Key Highlights

- The US and China are racing to become the world’s largest producer of semiconductors

- The US’s CHIPS Act raises the stakes by offering subsidies to US companies provided they do not expand production in China

- As the competition heats up, makers of advanced chips are likely to be the biggest beneficiaries

Tech war between US and China intensifies

Recent visits to Taiwan, first by Nancy Pelosi, speaker of the US House of Representatives, followed by a US congressional delegation, has significantly soured already tense relations between the US and China. These have led to not only continued Chinese military drills around Taiwan but the publication of a white paper by China to emphasise its commitment to Taiwan reunification.

However, despite the sabre-rattling from both sides, escalation into a full-blown military conflict is not expected in the near term. At the present time, China is unlikely to want to risk US economic sanctions and the freezing of central bank assets. Similarly, the US military appears reluctant to engage China on its home ground, especially given the latter’s control over the first island chain of countries in East and Southeast Asia.

Instead, the two countries are more likely to raise the stakes on their ongoing technology battle. This month, new disputes were sparked by the signing into law of the CHIPS (Creating Helpful Incentives to Produce Semiconductors for America) and Science Act. The Act provides for US$280 billion of funding, of which US$52.7bn of subsidies is to be made available to US chipmakers for research, development, and manufacturing.

China is taking big strides but it’s not quite there yet

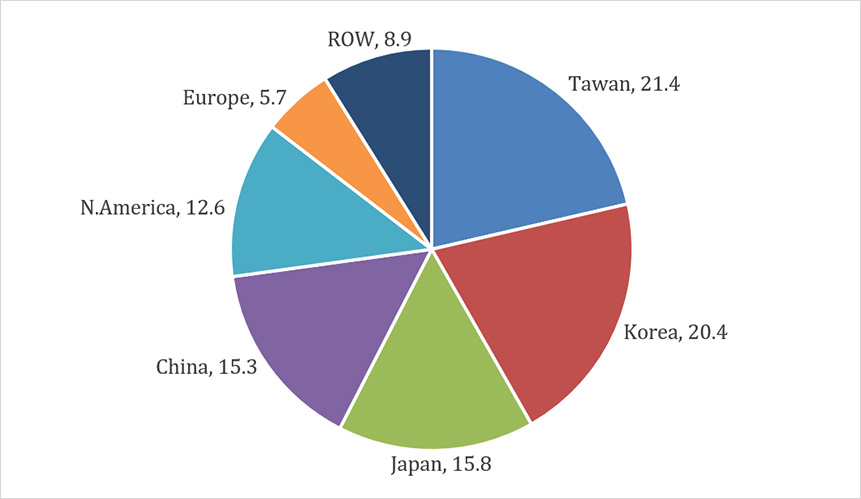

The latest salvo from the US comes from a position of weakness, as US President Biden readily admits. East Asia currently controls 75 percent of the global production of semiconductors, with Taiwan and Korea leading the pack.

China’s share of global capacity has continued to edge up and is now in fourth place and close to Japan’s, having moved ahead of the US’s capacity share for the first time in 2019. In contrast, the US has dropped from a manufacturing capacity share of nearly 40 percent in 1990 to around 12 percent today, according to a 2020 IC Insights report.

Figure 1: Percentage of global wafer capacity by geographic region, Dec 2020

Source: IC Insights, monthly installed capacity in 200mm equivalents

In terms of global chip sales, China also registered an unprecedented annual growth rate of 30.6 percent in 2020, allowing the country to capture 9 percent of the global semiconductor market, from just 3.8 percent five years previously. Based on this trajectory, China has the potential to secure close to a fifth of global sales by 2024, helped by the rise of new Chinese semiconductor enterprises – said to number 15,000 in 2020 alone.

However, the US remains by far the top country for chip sales. In 2020, the country accounted for almost half of the global total, according to the Semiconductor Industry Association’s 2021 Factbook. This is a leadership position that it has held for several decades and will continue to hold, although its share has weakened recently and may drop to 40 percent by 2024.

Tough choices for US Chipmakers

It is against this backdrop that the CHIP Act has been introduced, and its funding initiatives come with some tough conditions for US companies. Subsidy recipients are barred for 10 years from introducing or expanding their production of semiconductors in China beyond “legacy” versions, and these must be predominantly for the local market. This means that companies must choose between the potential value of federal funding and China’s cheaper manufacturing costs.

It is not known whether the Act plus other pressures from the US government will deter US companies like Intel from continuing with their plans to build new chip fabrication facilities in China. The company had announced new China investments in March this year, which would have brought their total investment in the country to just under $4 billion, making it one of China’s largest foreign investors.

In response, the China government has slammed the policy, saying that it will “disrupt international trade and distort global semiconductor supply chains”. Two Chinese trade associations also criticised the Act for intensifying geo-political competition, harming technological innovation, and hindering the global economic recovery.

All eyes on the prize: advanced semiconductors

These substantial subsidies and tough words reflect the importance of semiconductors as a component in countless electronic devices. But perhaps even more importantly, semiconductors are essential in some of the US’s and China’s most strategic technology and national security objectives, including 5G/6G communications, renewable energy, electric vehicles, and artificial intelligence.

Many of these applications require not just semiconductors, but advanced versions, the production of which is a highly technical exercise requiring deep expertise across different companies. It is thought by some that the US-initiated Chip 4 alliance which includes chip giants, South Korea, Japan, and Taiwan, is a tactical move to limit China’s access to global semiconductor value chains.

There have also been claims that the US is actively preventing the sale of advanced deep ultraviolet (DUV) systems to China. Dutch company ASML is a leading manufacturer of extreme ultraviolet lithography (EUV) systems, a state-of-the-art technology used to produce the latest and most powerful chips expensive equipment for chip production. The sale of these systems have been banned from China since 2019, making it difficult for the country to make cutting-edge chips.

Taiwan’s fortunes linked to its chip capabilities

Taiwan remains one of the few centres in the world capable of making advanced chips, with the Taiwan Semiconductor Manufacturing Company (TSMC) at its helm. The 2022 TSMC Technology Symposium was an opportunity for the company to announce that its industry-leading 2 nm chip technology will be commercially available by late 2025. This would put TSMC neck and neck with Intel in terms of the production of the world’s most advanced chips.

China is clearly hungry to acquire this technology and achieve self-reliance in terms of the end-to-end semiconductor supply chain. While this may not be incentive enough to launch military action in the short term, it certainly adds to Taiwan’s attraction. In the meantime, companies able to contribute to the production of advanced semiconductors looks likely to remain in high demand.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z