Whether you are a business with surplus cash or an individual wanting to supplement your monthly salary, investments that pay a regular income can come in very handy.

This is because such investments not only provide an income stream, they also allow your capital to grow.

However, there is always a danger of over-reliance on a single instrument, a single asset type, or a single sector. To ensure that your income stream is steady and does not dry up when hit by certain market conditions, it is worth considering investments that combine multiple asset types or multiple sectors, or both.

Why consider multi-sourced income?

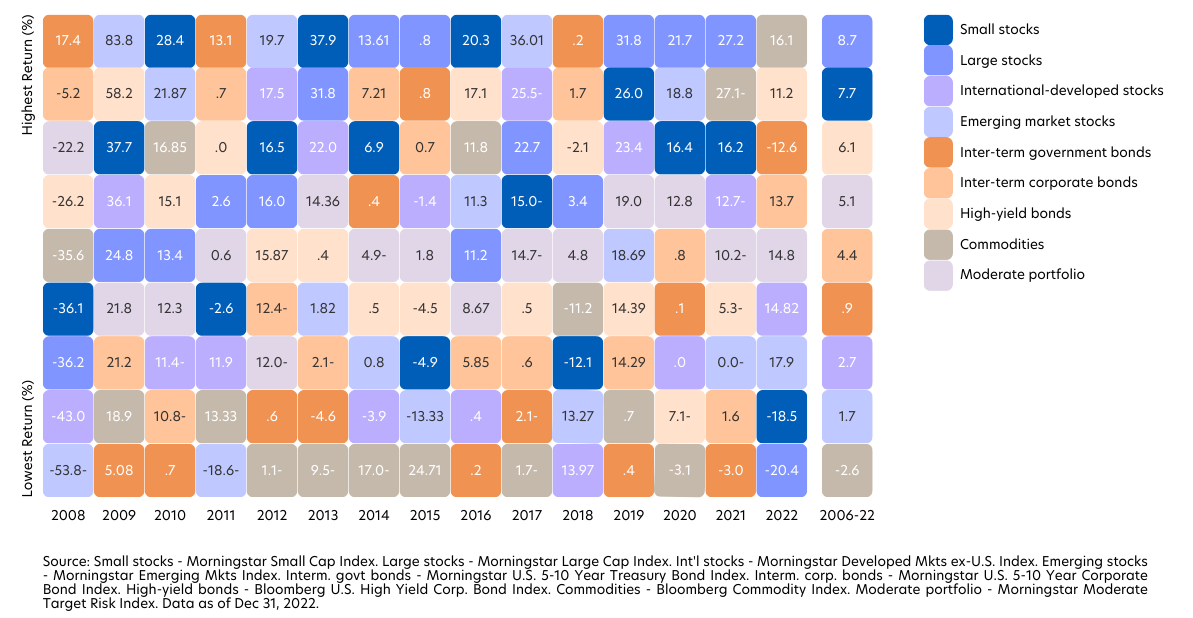

As the chart below shows, an asset class may do well one year but falter the next. This is because economic conditions can change significantly from year to year, and in recent times economic cycles seem to be getting ever shorter.

Figure 1: Asset class returns over time

By including a wide variety of global asset classes or sectors, multi-sourced funds are able to diversify risks and reduce over-concentration in any one area. This helps the funds achieve more consistent returns based on less dependency on specific economic factors, and greater resilience to unexpected events.

Additionally, multi-asset and multi-sector funds are managed by professional fund managers who have the skills and experience to navigate shifts in the interest rate and macroeconomic environment. These fund mandates provide their managers with a large selection of asset classes or sectors with which to implement their views.

Opportunities offered by UOBAM

UOB Asset Management (UOBAM) offers investors two solutions for achieving global diversification and enhanced yield opportunities: the United Sustainable Credit Income Fund and United Income Focus Trust.

Both funds sit on the higher end of the risk-return spectrum and are able to offer attractive monthly distributions1 and potential capital growth opportunities. As such, they are more suitable for investors with a moderately aggressive risk profile and long-term income needs.

Here is a comparison of the two funds.

| United Sustainable Credit Income Fund | United Income Focus Trust | |

| Distribution1 | Before June 2023: Monthly distribution of 5% per annum From June 2023: Monthly distribution of 6% per annum |

Monthly distribution of 5.5% per annum |

| Strategy | Adopts a global multi-sector approach to fixed income in pursuit of broader income opportunities. | Adopts a global multi-asset approach that encompasses traditional and alternative asset classes to provide multiple uncorrelated sources of return and income. |

| Underlying investments | Investment grade, high yield, and emerging market corporate bonds | Income producing traditional assets (e.g. equities and bonds) and alternative assets (e.g. real estate investment trusts, convertibles, preferred securities and currencies) |

| Top 5 country allocation (%)* | United States: 13.62 United Kingdom: 12.98 France: 8.62 Germany: 8.50 Spain: 8.02 |

United States: 48.75 United Kingdom: 6.69 France: 3.73 Germany: 3.14 Spain: 2.30 |

| Top 3 country allocation (%)* | Financials: 49.30 Industrials: 29.99 Treasuries: 4.28 |

Financials: 20.97 Information Technology: 8.31 Health Care: 8.13 |

*Source: UOBAM, as of 30 April 2023

1Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Funds’ prospectus.

How to choose the right fund for your needs

Here is what to consider:

1. I want diversified global bond exposure with attractive income potential and a sustainability focus

United Sustainable Credit Income Fund*

- Effective duration: 5 years

- Credit quality: BBB

- Weighted average yield to maturity : 6.87 percent

The Fund provides diversified fixed income exposure across credit ratings, sectors, or regions, to achieve attractive and stable income throughout the credit cycle. This means the Fund is able to invest in the most attractive yield opportunities globally.

As of 30 April 2023, the Fund has about a 60 percent allocation to investment-grade bonds and 35 percent allocation to high yield bonds. Within the 95 percent bond allocation, there is a 19 percent allocation to emerging market bonds.

Currently, banking and insurance sectors are favoured by the Fund given their attractive valuations relative to many industrial sectors. These sectors’ credit fundamentals are also more solid. The Fund’s top ten holdings are therefore mostly bank and insurance companies.

The Fund also works to make a positive impact on the United Nations Sustainable Development Goals (UN SDGs) and will not invest in bonds of corporates that detract from these goals or have a negative SDG rating.

Please see the United Sustainable Credit Income Fund page for more details, important notes and disclaimers.

2. I want a well-diversified all-weather income fund with downside risk control

United Income Focus Trust*

- Asset allocation:

- Equities: 46 percent

- Bonds: 45 percent

- Cash: 9 percent

- Long-term volatility target: 7.5 percent

The Fund invests in a broad spectrum of global assets to build resilience in riding out economic peaks and troughs while aiming to produce consistent income across all market cycles. It can dynamically adjust its allocation to equities, bonds and other investments.

As of 30 April 2023, the United Income Focus Trust’s top holdings include funds such as the iShares J.P. Morgan USD Emerging Markets Bond ETF and Wellington Emerging Market Development Fund, as well as individual securities like Apple, Exxon Mobil, Procter & Gamble, Microsoft, and Merck.

Please see the United Income Focus Trust page for more details, important notes and disclaimers.

*Source: UOBAM, as of 30 April 2023

If you are interested in investment opportunities related to the theme covered in this article, here are two UOB Asset Management Funds to consider:

|

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the calendar quarter or month. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. The Managers reserve the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a return of part of your original investment and may result in reduced future returns. Please refer to the Fund’s prospectus for more information.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z