percent per annum, double that of a bond-only portfolio4.

Figure 4: Total returns of Singapore bonds and Singapore equities (%), 2013 - 2022

Source: Respective index providers (Singapore bonds: S&P Singapore Bond Index, Singapore equities: FTSE Straits Times Index), as of 31 October 2023

In addition, Singapore bonds tend to be negatively correlated to Singapore equities, that is, when one goes up, the other goes down. In seven out of the past ten years, Singapore bonds moved in the opposite direction to Singapore equities.

Why dynamic asset allocation?

With a new year fast approaching, UOBAM expects Singapore’s economic growth to gradually improve, although this may not be evident till the second half of 2024. This will likely be driven by US interest rate cuts next year, but also good recovery in Singapore's services and travel-related industries.

Given this, we would expect the Singapore stock market to show an uplift next year, and for investors to diversify away from lower-risk asset classes into higher-risk asset classes. However, it is hard to strike the right balance between the two, especially when markets and macro-economic conditions are fast-moving.

A dynamic asset allocation strategy involves making regular and active adjustments to asset class weights to take advantage of opportunities as they arise. This means taking a more defensive positioning in Singapore bonds when near-term uncertainties increase, and resuming a growth stance in Singapore equities when uncertainties subside.

1Source: IMF, World Economic Outlook

2Source: Bloomberg, as of 31 Oct, FTSE Singapore government bonds and FTSE World government bonds

3Source: Bloomberg, from Sep 2018 to Sep 2023

4Source: Respective index providers (Singapore bonds: S&P Singapore Bond Index, Singapore equities: FTSE Straits Times Index), as of 31 October 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z