- The USD had been on a steady upward path since January this year

- But easing inflation fears over the past month have caused the USD to weaken

- Our analysis suggests that the USD will remain under pressure in the near term

- But we expect USD strength to remain a feature of 2023

Up, up and away

In stark contrast to almost all asset classes, the strength of the US dollar had been relentless throughout most of 2022. The DXY index, which measures how the USD is performing relative to a basket of other currencies, showed a rise of 18.5 percent from January to end-September 2022.

Figure 1: US Dollar Index (DXY) (Percentage change)

Source: MarketWatch as at 5 Dec 2022

This commanding position compared to other currencies had been driven by four key factors:

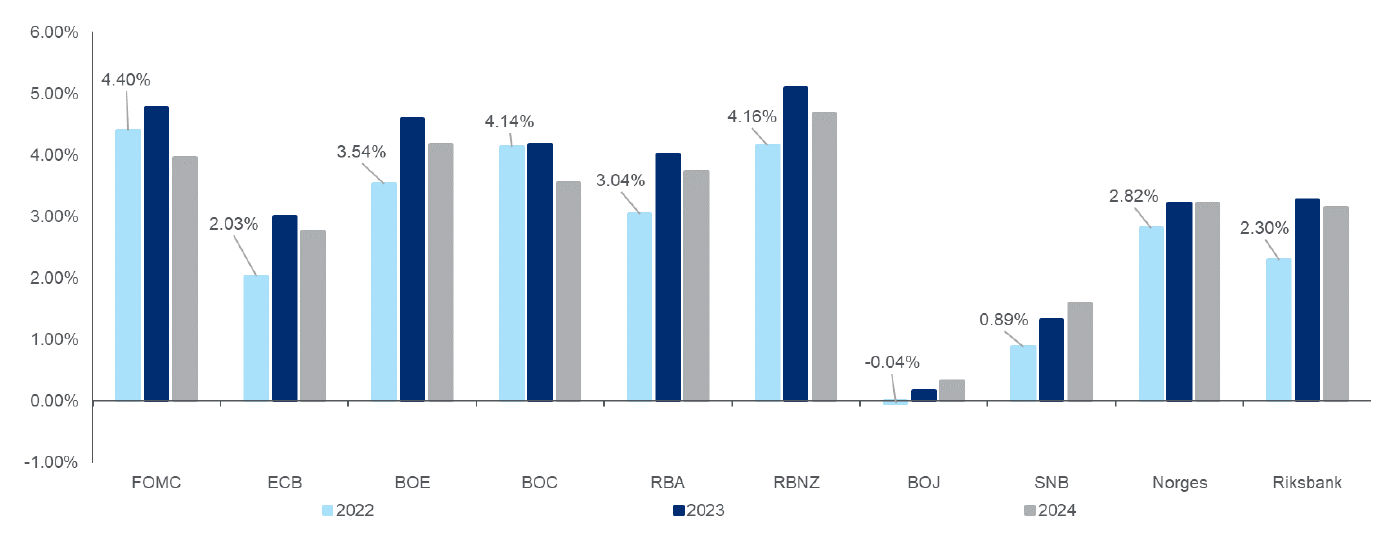

- Returns - Most obvious of course is the high level of US interest rates, prompting savers around the world to make a dash for the dollar. Having raised rates to curb inflation, the US Fed Funds rate for 2022, at 4.4 percent, is one of the highest in the world. This compares to the ECB’s 2.0 percent, the UK’s 3.5 percent, and Japan’s 0.0 percent.

Figure 2: Global yield spreads: Central Bank rates for 2022, 2023 and 2024

Source: UOBAM

- Fundamentals - While analysts have not ruled out the possibility of a US recession, the economy there is still offering better prospects than many other major developed countries.

Figure 3: IMF forecast: 2023 real GDP growth by country

| Germany | Japan | France | UK | US |

| -0.3% | 1.6% | 0.7% | 0.3% | 1.0% |

Source: International Monetary Fund

- Technicals - Until recently, daily DXY technical charts had suggested that USD bulls would continue to gain ground. Having managed to cross one resistance level after another, technical analysts were confident of an extended upward trend.

- Safety - Also in the USD’s favour is its traditional safe haven status. The dollar has a tendency to perform well in a crisis due to its high liquidity and investor demand for US Treasuries. The USD was therefore a beneficiary of 2022’s market turbulence.

A kink in the armour

However, the USD hit a wall in early November following the news that US inflation had eased further. This helped to give markets more confidence that prices had peaked and emboldened hopes that future interest rate hikes by the Fed would become less aggressive.

The correction in the US Treasuries market and USD happened more quickly than many traders were expecting. Caught by surprise, many traders with positive USD views were forced to sell down their positions, further accelerating the USD decline.

As a result, since its November high, the DXY has corrected by almost 10 percent, with many Asian currencies benefitting from the USD weakness. Just last week, the USD declined by a further 1.5 – 3.0 percent against the Thai Baht (THB), Malaysian Ringgit (MYR) and Indonesian Rupiah (IDR).

Turnaround not expected in the short term...

For the rest of December, we do not expect the USD to show a substantial recovery. Over the past 47 years from 1974 - 2021, our analysis shows that the USD has risen only 35 percent of the time. Over this period, returns in the month of December has only averaged -1.0 percent.

Based on this historical performance, seasonality factors and falling yields, we remain bearish on the USD over the short term, and we would resist reinstating any USD positions in December.

...but USD strength expected to resume in 2023

However, we note that even if the US Fed stops its rate hikes altogether (which is unlikely), this does not mean that the USD’s rise is at an end. Our analysis of the previous seven rate hike cycles suggest that the USD typically continues to strengthen for another six months following the Fed’s last rate hike.

There are also few signs that the factors supporting the USD are currently at risk. US interest rates may not rise much further from this point but are likely to stay high for some time. The USD also stands to benefit as the clouds of a global economic slowdown continue to hover.

As such, we are still constructive on USD strength in 2023 and we would view any extended dips as opportunities to add on to USD positions.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.