- South Korea is aiming for Japan-like reforms to boost its stock market

- Stocks have already rallied in anticipation of a substantial re-rating

- However, details released this week did not meet market expectations

South Korean authorities have been eyeing the Japan stock market since its rise last year, and after weeks of anticipation, unveiled their own version of corporate reforms this Monday. Many are hoping that the Corporate Value-up Programme will do for the South Korean stock market what similar reforms have achieved in Japan.

But having risen steadily over the past month, yesterday’s announcement saw the Kospi index correct by 0.8 percent. While some profit-taking was expected, the programme also did not go as far as investors had hoped.

Narrowing the “Korea discount”

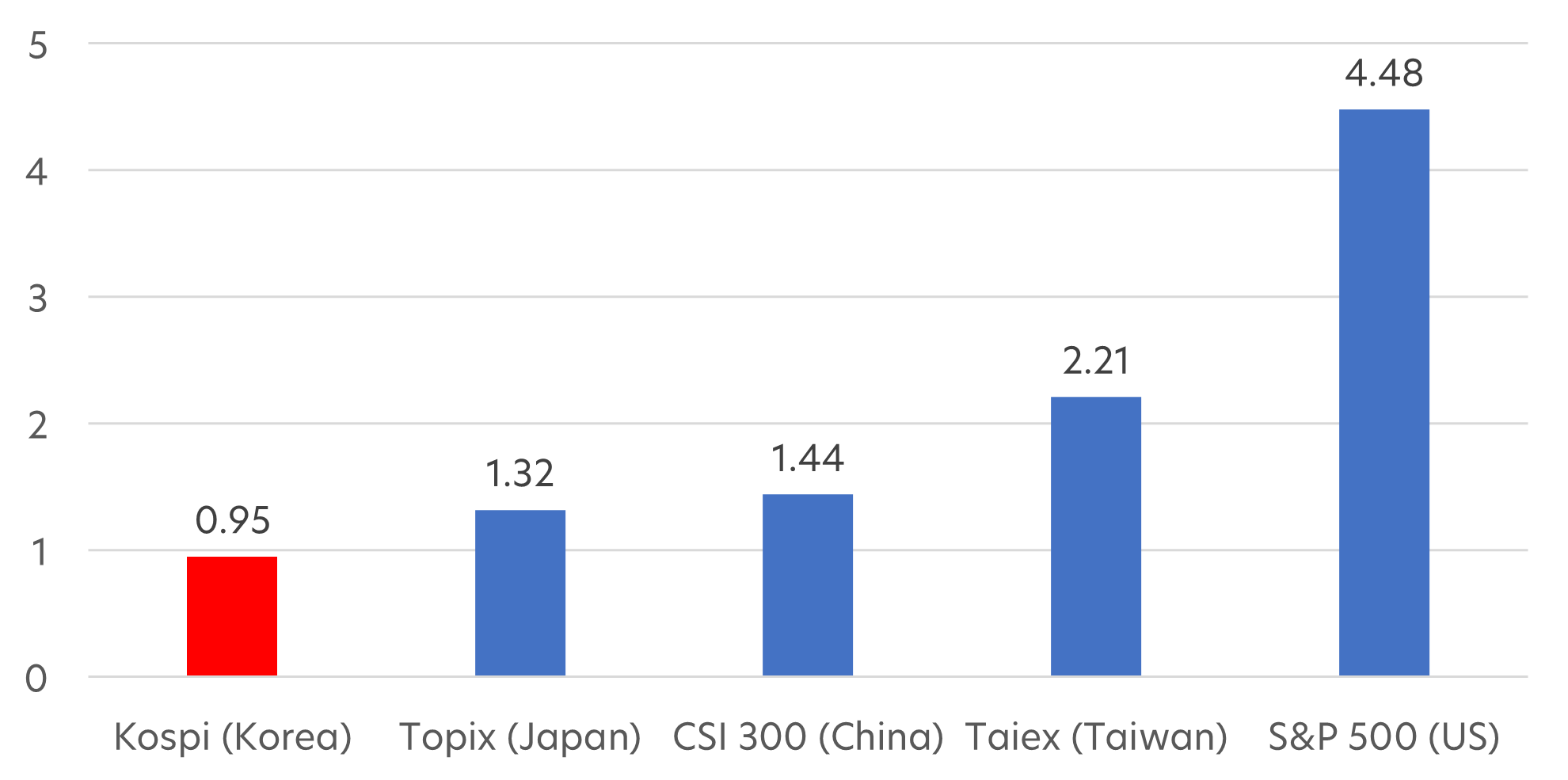

South Korea is Asia’s fourth largest economy and home to many global brands. Yet its stock market has long suffered from what is known as the “Korea discount”. Currently, two thirds of Korean companies’ price-to-book ratios (PBR) are below 1, typically an indication that a stock is undervalued. The average PBR of Kospi-listed companies is also significantly below that of their Japan, China, Taiwan and US peers.

Fig 1: PBR of Korea stocks vs peers

Source: Bloomberg, data as of 31 Dec 2023

Korean stocks have tended to trade at these much lower valuations due to perceived poor corporate governance and low shareholder returns. Last year, Korea pledged to address this by essentially taking a leaf out of Japan’s playbook.

Japan has been pursuing measures to improve corporate governance since 2013. However, it wasn’t until last year, when the Tokyo Stock Exchange ramped up its market reforms, that foreign investors stood up and took notice. Since then, and after 30 years of market stagnation, Japan’s Topix index has rallied, returning 30 percent in 2023, and 12 percent so far this year to reach an all-time high.

Korea’s pre-emptive rally

Even prior to the details released this week, some Korean companies including Hyundai Mobis, Samsung C&T, and SK Innovation had announced plans to increase the supply of available shares and thereby improve their stock valuations. To facilitate this, it is estimated that some 3.4 trillion won (S$3.4 billion) of company-held shares will be canceled this year.

Investors have also been quick to react by buying up stocks with low PBRs across a range of sectors, which has helped boost prices in recent weeks. Altogether, foreign funds have snapped up 10.2 trillion won (S$10.3 billion) of Kospi shares so far this year, a record high for the same period since 1999, according to Bloomberg data.

| Industry | Average PBR | Average price gain (%): 15 Jan – 21 Feb 2024 |

| Automobiles | 0.84 | 6.13 |

| Banks | 0.63 | 24.37 |

| Insurance | 0.43 | 29.19 |

| Financial services | 0.63 | 12.79 |

| Consumer retail | 0.69 | 8.45 |

Source: Bloomberg/UOBAM

Reforms are still evolving

Similar to Japan, Korea’s Corporate Value-up Programme promised such measures as:

- Encouragement for companies with low valuations to formulate plans to improve share prices

- Tax incentives for companies with management practices that prioritise shareholder returns

- A new Corporate Value-up Index to identify companies poised to boost their corporate value

- A new advisory board to support voluntary efforts by listed firms

- A new department solely dedicated to supporting the Corporate Value-up Program

However, Monday’s announcement was lukewarm in terms of delivering the implementation details that markets had been waiting for. There were no firm plans announced for increased tax support, including a hoped-for temporary reduction of the dividend tax rate. Other hints of improvements to shareholder value via revisions to Korea’s Commercial Act, increased stock purchase disclosures and a substantial change to Korea’s Stewardship Code (which guides the activity of institutional investors), also did not materialise.

Of particular disappointment was the lack of measures to help reduce chaebol cross-shareholdings, a prominent feature of the Korea stock market. Chaebols tend to wield particular corporate influence due to their cross-shareholdings.

Upside potential, but with some headwinds

Korean exports are set to continue their rebound amid the upturn in the global electronics cycle. Inflation is on a downtrend with Korea’s January Consumer Price Index (CPI) coming in lower than expected, paving the way for rate cuts that analysts expect to start in the third quarter of 2024.

UOBAM is of the view that, as with Japan, the Korean market has plenty of room to improve in terms of corporate governance. Assuming a well-executed corporate reform programme, the South Korean stock market may have the potential to be upgraded to MSCI Developed Market status, which will increase foreign investor interest.

We note that there is scope for further announcements once the South Korea Legislative Election concludes in April 2024. Also, a second “Value-up” seminar, scheduled to be held in May, could result in the finalisation of more definitive guidelines and policies by the end of June.

However, these is one aspect of Korea’s reforms that is notably different from Japan’s. We see the issue of Korea’s cross-shareholding structures as problematic. In our view, the set of reforms so far proposed by the Korean authorities do not yet adequately impact the crossholdings issue, and this will continue to hang over its corporate governance reforms.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asia Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you..

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z