This coming quarter will provide more clarity on the impact of US tariffs. We have become more confident that global cost pressures can be contained and growth will remain resilient. However, with the US market priced for perfection, there is little room for surprises.

Chong Jiun Yeh, Group Chief Investment Officer

Corporates: Surprising resilience

Despite trade conflicts ignited by the US, the global economy has shown surprising resilience. In particular, we note that corporate profits around the world remain solid, a pattern reminiscent of other recent crises, including the Covid pandemic and aggressive interest rate hikes. In the US, the tariff crisis looks unlikely to result in widespread layoffs. Companies typically consider workforce reductions only when margins and profitability begin to deteriorate.

Inflation: Too early to celebrate

That said, we think it is premature to completely rule out recession and stagflation risks. We remain watchful of a delay in the negative effects of tariffs, given various pauses in implementation. Also, companies themselves have sought to temporarily absorb the higher costs. This means that the full impact of tariffs on US consumption patterns may not yet have become evident.

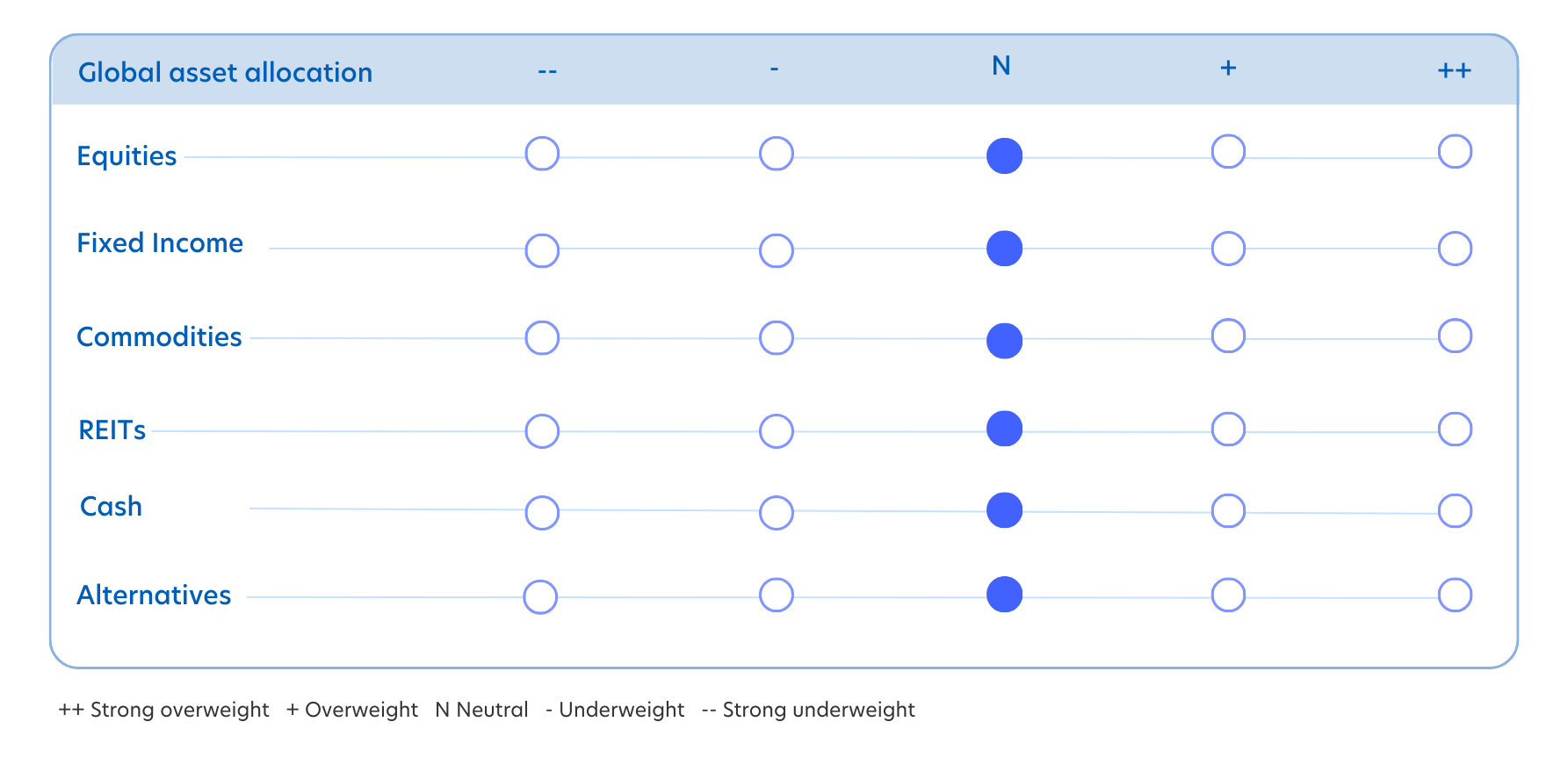

Asset allocation: Intentionally neutral

As such, we continue to take a neutral position across asset classes. This neutrality is strategic, rather than reflecting a lack of conviction. This coming quarter, we have raised our probability of sustained growth from 40 to 50 percent, and lowered our probability of a recession or stagflation-like conditions from 30 to 25 percent each. We believe a neutral positioning is the most resilient and offers the best chance of achieving positive returns across a range of outcomes.

Source: UOBAM, 4 Sep 2025. Note: *3-6 months horizon. The weights are relative to the appropriate benchmark(s), arrows show change from last quarter

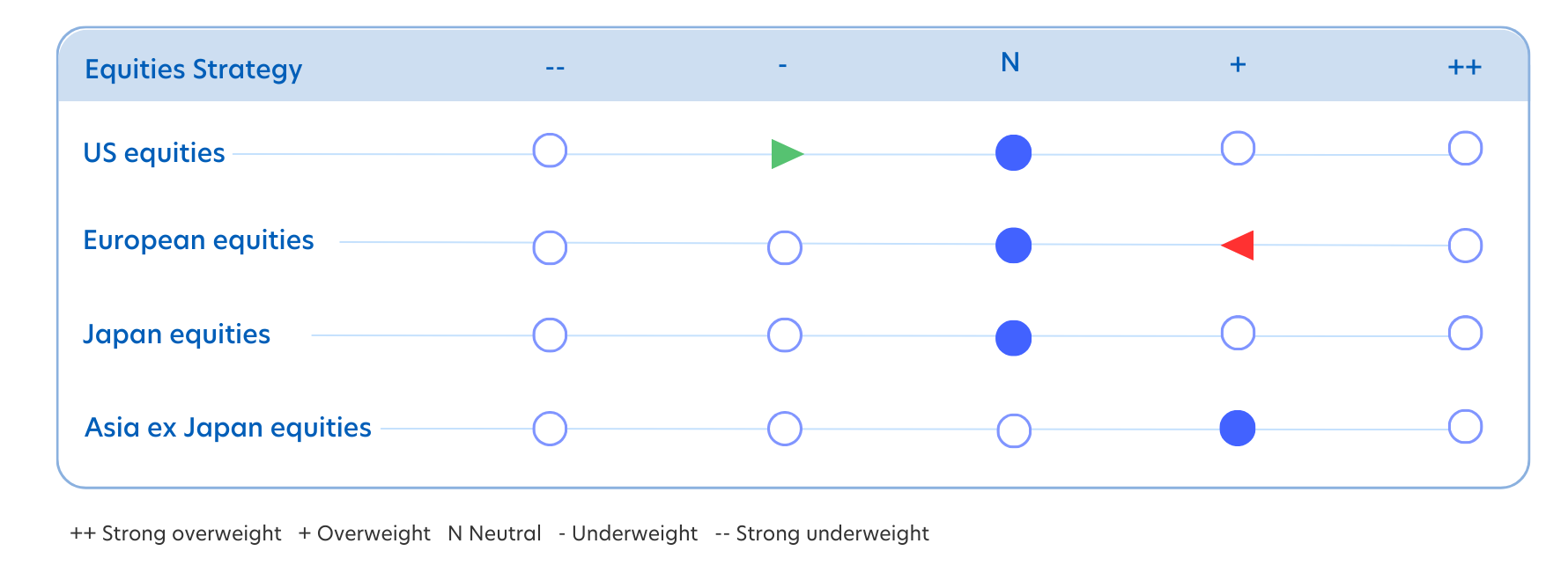

Equities: Less US-centric

The current strength of US equity markets reminds us of the mid-1990s, when innovation themes helped valuations climb to uncomfortable levels. Then, as now, there were good reasons to be cautious of the growing risks. But we also need to be wary of pulling the plug too early. Equity markets had several more years of double-digit returns before peaking in early 2000. We think that the current environment still offers equity upside but warrants a more diversified positioning. We would point in particular to the opportunities present in Asia.

Source: UOBAM, 4 Sep 2025. Note: *3-6 months horizon. The weights are relative to the appropriate benchmark(s), arrows show change from last quarter

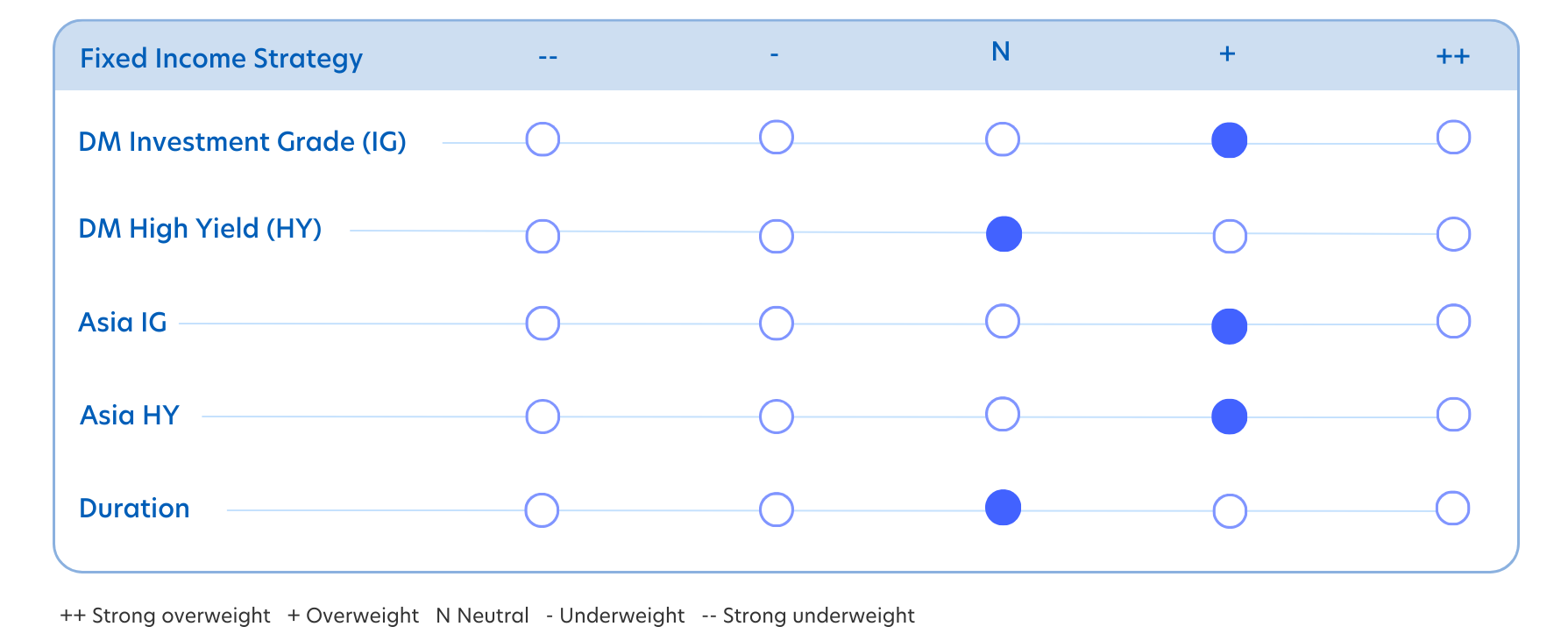

Bonds: Neutral duration and credit

The Fed’s easing cycle has resumed. After last week’s 25 bps cut, the market is now pricing in another one or two cuts before the year ends. Given our base case that developed market economies will remain resilient and all-in yields will stay relatively high, we think this continues to be a good environment to hold bonds for carry. However, we worry that bond markets may be underestimating the potential for higher inflation. As such, we remain neutral on both credit and duration, with 10-year US Treasury yields expected to trade between 4.0 to 4.5 percent.

Source: UOBAM, 4 Sep 2025. Note: *3-6 months horizon. The weights are relative to the appropriate benchmark(s), arrows show change from last quarter.

Read the full 4Q25 Quarterly Investment Strategy report here.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z