A rising economic powerhouse

Over the last half century, China has achieved remarkable economic growth, transforming from a predominantly agricultural economy to the second largest economy in the world. China’s goal for 2035 is to become ‘moderately developed’ and President Xi has outlined a path towards doubling the size of the Chinese economy by 2035. This will imply per capita gross domestic product (GDP) of around US$20,000 and at this level of income, China’s economy would be the largest in the world1.

Partake in the growth opportunities offered by China’s 14th Five-Year Plan

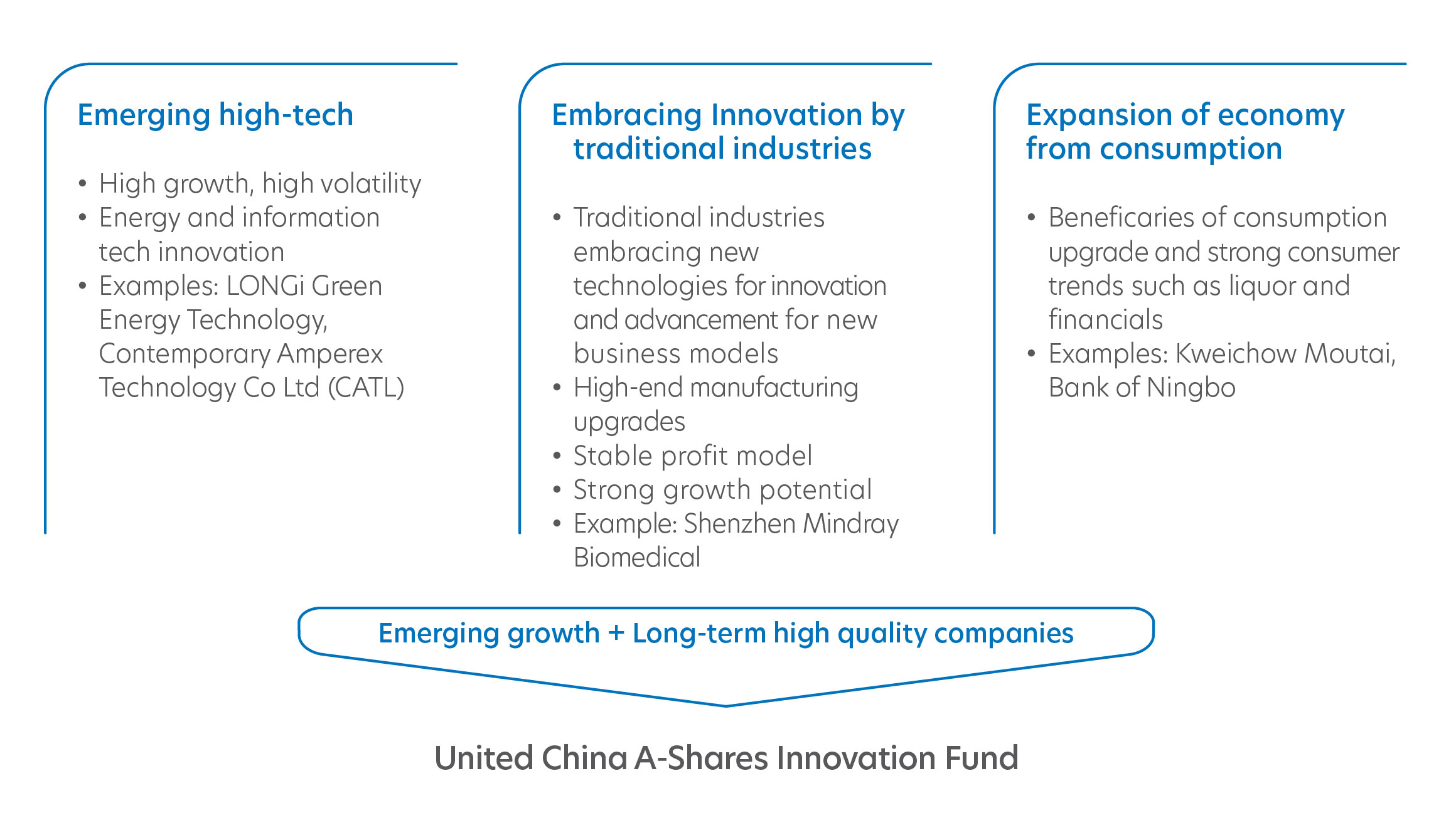

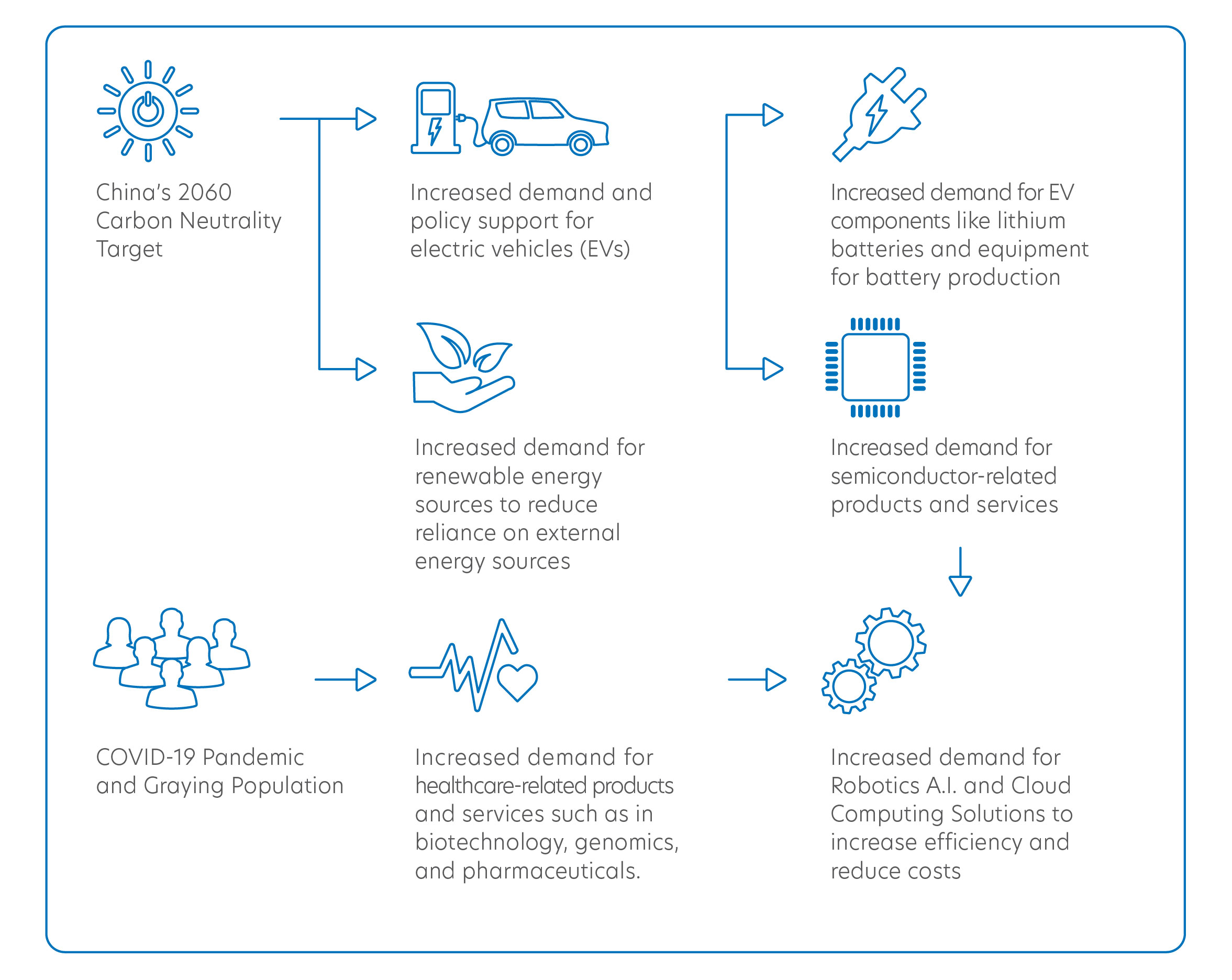

China’s 14th Five-Year Plan (FYP) envisaged the development on the sustainability of growth and the quality of life of its citizens. Technological innovation, green energy, and people’s well-being continue to be of utmost importance to the Chinese government and certain sectors are poised to benefit from the policy tailwinds.

China’s drive for cutting-edge technological innovation

Innovation is the core driver of China's high-quality development and the top priority of the 14th FYP. In particular, China will enhance basic research to generate breakthroughs in seven frontier technologies, including next-generation artificial intelligence (A.I.) and quantum information.

China’s shift towards more consumption-based economy

During the 14th Five-Year Plan period, China will mainly focus on expanding consumption and encouraging investment in its effort to create a unified domestic market. The Chinese government defines a unified domestic market as being highly efficient, rule-based, fair and open. It will remove local protectionism, market segmentation and impediments restricting economic circulation, thus facilitating the smooth flow of products and resources on a larger scale to effectively meet the needs of both China and the world2.

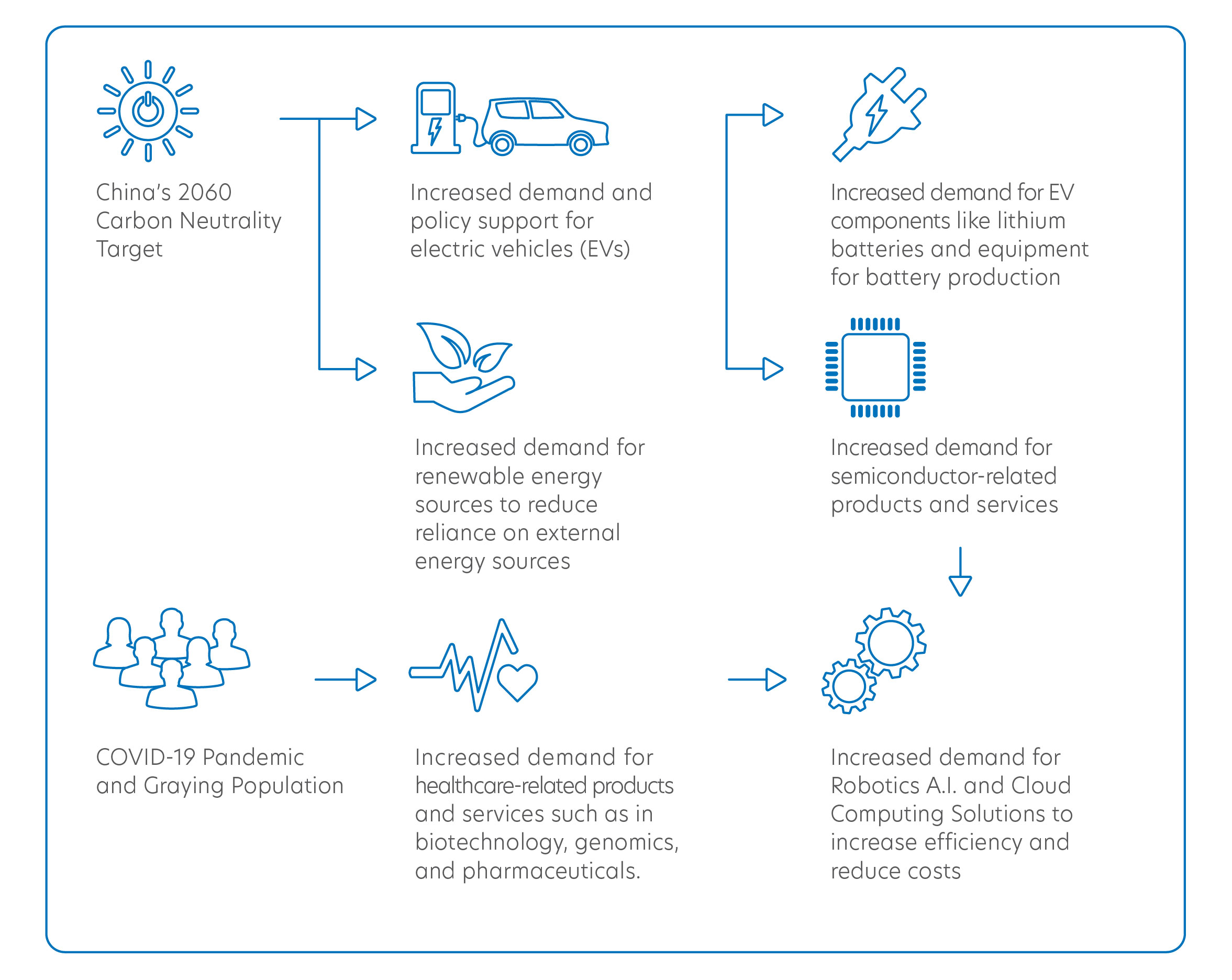

China’s green economy roadmap

China aims to reduce carbon emissions per unit of GDP by 18% by 2025, achieve peak carbon emissions before 2030, and carbon neutrality before 20603. To control both the intensity and volume of carbon emissions, the country will explore non-fossil energy while keeping a balance between economic growth and reductions of carbon emissions. To achieve their carbon emission objectives, investment on a massive scale, amounting to hundreds of trillions of renminbi, will be required, which will make green investing in China a lucrative sector. The Fund will allow investors to ride on China’s green economy’s road map by investing into clean energy.

Example of how structural developments affect China's industries

Key emerging opportunities in China

Themes

|

Description

|

New Consumption Market  |

With China’s middle class expected to double from around 400 million people to 800 million people in 20351, China’s potential for rising consumption is substantial. The rise of Chinese brands, the diversification of service consumption patterns and the improvement of modern logistics represent remarkable developments for the consumer market, and these trends will continue to be prominent during the 14th FYP period. To tap on China’s new consumer market, leading food and beverage companies are investing in innovation to capture market growth in areas including health-oriented and nutrition-focused products4.

Subsectors include: Food products, beverages, personal products, food & staples retailing |

New Infotech  |

The high adoption of A.I. solutions in China today can create US$600 billion in economic value annually5. According to Stanford University’s A.I. Index, China is one of the top three countries for global A.I. vibrancy6.

Subsectors include: 5G, A.I., Internet of Things (IoT), data centres, biotechnology, research & development |

New Industries  |

China is home to innovative firms that produce high quality products more efficiently and cheaply than foreign competitors. For example, China is a leader in EV battery production given its competitive advantage and access to raw materials7.

Subsectors include: Ion-lithium EV battery manufacturing, electric vehicles, consumer electronics, alternative power sources |

New Materials  |

Transformations occurring in the energy, automotive, logistics, manufacturing, and construction industries are driving demand for new materials. The materials industry trends include development of intelligent materials, nano-formulations, and advanced composites, with time-to-market accelerated by A.I..

Subsectors include: Raw materials, chemicals, packaging, metals and mining biotechnology, research & development |

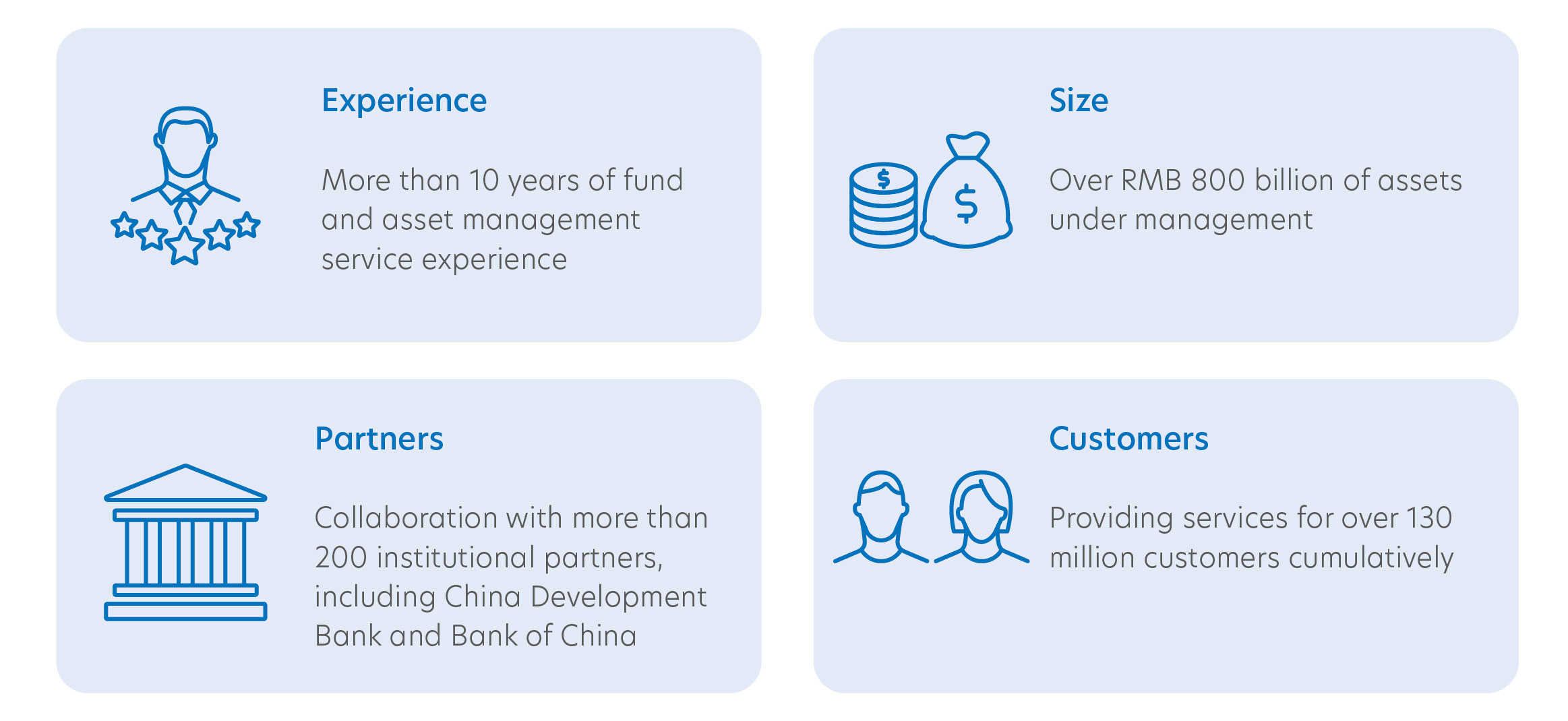

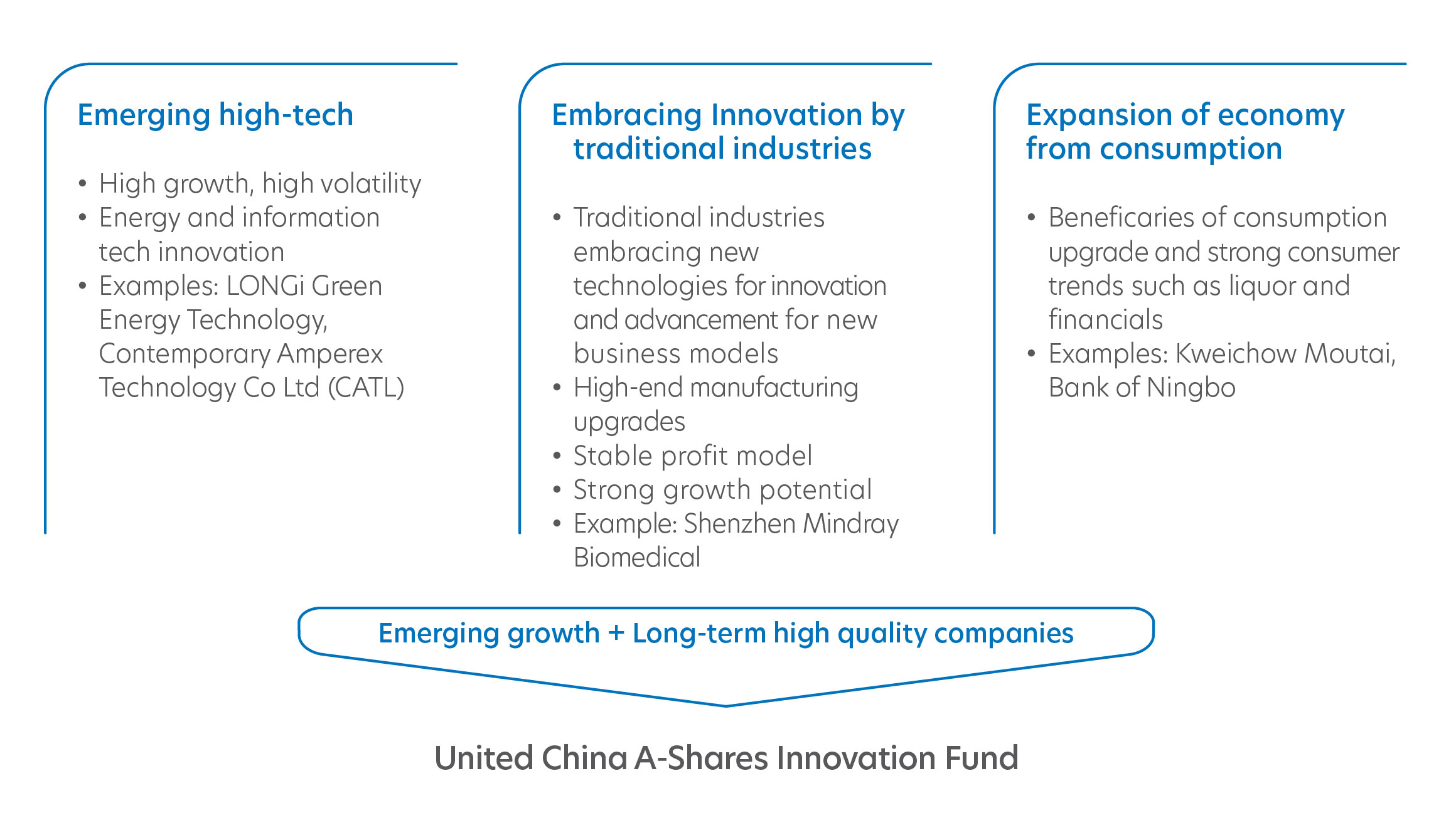

Capture China’s emerging opportunities with the United China A-Shares Innovation Fund

Source: UOBAM, as at 30 November 2022