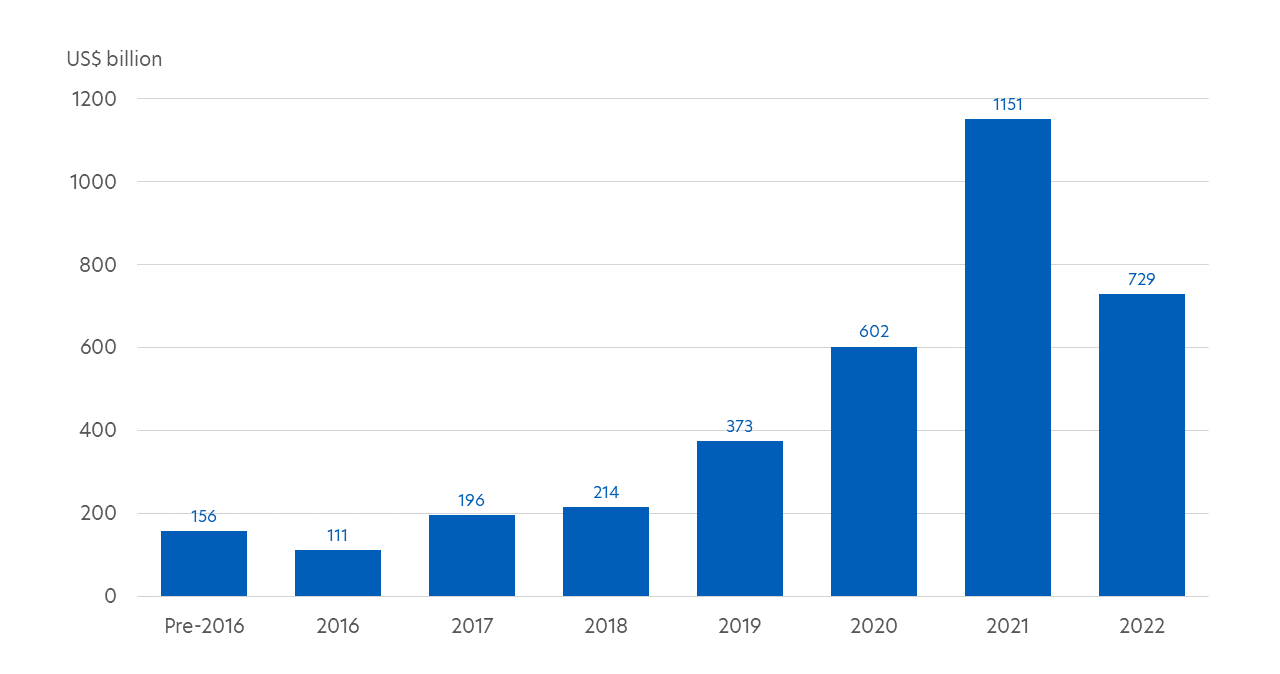

As governments and businesses scale up investments to combat climate change, the sustainable bond market is one of the fastest-growing fixed income segments at the moment.

To date, the cumulative amount of green, social and sustainability (GSS) bonds issued globally has exceeded US$3.5 trillion1.

Figure 1: Global GSS bond issuance

Source: World Bank based on data from Bloomberg, as at 30 Sep 2022.

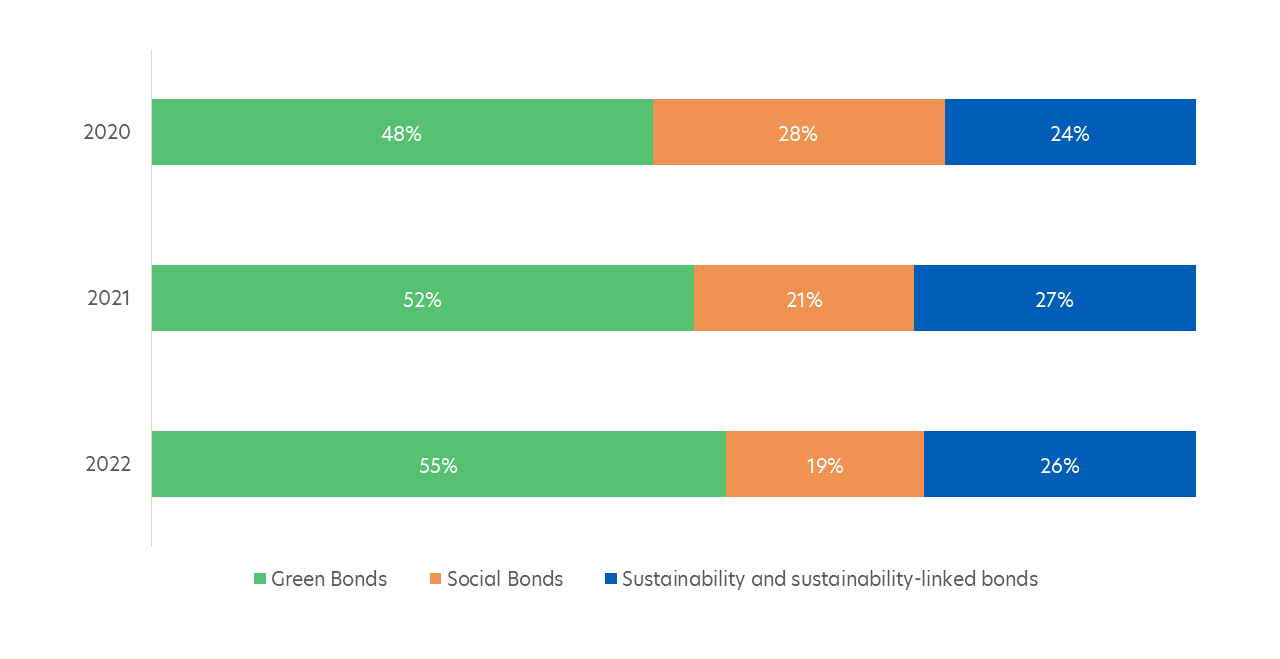

Green bonds lead the way

In recent years, green bonds have emerged as the leading segment of GSS bonds, accounting for 55 percent of total issuance2 in 2022. A key reason for this is the increasing need for green financing.

Figure 2: Green bonds dominate the GSS bond market

As climate risks intensify, many countries have committed to net-zero carbon emissions by 2050. But such efforts do not come cheap. A study by McKinsey estimates that capital spending to reach net-zero emissions would need to increase by US$105 trillion over the next 30 years3.

In line with the growing demand for green financing, the global issuance of green bonds has been steadily rising in recent years, reaching about US$473 billion in 2023. This trend is poised to continue. The Institute of International Finance forecasts that by 2025, annual issuance could be as high as $1.2 trillion, which will help finance:

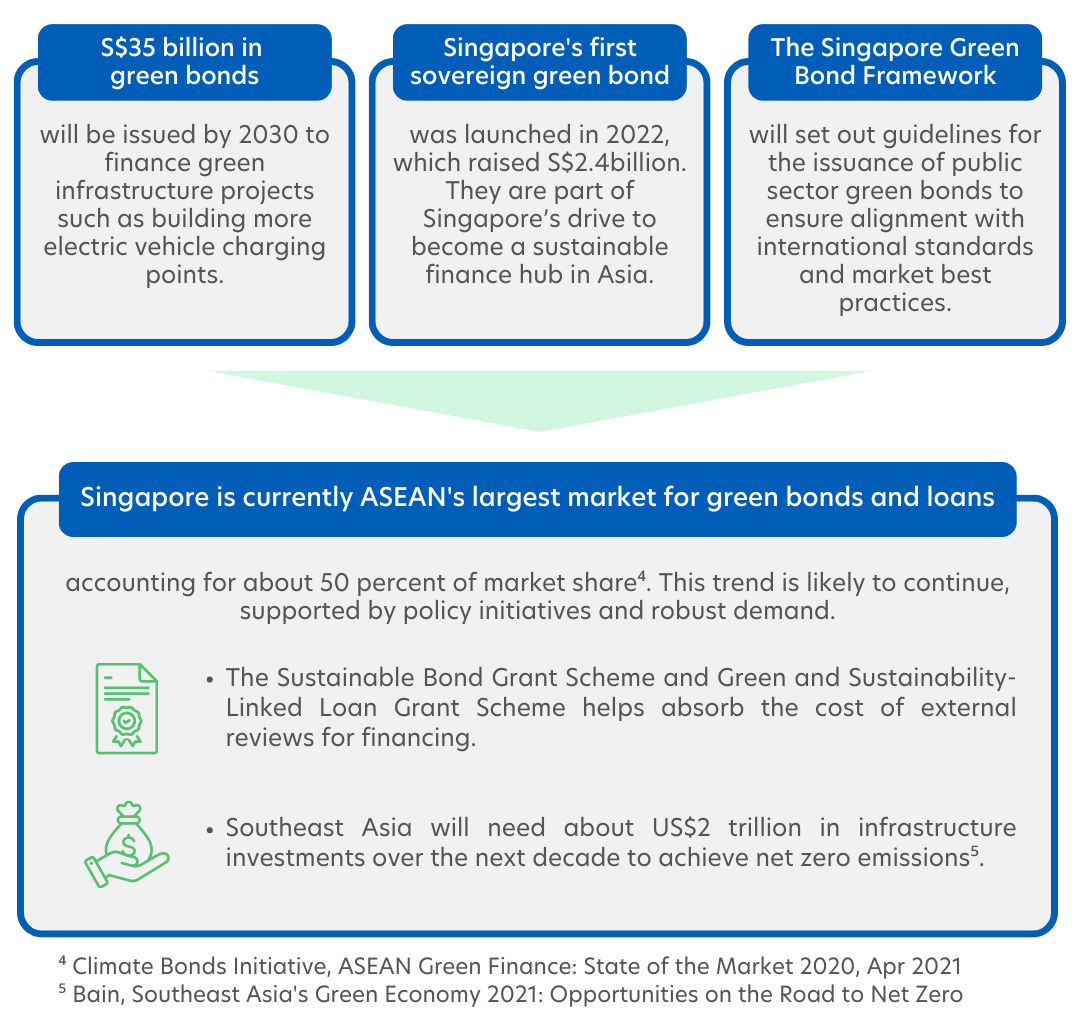

Strong support for green bonds in Singapore

As a low-lying nation, Singapore is especially vulnerable to the effects of climate change. The Singapore Green Plan 2030 (“Green Plan”) seeks to advance Singapore’s national agenda on sustainable development and pave the way for us to achieve net zero emissions.

Green bond issuances are an effective way to support these targets and finance Singapore’s transition to a net zero economy.

To that end, several initiatives have been put in place:

To find out more, watch Koh Hwee Joo, Senior Director of UOBAM’s Sustainability Office, as she shares her outlook on Singapore’s green bond market.

Why invest in green bonds

Beyond the desire to “do good”, investors hold green bonds for the same reasons they invest in traditional bonds – returns and income.

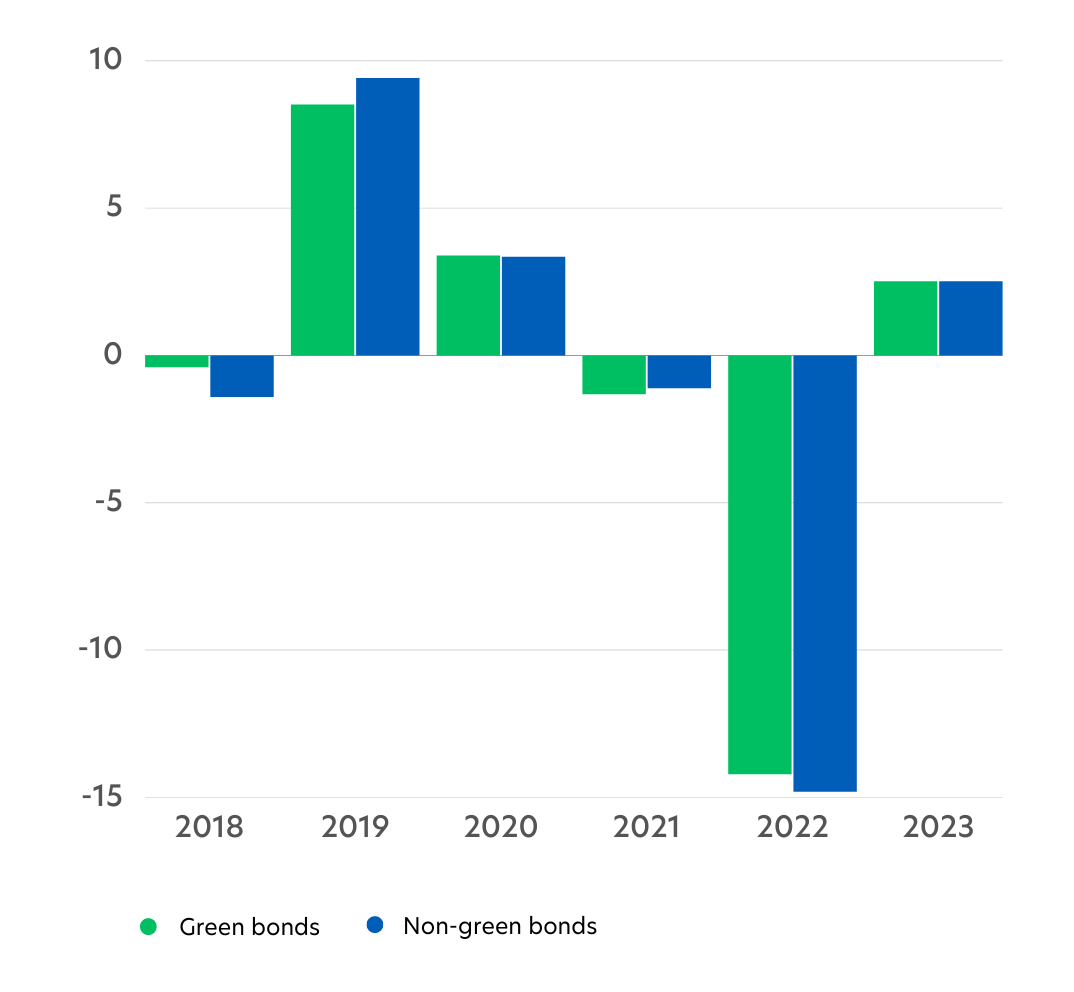

Historically, the duration-adjusted returns of green bonds have similar characteristics to non-green bonds.

Figure 3: Duration-adjusted returns (%) of green and non-green bonds

Sources: Bloomberg, J.P.Morgan Asset Management. Data as at Jan 2023

But over time, green bonds’ additional benefits will likely come more to fore:

1. More defensive than conventional bonds

Green bonds tend to be more defensive than traditional investment-grade corporate bonds because issuers of green bonds are typically large, stable entities such as financial institutions and utility companies6. Such entities usually hold up well even during a downturn.

Green bonds also tend to exhibit lower volatility over time. Many green bond investors such as pension funds have a longer-term horizon. As such, they are unlikely to panic sell their holdings in a crisis.

2. Strong growth potential

As the world transitions to a low-carbon economy, the demand for green bonds should remain elevated. This is set to drive the continued growth of the green bond market.

With new issuers entering the market, investors can also expect to see a more diverse investment opportunity set in terms of issuer type, sector, geography, and credit quality.

1World Bank, Green, Social, and Sustainability (GSS) Bonds, November 2022

2S&P Global, Sustainable Bond Issuance Will Return To Growth in 2023, Feb 2023

3McKinsey, How Big Business Is Taking the Lead on Climate Change, Mar 2022

4Climate Bonds Initiative, ASEAN Green Finance: State of the Market 2020, Apr 2021

5Bain, Southeast Asia’s Green Economy 2021: Opportunities on the Road to Net Zero

6Composition based on the Bloomberg MSCI Global Green Bond Corporate 5% Issuer Cap Index as of 26 April 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z