Why Asian high yield bonds?

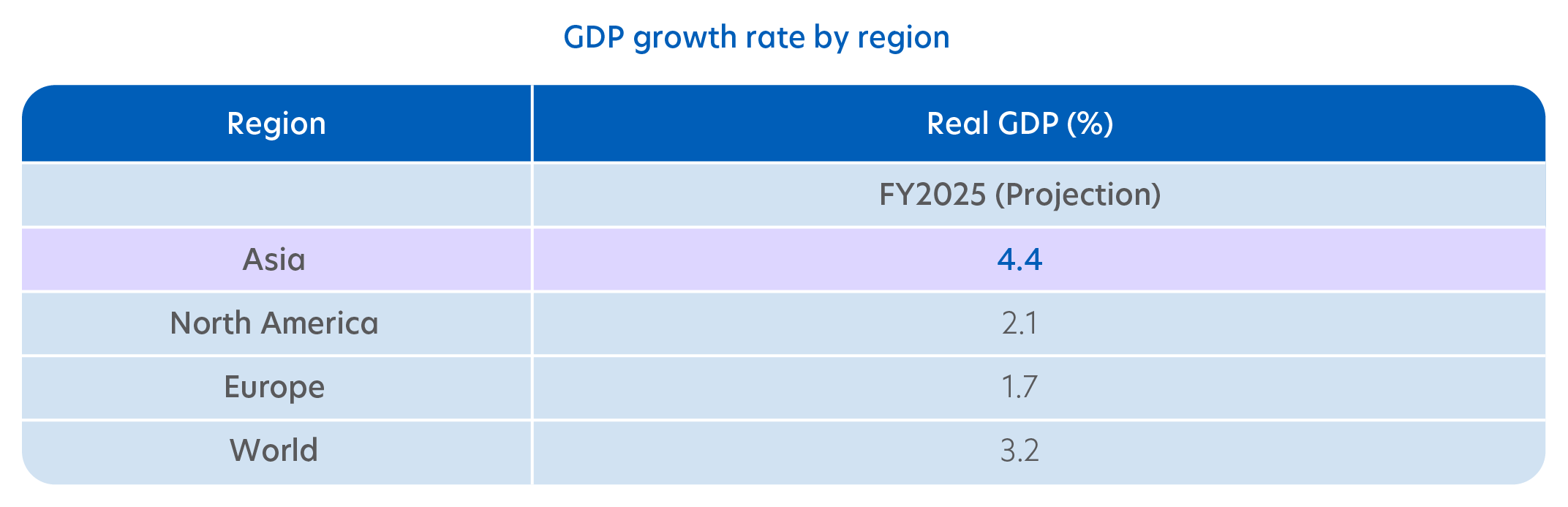

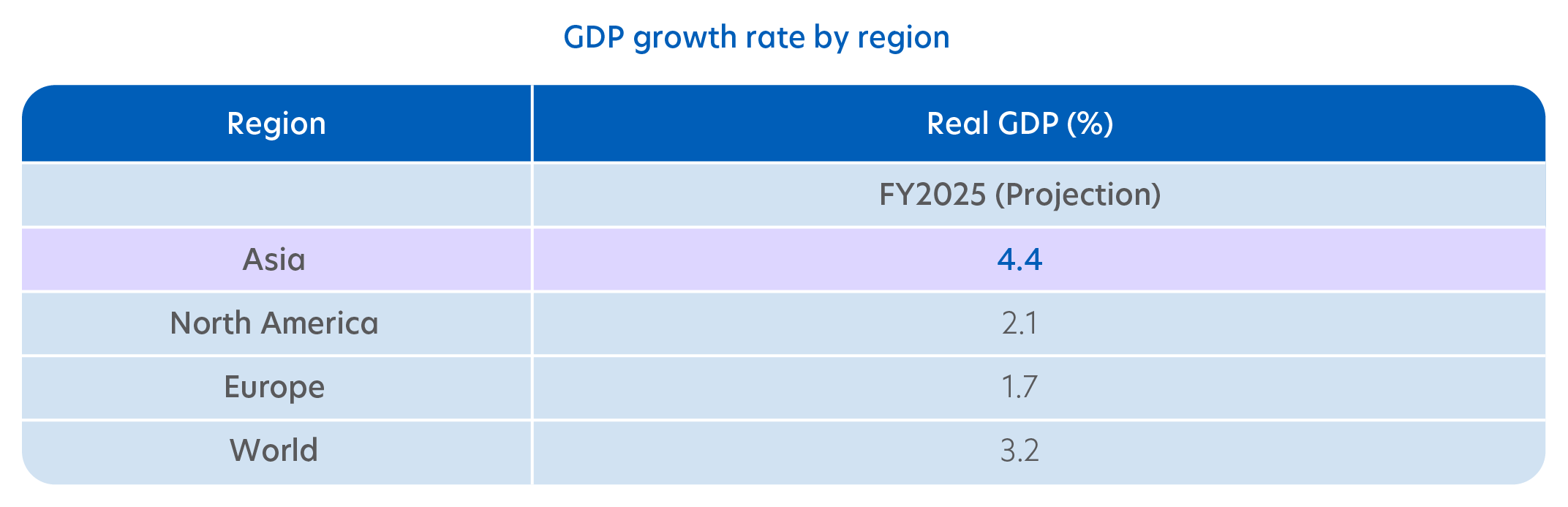

1) Asia has shown resilience despite global challenges

Asia continues to show economic resilience with healthy real gross domestic product (GDP) levels net of inflation compared to the rest of the world. High yield bonds are expected to benefit from Asia’s consumption-led recovery.

Source: Bloomberg, March 2025

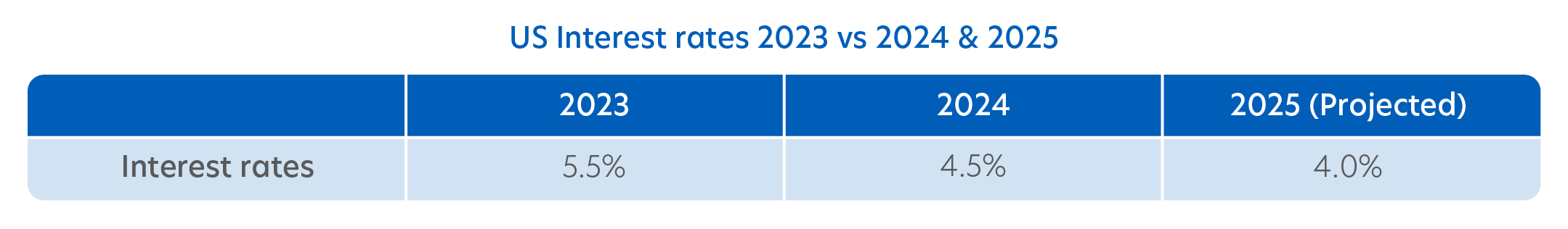

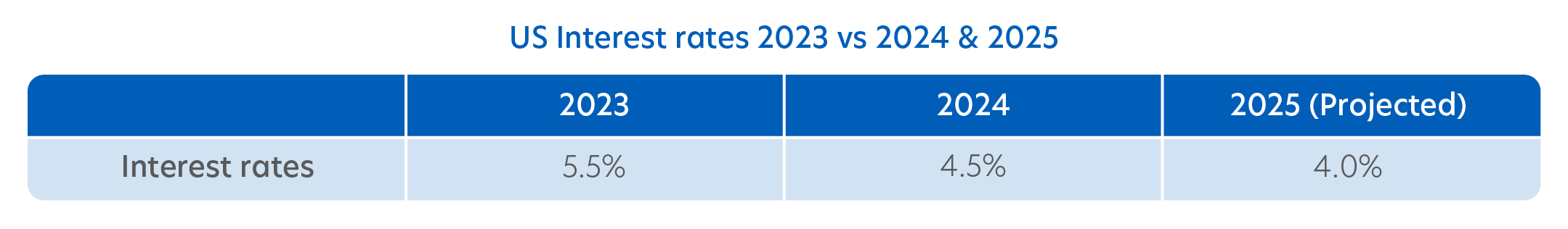

2) Peaking interest rates

The potential end of the US interest rate hikes means that besides high yields, investors also have the potential to capture bond price appreciation when interest rates eventually fall.

The spread (i.e. yield differential) of Asian high yield vs investment grade bonds is also likely to compress further given limited supply. This signifies higher bond prices, thereby increasing investors’ capital gains.

Source: Bloomberg, as of 22 April 2025

Source: Bloomberg, as of 31 March 2025

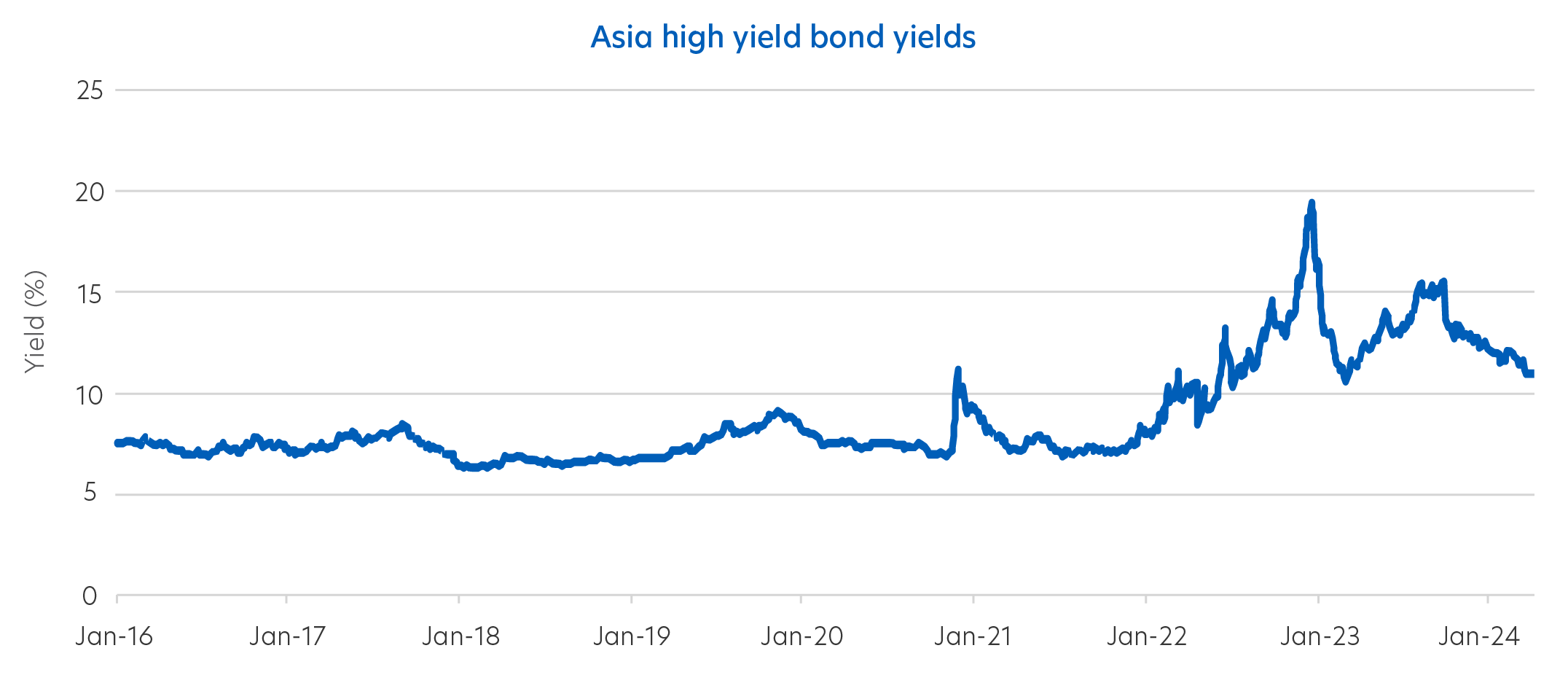

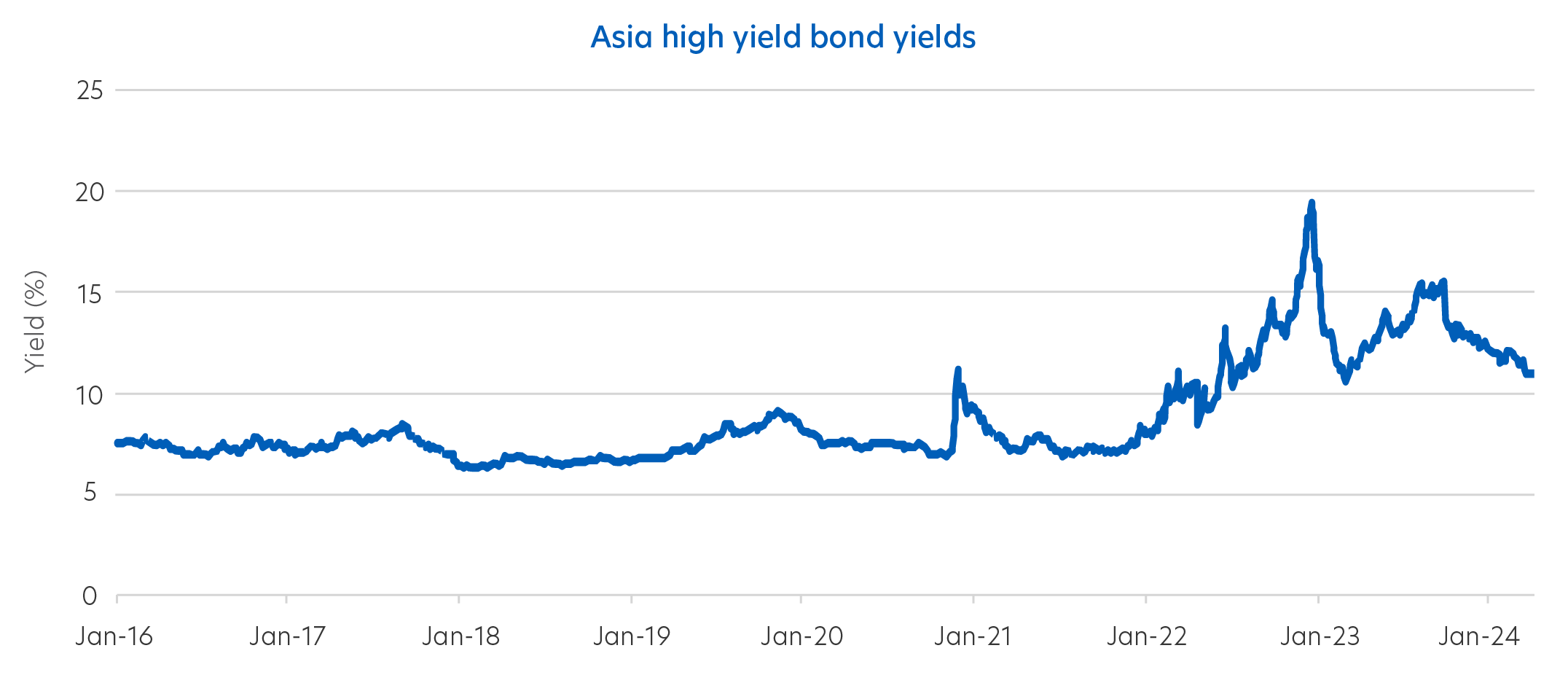

3) Strong yields and low volatility

Demand is expected to further strengthen for Asia high yields given that they are averaging yields close to 10 percent. This is close to Asia equity returns but with lower volatility. Asia credit market is 3.5 times less volatile than the Asia equity market4.

Source: Bloomberg, as of 31 March 2025. Asia high yield is represented by J.P. Morgan Asia Credit Index (JACI) Non-Investment Grade Index.

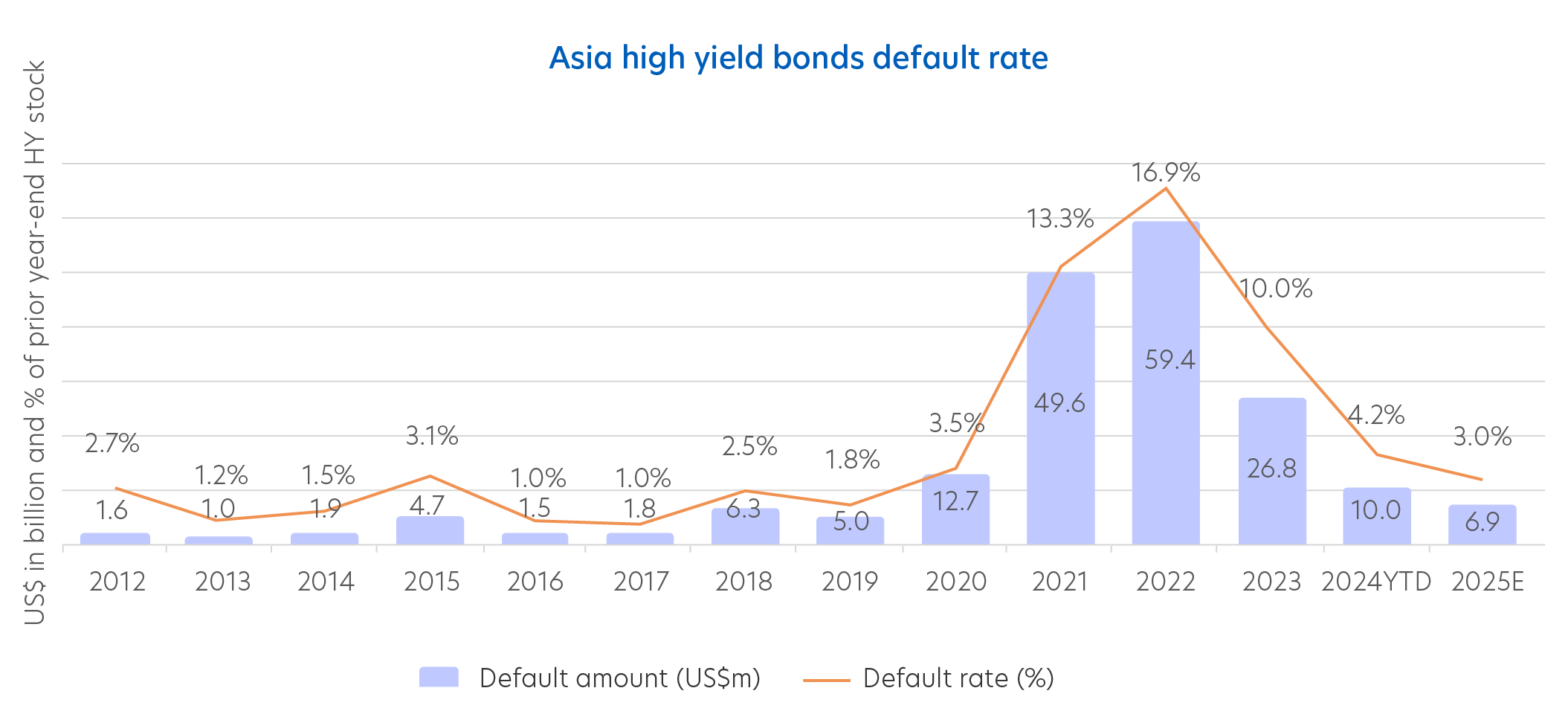

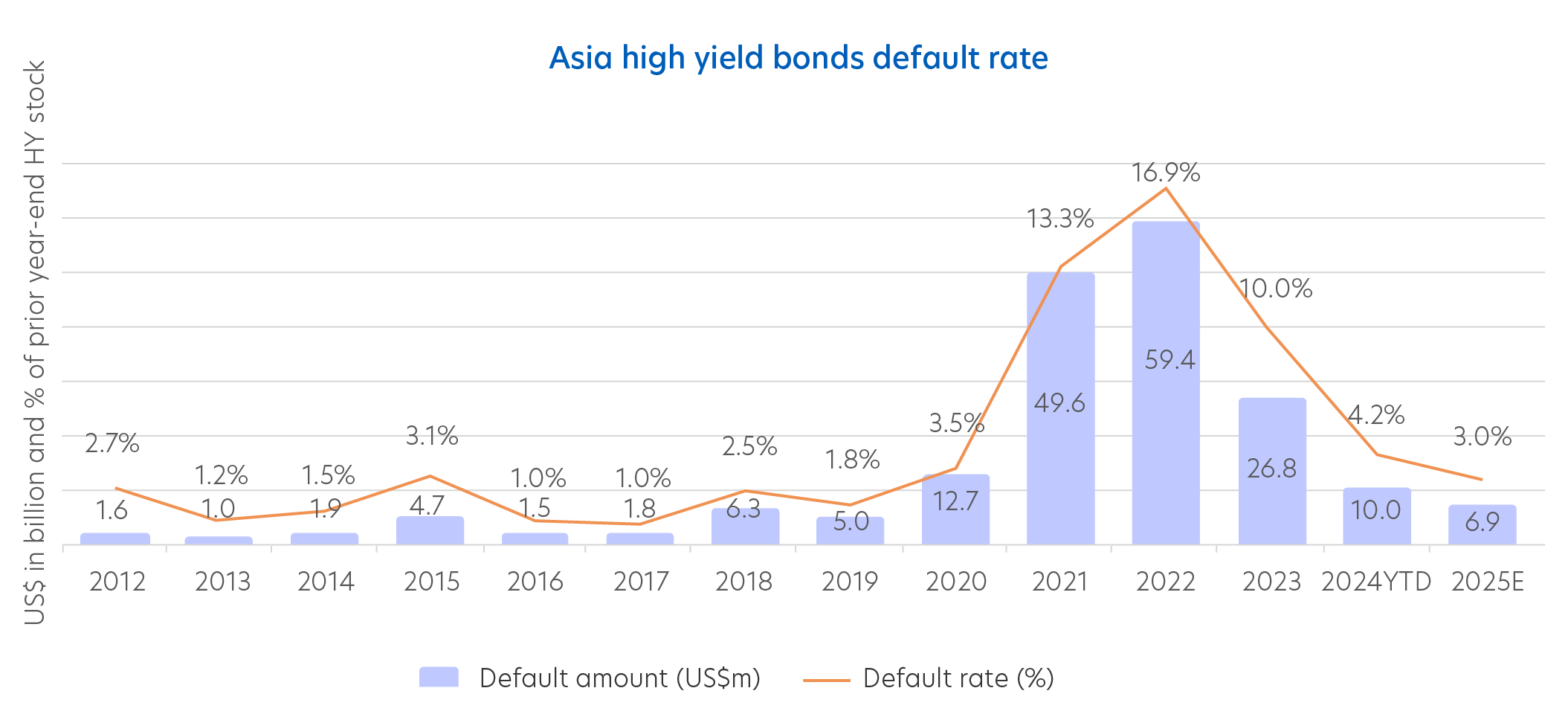

4) Low default risk

Asian high yield bonds’ default rate is typically lower than 3 percent. The rate jumped during the COVID pandemic due to defaults among Chinese developers, but the default rate is gradually returning to normal, which signifies moderating risk levels.

Source: J.P. Morgan, as of October 2024.

5 reasons to invest in the United Asian High Yield Bond Fund (the “Fund”)

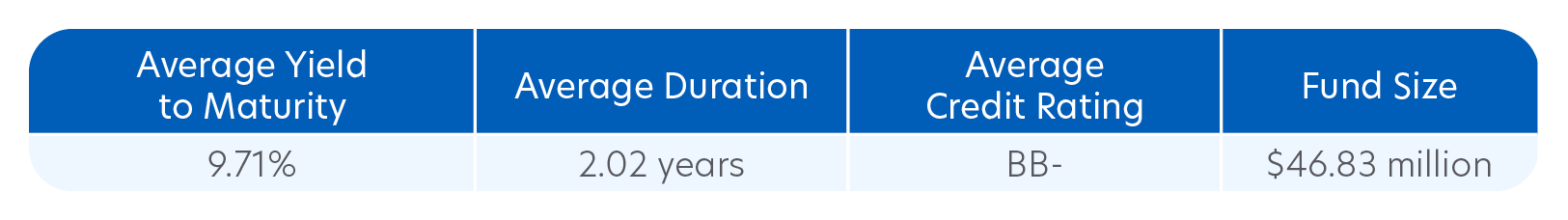

1) Attractive income

The Fund aims to offer investors a potential attractive regular monthly income of up to 7% per annum*.

*Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus.

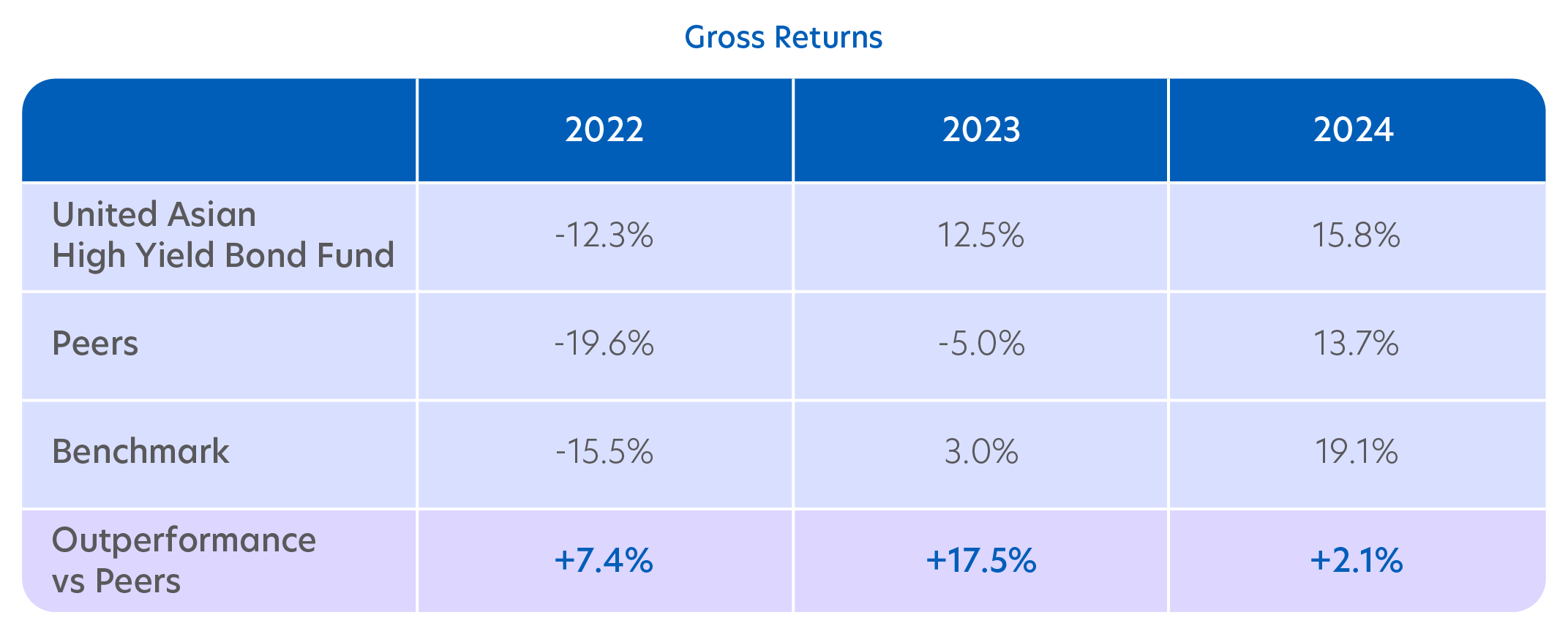

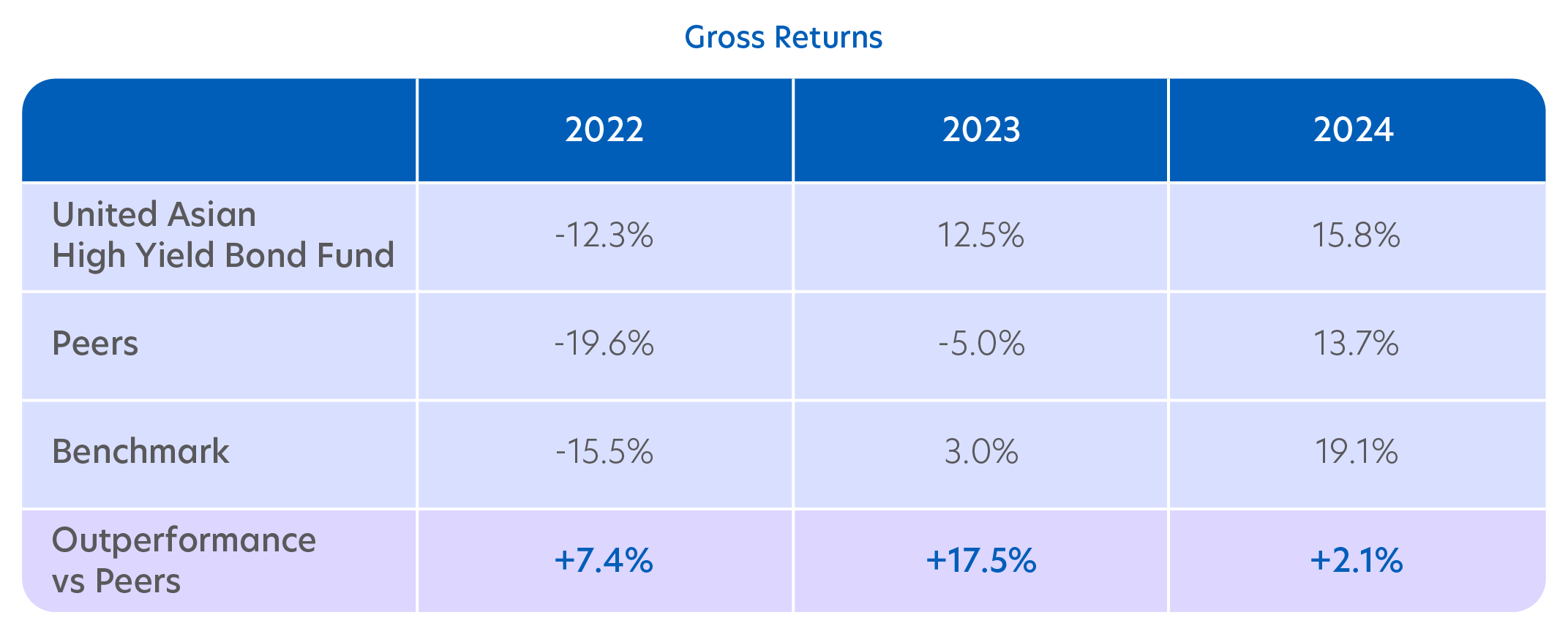

2) Strong outperformance versus peers

With its strategic positioning and emphasis on credit spreads for additional returns, the Fund has delivered returns above its industry peers.

Source: Morningstar, as of 31 March 2025. | Refers to United Asian High Yield Bond Fund - Class SGD Dist | Fund performance is calculated on a NAV to NAV basis. Performance as at 30 June 2024, SGD basis, with dividends and distributions reinvested, if any. Past performance is not necessarily indicative of future performance. | Peers category (Morningstar): Asia High Yield Bond | Benchmark: J.P. Morgan Asia Credit Index (JACI) Non-Investment Grade Total Return Index.

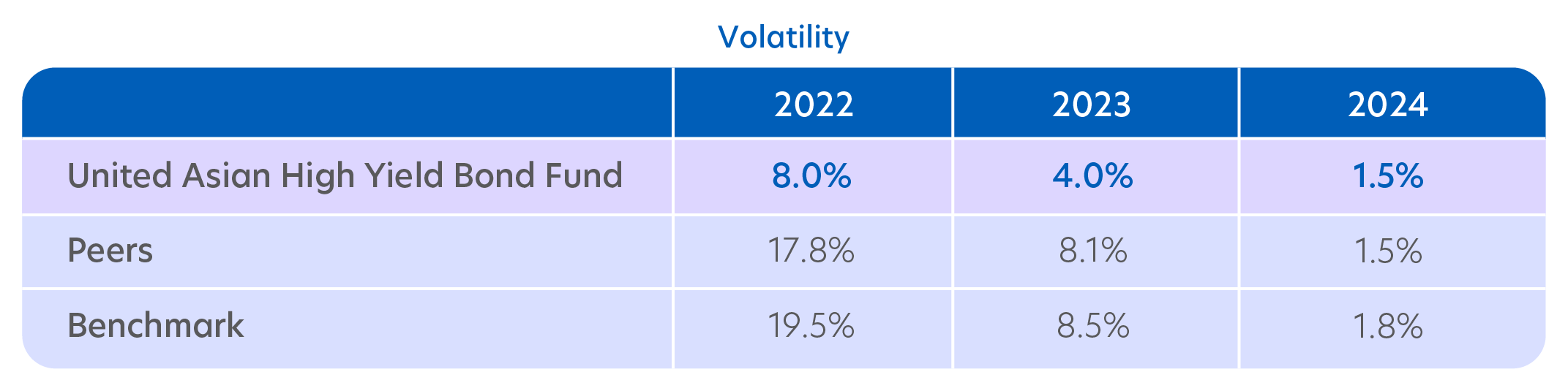

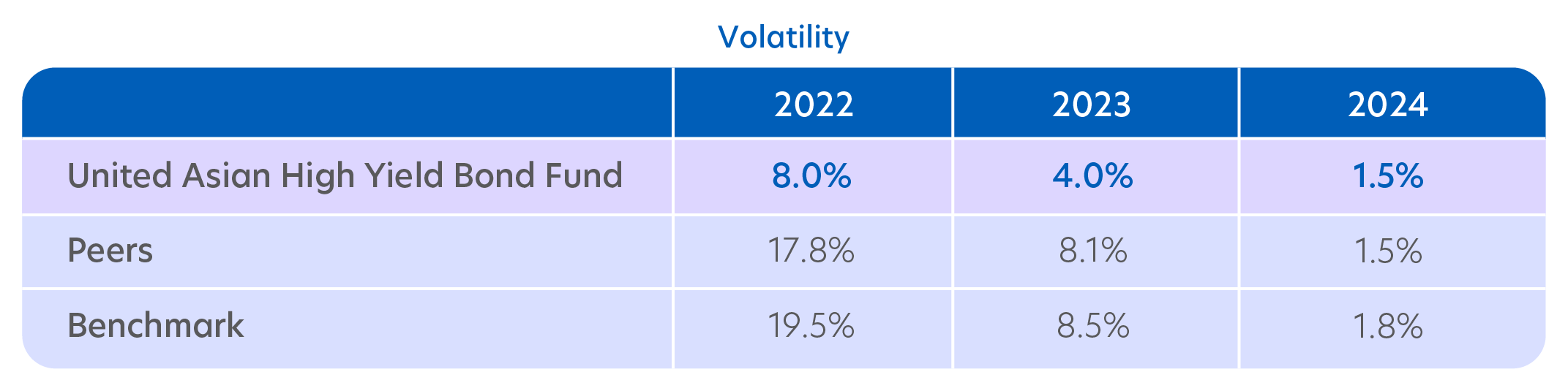

3) Lower volatility, no default since inception

The Fund is focused on generating returns at an acceptable risk level. As a result, it has a lower volatility compared to its peers and benchmark over the years.

The Fund also has a track record of no default and restructuring since portfolio inception.

Source: Morningstar, as of 31 March 2025 | Refers to United Asian High Yield Bond Fund - Class SGD Dist | Peers category (Morningstar): Asia High Yield Bond | Benchmark: J.P. Morgan Asia Credit Index (JACI) Non-Investment Grade Total Return Index.

4) Bottom-up driven with active risk-return positioning

The Fund is based on a bottom-up bond selection process that leverages UOBAM’s network of on-the-ground analysts and deep fundamental research, supported by a disciplined top-down strategy. It is managed flexibly with a focus on risk management rather than hugging the index.

The Fund’s strong credit analysis and regular portfolio reviews also allow for switching to undervalued securities and helps limit unsystematic risks. For example, in 2023, the Fund adopted a strong underweight position in the China high yield property sector, enabling it to outperform its peers.

5) Award-winning and highly rated5

Received the Outstanding Achiever award for the Singapore Fixed Income category at the Benchmark Fund of the Year 2023 awards.

Given a five-star rating by Morningstar in the category of Asia High Yield Bond as of 30 April 20256.