Victor Wong, Head of UOBAM Sustainability Office, shares his thoughts on whether the Russia-Ukraine conflict is causing countries and companies to reconsider their energy plans

Russia is one of the world’s largest gas and oil producers. Its war with Ukraine and resulting sanctions is seriously affecting global supplies. We ask Victor Wong, Head of UOBAM’s Sustainability Office, whether this is causing countries and companies to reconsider their energy plans

Q: Hi Victor, first of all, can you give us an idea of the shift in investment interest towards the clean energy sector?

This week, the IPCC (Intergovernmental Panel on Climate Change) released its report with a chilling warning that “without immediate and deep emissions reductions across all sectors, limiting global warming to 1.5 degrees C is beyond reach”. The report notes that there is sufficient global capital and liquidity to close existing investment gaps, but current financial flows are three to six times lower than the levels needed.

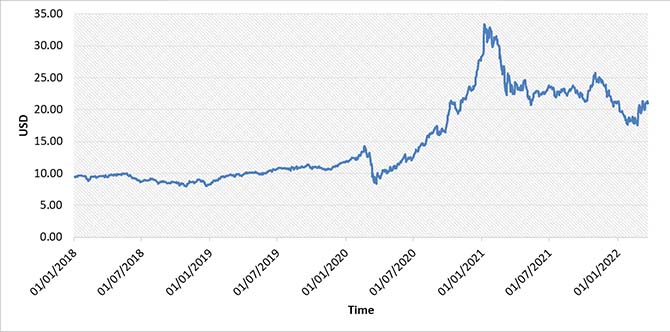

My hope and expectation is that the strong momentum of private investments into the clean energy sector seen in the last two years will pick up further. Look for example at fund flows into the iShares Global Clean Energy ETF (ICLN). This fund tracks the performance of the S&P Global Clean Energy Index, which invests in companies that produce energy from solar, wind, hydro, biomass, and other renewable sources. We can see that the inflow of funds into these clean energy stocks has grown exponentially since the start of 2020 and is now trending annually at double what it was pre-Covid.

Figure 1: Investment flows into the clean energy sector has risen strongly

iShares Global Clean Energy ETF price movement: Jan 2018 – Mar 2022

Source UOBAM/ Bloomberg

Q: So what is standing in the way of more support from investors and a faster pace of transition by corporates?

I think energy security and price volatility are major concerns for many investors, and this may be causing them to avoid the energy sector altogether. Alongside this, energy companies, particularly oil & gas majors, are often asked to increase or decrease supplies in times of high demand or over-supply, leading to uncertain and unstable earnings. These volatility fears are likely to have been exacerbated by the current Russia-Ukraine war.

It is also the case that the renewables infrastructure needed for clean energy to be produced on a commercial scale and integrated into the grid, is taking time to construct. Given that investments into renewables is a fairly recent phenomenon, there is still lack of scale in the clean energy sector. As such, in many countries, the opportunities to invest in large cap companies that can show a well-developed path to transition, or that have substantial scale in producing low-carbon energy, still remains fairly limited.

But this is changing. There is increasing alignment between private fund flows and public policy. For example, many Covid-19 economic recovery packages included incentives for further private investment in renewable energy. And as more companies are able to show the bottom line advantages of transitioning to renewable energy, more investors are likely to jump on board.

Q: In response to the Russia-Ukraine war, is Europe accelerating or decelerating its clean energy plans?

While Europe has a mature renewables market, many European countries are still highly reliant on Russian oil and gas, and particularly natural gas, for their energy needs. A total of 155 billion cubic metres of natural gas was imported from Russia by the European Union (EU) in 2021. This accounted for almost 40 percent of the EU’s total gas consumption.

This unsustainable reliance has hit home as a result of the Russian-Ukraine war, and in particular the accompanying volatility in prices, the imposition of sanctions, and the potential for Russia to halt all energy exports to Europe. Germany, one of the region’s biggest importers of Russian oil and gas, is now seeking alternative suppliers. However, to fast forward its independence from Russian energy, German officials admit that they will have to invest in coal reserves and fossil fuel infrastructure on a temporary basis.

But at the same time, the country is in the process of reassessing its “energy sovereignty”. There is widespread recognition that this can only be achieved by continuing to shift towards more renewable energy and greater energy efficiency. Germany’s Finance Minister, Christian Lindner, now calls renewable energies “freedom energies”. A package of laws coming into effect in July 2022 will enable electricity to be fully supplied from renewable sources by 2035.

Are other countries watching and learning from Europe’s experiences?

Yes, absolutely. Fears around energy security is not confined to Europe. Asia for example, while less dependent on Russian oil imports, has also felt the impact of volatile energy markets. As a result, there appears to be a growing acceptance that clean energy can help reduce reliance on other countries for local electricity needs, especially during periods of supply shocks.

In Singapore for example, the Energy Market Authority announced plans to reduce the carbon footprint of the country’s power sector by importing about 30 percent of its electricity from low carbon sources by 2035. It also plans to increase the use of electric vehicles under its Green Plan 2030, and this will require many more charging points to be established around the island.

Of course, the progress of energy transition is still not fast enough and not the same for all countries. Europe and the US have more mature clean energy economies with substantial installed renewables capacity. In Asia, more time is required for countries to match this capacity. However, even with the infrastructure already in place, it is now cheaper in parts of China and India to build new wind or solar farms than to operate existing coal power generators, and is better value than even some of the new natural gas-fired power plants.

Q: How will the current trajectory change for the world, and in particular Asia?

Even before the Russia-Ukraine war, we had started to see positive momentum within the energy transition and the renewables space. I would say that country commitments to shift away from highly-pollutive sources of energy – particularly thermal coal – and transitioning to lower carbon alternatives have reached a new, unprecedented level.

For instance, during COP26, as many as 46 countries signed the Global Coal to Clean Power Transition statement to “accelerate a transition away from unabated coal power generation” and “cease issuance of new permits for new unabated coal-fired power generation projects”.

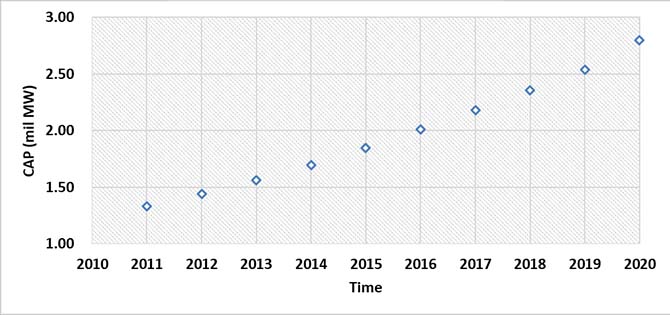

Figure 2: Renewal capacity is ramping up

World Renewable Capacity: 2011 - 2020

Source: UOBAM/ IRENA

With renewables now the cheapest source of new electricity generation in many places, we can expect the transition to start to accelerate. For example, I am very encouraged by the fact that the addition to global renewable energy capacity in 2020 beat earlier estimates and previous records, despite the economic slowdown from Covid-19.

According to the International Renewable Energy Agency (IRENA), the world added more than 260 gigawatts (GW) of renewable energy capacity in 2020, exceeding expansion in 2019 by close to 5 percent. More than 80 percent of all new electricity capacity added in 2020 was renewable with solar and wind accounting for 91 percent of all renewables. At the same time, total fossil fuel additions fell to 60 GW in 2020 from 64 GW in 2019, highlighting the continued downward trend of fossil fuel expansion.

Q: What will corporates do differently in future, given the lessons of the current conflict?

Given the energy price volatility stemming from the current conflict, corporates especially those that depend heavily on oil & gas imports, look likely to quicken their pace of transitioning into renewables. This includes capital investments into storage, electrified vehicles and heating, charging infrastructure, hydrogen production, recycling, sustainable materials and carbon capture.

Even prior to the conflict, lessons were learnt from the Covid-induced supply chain disruptions, causing a concerted shift into renewables. A BloombergNEF report estimates that global investment into low carbon energy transition totalled US$755 billion in 2021, up from US$595 in 2020 and just US$264 a decade ago. The Asia Pacific region attracted the lion’s share - US$368 billion - and is growing at the fastest rate.

Our engagements with Asia-based companies reaffirm that energy transition is a long-term trend but short-term challenges are inevitable. They acknowledge that current renewables capacity is still insufficient to meet global energy needs. In general, we expect some companies to resort to traditional fossil fuels as a short term measure to cushion the impact of supply shocks and events that threatens their energy security.

However, while this might seem like a step backwards, the opposite is true. The Russia-Ukraine war has resulted in companies calling for the acceleration of renewables capacity in order to reduce their reliance on fossil fuels and correspondingly, limit the impact from future energy market volatility. So while the current crisis may have injected some short term speed bumps, the longer term trend is for the transition to continue and in fact, to pick up speed.

Q: Has the conflict changed what the UOBAM Sustainability Office is doing?

UOBAM believes in the long-term trend of transition towards a lower carbon economy, the importance of pursuing long term energy security and the financial benefits of a lower carbon footprint. The conflict has only helped strengthen our message that investors should support companies undergoing this transition.

In our view, high energy-dependent companies that do not take strategic steps to transition to renewable will eventually see a negative impact on their reputations and earnings. And if the net zero target is to be met by 2050, such investments will have to triple over the next few years.

As part of UOBAM’s Environmental Policy and Active Ownership Policy (AOP), we engage with companies to better understand their sustainability practices, the transition process that they are taking, and the challenges they face. This year we are particularly focused on initiatives to mitigate climate risks and the incorporation of climate-related metrics into business strategies, decision-making and reporting.

We continue to be on the lookout for climate-tech companies that can attract substantial investor interest via either their equity or bond financing measures. Our clients are increasingly keen to include environmentally-sound companies into their portfolios. As such, our ESG ratings do take into consideration various environmental-related assessments such companies’ carbon footprint and exposure to clean technologies.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.