- August’s market rally especially benefited smaller cap tech stocks

- Falling yields are a key driver, but investor confidence has also increased

- We expect to see sustained fund flows into high growth sectors as China intensifies domestic chip development

Paul Ho, Group Head of Asia ex Japan Equities

China A-shares market roars back to life

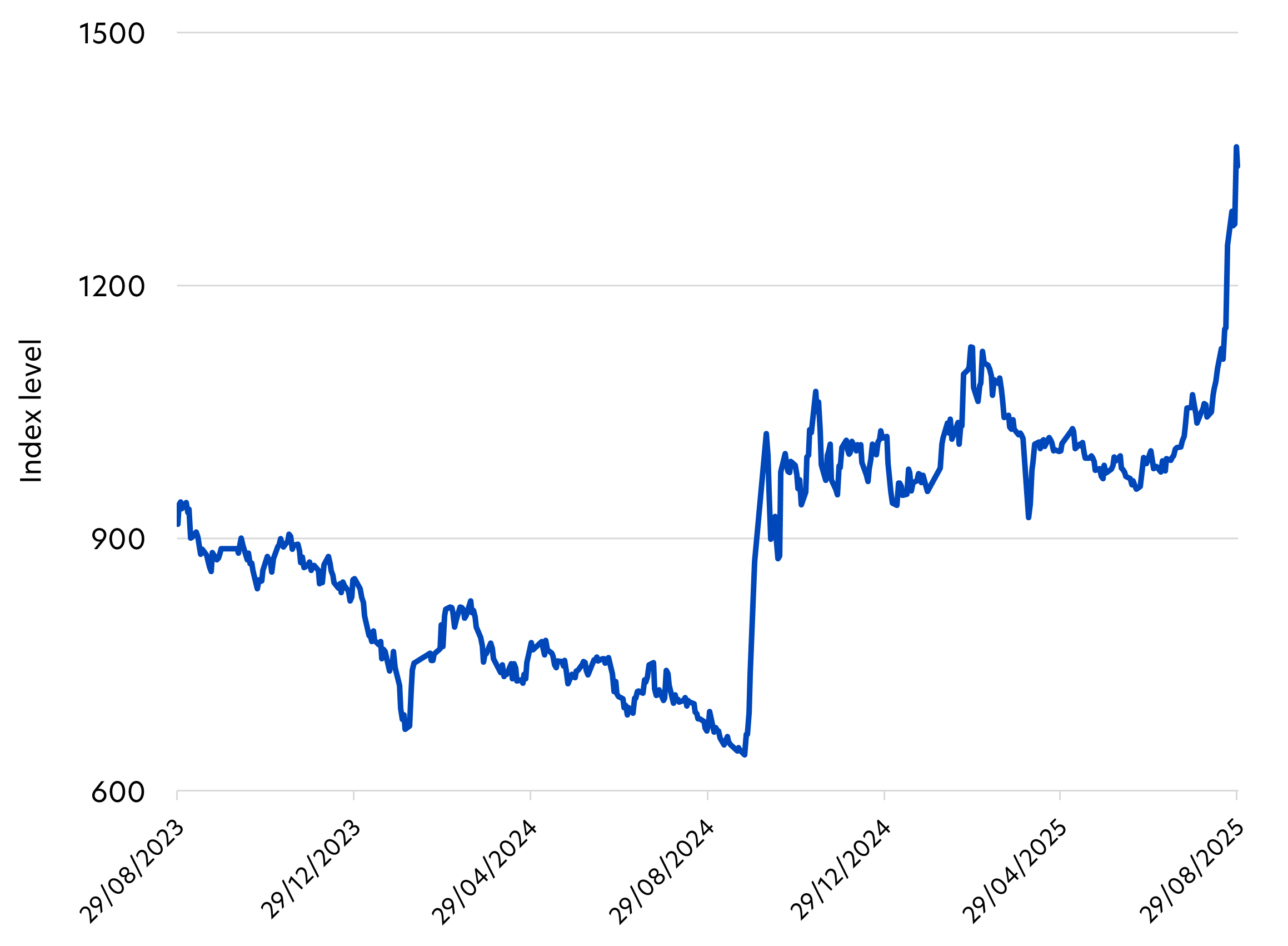

Over the past few weeks, the China A-shares market has shifted up a gear. The CSI 300 index, which tracks the top stocks on the Shanghai and Shenzhen stock exchanges, has gained 17.5 percent YTD, of which more than half – 10.3 percent – has come in the past one month.

But if we focus in on the A-shares tech sector, the gains are even more impressive. Shanghai’s SSE Star 50 Index is up by 29.8 percent, and Shenzhen’s ChiNext index is up 23.0 percent over the same one-month period.

Fig 1: SSE Star 50 Index, Aug 2023 – Aug 2025

Source: Bloomberg, as of 29 Aug 2025

It appears that the current rally is largely liquidity driven, that is, money is pouring into the China A-shares market from domestic retail and institutional investors, as well as offshore global and hedge funds. The spark that kicked off the rally was likely the prompt from the Chinese government for local firms to seek local alternatives to Nvidia’s H20 chips.

So can this latest rally last? We assess some of the key drivers.

1. China in a multilateral world

This rally may be surprising for some observers, given that the dust stirred up by US tariffs is yet to fully settle. However, the current consensus is that the US and China will avoid a worse-case scenario when the trade truce expires in November.

While the US’s bluster continues, most recently around access to China’s rare-earth magnets, the odds of a US-China trade embargo have dropped considerably. US tariffs on Chinese imports are expected to average around 30 percent, to be ratified at a potential Trump-Xi summit later this year.

Meanwhile investors seem impressed by China’s attempts to cement its non-US economic and political partnerships. This week’s gathering of the Shanghai Cooperation Organisation (SCO) was another reminder of this approach.

For example, at a time when many SCO member states, including India and Iran, are facing US tariffs and foreign aid cuts, President Xi has pledged over US$1.7 billion in new development loans and grants to the SCO community. By strongly supporting an alternative geo-political bloc, China offers investors opportunities for greater US diversification.

2. Risk-on sentiment

In addition to tariff relief, two factors have combined to bolster investor sentiment for China equities – declining yields and policy support.

China’s declining bond yields have been particularly steep in the last two years, with 10-year government bonds yields now around 1.7 percent compared to 3.0 percent at the start of 2023. For domestic investors, ranging from insurers to individual savers, this is leading to significant reinvestment risk. Similarly, global investors are faced with a depressed dollar and lower yields with some analysts expecting as many as three Fed rate cuts this year.

At the same time, the Chinese government has promised to maintain stock market stability. State owned insurers are now required to allocate 30 percent of new premiums to equities, while fund managers are directed to expand their holdings of mainland-listed equities by at least 10 percent a year for the next three years. This effectively places a floor on stock market corrections and has helped boost confidence among domestic and global investors alike.

As a result, investors are allocating more of their portfolios to A-share equities. While dividend-paying stocks are seeing a gradual rise, it is the smaller cap stocks with high growth potential that are currently leading the pack. Those in the AI, semiconductor, electronics, bio and optical tech, new energy and communications sectors are particularly in demand, with top performers seeing price gains over the last one month exceeding 100 percent.

3. Valuations are still attractive

The other major source of comfort for investors is China’s attractive valuations. Even taking into account the recent run-up, the China A-shares market continues to lag most global markets and its own historical trends. The CSI 300’s current level – ranging around 4,500 – is still about 30 percent below its all time high of 5,931 reached in February 2021.

In addition, the A-share market’s PE ratio of 11.2 is roughly in line with its 10-year average, and well below that of the US, EU and even some ASEAN markets. With a PE ratio of 26.2, the US market is currently valued considerably higher than its 10-year average of 19.3, prompting investors to search for cheaper alternatives.

Fig 2: Country PE ratios

| PE Ratio | 10-year PE average | |

| United States | 26.16 | 19.32 |

| Germany | 18.35 | 13.36 |

| Taiwan | 16.27 | 14.56 |

| Singapore | 16.07 | 13.02 |

| China | 11.22 | 11.06 |

Source: World PE Ratios, as of 29 Aug 2025

Furthermore, the focus in the first half of 2025 was on China’s big tech and internet companies which are typically listed on the Hong Kong stock exchange. On the other hand, the A-share market was deemed to be risky and investors expected to receive a higher premium above the risk-free rate.

As a result, the A-shares market registered a record-high Equity Risk premium (ERP) in April 2025, and levels continue to be elevated amid China’s sluggish economic data. However, as the effects of frontloading and excessive competition stabilise, and anti-involution policies kick in, we would expect to see an end to current deflationary trends. When this happens, there is room for a re-rating of mainland-listed companies, and for the A-shares market to continue its positive trajectory.

Made-in-China

There is also now real excitement around China’s potential independence of Western tech suppliers. Deepseek is actively using Huawei chips to train its models and Alibaba has just announced that it is now testing fully China-made AI inferencing chips. The ability to break free of its reliance on externally-sourced chips points to a new chapter in China’s tech future.

| If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider: United China A-Shares Innovation Fund

United Greater China Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z