The following paper is contributed by Wellington Management, the sub-manager of the United Global Durable Equities Fund. All views expressed are based on available information as of the date of publication.

The United Global Durable Equities Fund is based on the Wellington Durable Enterprises Strategy (the "Strategy”). The Strategy is a global equity approach managed with an absolute return mindset. The Strategy seeks a total return by investing in companies that are more stable than market perceives.

Why Durable Enterprises?

Durable enterprises are companies that could generate resilient earnings, irrespective of the broader economic environment. Wellington believes that stable companies have the potential to outperform with less risk overtime, especially when the market underappreciates their reliable qualities.

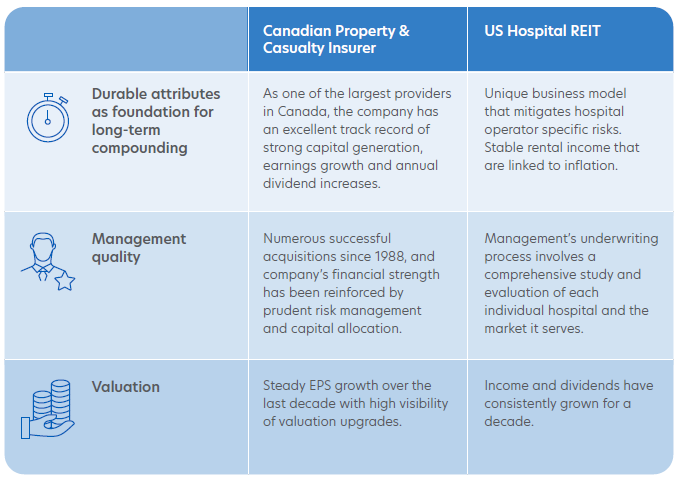

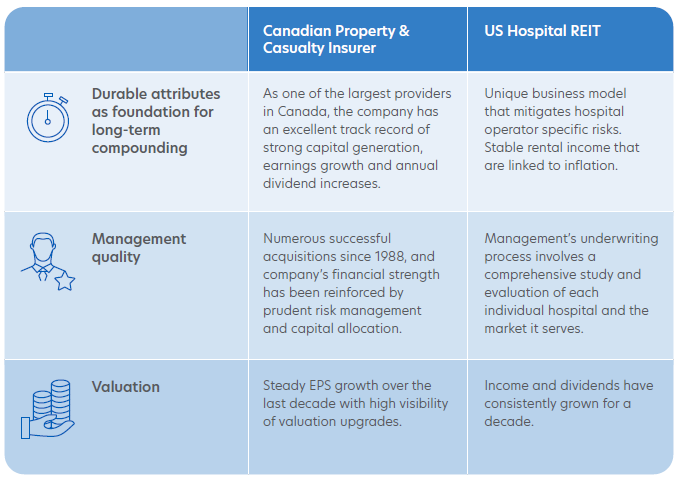

The Strategy is focused on owning a set of businesses that possess three key characteristics:

- Stable and resilient earnings that provide a foundation for long-term compounding

- A moderate valuation

- Businesses with excellent management skills that have the capacity to enhance the probability of long-term success and ultimately shareholder value

Stable and resilient earnings

Wellington defines stability as a profit base that is unlikely to decline, and the creation of value through prudent use of capital. In general, industries with steady competitive dynamics, limited economic sensitivity, and long product cycles are conducive to stability. Businesses within these industries may potentially deliver consistent profits through good management practices such as cost control and skilled execution.

Moderate Valuation

Central to Wellington’s philosophy is the belief that stability is not always reflected in the valuation of a stock. The Strategy looks at companies whose profile might not fit into traditional growth, quality, or value buckets. They normally have single-digit organic growth and are rarely in distress or out of favour. As a result, these companies often fail to attract the attention of style-focused institutional investors and may trade at lower valuations than we believe their stability merits.

Businesses with excellent management skill

Within the universe of unconventional durable companies, Wellington looks for management teams that are likely to create long-term shareholder value through prudent capital allocation. Thoughtful allocations of capital have the capacity to translate a stable profit base into attractive long-term growth in earnings and/or dividends per share.

How is Durable Enterprises different?

To illustrate the durability and resilience of the businesses they own within Durable Enterprises, below Wellington shares two examples of unique companies with excellent management teams driving stable earnings growth and shareholder return in the face of uncertainty.

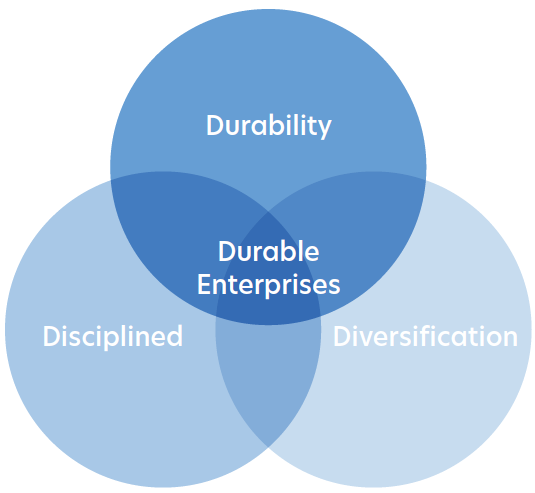

What are the key features of Durable Enterprises?

The idea of this portfolio came about when the portfolio manager, thought about how he would manage his mother’s retirement portfolio.

He envisioned a “sleep-at-night” portfolio that embodies these three points:

- Durability: The strategy is focused on companies that have proven to be resilient in the face of uncertainty.

- Disciplined: The strategy's buy/sell discipline aims to ensure that we are well-positioned to achieve the potential desired outcome through a market cycle.

- Diversification: The investment process leads to a portfolio of durable companies that may potentially provide meaningful diversification relative to more traditional global equity allocations.

Why Durable Enterprises now?

Equity investors tend to consider high returns and downside mitigation to be mutually exclusive. The pursuit of high returns often drives investors towards growth or value disciplines, both of which can be volatile. The quest for downside mitigation often leads investors to blue chips, which have historically had less volatility but also less upside optionality in strong economic or market environments.

Looking ahead, Wellington believes we are in an environment of higher structural inflation, higher interest rates, shorter cycles, increasing geopolitical risk, and elevated uncertainty and hence higher volatility. In turn, Wellington believes these factors will lead to greater volatility in the earnings streams of companies, due to the unpredictability of input prices and more variability in economic and business cycles.

With this as the backdrop, it is reasonable to conclude that investors will develop a greater appreciation for stability and consistency in earnings over the coming years. In particular, earnings that prove to be resilient, irrespective of the broader economic environment. We see investors gravitating to less “exciting” businesses that are well run and businesses that can compound their earnings consistently through prudent capital allocation.

Wellington’s research indicates that attractive long-term risk-adjusted returns are possible if management allocates capital wisely and valuation multiples do not compress. Given the comparatively low level of business risk facing many stable companies, they believe their stocks offer a compelling risk/return profile.

The low overlap of characteristics with growth, value, or traditional high-quality equities also means that a portfolio of unconventional stable companies may provide diversification relative to more traditional allocations.

Download PDF