1. What is the minimum amount to start?

SGD 1 for Scan and Pay via PayNow, SGD 50 for eNETS

2. What will be my trade date?

The trade date will be the dealing date of your order. Unit Trusts and ETFs are subject to their fund holidays. Should your order fall on a fund holiday, the dealing date for your order will be the next business day.

3. When will my trade be completed after I make a top up or withdrawal?

It will usually be completed within 3-9 working days.

4. How do I sell the portfolio that I have under UOBAM Robo-Invest?

Log in to the Dash app and at UOBAM Robo-Invest Dashboard, select Withdraw and key in the amount that you wish to withdraw:

- We will then calculate and sell sufficient quantity of investments held under your portfolio. Once all sales proceeds are received, we will process the transfer of the funds based on your withdrawal instruction.

- If there is a withdrawal amount of >=95% of your portfolio value, UOBAM Robo-Invest will require you to withdraw all from your account.

5. Can I transfer out my portfolio held under UOBAM Robo-Invest?

No. Clients are not allowed to transfer their portfolio out from UOBAM Robo-Invest. You may only make withdrawals.

6. What is the risk profiling and when should I retake the risk assessment questionnaire?

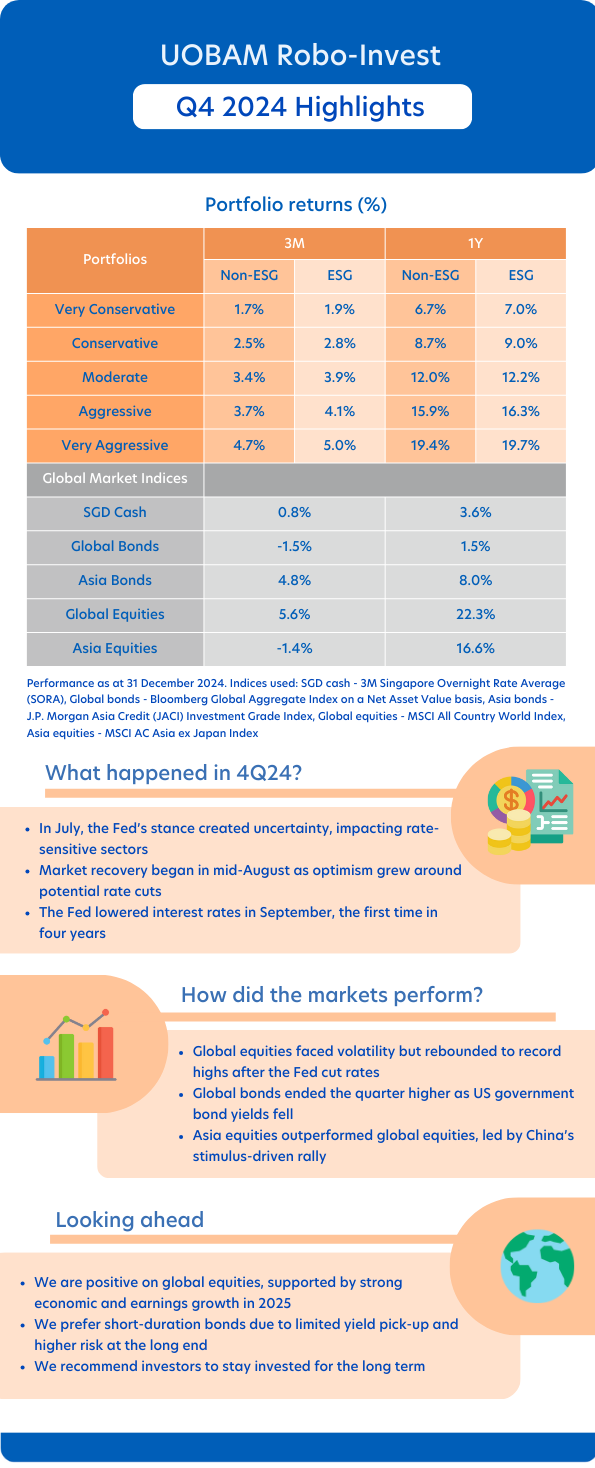

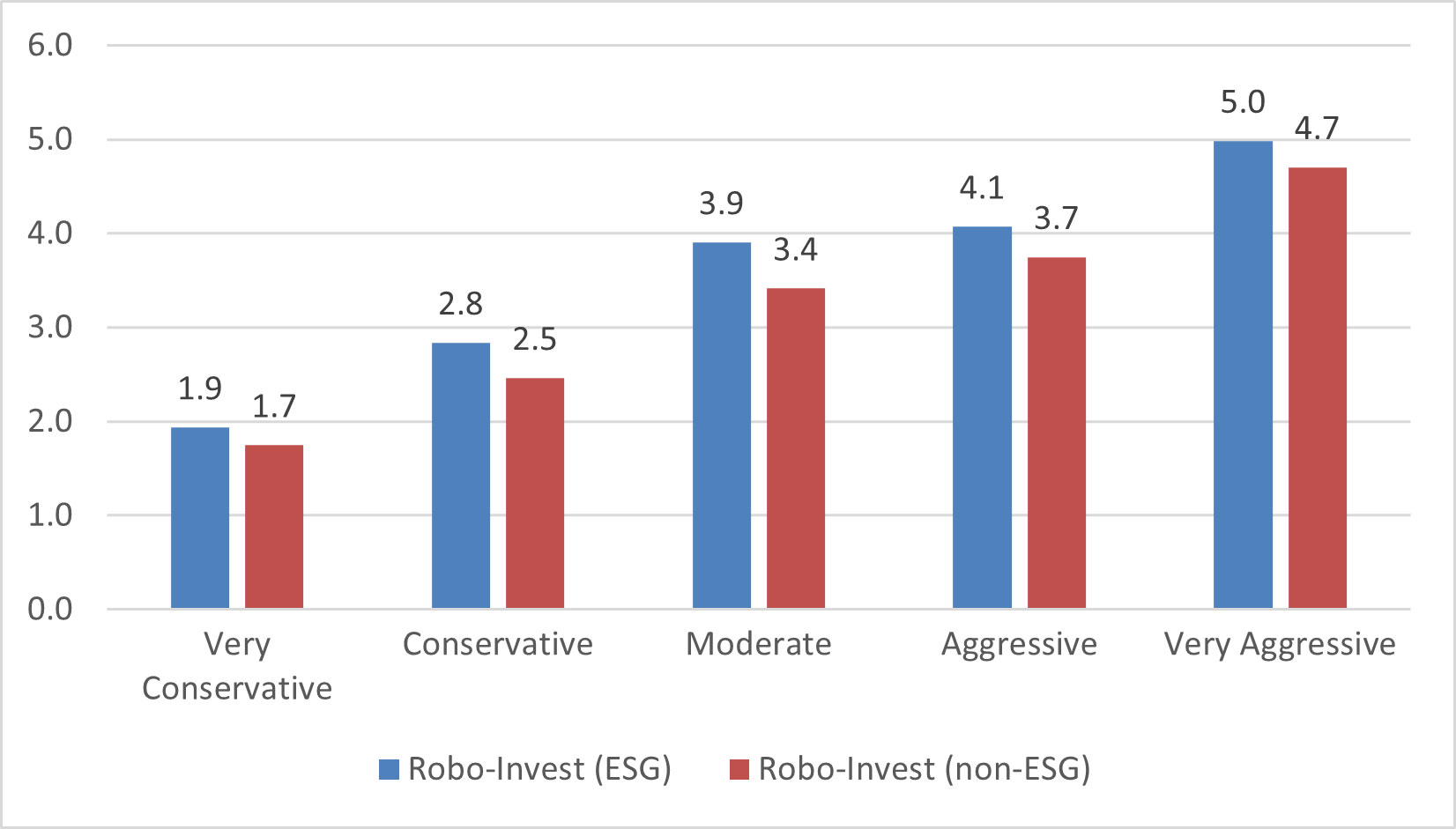

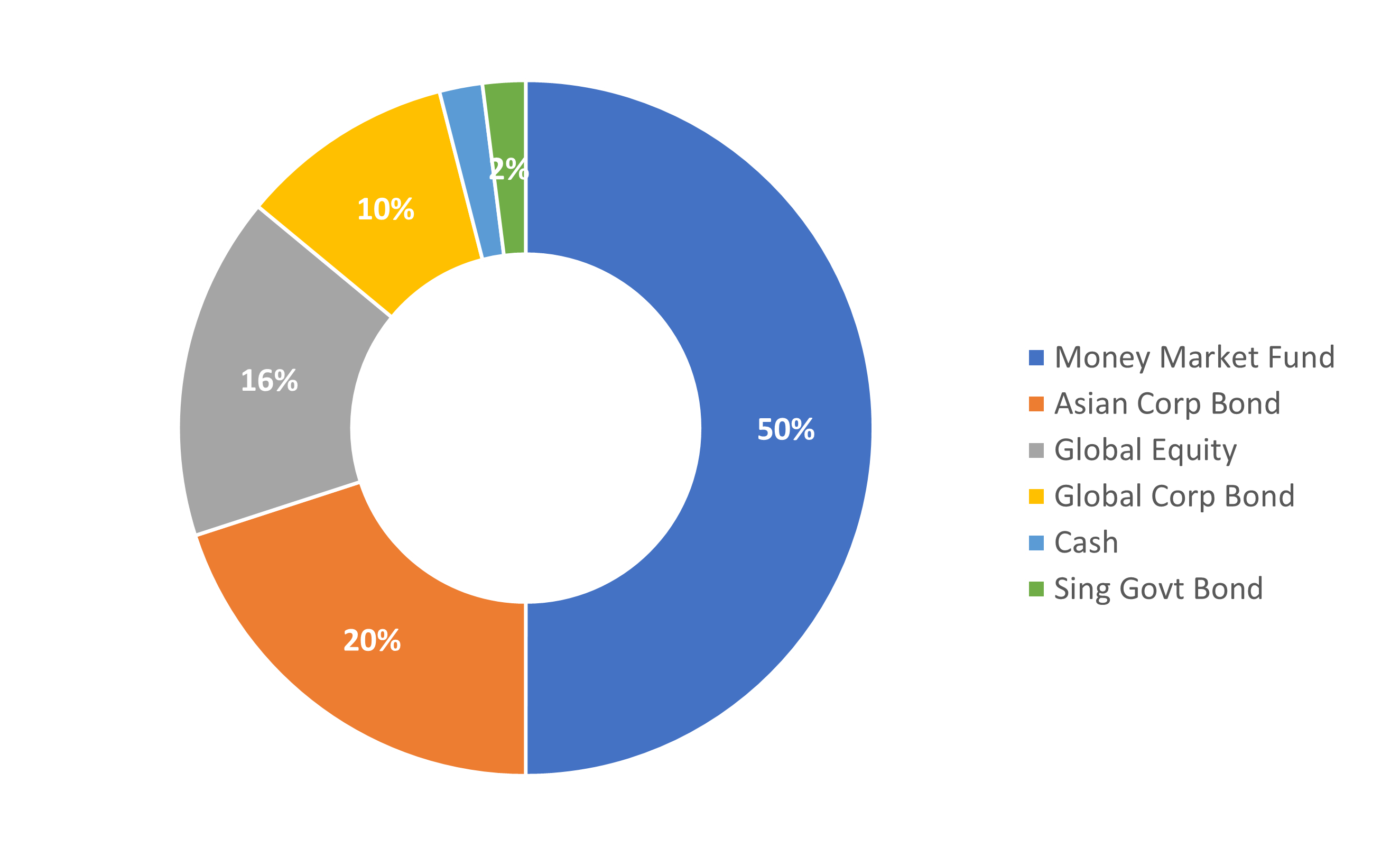

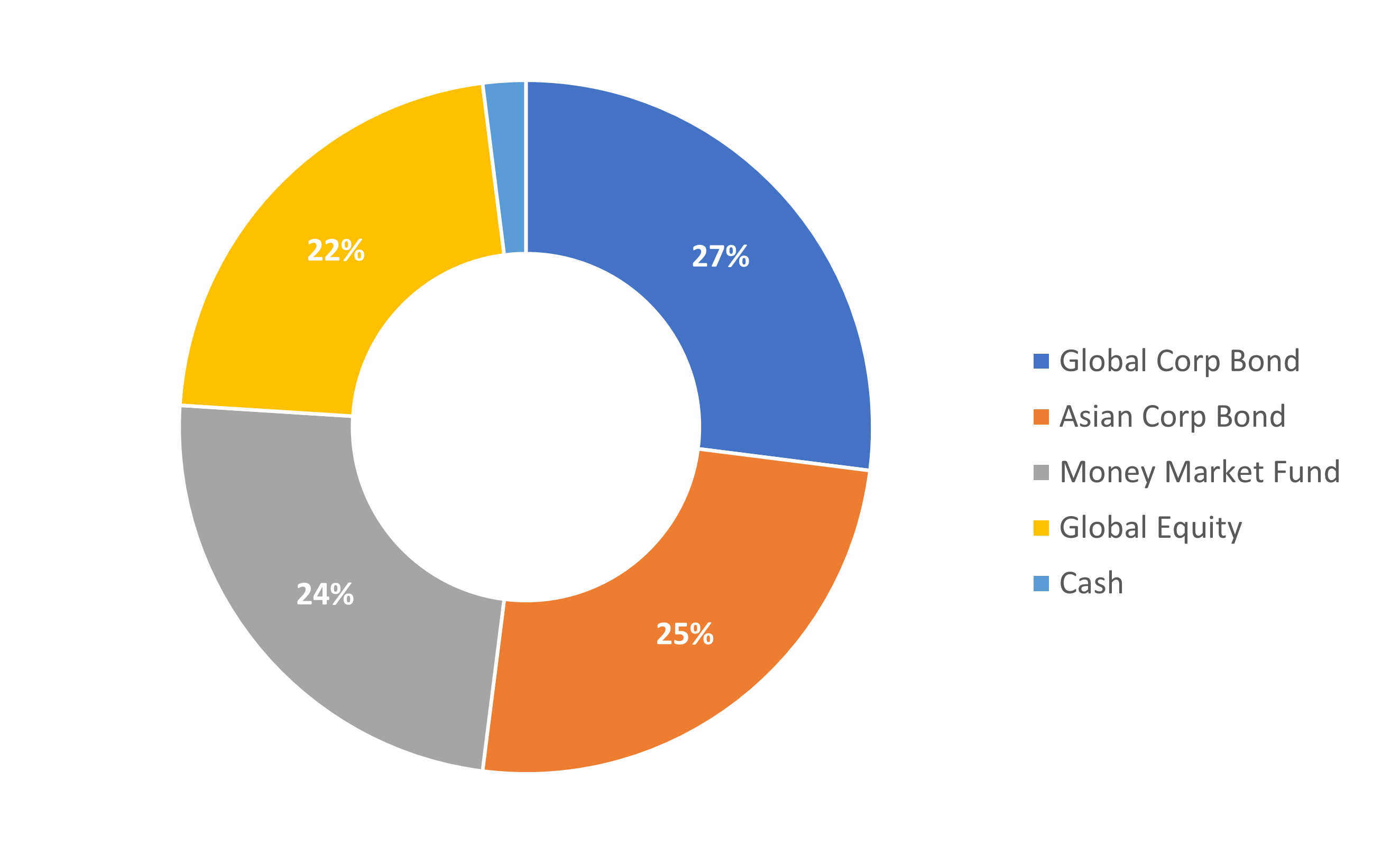

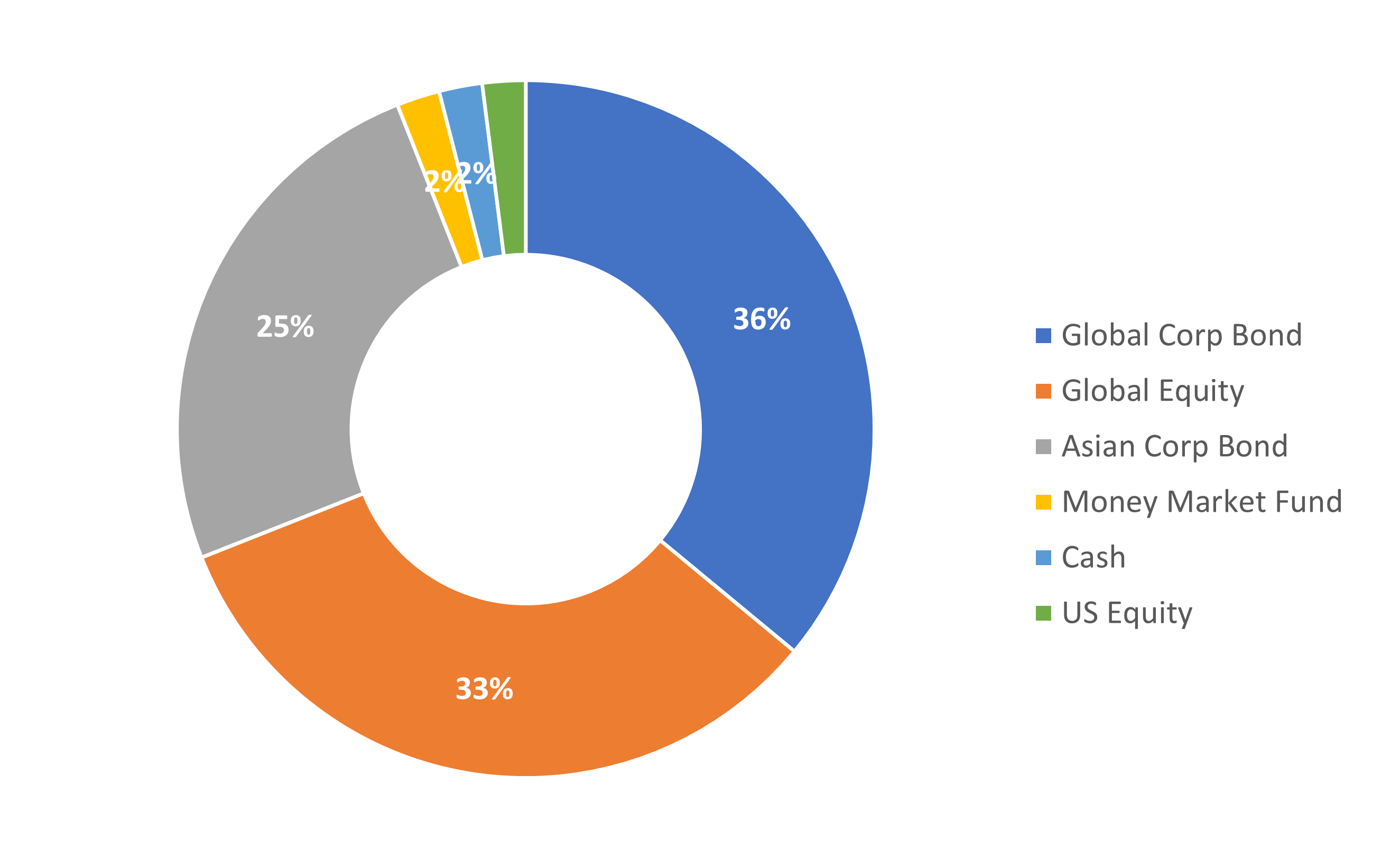

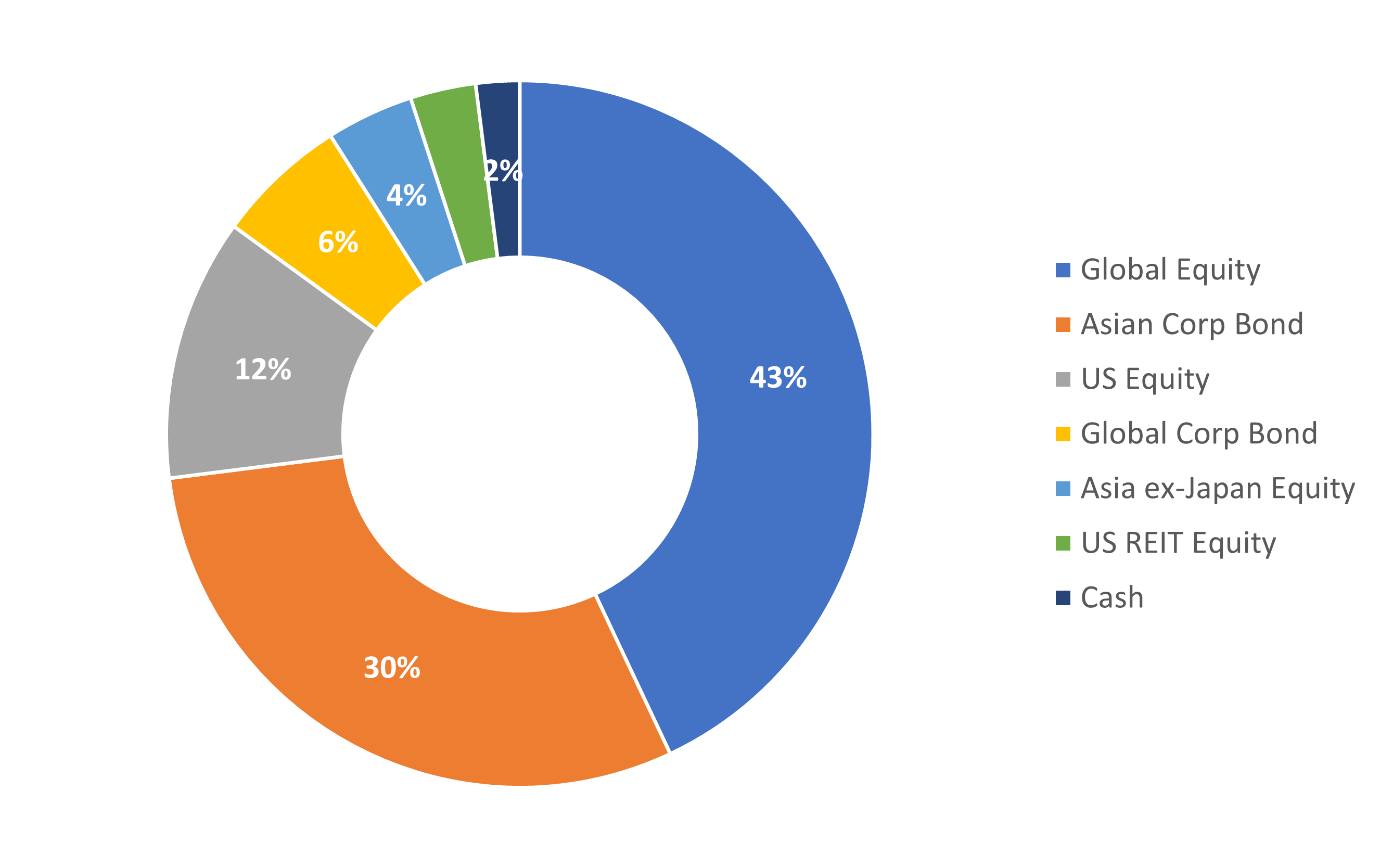

UOBAM Robo-Invest profiles your risk with a series of questions to understand your financial objectives and risk tolerance. In general, there are five risk categories under UOBAM Robo-Invest:

a. Very Conservative

b. Conservative

c. Moderate

d. Aggressive

e. Very Aggressive

UOBAM Invest then recommends a portfolio that suits your risk profile. You can retake the risk questionnaire after you have completed the onboarding process. In general, you can opt for a reassessment of your risk profile if there is a tangible change in your financial objective or risk tolerance. To retake the risk assessment, tap on “View Details” next to the indication of your risk profile on the Dashboard.

7. What is projected return?

This shows the indicative annual portfolio return as calculated by UOBAM's investment team.

It is based on our in-house proprietary market assumptions and the historical performance of the various asset classes.

However, do note that past performance is not a guarantee of future return and this number should only be used as a reference.

8. Can I select specifically what I want to buy using UOBAM Robo-Invest?

UOBAM Robo-Invest recommends a portfolio after assessing your risk profile. You can choose to reduce or take on more risk for your recommended portfolio. For instance, you may be a moderate risk investor but if you want to meet your investment goals earlier, you can consider topping up your investment amount or review your portfolio's risk exposures. You will be alerted when you adjust your risk appetite beyond the recommendation based on your risk profile.

The platform does not allow you to choose specific securities or unit trusts that you wish to invest in.

9. What is the difference between my risk profile and my portfolio's risk level?

Your risk profile is your capacity to take on risks, which is evaluated when you complete our risk assessment questionnaire during onboarding. The platform will then recommend a portfolio based on your risk profile. You can choose to reduce or take on more risk for your portfolio. For instance, you may be a moderate risk investor but if you want to meet your investment goals earlier, you can take on more risk for your portfolio by increasing your portfolio's risk level. You will be alerted when you adjust your risk appetite beyond the recommendation based on your risk profile.

10. Is my portfolio personalised or do you allocate standard portfolios to all your clients?

Your portfolio is recommended based on your risk profile and ESG preferences. Different risk profiles will have different recommended portfolios.

11. Can I create multiple portfolios with different risk level in my UOBAM Robo-Invest account?

Currently, UOBAM Robo-Invest is designed to offer a single portfolio and as such is unable to offer the option to set up different portfolios with different risk levels. We do understand your needs and we will be enhancing our app to include such option for our investors.

12. What is rebalancing?

As the market moves, the weights of the underlying investments in your portfolio may drift away. Rebalancing is the action of returning your portfolio to the original target allocation to maintain the same level of risk that your portfolio is exposed to. This also ensures that your portfolio is optimised to meet your target investment goals and stays relevant to market conditions.

13. How often does my UOBAM Robo-Invest portfolio get rebalanced?

Rebalancing occurs in the following 3 scenarios:

- Quarterly rebalancing which occurs on the last business day of each quarter.

- When you make a top up

- When you make a withdrawal.

Kindly take note that if rebalancing has been done within 31 days of the scheduled Quarterly rebalancing due to top ups or withdrawals performed, we will not conduct the Quarterly rebalancing again.

14. How does UOBAM Robo-Invest rebalance my portfolio?

Rebalancing is done automatically with the help of our robo-engine seamlessly. Our algorithm calculates the difference between the optimal weights each asset class should hold versus the current weights, and executes orders to buy or sell the relevant assets. This process realigns the portfolio to the original risk level you opted for.

For example, if the allocation is 50% and it drifts to 52%, only 2% will be rebalanced. The brokerage cost of performing the rebalancing will be included in our annual fee, with the exception of small SEC fees of 0.00051% of the value sold. Based on your investment amount, it is likely that you were not charged the SEC fees due to rounding.

15. What are the benefits for rebalancing?

Rebalancing is important to align the allocations of your portfolio according to the level of risk you selected as the market moves, in a disciplined manner. If the allocations vary too widely as rebalancing is not done, your overall portfolio could potentially be exposed to additional risks or not reflect changes that are implemented in the allocations by the algorithm when necessary.

16. What is an exchange traded fund?

ETFs or Exchange Traded Funds, as the name implies, are funds that are traded on a stock exchange. They are different from units trusts or mutual funds in that they are usually bought and sold on the exchange instead of being sold in bank branches or by financial advisers.

In addition, most ETFs tend to be managed in a systematic way, such as tracking a particular market index, with the aim of just delivering index return, while many unit trusts are actively managed by a fund manager with the aim to beat the index.

Thirdly, because ETFs are managed systematically with no intention to beat the market, they tend to charge lower fees as compared to unit trusts that try to beat their benchmarks. ETFs started out by tracking major stock market indices.

17. What are unit trusts?

Unit trust is a fund which pools together investors' money, which is then invested into a diverse portfolio of assets. The portfolio is usually actively managed by a fund manager. Unit trusts have defined investment objectives that are stated in their prospectuses and fund fact sheets.

Unit trusts are managed by professional fund managers, who are paid a fund management fee. Apart from this, there may be other fees to take note of, including trustee fees and administrative fees. You should look at the fund's Total Expense Ratio (TER) to understand the total cost incurred to operate the unit trust.

When you buy or sell a unit trust, you do so at its net asset value (NAV) per share, rather than at a listed price like for stocks. Nevertheless, most unit trusts can be liquid investments, and investors can easily enter and exit positions.

18. What are the benefits of having unit trusts in the portfolio?

Unit trusts which are actively managed widen the universe of underlying investments in addition to ETFs. We will assess the option of investing in unit trusts only if there advantages of using them over ETFs. In UOBAM Robo-Invest, we use SGD Hedged class of selected UOBAM unit trusts to form part of our fixed income portfolio to eliminate foreign currency risks as many fixed income ETFs are priced in USD. UOBAM has a long history and proven track record in managing Asian Fixed income unit trusts which we believe can benefit investors by using them to form the fixed income portfolios.

19. What is a corporate action?

Corporate action is an event initiated by a company and include dividends, rights, bonus etc.

The most common corporate action you will likely see in your UOBAM Robo-Invest account are pertaining to dividends.

20. What does the different corporate action status mean?

- 'Posted' indicates that the dividend has been declared and paid out.

- 'Unposted' indicates that the dividend has been declared but it is still in the process of paying out

- 'Ex-date' determines which date the stakeholders are entitled to receive the dividend. Typically, the ex-date is set two business days before the record date.

21. Why are there real estate investment trusts (REITs) in my portfolio?

Our investment team believes that REITs provide a good diversification to equities as they are typically more sensitive to interest rates than equity market movements. REITs can provide a steady income stream and are generally more defensive to market volatility, especially late in the economic cycle.