Investors appear spooked but not panicked by the rise in Middle East tensions. The United Global Durable Equities Fund offers a more cautious exposure to global equities

Heightened tensions in the Middle East following Iran’s unprecedented attack on Israel last weekend caused this week’s global market returns to weaken by 1 percent. The world waits to see the scale of Israel’s response, but we are hopeful that a major escalation of hostilities can be avoided, especially as the US has said that it will not participate in any Israeli military response.

Equity markets that have rallied strongly this year appear to be heading for a new period of uncertainty and volatility. However, given strong US growth and rate cuts in the EU by June, the appetite for global equities is unlikely to have diminished. Instead, investors will be looking for opportunities to diversify their portfolios towards more safe-haven assets like gold and the US dollar, and less risky bond and equity exposures.

United Global Durable Equities Fund (the “Fund”)

Equity investors seeking greater stability may want to turn to companies with stable earnings, are reasonably priced, and offer a more consistent business model.

The objective of the United Global Durable Equities Fund is to invest in such companies from across the world. In particular, the Fund looks out for under-rated companies, that is, those that exhibit more stability than the market perceives. By selecting stocks using an unconstrained, high-conviction approach, the Fund is able to achieve moderate capital appreciation while limiting downside risk.

The Fund’s target companies are those that meet the following criteria:

1. Resilient earnings

Can maintain stability and consistency in earnings regardless of the broader economic environment. This typically means those in industries that have steady competitive dynamics, low economic sensitivity, and long product cycles.

2. Under the radar

Tend to fall outside the usual classification of growth, value or quality stocks, and are therefore not within the sights of style-focused investors. Rather, these companies are rarely in distress, have not fallen out of favour, and have steady, single-digit organic growth.

3. Experienced management team

Have good management practices such as cost control and skilled execution as a way of generating long-term earnings growth and/or increasing dividends, ultimately creating long-term shareholder value.

Good diversification opportunities

This selection process results in a portfolio made up of unconventional yet stable companies, and therefore has less tendency to overlap with other traditional growth, value, or quality funds. This makes the Fund a good diversifier for an investor with existing global equities exposure.

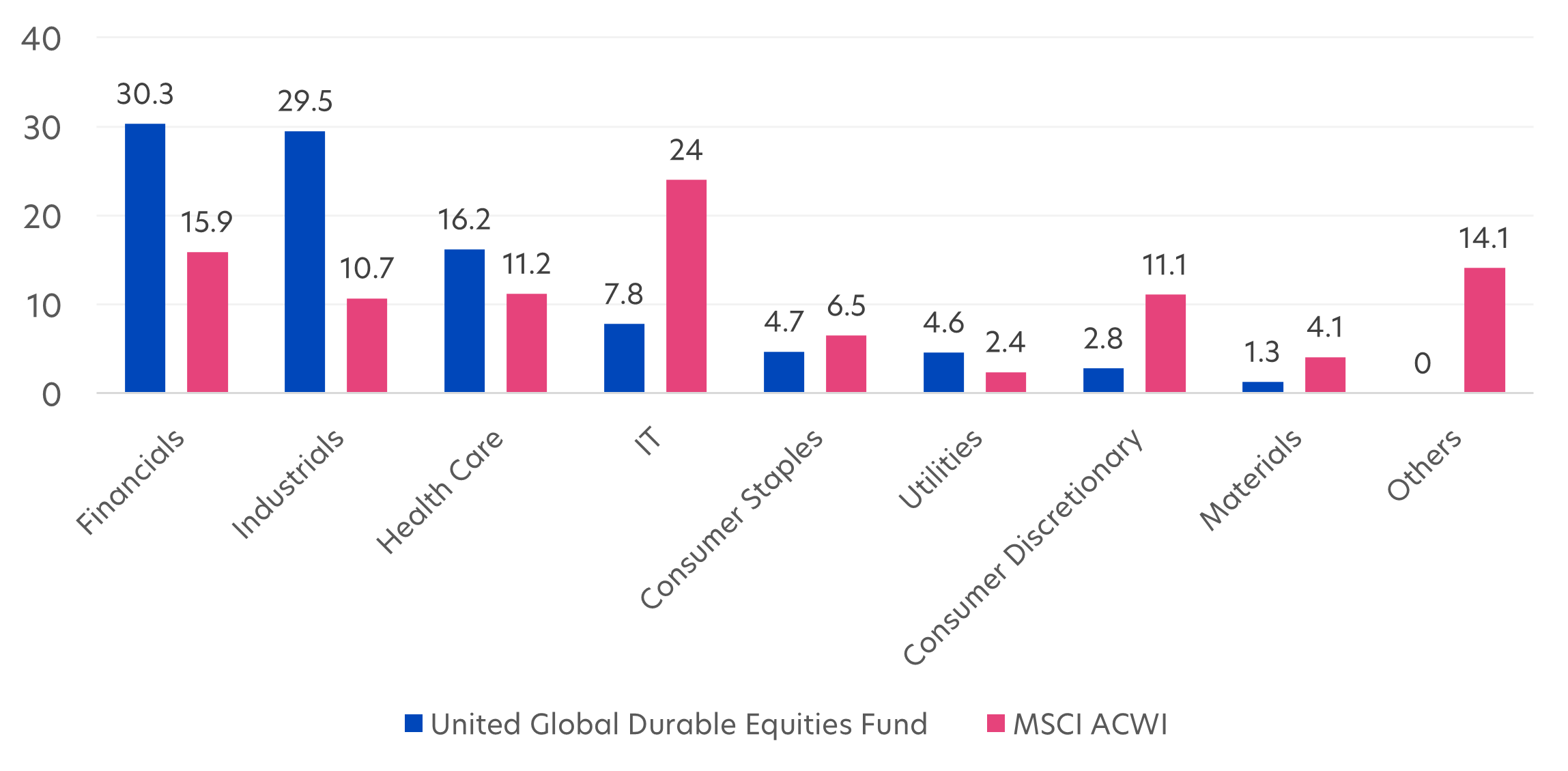

For instance, Information Technology (IT) accounts for around 24.0 percent of a typical global benchmark such as the MSCI All Country World Index (ACWI)1. Yet less than 10 percent of the Fund is in IT. Instead, the majority of the Fund – about 60 percent – is invested in financial and industrial companies, whereas these two sectors together make up only about a quarter of the benchmark.

Fig 1: Fund sector allocation (%) versus MSCI ACWI

Source: UOBAM/MSCI ACWI, as of 29 Feb 2024. Others: Communication services, Energy, Real Estate

Fig 2: Fund top 10 holdings

| Company name | Weight (%) | Description |

| Intact Financial Corp | 6.88% | Canadian multinational property and casualty insurance company |

| Constellation Software | 5.44% | Canadian diversified software company for public and private sector markets |

| Brenntag SE | 4.73% | German multinational chemical distribution company |

| US Foods Holding | 4.73% | American food service distributor |

| Engie SA | 4.59% | French multinational utility company involved in electricity generation, natural gas, nuclear, renewable energy and petroleum |

| BWX Technologies | 4.30% | American manufacturer of nuclear components and fuel |

| Arthur J Gallagher | 3.88% | American global insurance brokerage and risk management services firm |

| Finecobank Banca Fineco | 3.45% | Italian bank specialising in online brokerage |

| HDFC Bank | 3.35% | Indian banking and financial services company |

| HCA Healthcare | 3.33% | American healthcare facilities operator |

Source: UOBAM, 29 Feb 2024

Income and steady returns

Most of the companies held by the Fund are dividend-paying. As such, the Fund has an annualised dividend yield of 5.50 percent per annum, paid out monthly (Class A SGD Dist)2. Additionally, the Fund offers the opportunity to enjoy potential capital gains. Over the past five years, the Fund has generated an annualised total return of 7.97 percent.

Fig 3: Fund returns

| Annualised performance | |||

| Year-to-date | 1-year | 5-years | |

| United Global Durable Equities Fund | 5.12% | 12.60% | 7.97% |

| Fund (Charges applied^) |

-0.13% | 6.95% | 6.87% |

Source: Morningstar. Fund performance is calculated on a NAV to NAV basis, SGD basis, with dividends and distributions reinvested, if any. Performance as of 29 February 2024, based on Class A SGD Dist.

^Includes the effect of the current subscription fee that is charged, which an investor might or might not pay

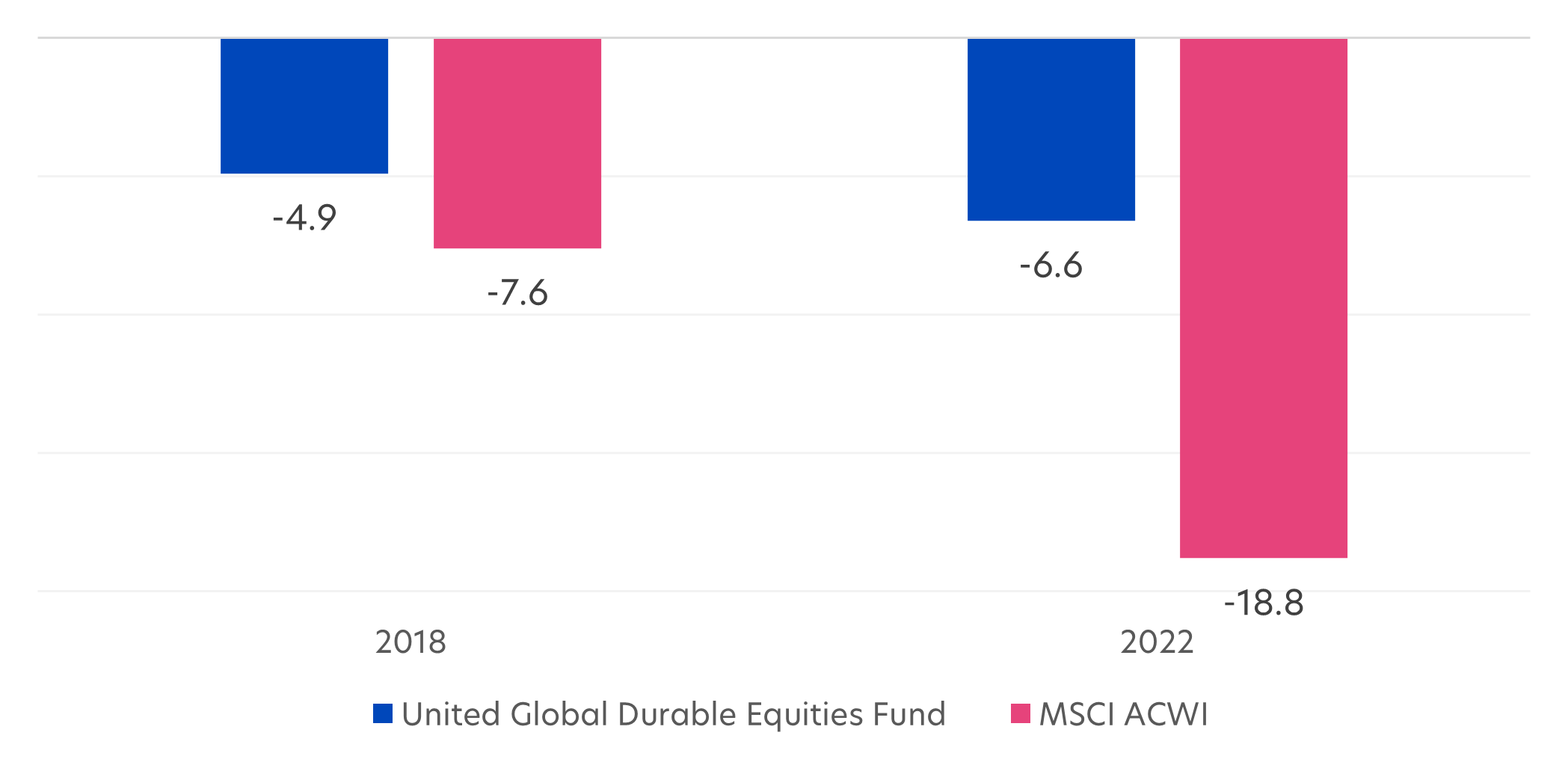

Perhaps even more importantly in this climate, the Fund has only experienced two negative years since its inception in 2015. Despite this, the Fund still managed to outperform the MSCI ACWI. This reflects the Fund’s emphasis on balancing capital gains and downside risk.

Fig 4: Fund outperformance in down years (%)

Source: Morningstar. Fund performance is calculated on a NAV to NAV basis, SGD basis, with dividends and distributions reinvested, if any. Performance as of 29 February 2024, based on Class A SGD Dist.

Fund Details

| United Global Durable Equities Fund, as of 29 Feb 2024 | |

| Investment objective | The Fund seeks total return consisting of capital appreciation and income over the long term by investing primarily in equity and equity related securities of companies listed and traded on stock exchanges globally. |

| Distribution Policy | Monthly distributions of up to 5.50% p.a.* *Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus. |

| Fund class available | Class A SGD Acc Class A SGD Dist Class A USD Acc Class A USD Dist |

| Management fee | Currently 1.75% p.a.; maximum 2.5% p.a. |

| Subscription fee | Currently up to 5%; maximum 5% |

| Minimum subscription / trading size | S$1,000/US$1,000 (initial) S$500/US$500 (subsequent) |

1Source: MSCI ACWI, as of 29 Feb 2024

2Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Global Durable Equities Fund You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the net asset value (NAV) per unit of the relevant Distribution Class as at the last business day of the calendar quarter or month. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. UOBAM reserves the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of income, capital gains, capital or otherwise) may have the effect of lowering the NAV of the relevant fund. Moreover, distributions out of capital may amount to a reduction of part of your original investment and may result in reduced future returns. Please refer to the Fund's prospectus for more information.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z