- US inflation data threatens hopes of at least two US rate cuts this year

- In contrast, Europe looks close to cutting rates in June

- These trends suggest the USD could strengthen this quarter

Hopes dashed of lower US inflation

After falling steadily last year, US inflation in 2024 has been rather sticky. To strengthen the case for a rate cut in June, markets had been hoping that March would see a return of the downward trend. So when the March Consumer Price Index (CPI) numbers released last week showed a slight uptick compared to February (3.5 vs 3.2 percent, year-on-year) and against expectations (3.5 vs 3.4 percent, year-on-year), investors were sorely disappointed.

The increases were driven by higher rental costs and gasoline prices. However, it wasn’t all bad news – supermarket food prices remained unchanged and motor vehicle prices fell, resulting in a price deflation for goods overall. The Producer Price Index (PPI), which tracks wholesale prices, also increased more moderately than expected in March.

Strong US economy causing rate cut uncertainty

Despite inflation still some way from the US Fed’s inflation target of 2.0 percent, the likelihood of a US economic downturn is diminishing. To the contrary, the US’s buoyant labour market points to economic strength. Nonfarm payrolls increased by over 300,000 in March, the biggest gain in more than a year. Average hourly earnings were also up 4.1 percent year-on-year. This has led the Fed to raise its 2024 US GDP forecast to 2.1 percent.

Given the health of the economy, the Fed is likely to take its time easing rates, and most economists now seem to be dismissing the prospect of a June rate cut. In contrast to widespread early-year expectations of three or four cuts in 2024, UOBAM suggested that two or three cuts were more likely. Today the consensus is for one or two cuts, while UOBAM economists warn that it is possible for the Fed to shy away from any rate cuts at all this year.

Interest rates out of synch globally

Meanwhile, Europe is on a different trajectory. Europe’s post-Covid recovery is considerably weaker than the US’s, with the European Commission recently revising down the EU’s 2024 GDP to just 0.9 percent. EU inflation is also falling steadily and is expected to average 3.0 percent this year. So despite holding rates firm last week, it is perhaps unsurprising that the European Central Bank has signaled the strong possibility of a June start to their rate cut cycle.

China too is under pressure to cut its benchmark lending rates in order to boost its flagging economy and meet its 5.0 percent GDP growth target. However, last month, as expected, the PBOC, China’s central bank, left its one-year loan prime rate (LPR) unchanged at 3.45 percent, and its five-year LPR unchanged at 3.95 percent. That said, PBOC officials continue to assure markets that further monetary easing has not been ruled out.

Over in Japan, for the first time in 17 years, interest rates were hiked from negative to zero in March this year. Economists are expecting the rate hikes to continue but sluggish consumption and factory output is causing concern that any hikes may be delayed. Despite the rate rise, the yen has sunk to a 30-year low against the USD.

USD is gaining and likely to stay strong

Given these developments, we are expecting the USD to trade stronger this coming quarter. The unsupportive interest rate trends in major economies, coupled with the delay in US interest rate cuts suggest that there is room for the USD to break out of its current trading range. The DXY index, a measure of the USD’s value relative to a basket of trading partner currencies, has been ranging between 102 and 104 since the start of the year, but hit 105 last week. On Monday, news of drones and missiles launched at Israel by Iran caused the USD - seen as a safe-haven currency - to move up further.

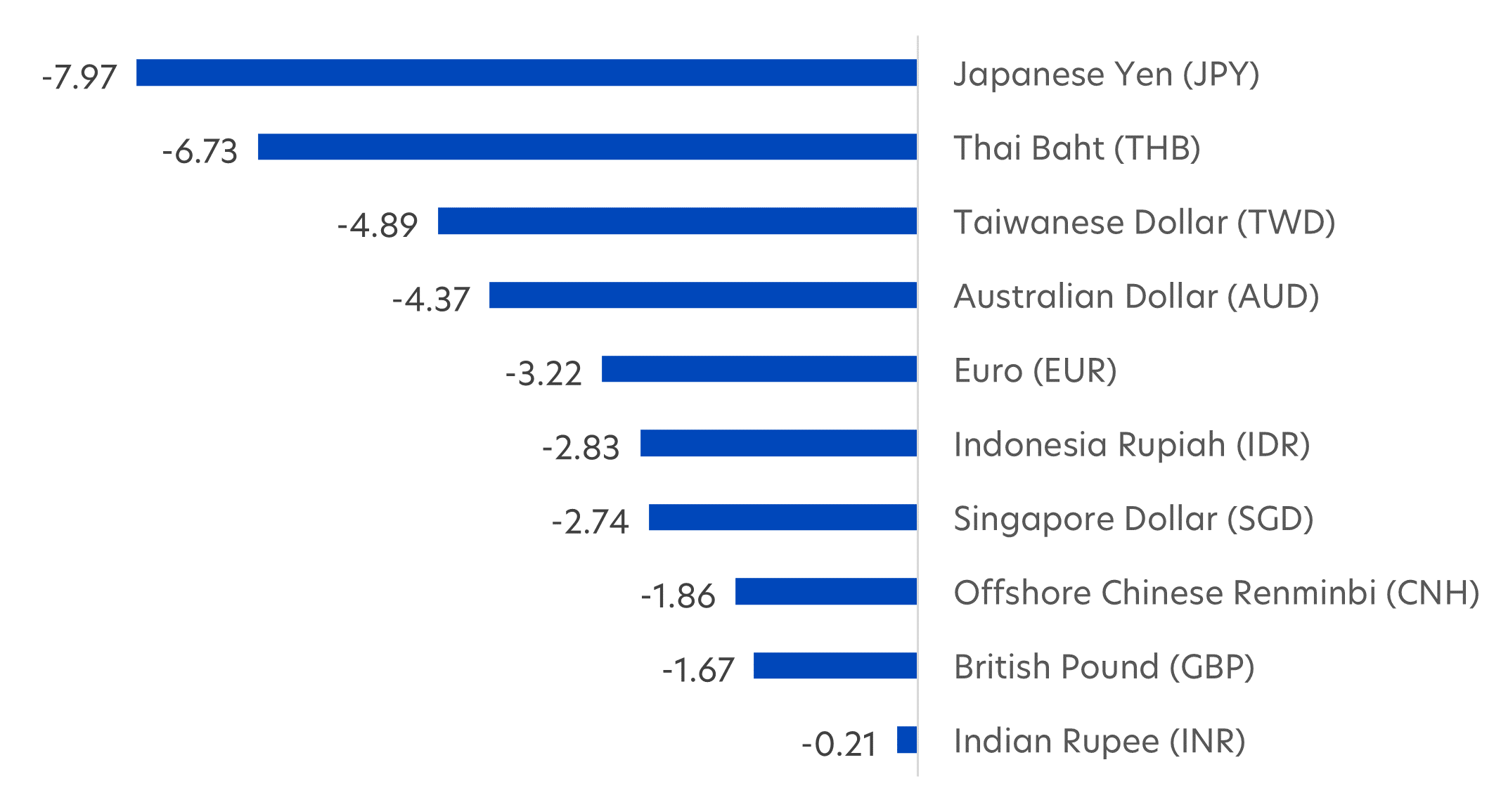

Here are recent USD gains against a wide range of Asian and European currencies.

Fig 1: Spot returns (%) of select currencies against USD (29 Dec 2023 – 12 April 2024)

Source: Bloomberg/ UOBAM

This bodes well for global equity investments denominated in USD. The 1Q 2024 reporting season is expected to see S&P 500 companies report earnings growth of above 3.0 percent year-on-year, making this the third straight quarter of growth. Coupled with the US’s positive economic story and strong currency, global investors look likely to continue to seek out US stocks, despite record highs. This in turn will lend further support to the USD.

| If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider: United Global Quality Growth Fund United Global Durable Equities Fund You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.