- Japan’s equity market has rallied to its highest level in three decades

- This change in Japan’s fortunes is driven by foreign money looking to diversify away from the US

- Further upside is possible, especially for the lagging small cap sector, but the risk of short term volatility remains

Buffet sticks up for Japan

Warren Buffet has been the catalyst for many investment trends in the past, and this Japan rally is no different. While the country’s economic and corporate environment has been steadily improving, it would take Buffet’s intervention to spearhead a steep rise in the market.

In fact, the market ended 2022 about flat for the year and saw only a tentative rise in the first quarter of 2023. But the announcement in April that Buffet’s investment firm Berkshire Hathaway had increased Its allocation to a few large Japanese stocks, including Mitsubishi Corp and Sumitomo Corp, helped spark a sudden inflow of US$7.83 billion in just five days.

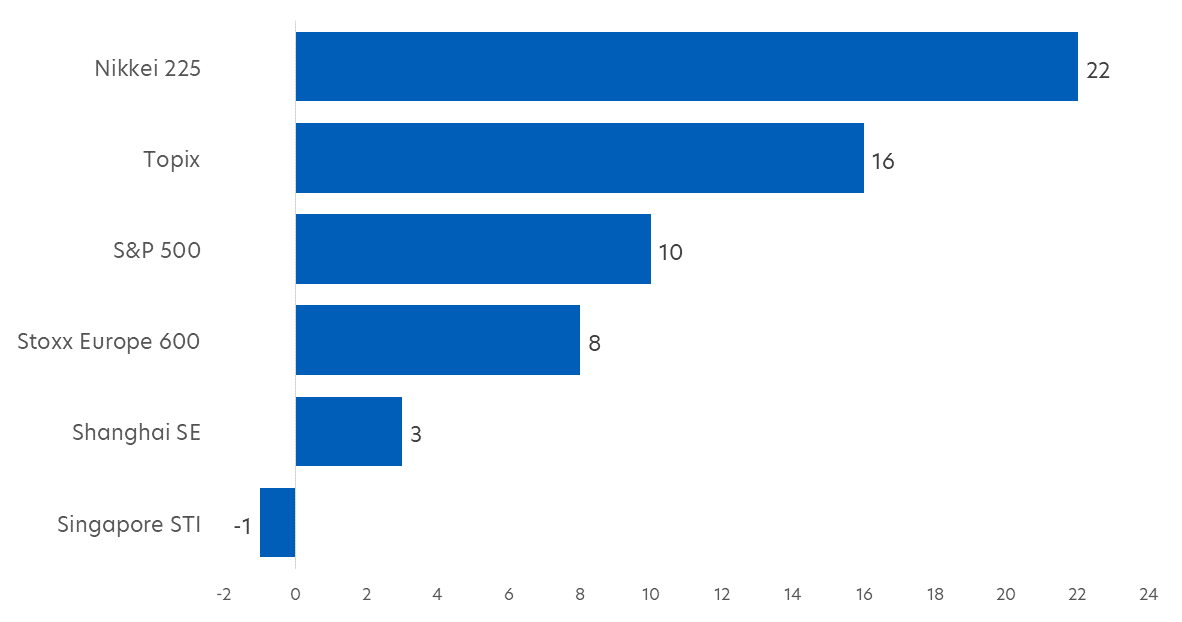

This has enabled Japan’s Nikkei 225 and broader TOPIX indices to push past levels last seen 33 years ago. Year-to-date, they are up by about 22 and 16 percent respectively, making Japan one of the best performing markets in the world.

Figure 1: Index Year to Date Returns (%)

Source: MarketWatch, 29 May 2023

Will Japan’s rally continue?

So the question now on everyone’s lips is of course, does this rally have legs? It is worth noting that since the bursting of Japan’s asset bubble in 1990, many hopes of a Japan market revival have come and gone. However, analysts think that major improvements in the country have not received sufficient notice, and the world is finally waking up to these.

1. Improved corporate governance

Unlike in the US, shareholder activism, share buybacks and dividend payments for Japanese corporates has been relatively subdued until the last few years, prompted by former Prime Minister Shinzo Abe. As a result, capital returns to shareholders hit a record high last year. At the same time, corporates’ cross-shareholdings are being unwound. All this is set to make Japanese stocks more attractive to foreign and domestic investors.

2. Positive earnings

Corporate earnings last year largely exceeded market consensus. For the 2023 – 2024 fiscal year, firms are expecting their earnings to further expand, albeit modestly, helped by the 2.0 - 3.0 percent nominal GDP growth forecast for this year. There are concerns that exporters could face a challenging time if indeed the global economy decelerates significantly. On the other hand, a milder-than-expected global recession would be a positive surprise for Japan stocks.

3. Cheap yen

In a rates-driven global environment, Japan’s low interest rates suggests that the yen could stay weak, which would help the export and tourism sectors. Against the dollar, the yen has fallen to 140, a six month low and well below many Japanese companies’ forecast of 125-130. While Japan’s government has previously stepped in to halt major currency slides, Japan’s Finance Minister Shunichi Suzuki said last week that currency rates should reflect economic fundamentals, suggesting a hands-off approach for now.

4. Rising domestic demand

Japan’s consumer businesses have performed well amid stronger-than-expected domestic demand as well as a steady influx of inbound travellers, especially from China. There are expectations of an even greater ramp up in pent-up demand given Covid restrictions have not yet lifted in full. Furthermore, annual wage negotiations ended in early May with an average increase of 3.7 percent, levels not seen since the early 90’s. It is possible that a virtuous wage/demand cycle is underway, thereby ending the country’s longstanding deflationary problems.

5. Attractive valuations

Japanese stocks may have reached a multi-decade high, but remains inexpensive when compared to other markets. The Topix’s price-to-book ratio of 1.3 times is still well below the 4 times for the S&P 500 Index’s and 1.8 times for the Stoxx Europe 600. Current prices are also at 13 times forward earnings – about half that of the US market. At these levels, it is possible for shareholder benefits such as share buybacks and higher dividend payouts to lift investor demand, even without higher earnings revisions.

Lagging mid and small cap stocks have potential to shine

So far, this foreign investor-driven rally has been fuelled by large value stocks and sectors. The time seems ripe for mid and small cap stocks to catch up on the action. As global economic uncertainties deepen, interest looks set to shift from exports to domestic demand, thereby favouring smaller companies.

These smaller firms are also set to benefit more immediately from ongoing shifts in the Japanese corporate sector. For example, to achieve higher efficiency, corporates appear willing to invest more heavily in digital transformation. This is positive for Japan’s IT companies, including those offering systems integration, software development and cloud support.

Similarly, Japanese corporates will benefit from the easing of restrictions preventing skilled foreign workers from obtaining long term residency status. This change was only announced in February this year, yet foreign worker arrivals have already increased by 36 percent year-to-date. While this influx will likely take time to impact the earnings of large corporates, human resource company earnings will enjoy a jump this year.

Room to expand but risks remain

Given the many positive drivers discussed above, we believe that Japan’s overall equities market continues to have upside potential over the next few months.

Over the longer term, there are hopes that the Japanese government will add to the US$200 billion economic stimulus unveiled last October. The country could also become more important as an alternative destination for supply chain investment should the US decide to further reduce its reliance on China.

However, the possibility of a global slowdown could dampen some investor enthusiasm in the near term. Meanwhile any bad news with regards to, for example, the US debt ceiling or China’s economic recovery could prompt profit taking and increased volatility.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z