Key Highlights:

- Investors’ attention has recently turned to whether a recovery will lead to an overheated environment causing long-term bond yields to pick up faster.

- Inflationary pressures could build but are unlikely to deter central banks from their low-rate commitments.

- Investors may opt to hedge their portfolios in a potential reflationary environment in the following ways: equities over bonds, cyclicals, favouring mid-caps, income-generating assets, alternative and ESG assets.

The current upswing in risky assets has been underpinned by 3 key drivers:

- Vaccine rollouts have been significantly ahead of schedule.

- Macroeconomic recovery has proved stronger than expected due to highly supportive fiscal and monetary policies from governments and central banks.

- Low long-term interest rates in part because short-end policy rates have been anchored by ultra-easy monetary policies.

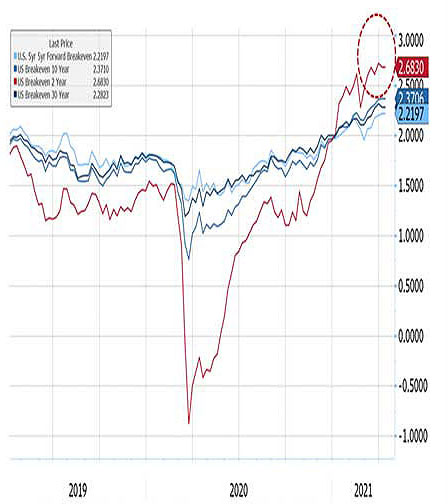

Attention among investors has however recently turned to whether a robust recovery will lead to an overheated environment that will cause long-term bond yields to pick up faster-than-expected. US 10-year bond yields for instance have risen over 100 basis points (bps) since bottoming out in the last quarter of 2020 with long-term inflation expectations now above pre Covid-19 levels (Chart 1 & 2).

Chart 1: UST 10-yr has risen over 100 basis points since bottoming out in 4Q'20

Source: Bloomberg

Chart 2: Market pricing on long-term inflation expectations have risen above pre COVID-19 levels

Source: Bloomberg

Inflation – transitory or structural?

That would seem to indicate that current inflation pressures to most market participants are “transitory” (73% in a Bank of America’s Global Fund Manager Survey in June) due to base-effect data comparisons against year-ago figures which was the middle of a pandemic-induced recession, and that price rises will gradually slow down when temporary shortages and supply disruptions start to normalise in the coming months as reopening activities progress. Under such assumptions, inflation pressures are unlikely to last beyond this year.

While the initial rise in yields was spurred by concerns over inflation as economies reopen and pent-up demand surges, it should be noted that US inflation, by and large, has largely been noticeably subdued since the onset of the pandemic till 1Q 2021 before surprising on the upside for three months in a row. That is despite initial worries that loose monetary policies and zero-interest rates would lead to runaway prices.

In addition, central bankers have signalled that higher-than-average inflation is not necessarily a preclude to any rate hikes. That is because governments are unlikely to risk any stalling in the momentum of economic recovery amid concerns over renewed virus outbreaks. The US Federal Reserve (Fed) has for instance switched to the new average inflation targeting (AIT) framework which will mean a slower pace of tightening even under inflation pressure.

As the US Fed chair, Jerome Powell has said on numerous occasions that its chief priority is that of US employment in the path towards recovery and that the Fed will resist any impulse for rate hikes while tolerating inflation levels above 2% for a longer period than previously until economic growth shows sustained improvement and employment goals are met.

In short, inflationary pressures could build but that will not deter central banks from their low-rate commitments especially when are inclined to keep bond yields from rising excessively and have tools at their disposal to do it.

Structural inflation worries

On the other hand, some have expressed concerns that the US output gap could close quickly in that fiscal support, pent-up savings, and easy financial conditions could persistently push demand well above potential GDP. As such, wage growth may rise faster vis-à-vis previous cycles and shelter inflation could continue to rise (as US home prices remain well-supported). Hence, the Fed may have to raise its policy rates sooner than what is implied under their new AIT framework. Under this scenario, investors may opt to hedge their portfolios in what they see as a reflationary environment in the following ways.

1. Equities over bonds

Increasing inflation from a low base is usually interpreted as a sign of improving growth prospects and a diminishing risk of deflation, which is often supportive for equities. In addition, the equity risk premium would likely tighten as well (if the real bond yield continues to be depressed versus the real EPS growth rate).

2. Cyclicals

Cyclical sectors such as energy, materials, industrial and financial sectors tend to outperform better in times of higher inflation (Chart 3).

Chart 3: Average equity return conditional on level and 3m change in US 10-year breakeven inflation

Source: Goldman (30 Sep ’20), “Portfolio Strategy Research”

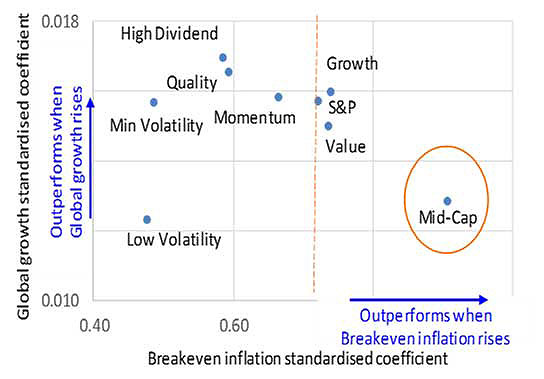

3. Favour mid-cap versus minimum/ low volatility

Our internal research shows that the Mid-Cap segment tends to outperform in a reflationary environment while Minimum Volatility and Low Volatility tend to underperform (Chart 4).

Chart 4: Since 2017, every 1 standard deviation increase in breakeven inflation has driven a 0.9 standard deviation increase in Mid-Cap returns (versus a 0.5 standard deviation increase in Min/ Low Vol returns)

4. Income-generating assets

These would include high dividend equities, REITs and high yield corporate credit. High dividend equities – being short duration assets – and REITs would perform well as the economic recovery continues to broaden out alongside rising bond yields.

Similarly, shorter-duration high yield corporate credit is preferred over government bonds, as the income component would help offset the drag from the duration component.

5. Alternative assets

Commodities including gold and private market assets such as real estate (that generate income with low correlation to equities) would be attractive as well.

6. ESG assets

ESG related equities and bonds such as those in renewable energy for the longer term due to growing interest and awareness in sustainable investing and increasing support from government initiatives as well as big institutional funds.

By Anthony Joseph Raza, Senior Director, Multi-Asset Strategy & Choo Chian, Director, Multi-Asset Strategy

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.