In the first of our new 5-part series on a new “higher-for-longer” era, we look at the forces that could keep up the pressure on inflation for years to come.

The Covid toll on economies

Many people assume that our current inflation woes can be traced back to Covid lockdowns. This caused economies to grind to a halt, which in turn led to severe global supply chain disruptions, backlogs in goods production and service deliveries, strong demand for workers giving rise to wage pressures, and higher energy prices.

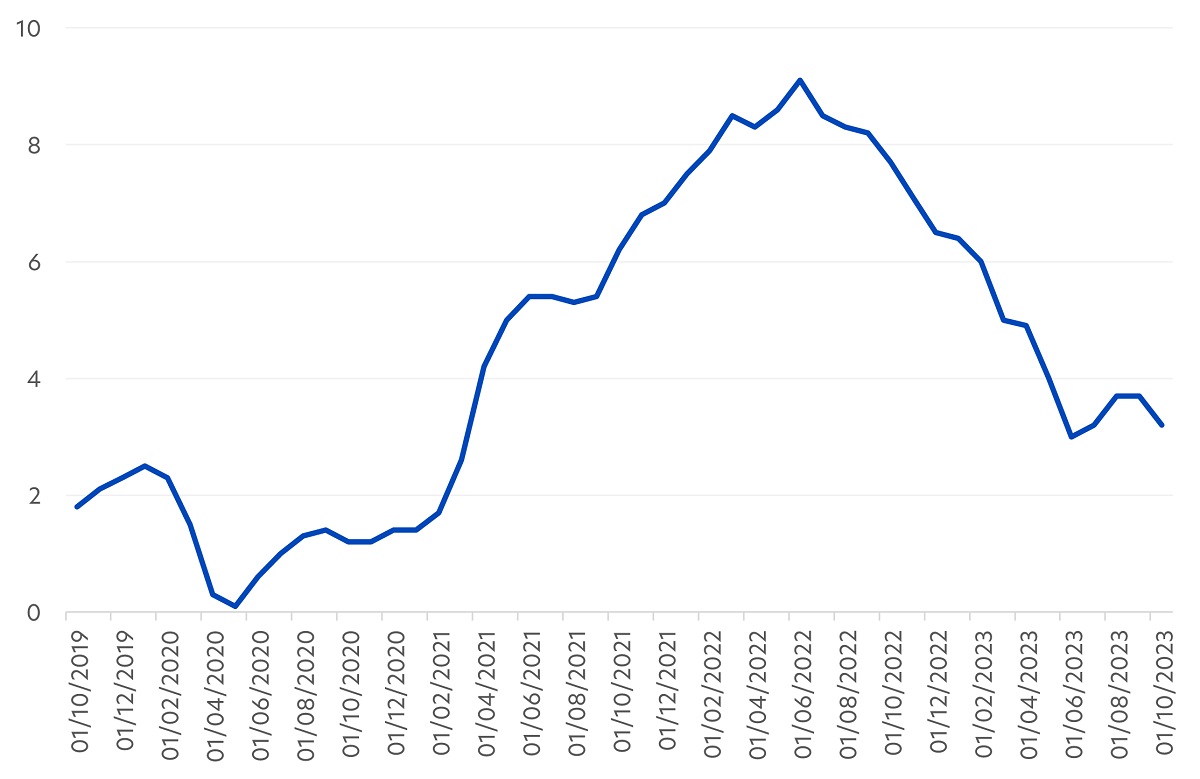

If so, it is fair to expect that these inflationary pressures are only temporary. Today, almost exactly four years since the first known outbreak in Wuhan, China in December 2019, Covid seems a distant memory. Global inflation’s steep rise and fall since Covid can be seen by looking at the US’s consumer price index (CPI), and it would certainly appear that most Covid-induced inflation effects have largely dissipated.

Figure 1: US CPI 12-month change, Oct 2019– Oct 2023

Source: Bloomberg/UOBAM

Inflation down but not out

However, while inflation has fallen to more manageable levels, it is still some way above the 2 percent target set by the US Fed. We believe that going forward, inflationary pressures may not be as temporary as hoped. Indeed, we expect inflation to persist as a feature of global economies for many years to come.

There are several structural drivers that we think will continue to exert upward pressure on global prices. The three most important are:

1. US-China tensions

China is known as “the world’s factory”, and accounts for about 30 percent share of global manufacturing output, double that of the US. This has been mutually beneficial for both countries, but as China’s focus shifts from low-cost to higher-end manufacturing, what looked like benefits now looks increasingly like competition. Geopolitical issues such as Taiwan have also soured relations. As a result, US-China trade appears to be faltering, with China seeing a 14.5 percent drop in 1H23 exports to the US, compared to a year ago. This decoupling looks likely to mean higher prices for US consumers and lower profits for US companies.

2. Climate change

According to a recent study by the World Economic Forum1, climate change is currently costing the world US$16 million per hour. This number is only set to grow as climate change intensifies, and is expected to reach between US$1.7 – US$3.1 trillion per year by 2050. Whether arising from damage repair or investment in low-carbon solutions, the consequences of climate change is likely to be highly inflationary.

3. Food and energy shocks

Global instability, including the Russia-Ukraine war, and the Israel-Hamas war, looks unlikely to abate anytime soon. In fact, there remains a risk that the Middle East could get drawn into the conflict. The world witnessed a major uptick in food prices following the outbreak of war in Ukraine, and is braced for oil price rises should the Israel-Hamas war escalate. These shocks will likely keep inflationary pressures elevated.

Not necessarily bad for the economy

Ongoing inflationary pressures will in turn require an extended period of relatively high interest rates - commonly described as “higher-for-longer”. In fact, we note that inflation may still meet the US Fed’s 2 percent target in 2024, but this will be at the expense of interest rates trending substantially higher than in the past decade.

That said, in contrast to the generally negative view of higher-for-longer rates, we do not think that growth will be reined back. As long as interest rates remain relatively steady and well-telegraphed, there is scope for economies to expand in a higher interest rate environment.

It is worth bearing in mind that the pre-Covid decade from 2010 – 2019 was defined by disinflation, that is, low and below-target inflation. Prior to this, a borrowing spree had led to a severe housing bubble and eventually culminated in the 2008 Global Financial Crisis (GFC). This was followed by a decade of economic deleveraging similar to that in Japan.

Avoiding the Japan effect

As we know, Japan has struggled with low inflation, low interest rates and low growth for 30 years. For most of this period, stock market returns have been flat, even including dividends. This is because once interest rates fall to zero or near-zero, central banks have lost a crucial means of boosting economic growth – by cutting rates.

On the other hand, the past two years have taught the world an important lesson – that it is possible for employment to stay strong despite high interest rates. During this time, despite the US’s fastest ever pace of interest rate hikes, the unemployment rate dropped to the lowest level for several decades. This will likely give central banks the confidence to keep interest rates relatively high without jeopardising growth.

As such, going forward we do not expect to see a near term return to the 0 to 0.5 percent interest rate that was in place pre-Covid. Instead, we anticipate policy rates trending closer to levels experienced in the 1990s and early-2000s, when median interest rates ranged between 4.5 percent to 6.0 percent. Nevertheless, the period will be marked by greater market volatility as investors come to terms with this new and unfamiliar higher-for longer era.

Next week, we look at the asset classes and investment strategies that are likely to outperform in a higher-for-longer environment.

1Source: World Economic Forum, Climate change is costing the world $16 million per hour: study, Oct 2023

If you are interested in investment opportunities related to the theme covered in this article, here are three UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z