Key Highlights

- Data released last week recorded new highs for US inflation

- Across-the-board rises suggests that inflation may be more persistent than earlier hoped

- US equities have fallen more than 20 percent since its January high, putting it in bear market territory

Broad-based price rises

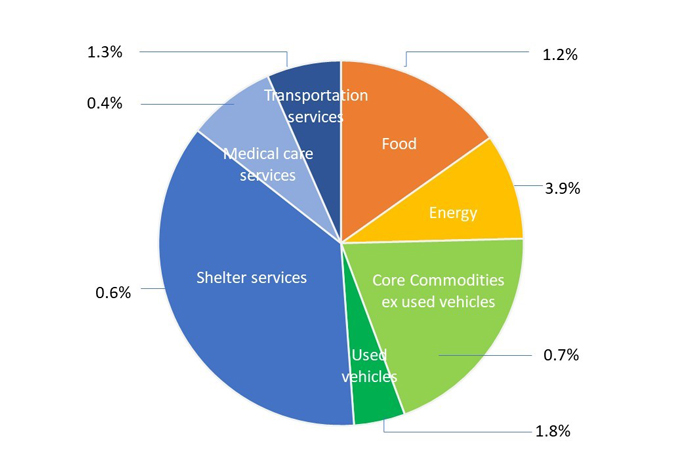

It isn’t only that the US consumer price index (CPI) in May rose to a new 40-year high of 8.6 percent compared to a year ago. No doubt this was a disappointment to markets hoping to see a repeat of April’s slight dip. But it was the broad inflation advances across all sectors of the US economy that was more sobering.

While food and fuel prices were expected to continue their upward march, many items saw a significant step up from April. The food index increased 1.2 percent (versus 0.9 percent in April) with dairy prices and related products up by nearly 3 percent, and eggs higher by 5 percent in just one month.

Energy prices increased 3.9 percent in May (versus a drop of 2.7 percent in April) with natural gas prices seeing the greatest spike of 8.0 percent. Looking over the past 12 months, the numbers become even more stark. The price of fuel oil (from which gasoline is derived) more than doubled, the largest increase since records began in 1935.

Even stripping out food and fuel prices (which are known to be volatile), May’s core inflation rose by 6.0 percent over the past 12 months, and 0.6 percent month-on-month. Housing, which represents about a third of the CPI’s basket of goods and services, increased 5.5 percent over 12 months, the biggest one-year change since Feb 1991. New and used vehicle prices, which continue to be hit by post-pandemic supply issues, have risen by 12.6 and 16.1 percent respectively over the last 12 months.

May 2022 US CPI seasonally-adjusted month-on-month percentage change, by relative importance of expenditure category

Source: US Bureau of Labor Statistics/UOBAM

Consumer sentiment at record low

These inflation numbers confirm what consumers already know – that their daily expenses are rising steadily. So it is no surprise that consumers are wary of the future. However, the extent of this concern, as captured by the Michigan Consumer Sentiment index, also caught markets by surprise last week.

Against a forecast of 58.5, and the actual May level of 58.4, the index in June slipped to 50.2, the lowest level ever recorded. About half of the consumers surveyed attributed their negative views to inflation, with consumers’ assessment of their personal financial situation worsening by 20 percent.

US enters Bear Market territory

The unexpectedly large change in CPI and consumer sentiment data has sparked a global market selldown. Over the past two business days, the S&P500 has plunged by about 8.0 percent, and by 21.8 percent since the most recent high in January. This fall crosses the minus-20 percent technical definition of a bear market, and is generally associated with widespread investor pessimism.

Asian markets did not manage to withstand this onslaught, with many major indices, including the Hang Seng, Kospi and Nikkei 225, down by at least 3.0 percent on Monday. Despite concerns about renewed lockdowns in Beijing and Shanghai, the Shanghai Composite was least affected, declining 0.9 percent.

Bond markets have not fared much better. Fears of even more aggressive interest rate hikes caused 10-year US Treasury yields to move past 3.35 percent, levels not seen since Jan 2011. Meanwhile, 2-year Treasury yields also rose steeply, and this week hit 3.40 percent, thereby causing the yield curve to invert. When yield spreads (ie the difference in borrowing costs) between 10- year and 2-year Treasuries turn negative (ie the yield curve slopes downward rather than upward), this is typically associated with market expectations of a recession.

Soft landing...

Markets are now re-assessing what the Fed will do next. Previous expectations of two 50 basis points rate hikes in June and July seem to be going out of the window. Many economists are now putting their weight behind two 75 basis point hikes in the near term, followed by three more smaller hikes before the end of the year. This means that over the course of one year, US interest rates will go from zero to potentially 3.25 - 3.5 percent.

It is debatable whether this anticipated ramp up in borrowing rates will enable the Fed to dampen inflationary pressures without killing off economic growth. In a soft landing scenario, inflation starts to drift down, allowing the Fed to soften its stance and for growth to continue at a moderated pace. If this pans out, the latest market correction could be regarded as overdone, paving the way for a near term market recovery.

...Or hard landing?

On the other hand, inflation could prove to be highly sticky, especially if wage push inflation ensues. This is when the overall rise in the cost of goods and services increases workers’ incentive to seek higher wages. To maintain their profits, employers respond by increasing their prices, further increasing wage pressures in a vicious inflation cycle. Amid the current labour shortage, workers’ action to improve their wages has already increased around the world and could intensify.

Faced with this, the Fed is unlikely to ease its rate hike plans, even to the extent of seriously undermining consumer confidence and shrinking the economy. In this hard landing scenario, the US economy enters a recession, typically marked by a slump in earnings, business failures, and high unemployment. Despite these challenging conditions, continuing supply shocks could keep inflation elevated, leading to a worst case scenario: stagflation.

UOBAM does not currently anticipate a US recession. We continue to monitor leading economic indicators and would welcome a controlled softening of consumer sentiment and activity as a sign that inflation is being tamed. In the meantime, US unemployment remains low and company earnings are still positive. That said, we note that the risks of a recession have increased and maintain our underweight position in equities and bonds, and overweight position in alternative assets and cash.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.