Cash has offered good returns over the past two years given multi-year high interest rates. But with rate cuts expected soon, you will need to consider other options if you want to maintain these returns

Cash yields had moved sharply higher over the past two years, providing many investors with decent annual returns. But with interest rate cuts on the horizon for many markets, cash can no longer deliver the returns that depositors have become accustomed to.

Why is this and what are the options if you don’t want to settle for less?

1. Cash is facing renewal risk

As inflation continues to moderate, the US Fed is poised to cut interest rates this year. At UOBAM, we think core inflation trends will justify two rate cuts in 2024, though the timing of those cuts is yet uncertain.

This means cash rates are likely to drop in the coming months. When that happens, cash investors would have to rollover their capital at lower rates and receive lower returns as a result.

Bonds and bond funds mitigate this risk by locking in higher yields for longer. For instance, a three-year bond that yields 5 percent will continue yielding 5 percent for the next three years until it matures. Similarly, a bond fund can buy longer duration bonds from the proceeds of matured bonds to overcome falling interest rates.

2. Cash offers no capital appreciation

While bonds and cash are both interest-paying assets, only bonds have the potential for price gains. A bond’s price is primarily influenced by three factors: demand, term to maturity and credit quality.

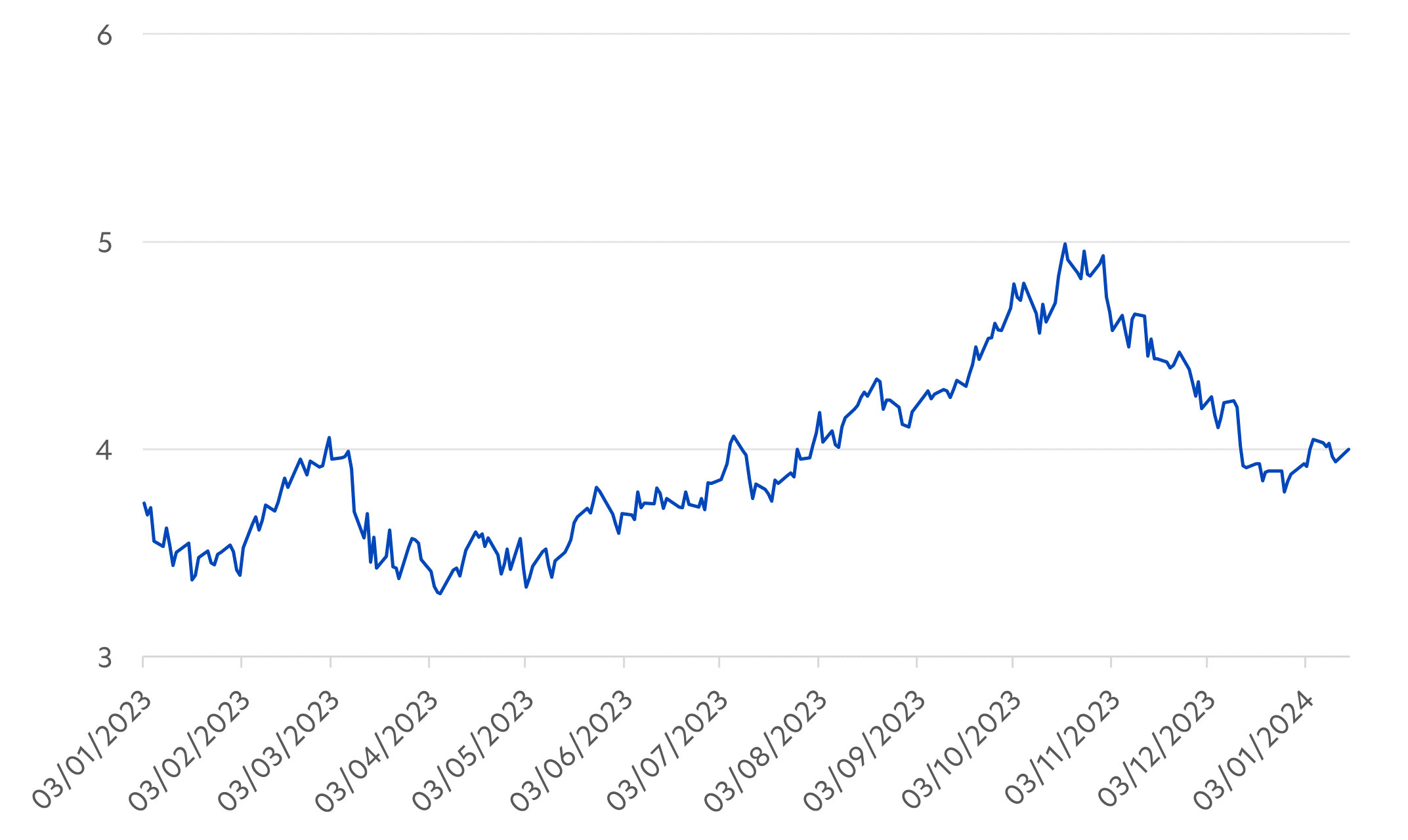

In November and December 2023, investors had already started to take advantage of rate cut trends by buying bonds. As a result, 10-year US Treasury yields declined from a high of 5 percent in mid-Oct 2023 to 4 percent at end-Dec 2023.

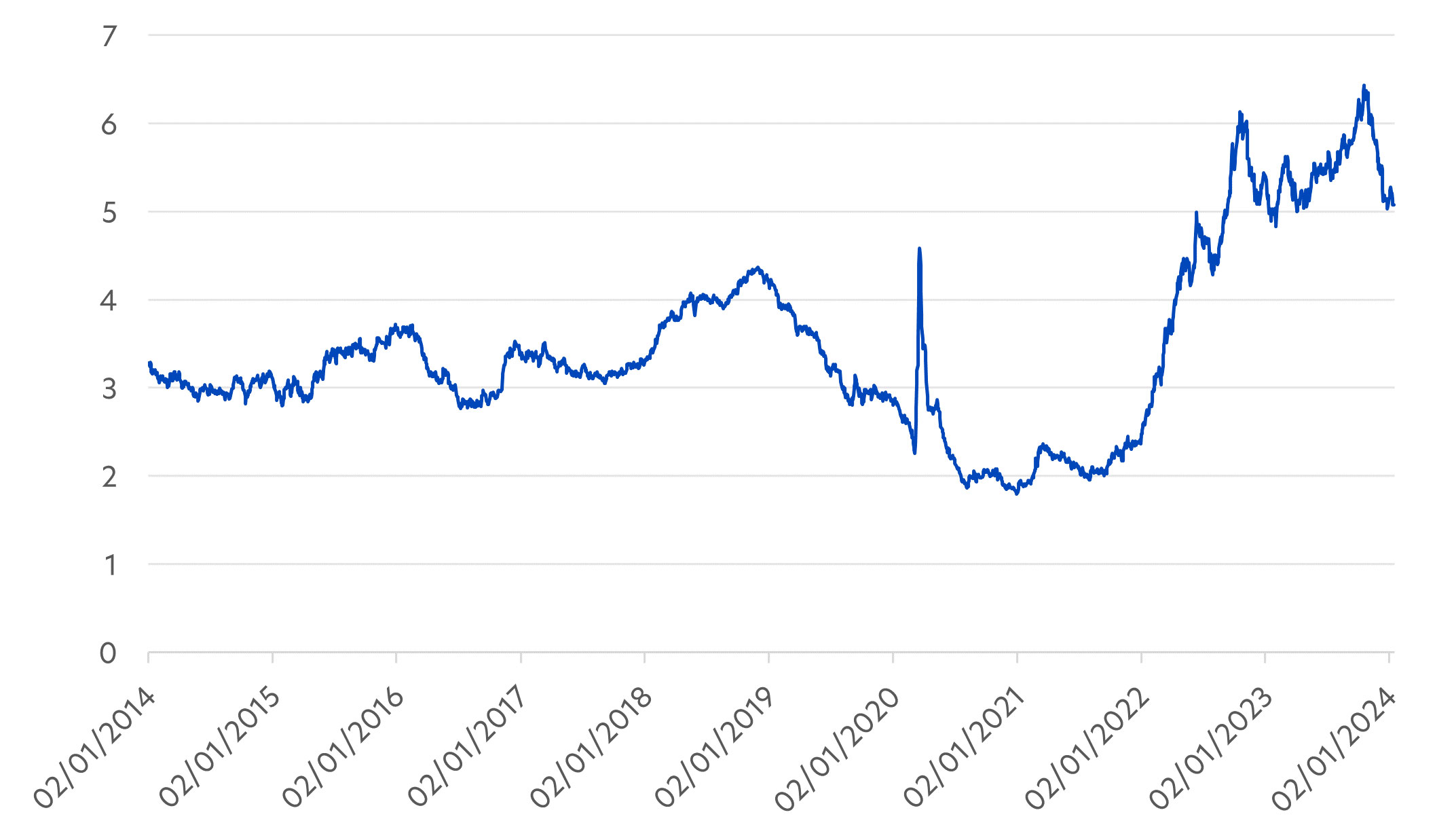

Figure 1: Yield on 10-year US Treasury bond

Source: Bloomberg, as of 16 Jan 2023

Corporate bonds also benefit when risk appetites improve. This higher appetite encourages investors to move from government bonds to investment grade and high yield corporate bonds, causing credit spreads to tighten and prices to rise.

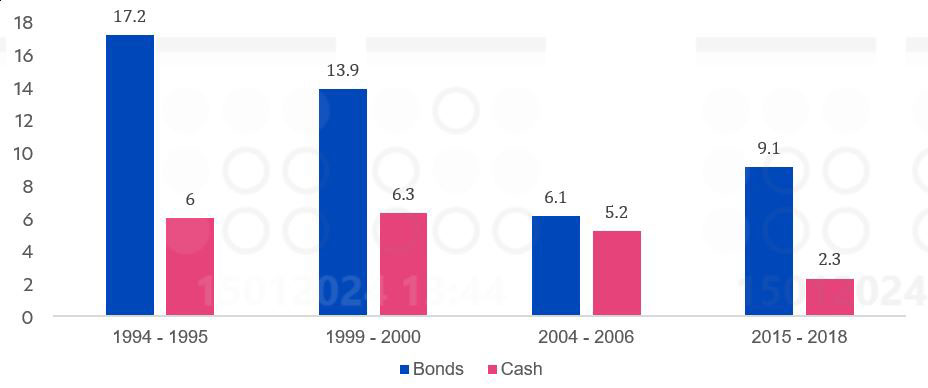

3. Cash lags when rates peak

Cash has historically lagged bond returns when the Fed approaches the end of its rate hiking cycle. In the 12 months following the last four Fed-tightening cycles, bonds outperformed cash by between 1 – 11 percent.

Figure 2: Bonds vs cash 12-month return (%) after last rate hike

Source: Bloomberg, as of 31 Dec 2023. Bonds: Bloomberg US Aggregate Bond Index, Cash: Bloomberg US Treasury Bellwethers 3 month index. 3-month T-bills are often used as a proxy for cash

Research shows that the Fed rate pause period - the time after the last rate hike and before the first rate cut - usually lasts about six months. More than 80 percent of bonds’ excess returns typically happens during this period. Given that the last Fed rate hike in the current cycle was in July 2023, investors who wait much longer risk of missing out on most of the potential bond gains.

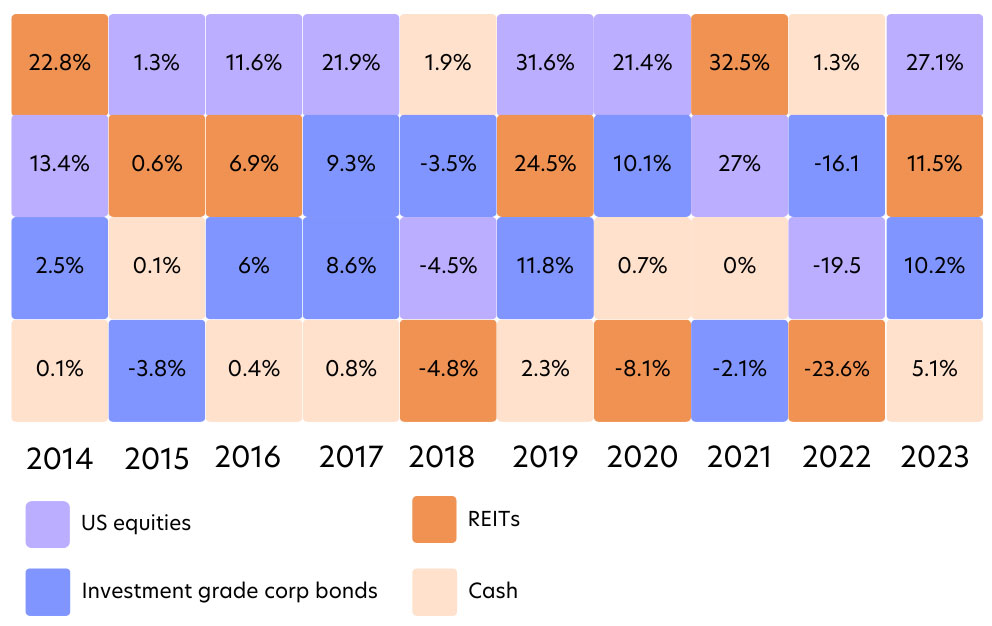

4. Cash historically underperforms, including in 2023

As shown in the table below, except in 2022, when it was top performer, cash typically delivers lower returns than bonds, equities and real estate investment trusts (REITs). In 2023, despite average 5.1 percent returns, cash was among the worst performers and trailed equity returns by 15 percent or more.

Figure 3: Cash often underperforms

Source: LSEG Datastream, 3 January 2024. US equities: MSCI USA Index, IG credit: Barclays Global Corporate Credit Index, REITs: S&P Global Real Estate Investment Trust (REIT) Index, Cash: Bloomberg Barclays U.S. Treasury Bill Index

Why bonds can help plug the renewal gap

For those not ready to add equity exposure, bonds allow investors to lock in yields for longer without taking on too much risk. In 2024, we expect bonds to continue beating cash and prefer corporate bonds for their better return profile.

The investment-grade (IG) segment looks especially attractive given these factors:

- Good income potential

The yield on a 3-year US-domiciled IG corporate bond is currently around 5 percent, the highest it has been in a decade. At these levels, IG corporate bonds are expected to see strong demand from institutional and retail investors alike.

Figure 4: US IG corporate bond yield (%)

Source: Bloomberg, as of 16 Jan 2023. Index: Bloomberg US Corporate Bond Index

- Low credit risk

Corporate fundamentals remain strong amid a resilient global economy. The healthy company balance sheets and solid profit margins resulted in more upgrades than downgrades for IG corporate bonds in 2023. With the possibility of a US recession in 2024 now largely dismissed, the probability of default for IG issuers is likely to remain very low.

Cash is wealth preservation, not a wealth building strategy

Holding some cash is prudent for flexibility and near-term needs. Those with a short time horizon or who have already met their wealth needs may also prefer to hold cash.

However, cash is not a wealth-building strategy. Staying too long in cash could mean sacrificing the income and capital appreciation benefits that assets like bonds and equities can provide. In the current environment of falling interest rates, IG bond funds offer a way to achieve steady and reasonable returns.

If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z