In the first of our three-part Singapore series accompanying the recent launch of our United SG Dynamic Income Fund, we look at what lies in store for S-REITS given the recent sell-off.

Hit by interest rate concerns

Singapore REITs (S-REITs) rallied in the first half of 2023 on hopes that interest rates would peak by mid-year. Instead, the US Federal Reserve signalled in their September meeting more interest rate hikes this year and fewer-than-expected rate cuts in 2024. Disappointed investors subsequently sold down their REITs investments.

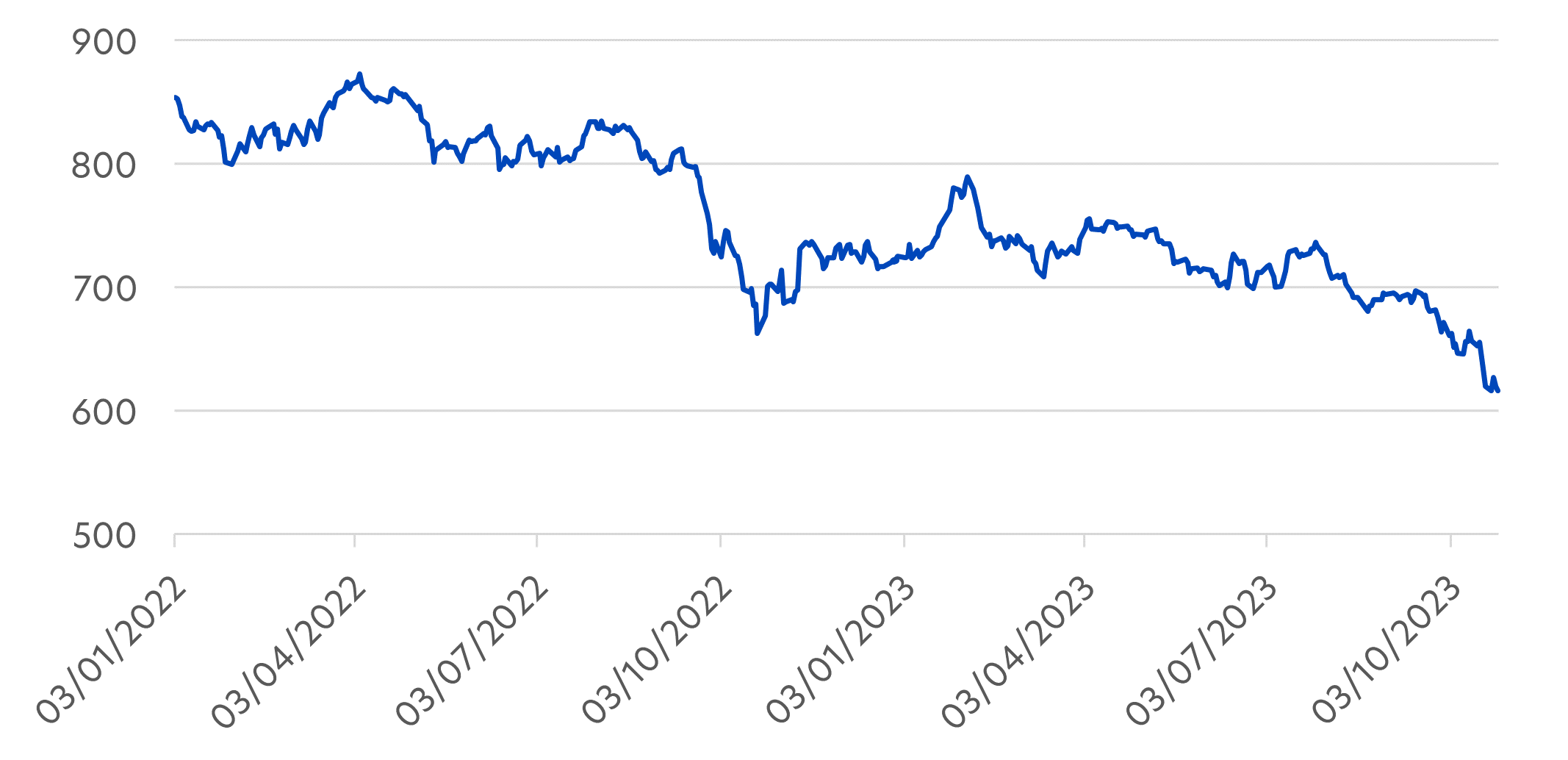

Fig 1: Performance of S-REITs, Jan 2022 – Oct 2023

Source: UOBAM, Bloomberg. S-REITs (FSTREI Index), as of 26 Oct 2023

So why are REITS so sensitive to higher interest rates? There are three key reasons:

- High rates translate to higher financing costs for REITs. This erodes profitability and lowers distribution per unit (DPU) for shareholders.

- High rates make REIT dividend yields less attractive compared to yields offered by lower risk investments like bonds. With the 10-year US Treasury yield now hovering around 4.8 percent, the yield spread between REITs and government bonds has narrowed significantly.

- High rates tend to decrease real estate valuations, as a higher discount rate will need to be applied when valuing property asset prices. This can impact a REIT’s net asset value and result in weaker share prices.

Still a good investment opportunity

Despite recent price volatility, we believe S-REITs still offer attractive qualities:

- Stable, above-inflation income

REITs are required to distribute at least 90 percent of their taxable income as dividends to shareholders annually. This makes them ideal for investors seeking regular income.

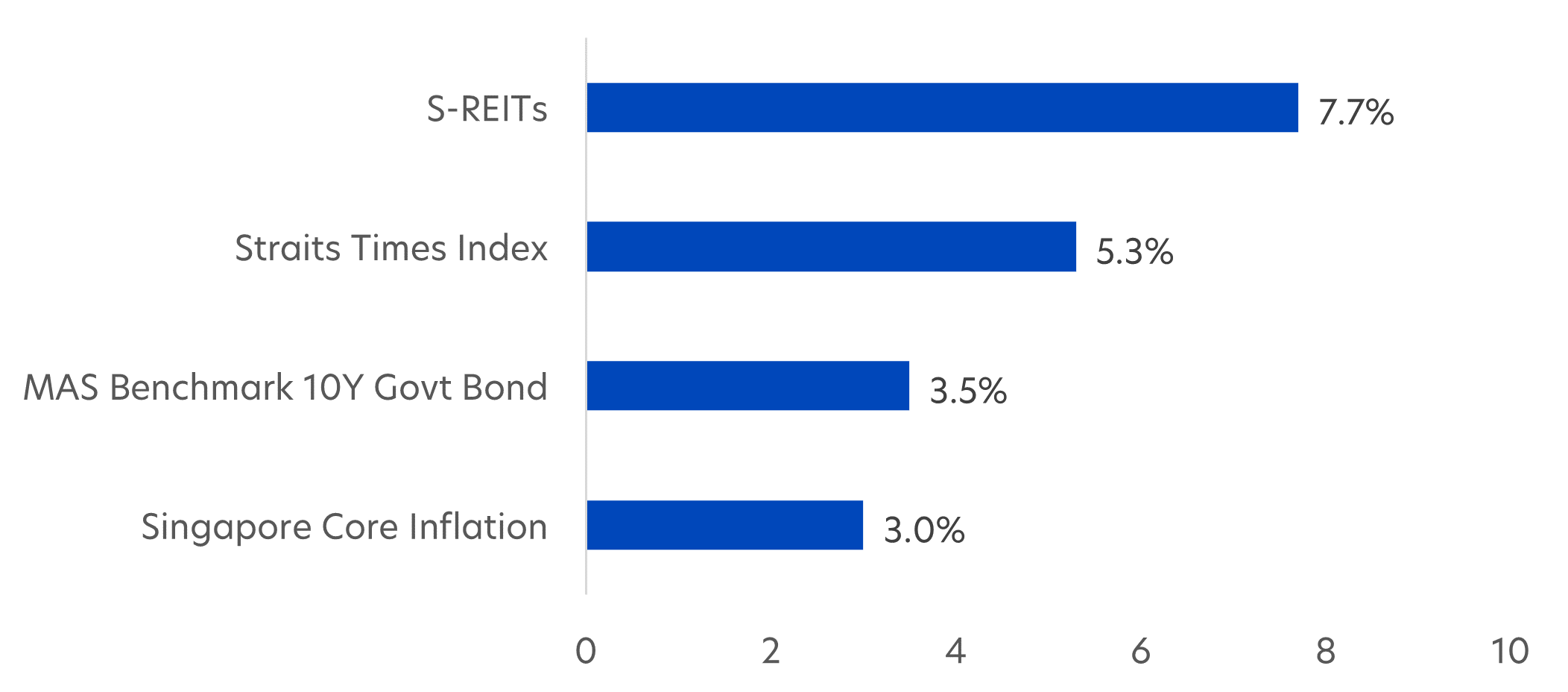

The average dividend yield for S-REITs currently stands at 7.7 percent compared to 5.3 percent for Singapore stocks and 3.5 percent for 10-year Singapore government bonds1. This is more than double Singapore’s current core inflation rate of 3.0 percent2.

With inflation expected to stay above long-term averages, a GST hike pending, and both water charges and public transport fares set to increase in 2024, the substantial passive income provided by S-REITs will come in very handy.

Fig 2: S-REITs have higher yields compared to other asset classes

Source: Chartbook: SREITs & Property Trusts, SGX Research, October 2023

- Long-term total return potential

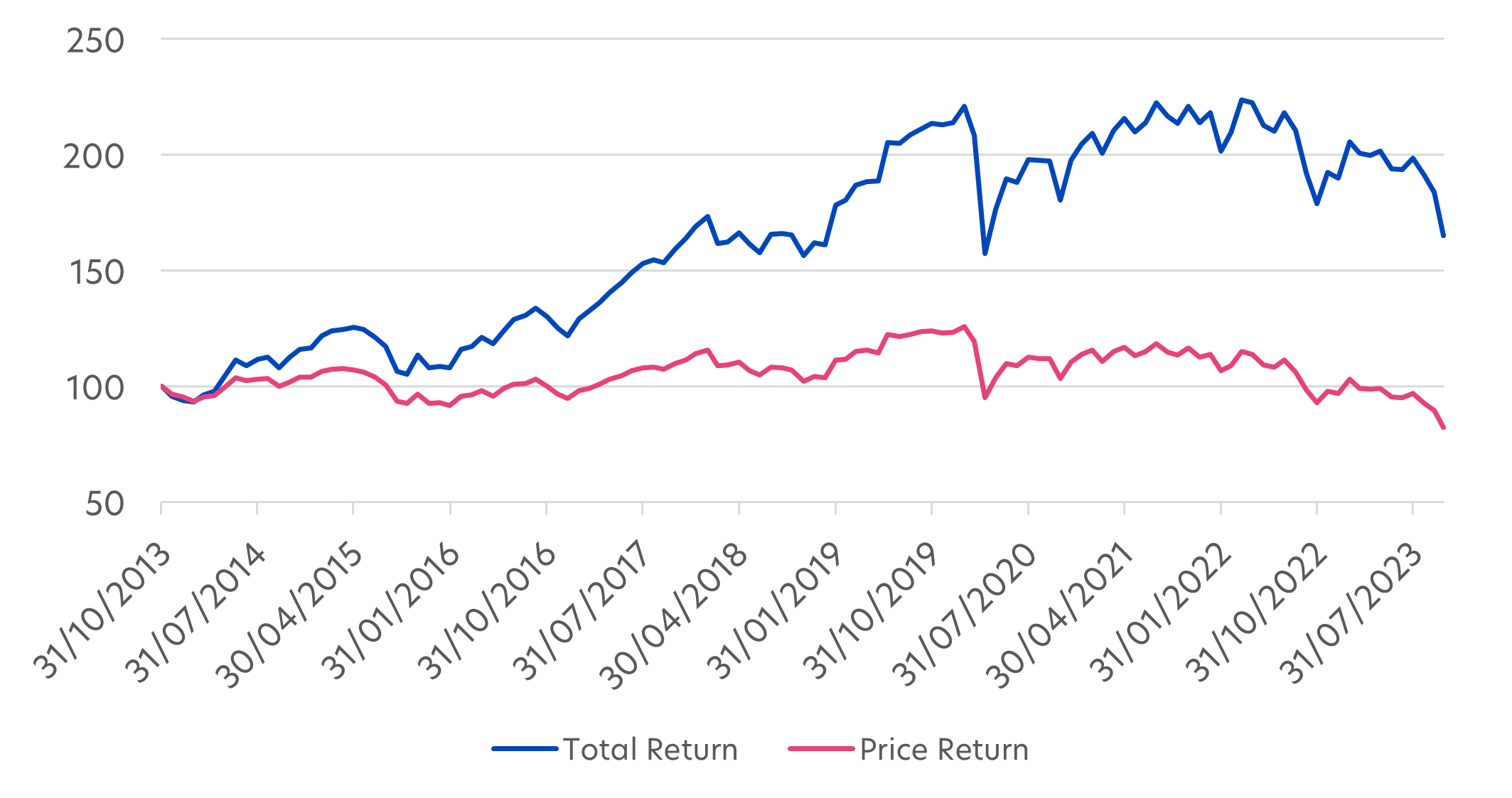

Although S-REIT prices have been relatively volatile, this is more than compensated by their high dividend yields. As a result, S-REITs’ total return, that is, price appreciation plus dividend yields, was 57.8 percent3 over the last 10 years. In comparison, Singapore equites returned 45.5 percent over the same period.

Fig 3: S-REITs Total Return vs Price Return, Oct 2013 – Oct 2023

Source: Bloomberg, UOBAM, as of 26 Oct 2023

- Strong fundamentals

Despite headwinds posed by higher interest rates, S-REITs have demonstrated balance sheet resilience. Debt levels are low with the average gearing ratio of S-REITs at 38.2 percent4, comfortably below the regulated gearing ratio limit of 50 percent.

Meanwhile, the average interest coverage ratio for S-REITs – which measures how well a REIT can meet its interest payments – stands at 4.6 times5, well above the MAS’s minimum requirement of 2.5 times.

- Compelling valuations

The recent pullback in S-REITs means valuations have turned more attractive. Our analysis shows that S-REITs are currently trading at an average forward dividend yield of 6.5 percent, slightly above the mean, and an average price-to-book ratio of 0.8 times, below the valuation levels reached during the 2017 – 2018 interest rate hike cycle.

Also in our view, interest rate headwinds have been largely priced in and the rate hiking cycle is coming to an end. As such, current S-REIT valuations are an opportunity for investors to position for a pause in interest rate hikes. This could spark a recovery in S-REIT prices.

- Increased economic activity

Singapore’s economy is seeing growth in its tourism and the services sector. The favourable supply and demand dynamics should help support Singapore’s real estate sector. The continued pickup in economic activity is also positive for rent growth. For example, prime logistics rents are up by 11.7 percent year-to-date, buoyed by strong leasing demand and the limited supply of quality logistics space6. Prime retail rents also rose at a faster rate in Q3 this year compared to the previous quarter, reflecting the ongoing recovery in retail sales7.

Dividend income will continue to attract investors

While the near-term outlook for S-REITs remains subdued amidst a challenging interest rate environment, their high dividend yields nonetheless look compelling. Many S-REITs are now attractively valued and hold the potential for capital appreciation when interest rates eventually stabilise.

That said, investors should remain selective. We prefer REITs with quality attributes such as lower leverage and better yield-plus-growth trajectories to deliver stronger total returns.

1Source: Chartbook: SREITs & Property Trusts, SGX Research, October 2023

2Source: MAS, September 2023

3Source: Bloomberg, as of 26 Oct 2023. S-REITs (FSTREI Index), Singapore equities (STI)

4Source: Chartbook: SREITs & Property Trusts, SGX Research, October 2023

5Source: SGX Research, June 2023

6,7Source: Singapore Figures Q3 2023, CBRE

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z