ASEAN equity gains continue to differ greatly by country. We share our assessment of each market and why Malaysia is our top pick

2023 was a challenging year for most ASEAN economies given the slowdown in exports. This year looks to be better, with growth for the region forecast to reach 4.5 percent this year, considerably higher than the estimated global average of 3.1 percent. The spur towards higher growth is expected to come from a turnaround in manufacturing and exports, as well as a recovery in tourism. Local governments’ measures to boost domestic consumption will also help.

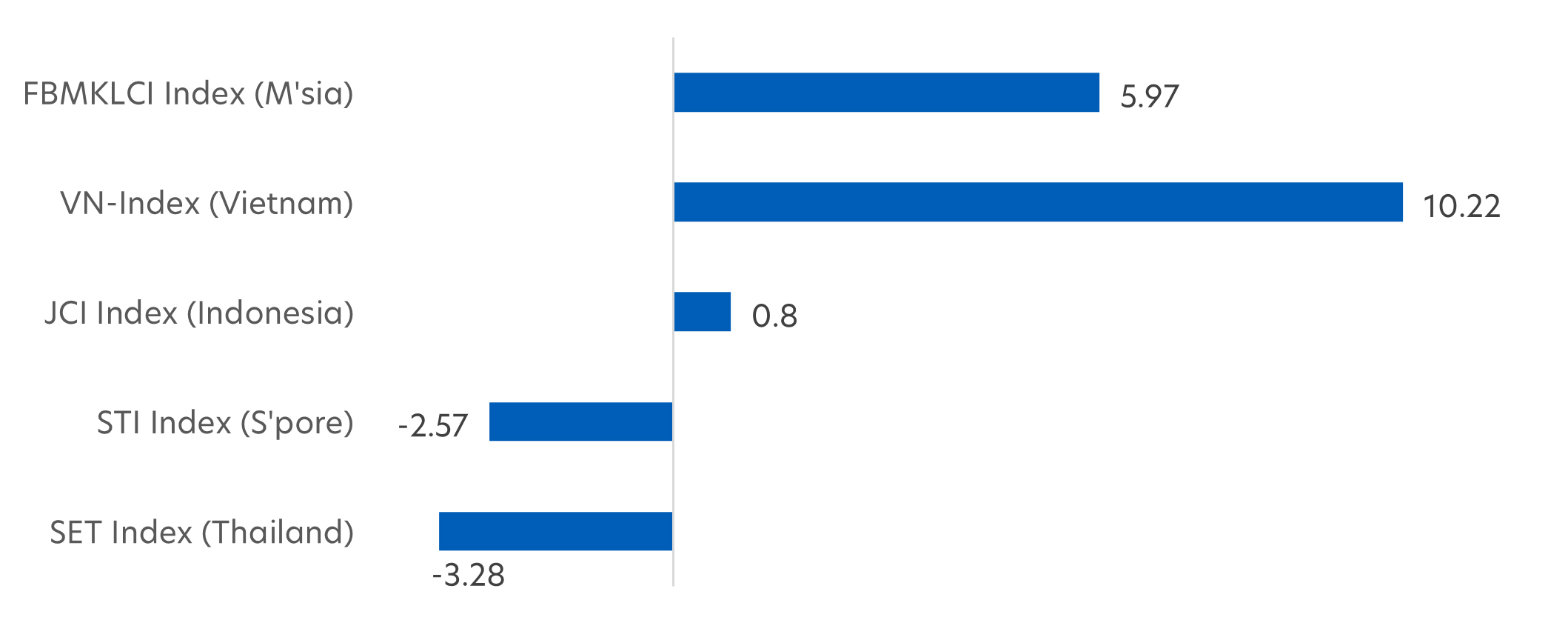

Despite this more positive outlook for economic growth and corporate earnings, the equity gains have been very uneven across ASEAN markets so far this year, and we expect some of this dispersion to continue. As a result, we favour some ASEAN markets above others.

Fig 1: Divergence in YTD performance (%)

Source: Bloomberg, as of 12 March 2024

Malaysia: Positive

Malaysia is our preferred market within ASEAN looking forward into the second quarter of 2024. It is relatively defensive and is leading the region’s recovery given the following factors:

- Strong corporate earnings growth

According to Bloomberg estimates, Malaysia’s benchmark FBMKLCI index is poised to see earnings growth of 12.4 percent in 2024. This is a reversal of 2023’s negative earnings of 12.6 percent. Most sectors are also set to see positive growth although energy and industrial names stand out. - Increased foreign inflows

Foreign investors have been the largest net buyer of Malaysia stocks since November 2023, encouraged by the cheap ringgit. In February 2024, foreign investors bought RM 1.32 billion worth of stocks, double that of the previous month. - Attractive valuations

Malaysia stocks are currently trading at undemanding valuations. The 12-month forward price-earnings ratio is currently averaging 14.1 times, which is below the 10-year average. This offers the prospect of good upside potential. - Sector opportunities

We remain positive on Malaysia Energy names as they stand to benefit from the ramp up in capital expenditure spending by state-owned oil and gas company Petronas. Tech exporters are also set to benefit from the global technology upcycle while utilities should remain relatively resilient. Property stocks should also see upside from infrastructure and construction projects in Johor amid the creation of the Johor-Singapore Special Economic Zone. - Risks

Inflation has been moderating in recent months, However, the Malaysian government’s intention to shift away from blanket to targeted subsidies for necessities could trigger a flare-up in prices. The ringgit’s depreciation, now at a multi-decade low, is also making imports more expensive and exacerbating the country’s cost of living pressures.

Indonesia: Neutral

- Stable government

We are upgrading Indonesia from negative to neutral following Prabowo Subianto’s decisive victory in the Presidential election. Going forward, we think the trajectory for Indonesia’s stock market will be determined by the shape of the country’s next ruling coalition and cabinet, and how well policies are executed. - Policy continuation

President-elect Subianto is likely to continue with the economic policies of outgoing president Jokowi, which should translate to reduced earnings uncertainty. We also expect moderately above-trend earnings per share (EPS) growth for Indonesia corporates in 2024 although we note that earnings growth momentum has slowed recently.

Vietnam: Neutral

- Export recovery

We remain neutral on Vietnam as we expect earnings to rebound this year on the back of Vietnam’s improving exports. The country’s total export turnover of goods in the first two months of 2024 showed a 19.2 percent increase compared to the same period last year, driven largely by computer and electronics exports. - Robust foreign direct investment (FDI)

We also expect stronger EPS growth for Vietnam corporates in 2024 given the pick-up in foreign investment. Vietnam attracted more than US$2.36 billion in FDI in January, an increase of 40.2 percent over the same period in 2023. More large-scale FDI projects are expected in the coming months, which will spur investments in areas such as infrastructure, transportation, telecommunication, and software production.

Singapore: Negative

- Slow growth

Singapore’s 2024 GDP is projected to come in at 1 - 3 percent, one of the lowest rates in the region. This is a major factor in our decision to downgrade the market from positive to negative.

| 2023 GDP actual (YoY%) | 2024 GDP forecast (YoY%) | 2024 EPS growth forecast (%) | |

| Singapore | 1.1 | 2.3 | 0.6 |

| Malaysia | 3.7 | 4.3 | 10.6 |

| Indonesia | 5.1 | 5.0 | 9.5 |

| Thailand | 1.9 | 3.3 | 11.3 |

| Vietnam | 5.1 | 6.0 | 43.2 |

Source: Bloomberg, Factset, 23 Feb 2024

- Export dependent

Given still-high interest rates and weak global trade momentum, this export-oriented economy is likely to face continued headwinds. Ahead of a pick-up in external trade, Singapore’s corporate earnings outlook will likely remain lacklustre. According to Bloomberg estimates, the EPS growth forecast for the Singapore market is just 0.6 percent, significantly behind that of regional peers. - Upside risks

A stronger-than-expected rebound in tourist arrivals, and a pronounced pick-up in growth with major trading partners like the US, European Union and China could deliver higher-than-expected GDP growth for 2024 and brighten investor sentiment.

Thailand: Negative

- Limited earnings upside

Thailand has seen a sharp increase in earnings downgrades and in the near term, we expect any upside potential in earnings to be limited. As such, we have downgraded Thailand from neutral to negative. - Earnings turnaround in 2H

However, we think that the Thai market could still see conservative EPS growth later in the year. Chinese tourist arrivals have been recovering since Thailand waived visa requirements for China. Meanwhile government spending is set to ramp up from April following a delay in finalising the 2024 budget.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asia Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you. .

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z