*Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus. Past performance is not necessarily indicative of future performance.

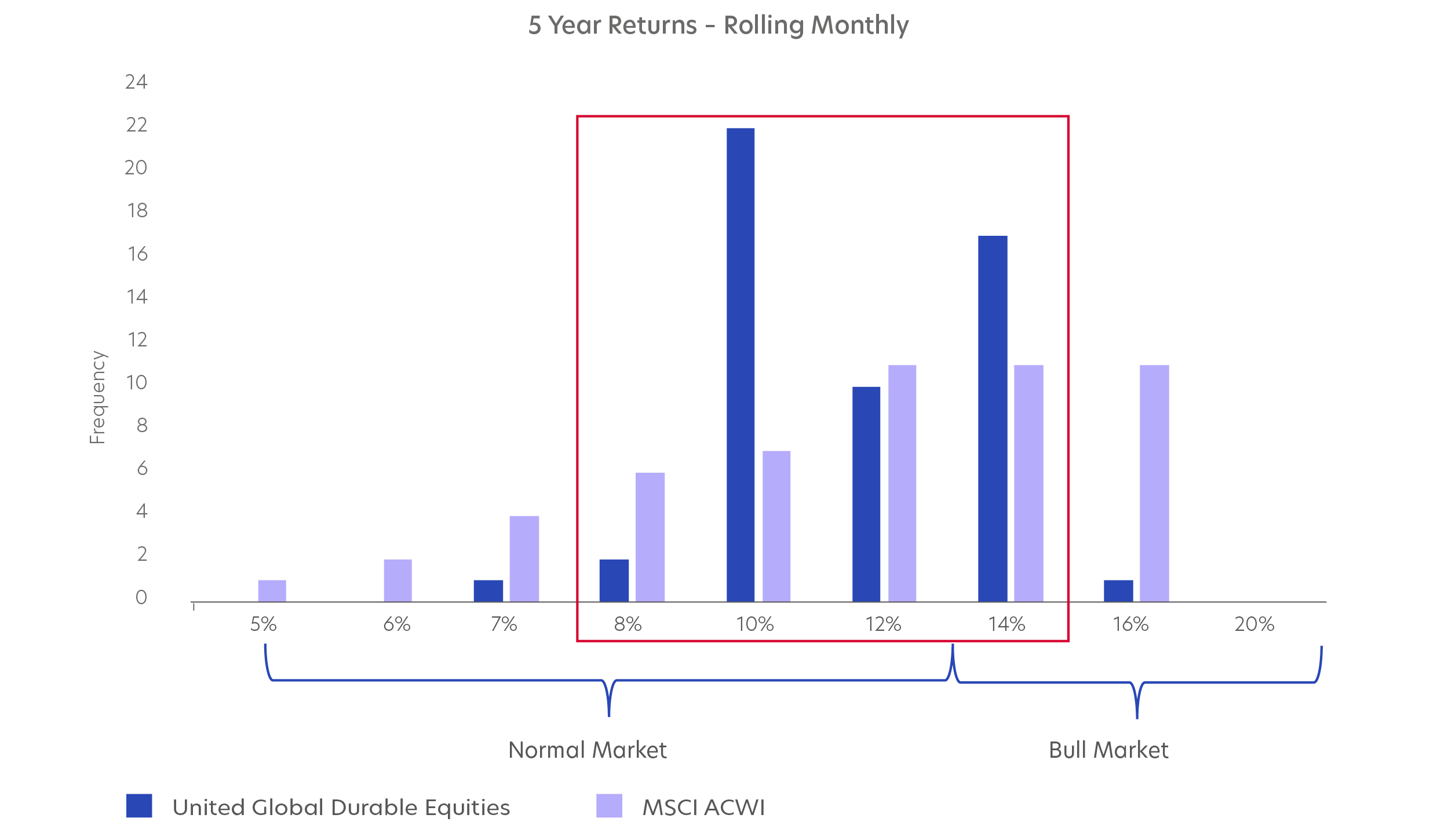

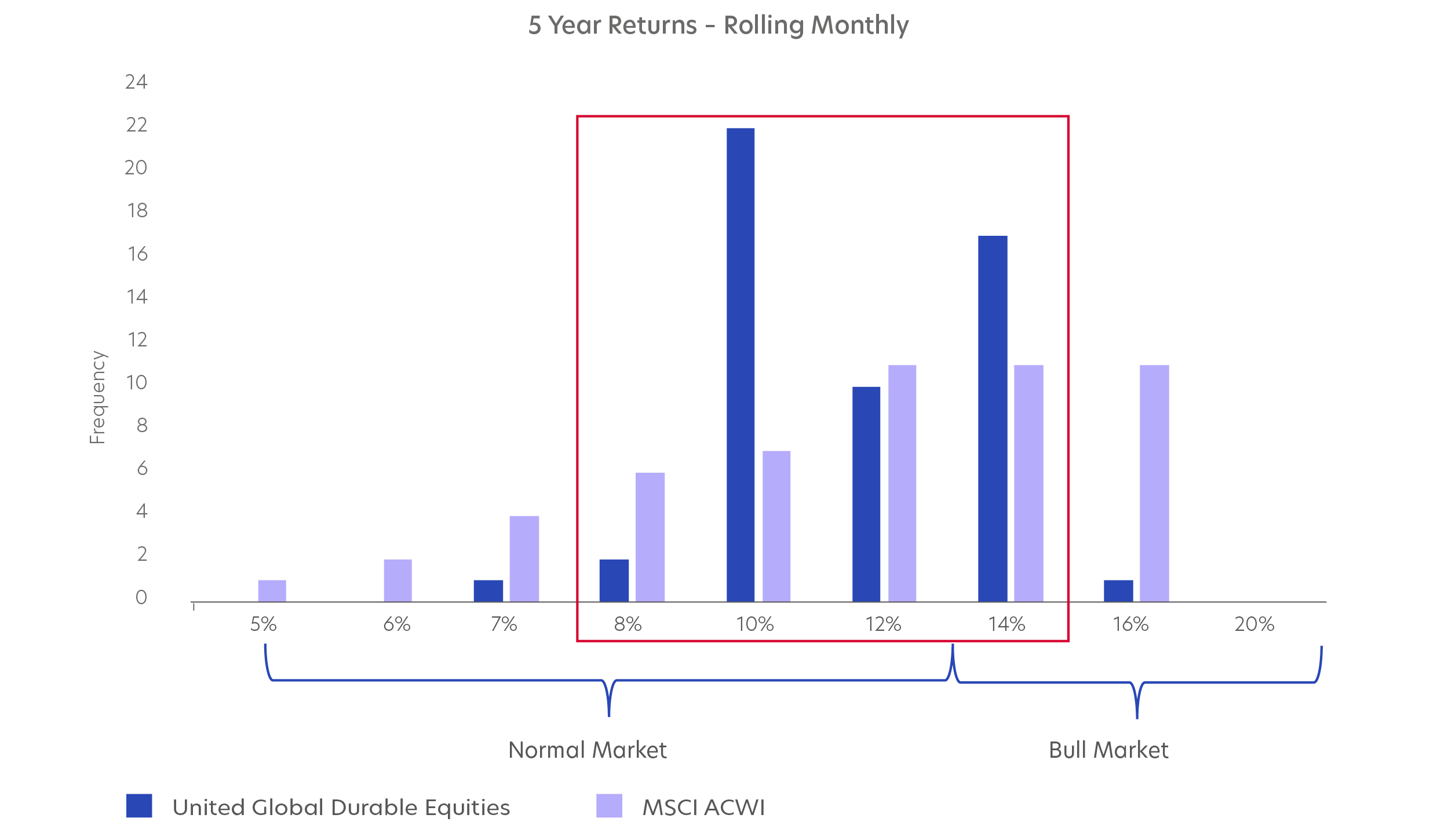

Proven stable and consistent returns

The Fund has delivered returns within the 8% to 14% range for 96% of the time, compared with just 66% for the MSCI All Country World Index (ACWI), highlighting the Fund's lower return volatility and more stable performance profile, offering investors a more predictable investment experience.

Source: MSCI, Wellington Management, UOBAM, July 2025. Benchmark used in the calculation of the chart: MSCI All Country World. Sums may not total due to rounding. Performance returns for periods one year or less are not annualised. Gross returns of the composite used in the calculation of the chart. Past performance is not necessarily indicative of future performance.

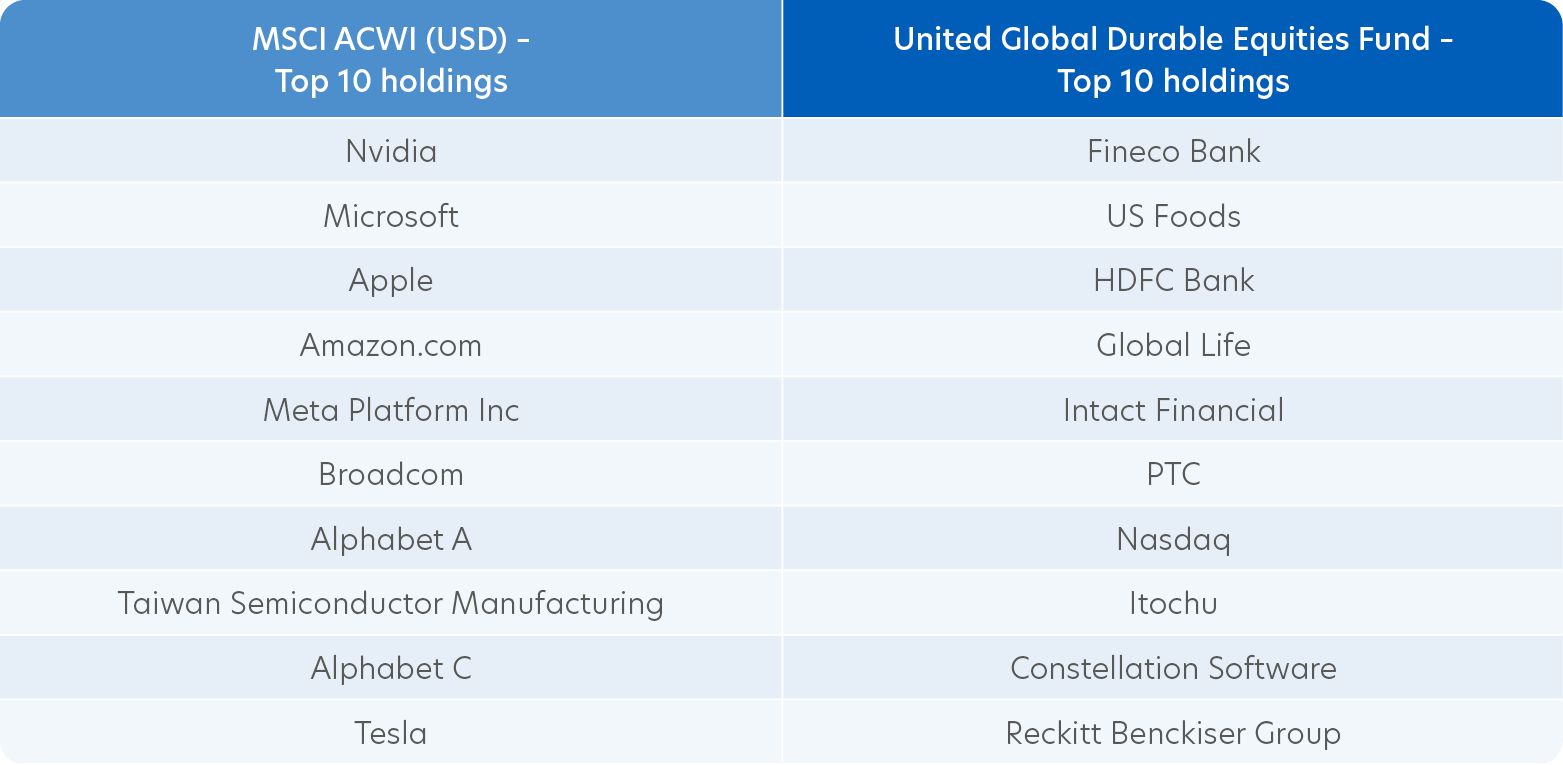

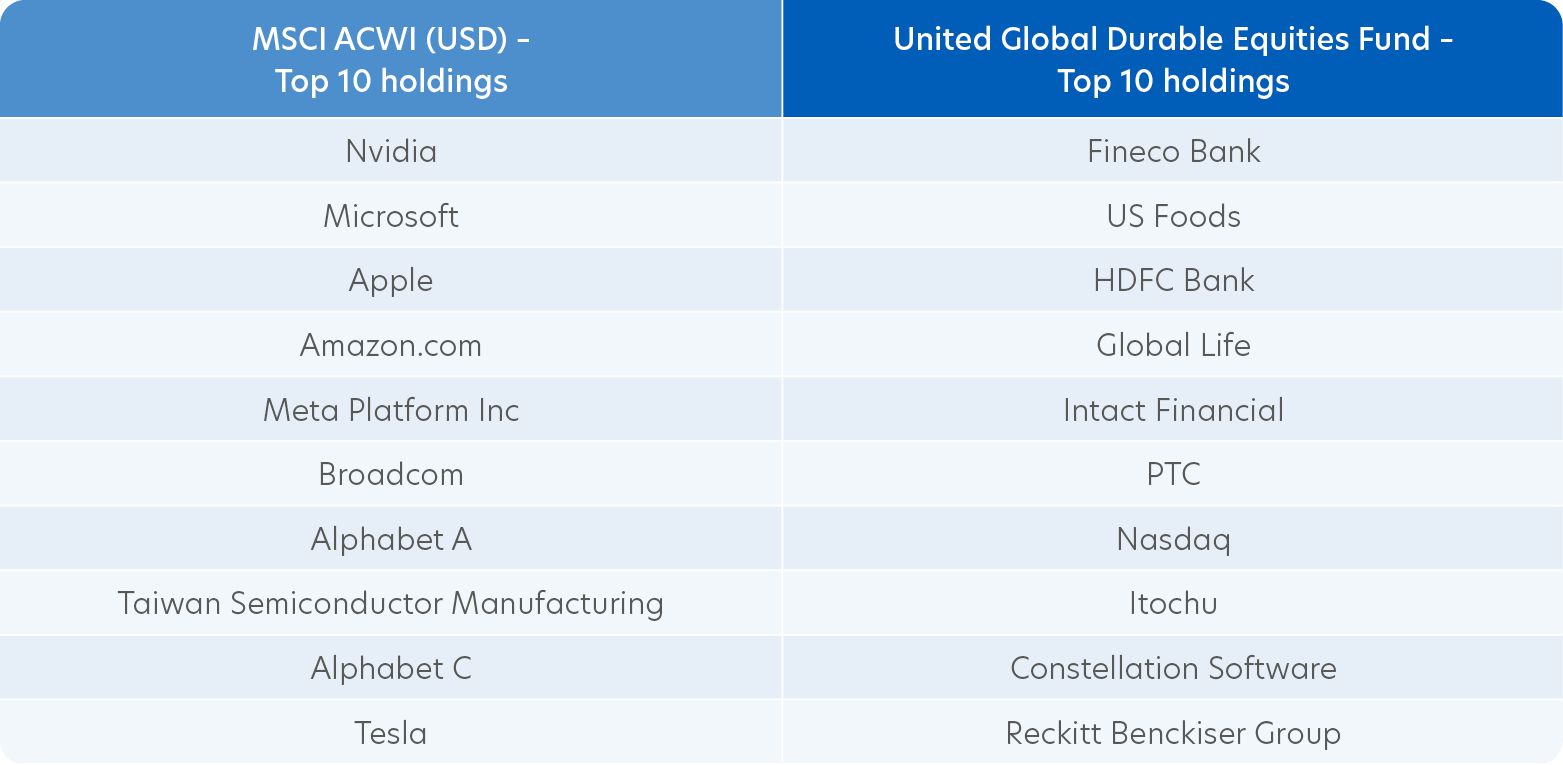

Meaningful diversification

Low overlap with traditional growth, value, or quality funds provides good diversification to existing global equity allocations. This positioning can help investors capture opportunities often overlooked by conventional approaches.

Source: UOBAM, Wellington Management, MSCI as of 31 July 2025.

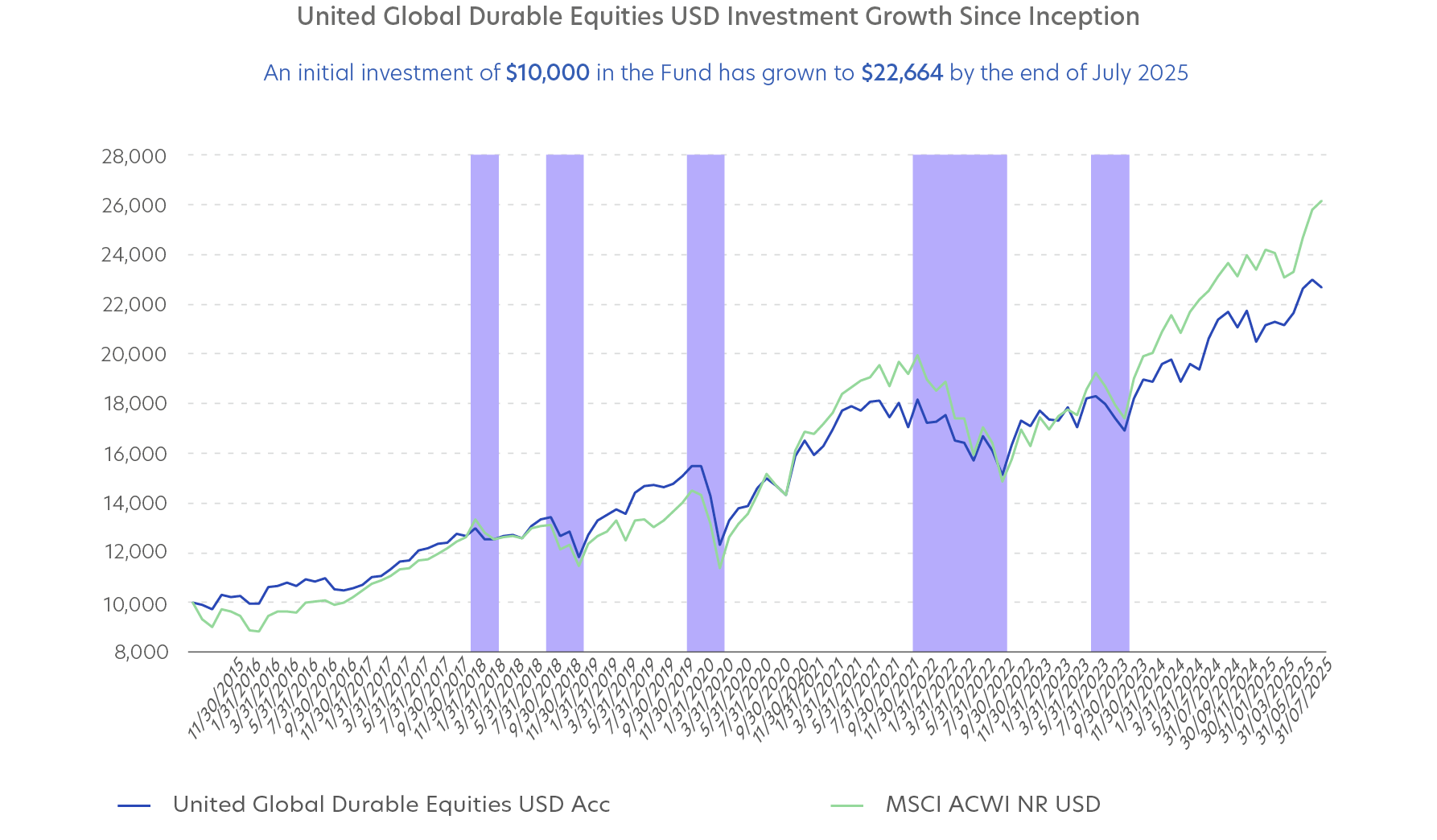

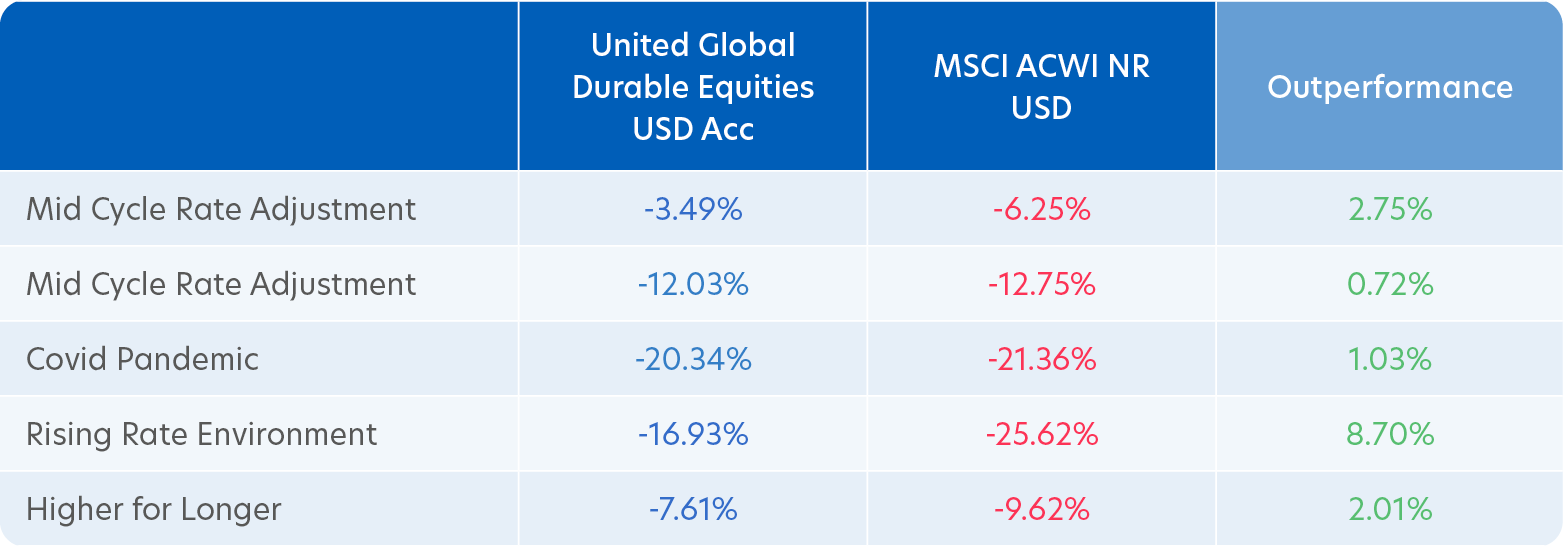

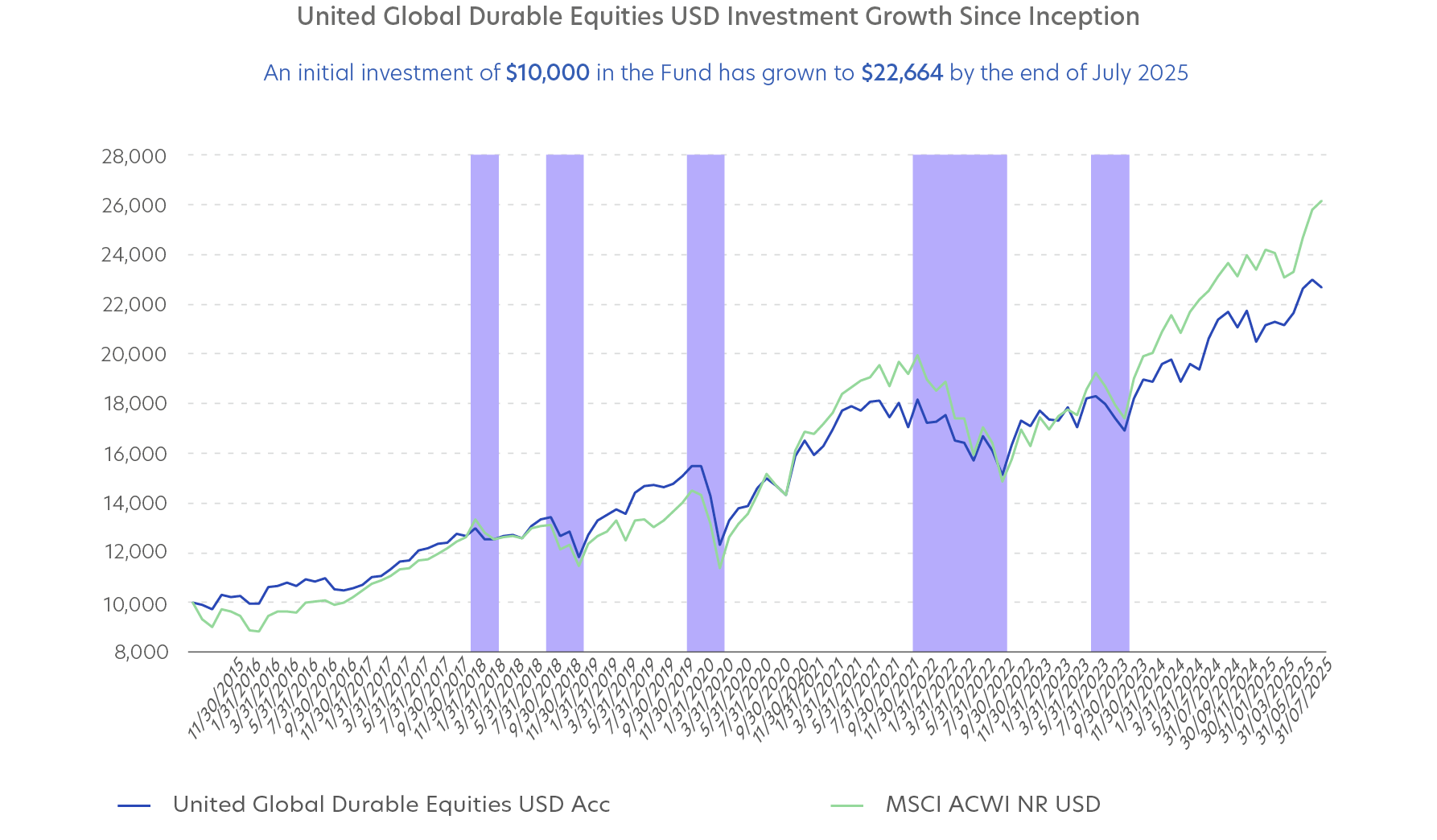

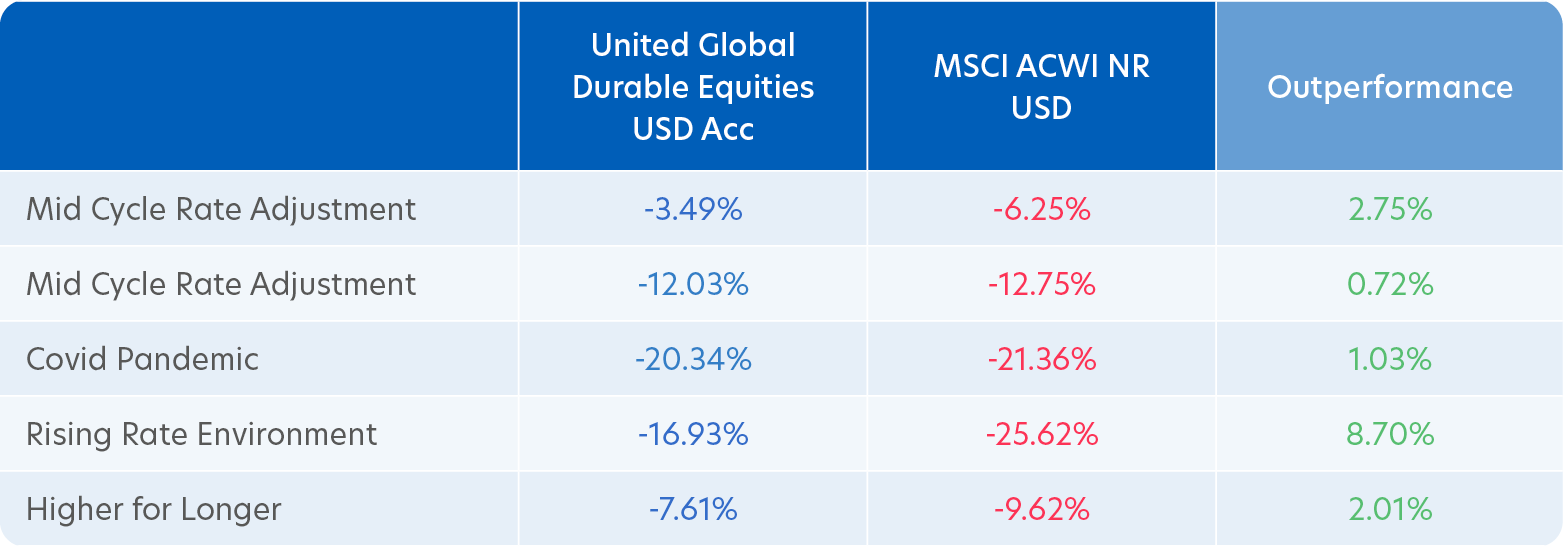

Winning by not losing

The Fund aims to invest in durable companies with stable earnings, consistent business models, and reasonable valuations, with the aim of minimising drawdowns and driving long-term compounding.

Source: Wellington Management, UOBAM, July 2025. Inception date: 10 Aug 2015. Sums may not total due to rounding. Performance returns for periods one year or less are not annualized. The past performance of the scheme is not necessarily indicative of the future performance of the scheme.

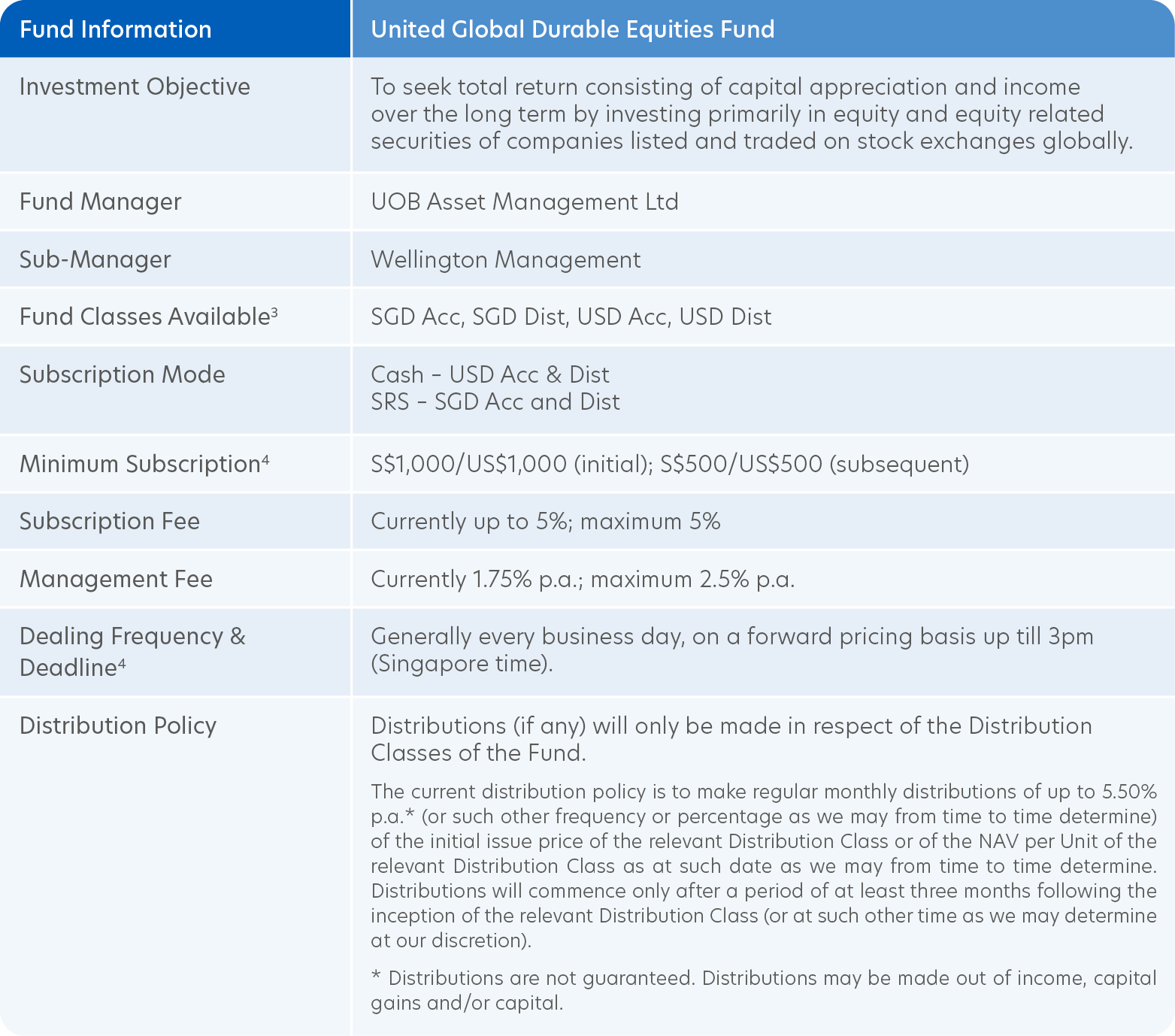

Fund returns

The Fund has delivered solid returns across multiple timeframes. Over the past three years, it has outperformed peers while maintaining lower volatility.

Source: Morningstar, as of 31 July 2025. Refers to United Global Durable Equities Fund – Class SGD Dist. Fund performance is calculated on a NAV to NAV basis. Past performance is not necessarily indicative of future performance. Peers category (Morningstar): Global Flex-Cap Equity. Does not include the effect of the current subscription fee that is charged, which an investor might or might not pay.

Attractive income

The Fund offers an annualised dividend yield of 5.5% per annum, with distributions made on a monthly basis (Class A SGD Dist)2.