Key Highlights

- Powell’s speech at the Jackson Hole symposium suggests US interest rates will stay elevated

- The Fed appears willing to endure substantial economic pain in order to force down inflation

- Meanwhile in Europe, rampant inflation and rising rates point to the potential for a deeper recession

Powell’s tough talking weakens markets

The message last week from Federal Reserve chair, Jerome Powell, was clear – the Fed will continue to raise interest rates in order to bring inflation down, even at the expense of a US economic slowdown. While this is nothing new, some optimism had crept into markets that inflation was close to its peak, and that a softening of the Fed’s stance on interest rates was now possible.

However, Powell was uncompromising when he spoke at the Jackson Hole central bank conference last Friday. He pointed out that history cautioned against “prematurely” loosening policy and that the US would "keep at it until we are confident the job is done". This, he said, would "likely require restrictive policy for some time"..

These words sent US markets into a tailspin, with all major US indices falling by over 3.0 percent. But having had the weekend to digest the news, the Asia Pacific market correction on the following Monday were more subdued, with the Japan and Korea indices down by 2.0 to 3.0 percent and Hong Kong and Australia down by 1.0 to 2.0 percent.

More rate hikes to come

Importantly, Powell reiterated the Fed’s inflation target of 2.0 percent. He stressed that a return of inflation to this level was a necessary condition for positive economic outcomes in the future. Minneapolis Fed President Neel Kashkari subsequently reinforced this, saying, “People now understand the seriousness of our commitment to getting inflation back down to 2 percent”.

This strongly suggests that the Fed does not view a stabilisation of inflation to be an adequate criteria for easing current interest rate trajectories. And while the current market consensus is for a 50 basis point (bps) rate hike at the Fed’s September meeting, Powell hinted that he was open to more aggressive action. He noted that, "July's increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period.”

As a result, 10-year and 2-year Treasury yields, continued its upward march to reach 3.09 and 3.42 percent respectively. Not only are bond yields rising again, but the 2s10s spread (that is, the difference between short and long term Treasuries) has turned negative, both leading to increasing recessionary fears.

Europe reels under inflationary pressures

Now all eyes are on Europe. Against months of policy tightening by the US Fed, the European Central Bank’s (ECB) rate rises have been far more modest. The ECB’s first rate hike in 11 years, of 50 bps, only started in late July, much later than the Fed. Given that European rates had been negative since 2014, the ECB’s rates are far behind the Fed’s rate of 2.25 to 2.50 percent.

This despite that fact that annual inflation in both regions is now at similar levels, with Euro area inflation registering 8.9 percent in July, compared to US’s 8.5 percent. It is notable however, that inflation in the Euro area continues on an upward trend, whereas US inflation may have peaked in June at 9.1 percent.

There is good reason to suspect that Euro area inflation has a long way to go. The price of natural gas, an energy source on which Europe is highly dependent, has surged almost 20 percent this month and is 2.5 times higher than at the start of the year.

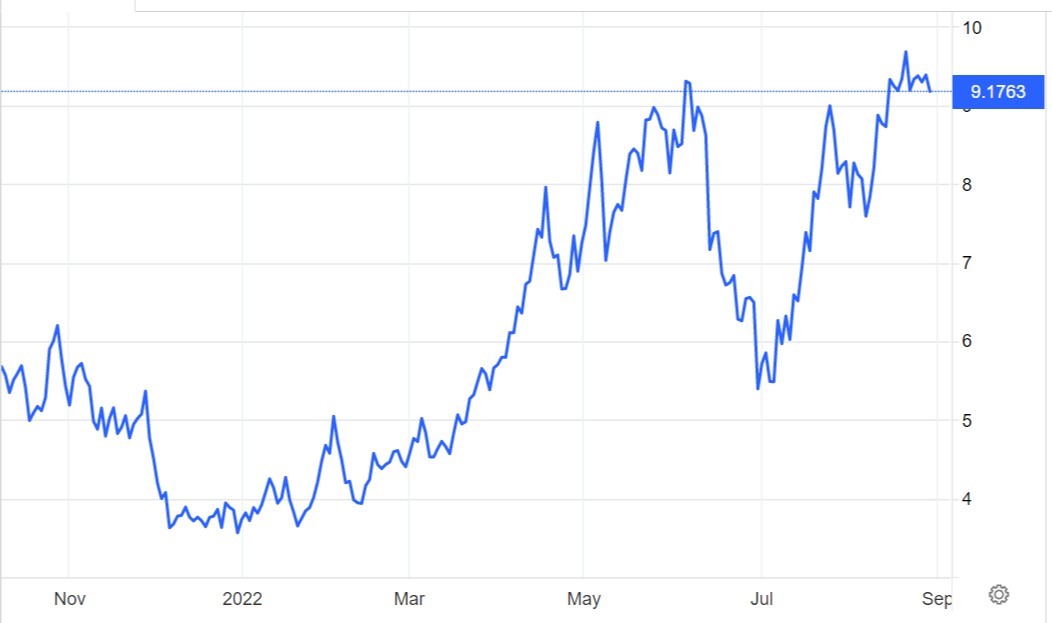

Figure 1: Natural gas price (USD/MMBtu)

Source: Trading Economic/UOBAM

This explosion in the price of natural gas is causing electricity bills for European households to rise by five to 10 times their pre-Covid levels. Further increases will depend on whether Russia further tightens its squeeze on gas supplies to Europe, having already significantly reduced flows in recent weeks.

Global impact of a European spillover

Faltering eurozone growth, plus a more measured approach to rate rises, is also set to keep the euro weak. This month, having fallen below parity with the USD for the first time in two decades, there are fears that the EUR/USD could fall further.

This would exacerbate inflationary pressures, and further threaten the region’s growth prospects. There are already several alarm bells ringing. The European Commission’s monthly Economic Sentiment Index fell again in August with industry and services accounting for the biggest drop in optimism.

In the event of a deep European recession, coupled with considerably slower growth in the US and China, there is a danger that the 3.2 percent global growth forecast for 2022 will not be met. The International Monetary Fund (IMF) warned in a recent report that, “The world may soon be teetering on the edge of a global recession, only two years after the last one.”

However, this is not a foregone conclusion. Unemployment in the euro region remains low and stable, and the European Commission’s growth forecast for the EU economy is 2.7 percent in 2022 and 1.5 percent in 2023. We recommend caution and a neutral positioning in this highly uncertain environment. Our base case is for 2022 to remain volatile, but for the global outlook to start to improve in 2023.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z