Money market funds are the rage currently. In the first two months of the year, close to S$100 million flowed into Singapore-managed money market funds, according to Morningstar research.

In a recent webinar, Joyce Tan, UOBAM’s Head of Fixed Income Asia/Singapore, answered participant questions about why investors are flocking to these funds. Here is an extract:

Here are some additional Q&As from the webinar.

Participant: I do not want to take much risk. Should I just buy Singapore T-bills?

Joyce: T-bills i.e. Treasury bills are basically government bonds that have maturities of either six months or one year. In Singapore, you can apply via ATMs and online from Singapore local banks.

However, there a few things to note about T-bills. There are many steps involved in applying and buying a T-bill, including checking on the Monetary Authority of Singapore (MAS) website for when the next T-bills will be issued, and deciding whether to make a competitive or non-competitive bid.

More importantly, there is the risk of not getting your desired allocation, and you typically need to hold the T-bill to maturity. So, if you buy a one-year T-bill, then you will not have access to that capital for one year.

Participant: Why are so many people buying money market funds?

Joyce: I have also heard of more people shifting their savings into money market funds. To me, even on a private basis, I think that makes a lot of sense. A money market fund basically invests in highly liquid, short-term, low risk investments including fixed deposits, MAS bills, and Singapore government T-bills. Some funds do allow for some limited exposure to high-grade, short-dated corporate bonds. The average maturity of these investments is usually about six months.

The important thing about money market funds is they are generally less volatile than stocks and bonds. So, they provide investors with a convenient place to park their cash while potentially earning a higher rate of return than traditional savings accounts. And with bond yields currently at multi-year highs, the interest rates offered by money market funds are particularly attractive at the moment.

Participant: Are there any other benefits besides yields?

Joyce:There are in fact, many other benefits. Firstly, money market funds are easy to buy and sell. Unlike a T-bill, you do not need to wait until a specific day to subscribe and you can redeem your investment almost immediately. So, let’s say you received your bonus today. You can go and buy your money market fund straight away. Tomorrow, if you see something you really want to buy, you can sell some or all of your fund and get your money back. This lets you maximise the utility of your idle cash.

Secondly, professional managers can buy instruments not available to retail investors. For example, money market funds can buy into very short duration i.e. one-month and three-month MAS bills. Currently, shorter duration bonds have higher yields than longer duration bonds, so this gives us a better potential for returns. Funds can also sell their holdings more easily and at lower cost than possible for a retail investor.

Thirdly, money market funds benefit from diversification. Funds can spread the risk across bond issuances and maturity periods. By doing this, it is possible to take advantage of any spike in rates or changes in market. Retail investors can usually only afford to buy a few instruments.

Participant: What does the United SGD Money Market Fund offer that other money market funds do not?

Joyce: The aim of the Fund is to provide a return that is comparable to Singapore dollar short-term interest deposits. Currently, the Fund is invested almost exclusively in MAS bills and T-bills and is a good alternative for investors wanting to get exposure to these instruments in a convenient way but with the added benefit of daily liquidity.

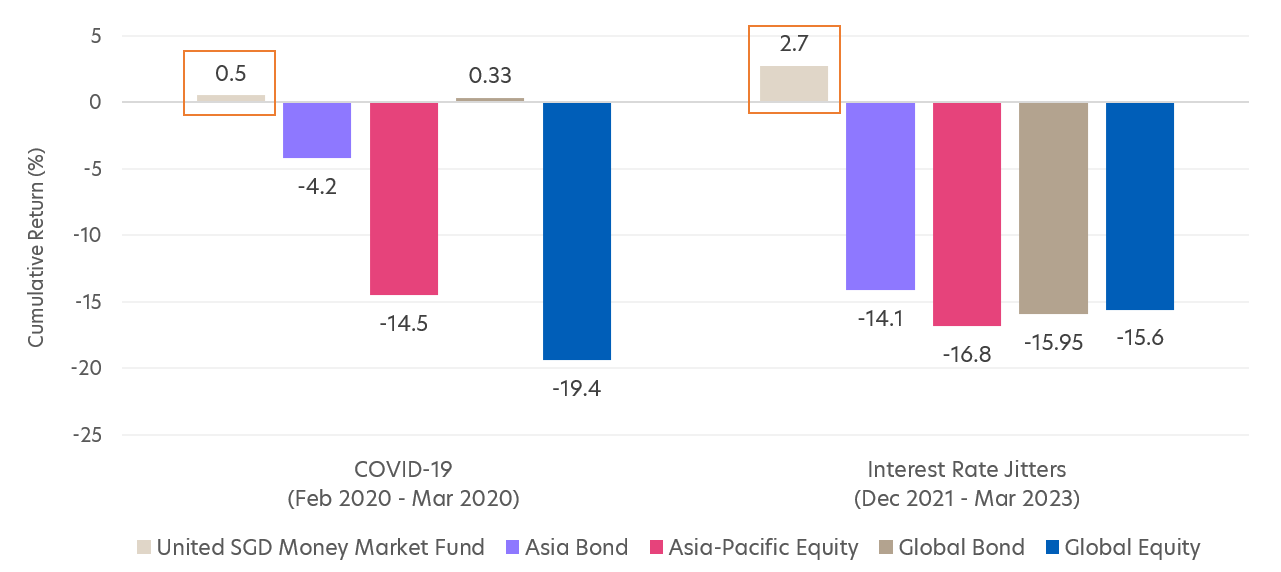

Also, by doing so, the Fund is able to weather financial storms. For example, during the COVID-19 crisis and recent interest rate jitters, the Fund did not suffer any losses, as compared to the wider bond and equity markets.

Figure 1 : United SGD Money Market Fund vs bond and stock markets1

Source: Morningstar, as at 31 March 2023, SGD terms.

1Performance is based on United SGD Money Market Fund Class Z SGD portfolio, on a NAV basis, with dividends reinvested if any.

Past performance is not necessarily indicative of future performance.

In terms of performance, since inception, the Fund has managed to deliver returns higher than traditional savings accounts. Morningstar puts the Fund’s year-to-date, 1-year and 3-year performance within the top 25 percent of all Singapore-managed money market funds.

As of 31 March 2023, the Fund’s yield to maturity, which is the interest rate that investors can enjoy if they buy into the Fund, is at 3.45 percent. At the same time, if interest rates start to fall, the Fund can opportunistically consider investing in good quality short duration investment grade corporate bonds to deliver enhanced yield to investors.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z