- This week’s National Party Congress (NPC) is focused on re-establishing economic stability in the wake of China’s re-opening

- There is potential for China’s 5.0 percent growth target to be exceeded, driven by domestic consumption

- The threat of more US sanctions is not expected to significantly dent China’s trade with the US and rest of the world

It has been a busy week on the Chinese political calendar. Alongside the opening of the so-called “two-sessions” National Party Congress (NPC) came the release of China’s official GDP forecast for 2023, set at “around 5.0 percent”.

This is China’s lowest growth target on record, and has not been well received by financial markets. Nevertheless, given that the official forecast for last year was 5.5 percent, against an actual growth rate of only 3.0 percent, it seems that this year the Government is keen to under-promise and over-deliver.

There are several reasons to be optimistic about China’s growth this year:

1. Economic activity is recovering

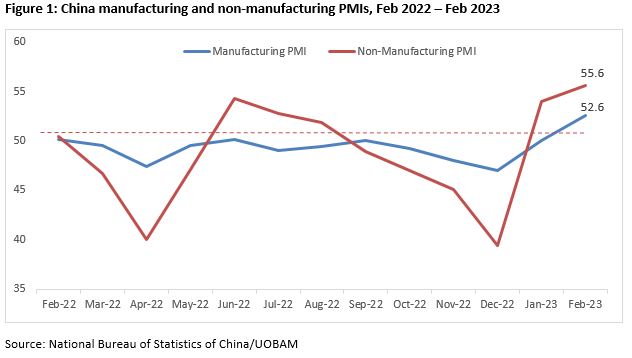

After four months of contraction, China’s Purchasing Managers Index (PMI), for both manufacturing and non-manufacturing have bounced off their December lows and re-entered expansion territory.

The jump in the manufacturing PMI in February is particularly significant. It was a larger uptick than expected and suggests that the recovery may be gathering momentum. Three months into China’s reopening, the strong rise is also helping reassure investors that the reopening is not losing steam.

2. Ramp up in the services sector

To ensure sustainable growth, China’s NPC has also endorsed a higher urban employment creation goal of 12 million in 2023, higher than the 11 million in 2022.

This goal is likely to be met by the expected expansion of the services sector, as signalled by the rise in the non-manufacturing PMI. Already in February, non-manufacturing companies, especially those in the construction industry, showed higher employment rates than the previous month. Business activity within the services sector was also up.

3. Return of domestic consumption

The government work report presented at the NPC warns that China faces external challenges in 2023 given slower global growth, and therefore less demand for Chinese exports.

As such, there is a need to look closer to home. A number of policies have been announced that are directed at boosting domestic consumption, including the lifting of urban and rural incomes. Already, we detect a rebound in travel, dining and retail spending since the Spring Festival holiday. However, as mentioned in a previous report, this recovery will likely be gradual as people slowly resume their pre-Covid activities.

4. Potential for more policy support

The NPC this week saw the unveiling of several new policy measures including an increase of its deficit-to-GDP ratio to 3.0 percent from 2.8 percent last year. The annual quota of special-purpose bonds has also increased by 150 billion yuan to 3.8 trillion yuan (US$551.12 billion).

However. we would note that these and previous measures are still relatively modest, with room for more aggressive fiscal support in the future. The measures so far seem to be acting more as a buffer than an economic driver, and the government appears to be keeping this tool in its back pocket for now.

Not all plain sailing

However, we do not expect the road to recovery to be entirely smooth. Here are some of the most significant challenges:

- Over the next two quarters, while China’s reopening will be a positive force, the uncertain external environment may delay the normalisation of the business supply chain.

- China’s own National Development and Reform Commission (NDRC) warns that “resuming growth in real estate investment is an uphill battle.”

- Some local governments are facing fiscal imbalances and a number of their financing platforms are incurring debt risks.

- A US crackdown on China entities hit the headlines again last week, with genetics firm BGI Research, server manufacturer Inspur Group and chip maker Loongson among dozens of Chinese tech firms banned from exporting to the US. Despite this dial up in the US-China trade and tech war, we are not pessimistic about its outcomes. US-China trade hit a record high in 2022 and the US remains China’s top single-country trading partner. Over the medium term, we believe US firms will face significant difficulties replacing China’s production quality and scale, and hence a major change in current trading arrangements seems unlikely.

- Over the longer term, China will need to become more tech self-sufficient. We are closely monitoring the Chinese landscape to identify companies able to reduce their reliance on imported tech know-how.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z