Finding a suitable investment style can help you better align to your investment objectives

Growth, value, and quality investment styles are often pitted against each other, but all three are valid, depending on your ability to withstand volatility and time horizon. So how do they differ, and which strategy suits you best?

Growth investing

Growth companies are typically ones that:

- are expected to grow at a higher rate than the market

- can deliver better-than-average growth in sales or earnings

- tend to reinvest most or all of their earnings to drive higher growth. As such, they typically pay little or no dividends.

As a result, growth stocks have higher valuations for their stocks and above-average price-to-earnings (P/E) ratios, given the strong potential for future growth.

Attracted by the upward momentum of growth stocks, their prices can soar especially as more and more investors pile into them. But notably, the trend can quickly reverse if growth expectations are not met.

As such, growth stocks may be more suitable for investors looking for higher returns in a relatively short period of time, and who can stomach higher risks.

Value investing

Value companies are typically ones that:

- are larger and more well-established

- able to show strong long-term fundamentals, but may be temporarily out of favour

- have less need for capital to drive growth, and therefore are more likely to use their profits to issue dividends to investors

The hope is that value stocks are under-priced given their fundamentals but will eventually be worth more. This means that investors often look for stocks with a low P/E ratio.

Sometimes however, there is a reason for the low valuation, such as stagnant earnings or poor company management. Value investors therefore risk falling into such “value traps”, that is, buying cheap stocks that may not appreciate as expected.

That said, value stocks are generally less volatile compared to growth stocks. Given their promise of higher dividends, they tend to attract conservative investors seeking income and modest capital appreciation.

Quality investing

Quality companies are typically ones that:

- have consistent earnings growth and stable profits

- have high financial productivity, that is, it tends to reinvest its cash flows back into the business to defend and grow its competitive advantage

- have competitive advantage(s) that enable it to maintain its market-leading position and pricing power

Since quality companies tend to perform well across different market environments, they are suitable for investors seeking stable consistent returns no matter the investing climate.

Comparison of investment styles

| Growth stocks | Value stocks | Quality stocks | |

| Description | Fast-growing with the potential for high capital appreciation | Currently undervalued but potential for prices to rebound | Stocks of companies capable of sustainable and stable earnings |

| Valuation (P/E ratio) | Higher | Lower | Moderate relative to growth and value |

| Volatility | Higher than the broader market | Lower than the broader market | Lower than the broader market |

| Dividends | Low or none | Generally high | Average. Can grow over time |

| Sectors1 | Information Technology Consumer Discretionary Communication Services |

Financials Healthcare Industrials |

Usually found across sectors; top 3 largest sectors within the MSCI ACWI Quality Index are: Information Technology Healthcare Industrials |

Quality vs growth and value

Quality investing may be a less well-known investment style but it has come to the fore in recent years given the high market volatility. It also sits between growth and value investing and is therefore an attractive option for those who want to straddle these two extremes.

Although similar to growth investing, quality investing takes a more conservative approach by focusing on a company’s current profitability and cash generation. Growth investors on the other hand tend to prioritise revenue growth and the potential for future profits.

And although similar to value investing in that both styles seek companies with strong fundamentals, quality investing is less focused on the price of a company’s stock. Instead, this style is more concerned with quality characteristics such as financial productivity.

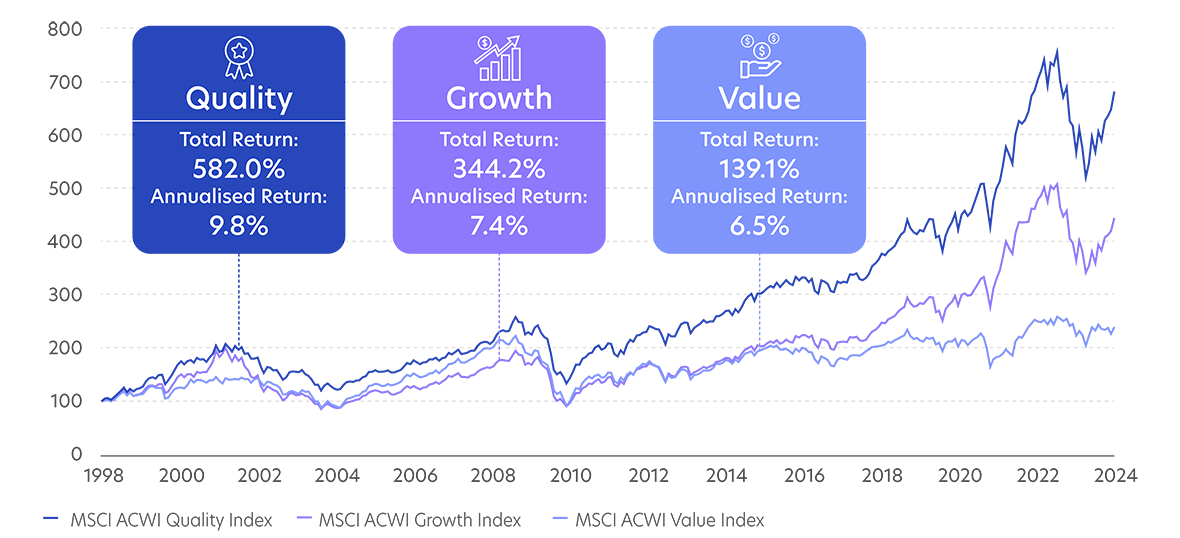

Performance comparisons

Historically, growth stocks tend to do well when interest rates are low and company earnings are rising.

But when rates rise, value stocks tend to shine as investors prioritise current earnings over future revenue growth.

But over the long term, quality has tended to outperform. Over the past decades, quality stocks have outperformed their growth and value peers through different market cycles and interest rate environments.

Fig 1: Quality vs value and growth indices, 1 January 1997 – 30 June 2023

Source: MSCI, Morningstar, as of 30 June 2023. MSCI ACWI Growth Index, MSCI ACWI Value Index, MSCI ACWI Quality Index

UOB Asset Management’s house view is that interest rates have peaked, but levels will likely stay high for an extended period. Given this, we think investing in equities is coming back into favour, but expect short term volatility to continue. Investors looking to re-enter the equities market may want to do so cautiously, with a focus on more defensive options.

1Based on the top 3 largest sector weights of the MSCI ACWI Growth Index, MSCI ACWI Value Index, and MSCI ACWI Quality Index, as of 31 July 2023

If you are interested in investment opportunities related to the theme covered in this article, here are two UOB Asset Management Funds to consider:

|

MSCI Data are exclusive property of MSCI. MSCI Data are provided "as is", MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z