Gold can help investors hedge against inflation. In the last of our 5-part Higher-for-Longer series, we look at the drivers behind the recent gold rally, and why this unique precious metal deserves a place in investors’ portfolios

“As good as gold”

Precious metals, and gold especially, have been held by governments, corporations and individuals going back centuries. Although the “gold standard” - a monetary system that pegs currencies to a fixed quantity of gold - was dropped from widespread use in the 1970s, gold continues to appeal as a hedge against crises.

This is because gold’s value is not subject to interest and exchange rates or any other monetary policy, a feature that becomes particularly important during times of high inflation, that is, when money is losing its value.

Gold in a higher-for-longer world

Looking forward, global inflation may have eased from multi-decade highs but is unlikely to return to pre-pandemic levels anytime soon. In fact, structural trends such as deglobalisation, climate change challenges and rising geopolitical tensions look set to maintain an upward pressure on prices for years to come.

This long term, high inflation environment is bringing back to prominence the traditional inflation-hedging properties of gold. It is worth noting that gold does not necessarily perform well in all inflation scenarios. During periods of high and rising interest rates, gold demand may waver given that it does not provide direct income opportunities. This was the case, for example, in 2022.

However, gold is viewed as a reliable store of real value and is therefore a safe haven investment when recession fears mount. This partially accounts for gold’s stellar performance in 2023 and remains a compelling reason to hold gold going into 2024.

Fig 1: Gold price, 2020 - 2023

Source: World Gold Council, data as of 13 Dec 2023

A golden opportunity

There are several factors favouring gold next year, and which should continue to keep prices elevated:

- Rate cuts and weaker USD

The US Federal Reserve has signaled at least three interest rate cuts in 2024. Lower rates create a more favourable environment for gold as it reduces the opportunity cost of holding gold over other interest-paying assets such as bonds. Rate-cuts will also likely weaken the USD. This makes gold less expensive for international buyers, thus pushing up demand. - Strong central bank demand

Gold prices have been supported this year by strong central bank purchases of gold. According to the World Gold Council, central banks bought 800 tonnes of gold in the first nine months of 2023, 14 percent higher than the same period last year. This is part of a rising de-dollarisation trend, i.e. more central banks wishing to diversify more of their reserves (and economic reliance) away from the USD. Going into 2024, this trend looks set to continue or even accelerate. - Geopolitical tensions

Gold’s safe haven status will continue to feed demand given ongoing geopolitical uncertainties. Not only do the Israel-Hamas and Russia-Ukraine wars show no signs of abating, but the US Presidential elections next year also raises the possibility of US foreign policy changes and new sources of tension. - Recession fears

It is not UOBAM’s base case scenario that the US is under threat of a recession next year, given strong employment and a potential manufacturing recovery. However, we note that the world is now in a late stage of its expansion cycle, and a recession is possible in the coming few years. Many investors will likely be positioning at least part of their portfolios for an earlier-than-expected recession by holding some gold.

The United Gold & General Fund

The United Gold & General Fund (the “Fund”) aims to provide capital gains by investing in companies that mine for gold or other precious metals and commodities. As gold prices rise, the profits of gold mining companies tend to rise too, which could result in share price gains.

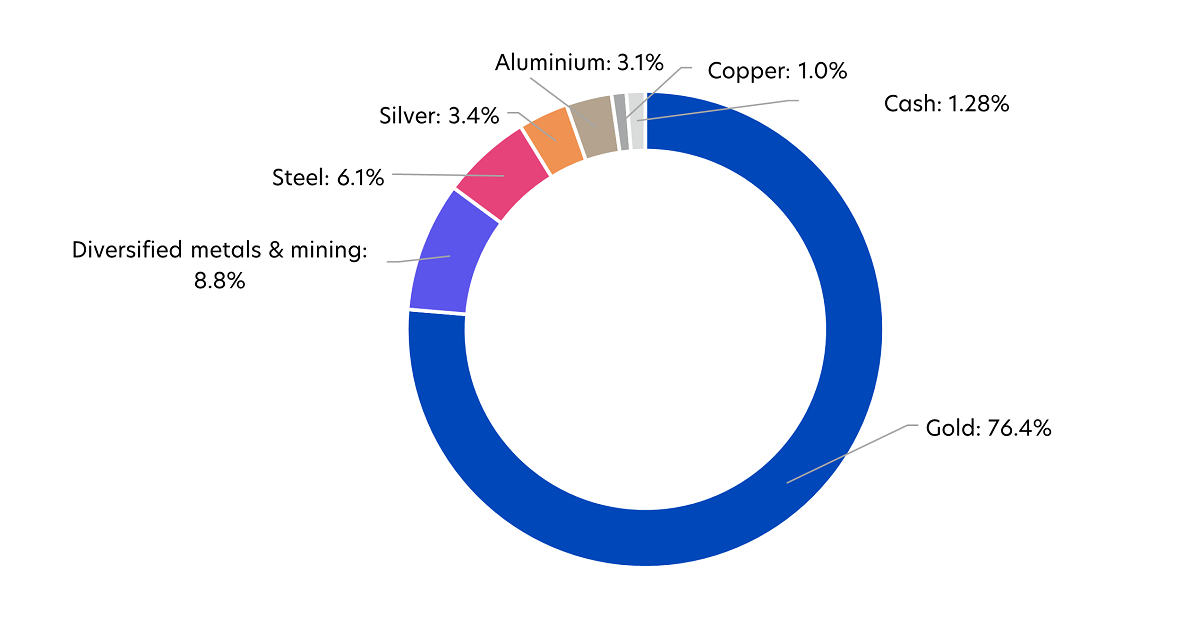

Heavy exposure to gold

The Fund focuses primarily on gold mining companies with gold making up 76.4 percent of its sector allocation. To enhance diversification and returns, it also invests in companies that mine other precious metals and bulk commodities such as silver, steel, and aluminum.

Fig 2: Fund sector allocation

Source: UOBAM, as of 30 Nov 2023

Its top holdings include some of the world’s largest mining companies.

Fig 3: Fund top 10 holdings

| Company name | Weighting (%) | Description |

| Agnico Eagle Mines | 9.7 | Gold mining company operating mines in Canada, Mexico, and Finland |

| Barrick Gold Corpp | 8.7 | Mining company that produces gold and copper with 16 operating sites in 13 countries |

| Newmont Australia | 8.0 | World's largest gold mining corporation and a producer of copper, silver, zinc and lead |

| Gold Fields | 6.1 | One of the world's largest gold mining firms headquartered in South Africa |

| Northern Star Resources | 6.0 | Australian gold mining company with operations in Western Australia, Northern Territory and Alaska |

| Newmont US | 5.7 | World's largest gold mining corporation and a producer of copper, silver, zinc and lead |

| Evolution Mining | 5.2 | Australian gold mining company with operations in Australia and Canada |

| Rio Tinto | 4.5 | World's second-largest metals and mining corporation |

| Alamos Gold | 4.0 | Canadian gold mining company with operations in Canada and Mexico |

| Oceanagold Corp | 3.6 | Gold and copper producer with operations in the US, Philippines, and New Zealand |

Source: UOBAM, as of 30 Nov 2023

Consistent outperformance

Testament to its 5-star Morningstar rating1, the Fund has consistently outperformed its peers, achieving a first or second quartile ranking over the past five years. In the November year-to-date, the Fund returned 4.2 percent, beating the 1.9 percent returns for peers in the same category.

Fig 4: Performance comparison: Month-end trailing returns (%)

| Total returns | YTD | 1 year | 3 year | 5 year |

| United Gold & General Fund | 4.2 | 4.9 | 0.7 | 11.5 |

| Category | 1.9 | 2.0 | -6.1 | 8.9 |

| Quartile Rank | 2 | 2 | 1 | 1 |

Source: Morningstar, as of 30 Nov 2023. Fund performance is calculated on a Net Asset Value (NAV) to NAV basis, without sales charge applied.

Looking ahead, as we enter a new higher-for-longer regime, it is important for investors to remain well-diversified. This includes adding assets like gold to diversify portfolio risk. The United Gold & General Fund offers both inflation and recession-hedging benefits, as well as the potential to capitalise on rising gold prices.

Fund Details

| United Gold & General Fund, as of 30 Nov 2023 | |

| Investment objective | Achieve returns on investment mainly in securities of corporations whose business is or is substantially in the mining or extraction of gold, silver or precious metals, bulk commodities, base metals of all kinds, and other commodities and it includes the mining or extraction of oil, gas, coal, alternative energy or other commodities or other minerals. |

| Top 5 country allocation (%) | Canada: 40.9 United States: 18.8 Australia: 16.6 United Kingdom: 7.0 South Africa: 6.1 |

| Top 5 sector allocation (%) | Gold: 76.4 Diversified Metals & Mining: 8.8 Steel: 6.1 Silver: 3.4 Aluminum: 3.1 |

| Top 5 holdings (%) | Agnico Eagle Mines: 9.7 Barrick Gold Corp: 8.7 Newmont Corp: 8.0 Gold Fields: 6.1 Northern Star Resources: 6.0 |

| Fund class available | - |

| Management fee | 1.50% p.a. |

| Subscription fee | Up to 4% p.a. |

| Minimum subscription / trading size | S$1000 (initial); S$500 (subsequent) |

1Morningstar, 30 Nov 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z