- Japan’s 2Q GDP surprised on the upside

- Investors remain cautiously optimistic about Japan’s prospects

- A pick up in domestic spending is needed for full confidence to be restored

Another quarter of good news

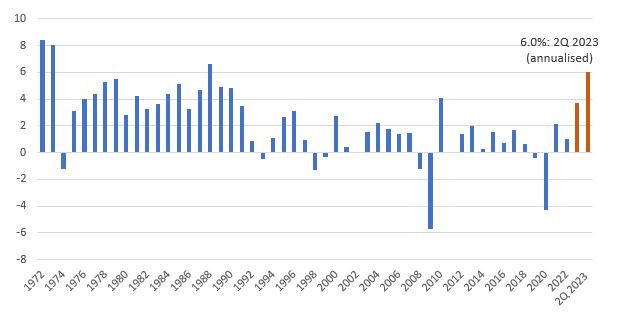

Japan’s GDP numbers released this week showed yet another quarter of expectations-busting economic expansion. Quarter-on-quarter, the economy grew by 1.5 percent, almost double the market’s forecast of 0.8 percent. This translates into an annualised growth of 6.0 percent compared to last quarter’s 3.7 percent, and the actual 2022 growth of just 1.1 percent.

After limp or negative growth since the early 1990s, it is still too early to say whether this is a turning point for the Japanese economy. However, there are reasons to be optimistic. The country has not seen three consecutive quarters of growth since 1Q 2019. This quarter’s growth is also the strongest since 3Q 2020. At this rate, analysts predict that the full year number could hit 5 percent, a multi-decade high.

Figure 1: Japan GDP annual growth (%)

Source: The World Bank, Bloomberg, UOBAM

Multiple confidence drivers

Ever since Warren Buffett announced his interest in select Japanese stocks, analysts have been re-evaluating Japan’s economic prospects. They note a distinct shift in both the private and public sector’s approach to the country’s business environment.

Japanese companies now appear more determined to fast-track their adoption of technology, invest their cash, secure their supply chain security and improve their stock prices. Meanwhile the government has taken steps to improve the labour supply and imposed tighter governance and fiscal requirements.

However, a sustained GDP lift would be the spark needed to set Japan’s equity markets alight. Assuming that inflation can be controlled, this would lead to higher company earnings, better profit margins and improved asset prices.

Market rebound

That said, Japan’s stock market already stands as one of the world’s best performing year-to-date. Since January, the Nikkei 225 has gained over 25 percent, beating the S&P500’s 17 percent. Interest in Japan has also likely been fuelled by disappointment in China’s market with the Shanghai Composite Index flat so far this year.

Much of this is the result of large institutional investors increasing their exposure to Japanese equities. For example, Aware Super, Australia’s third largest pension fund with AUM (assets under management) worth US$104 billion, stated recently that it had profited from its tactical overweight position in Japan and would continue to be actively engaged in the market.

In fact, monthly net flows into European and US-listed Japanese equity ETFs (exchange traded funds) have been rising since the end of the first quarter with several monthly flows in excess of US$1 billion. As of 1 August, Japanese equities remained among the world’s top ten ETFs in terms of flows.

Not out of the woods yet

However, some aspects of Japan’s latest GDP numbers are still worth watching. In particular, last quarter’s growth was driven almost entirely by the 3.2 percent boom in exports, largely of cars, while inbound tourism was also a significant contributor. No doubt the weak yen, which is close to a multi-year low against the dollar, is helping boost the attractiveness of Japanese exports.

However, given the expected slowdown in global demand, domestic consumption is required for this growth to be sustainable. Yet private consumption, which accounts for over half of the economy, shrank by 0.5 percent in 2Q compared to 1Q.

It is also unclear currently whether the Bank of Japan (BOJ) will maintain its ultra-low interest rate policy. By lifting the restrictions on its Yield Control Curve (YCC) in June, it appeared that the BOJ was reviewing this policy to help counter rising (although still low) inflation rates. Stock investors who have been used to easy monetary conditions in Japan would potentially be disappointed should the BOJ reverse its dovish stance.

“A new form of capitalism”

While these short term risks persist, long term investors are looking forward to the unfolding of Japan’s national “grand strategy” announced by Prime Minister Fumio Kishida.

Designed to address the country’s national security while at the same time boosting is economic prosperity, this “new form of capitalism” seeks to transform key sectors such as energy, technology, artificial intelligence, agriculture, healthcare and education. This sets a path for Japan to resume its economic ascendency on the global stage, after decades in the wilderness.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z