- China’s policy relaxations are still modest, but the pace has picked up

- As a result, China’s economic slowdown appears to be bottoming

- We are on the lookout for more opportunities, but remain underweight

More funds becoming available

Last week saw the People’s Bank of China announce yet more measures to inject liquidity into Chinese financial system, in what appears to be a “drip-drip” rather than “big bang” approach to economic stimulus. This announcement to cut financial institutions’ reserve requirement ratio (RRR) by another 25 basis follows a similar cut in March this year. The rate for big banks now stands at 10.5 percent, a gradual relaxation from the 11.25 percent level in October 2022.

The latest cut will mean around CNY500 billion of additional liquidity in the banking system. Banks will be able to provide more business and personal loans, and help soak up the large amount of local authority bond issuances due this year to finance infrastructure projects.

Another CNY591 billion of funds is also being made available via the 1-year Medium Term Lending Facility (MLF). This more than replaces the CNY400 billion that recently matured, with another CNY3.76 trillion set to mature over the next two quarters.

Industrial production is rebounding

Meanwhile, China’s economy, having been battered over the past few months by disappointing growth news, is starting to show more positive signs. For example, in August, industrial production grew by 4.5 percent compared to a year ago, beating analyst expectations.

The recovery was encouraging for the high-tech manufacturing sector, which recorded a 5-month low of 0.7 percent year-on-year (yoy) expansion in July, but managed to jump back up to 2.9 percent in August. However, it was chemicals, raw materials and products manufacturing that saw the biggest gains of 14.8 percent in August compared to a year ago.

Retail sales are also growing at a faster-than-expected pace of 4.6 percent in August, and 7.0 percent so far this year compared to similar periods in 2022. The boost came from consumer spending in items such as cosmetics, communication appliances and jewellery.

Improvement in manufacturing conditions

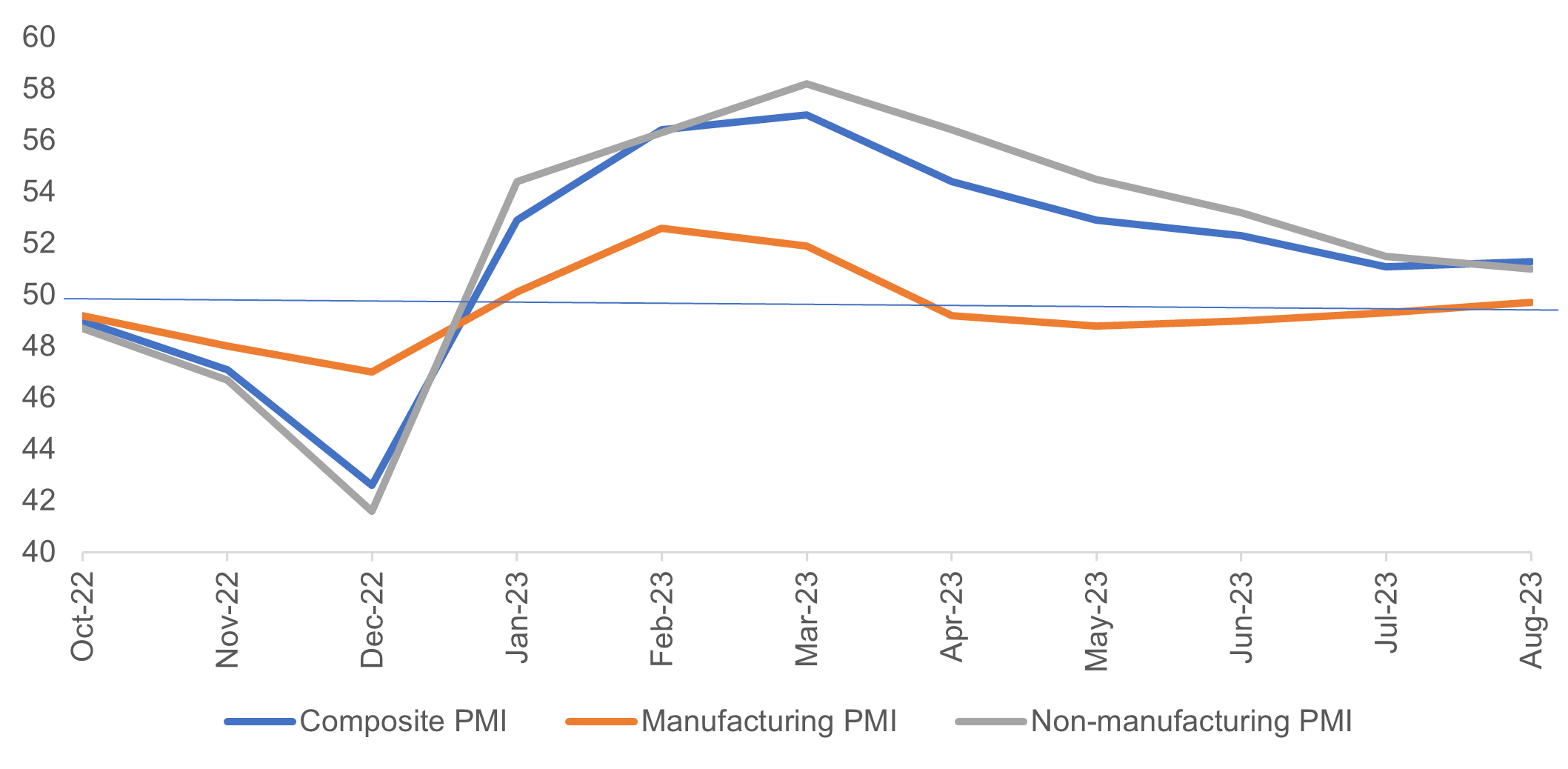

The higher industrial production last month is supported by a similar trend in China’s Purchasing Managers’ Index (PMI). This index provides an indication of whether economic activity is expanding or contracting, across both manufacturing and non-manufacturing (i.e. services) sectors. In August, the manufacturing PMI rose to 49.7 from 49.3 in July, marking a near-neutral level for manufacturing market conditions. In general, the sentiment among manufacturing business owners seems to be improving as stimulus measures are announced at increasing frequencies.

Figure 1: Main PMI indices, Aug 2023

Source: NBS, UOBAM

However, the non-manufacturing PMI missed expectations. Although now at 51.0, that is, above the neutral level of 50, the non-manufacturing sector has been affected by declining new orders and extreme weather conditions. As a result, business sentiment for this sector is at its weakest level this year, but we would expect it to follow manufacturing sector trends in due course.

Property market stabilisation

The property sector downturn is perhaps the most difficult to stabilise, although the government has been working to introduce a range of nationwide easing measures. This includes a minimum down-payment ratio at 20 percent for first-time homebuyers and 30 percent for second-time homebuyers. In higher-tier cities, this was previously 30 percent and over 40 percent respectively.

In addition, first-time homeowners will be allowed to replace their existing mortgage with a new loan on a lower rate, while the minimum mortgage rate for second-time homeowners has been lowered to a Loan Prime Rate (LPR) of 20 basis points from 60 basis points previously.

These measures suggest that the government will help to drive greater interest in property ownership ahead of the traditional peak buying season in September and October (金九银十).

How effective are the measures?

Investors are hoping that the roll-out of policy measures so far and in the future will help prop up consumer confidence. At the moment, in stark contrast to the US and most other parts of the world, China is facing deflationary pressures. This tends to cause consumers to delay their purchases, thereby undermining growth and demand. It is not yet clear how effective these policies will be, and as a result, UOB Asset Management (UOBAM) remains tactically underweight China. However, the introduction of new measures seems to be gaining pace. and we believe that this will open up new opportunities in China even before growth fully recovers, possibly in 2024.

If you are interested in investment opportunities related to the theme covered in this article, here are two UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z